NOTICE: This post references card features that have changed, expired, or are not currently available

Yesterday we learned that the Double Cash card’s cash back can transfer 1 to 1 to Citi ThankYou Points. That means that this card can equally earn either 2% cash back or 2X ThankYou rewards for all spend. Since the transfer wasn’t working properly yesterday, there was one remaining question: Will we be able to transfer these points to airline programs like Avianca, Virgin Atlantic, Turkish, etc. if we have a full-powered ThankYou card like the Citi Premier or Prestige? It’s not a dumb question since points earned from bank accounts, are not transferable to airlines even when paired with a premium card.

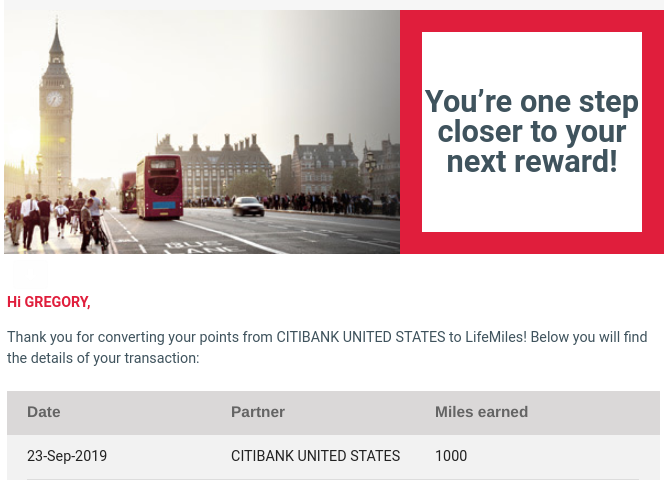

This morning, I found that points transfers are working, and I was able to successfully transfer cash to points and then points to airline programs (I moved 1,000 points to Avianca LIfeMiles). More specifically, I did the following:

- Convert Double Cash cash back to ThankYou Points

- Shared 1,000 Double Cash ThankYou Points with my Citi Prestige Card

- Transferred 1,000 ThankYou Points from my Prestige account to Avianca LifeMiles

- Confirmed that the 1,000 ThankYou Points I used were from the Double Cash card.

The above will work equally well (and more simply) if you combine ThankYou accounts so that step 2 won’t be necessary. I did it the way I did to make it easier to confirm that points came from the Double Cash card.

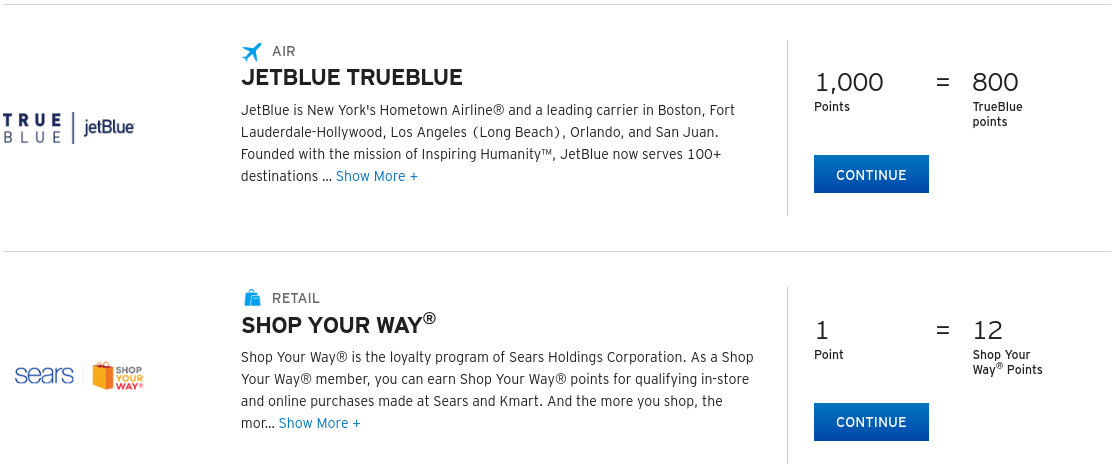

Note that if you don’t have a Premier or Prestige card, you are limited to just two weak transfer partners:

Does DC have a 100K pts/miles transfer cap into Premier or Prestige like the standard TY pts transfer?

Yes, but you could alternatively combine TY accounts so that limit won’t come into play

I have Prestige and Rewards+ in addition to my DC card. I converted my DC cash back into TY points. Citi set up a 2nd TY account for those. I called in on my DC and combined that new TY point account into my pre-existing TY account. All points converted from DC are fully transferable into any of the airline partners, just like my points earned from the other cards.

[…] Smiles. However, domestic US flights are not the only sweet spot; given the recent development that Citi Double Cash rewards can transfer 1:1 to Thank You points, this program deserves even more attention. Here’s a look at some of the Turkish Miles & […]

[…] 21:46 – Citi Double Cash points to be transferable to Thank You Points […]

If you product change from a Premier to the Double Cash, will your TYPs associated with that card now remain intact? Also is it possible to PC a card with Citi over secure message, or do you have to call?

No. Double Cash is still primarily a cash back card so you would lose your points if you did that product change. Change instead to the no-fee Rewards+ and convert a different card (AA card perhaps?) to the Double Cash. I believe you have to call.

[…] can be converted to TYPs on a 1:1 basis ($1.00 in rewards converts to 100 TYPs). And this morning, Greg at Frequent Miler is reporting that he was successfully able to share Double Cash TYPs with his Citi Prestige card and convert […]

I thought there was a problem that once you move the points, you don’t know which ones are used first. So, move points from DC to Premier, then redeem out of the premier account, which points are used first, the DC or Premier ?

Is important because of Citi’s stupid rules about not all TYP being equal as I understand the DC points can expire 90 days after being moved

No I did it that way specifically because you CAN see which is used. They always use first the soonest expiring points. Once I moved the points I could see that I had 1,000 Double Cash points that would expire at the end of the year. After transferring to Avianca, there weren’t any soon to expire Double Cash points

thanks for the follow up.

Anyone know if applying for DC will reset your TYP clock ?

The problem with not knowing which points are used arises when you combine TY accounts. In that case you have one combined account holding points from different cards but those points have no expiration dates and Citi has not revealed how their system allocates points to a redemption when all of the points have no expiration. Moving points is better for controlling which points are used – as you said the moving starts a 90 day clock on the moved points and points expiring soonest are used first. But there is a 100K annual limit on moving points.

Did you Previously have points in the Premier/preferred account ? It could still be restricted just like TYP and from banking stays restricted even after transferred

No the way I did it I could see that my bank points were not used but the DC points were.

Wait!! You mean you didn’t realize the Sears Shop Your Way points are the best transfer partner?

Now that I’ve made this joke, there’s prolly some SYW transfer to travel that is the best hidden offering in the points and miles sphere. I’ll spend the next week looking.

Damn! I found it! SYW to Thomas Cook 1 point= =$1 million

If you move TY points from citi double cash to citi prestige, you have 90 days to use the points before they expire.

If you combine your double cash TY points account with your prestige TY points account, there is no 90 day deadline. You can not uncombine the accounts, if you want cash back again.

Most of that is true except the very last part. DC always defaults to cash back but you can optionally redeem that cash back to your ThankYou account regardless of whether you’ve combined with other cards. If you decide not to combine then simply don’t redeem for TY points until you’re ready to make a transfer.

[…] Update 9/23/19: Thankfully this was just imprecise language by Citi. If you transfer points to your Chairman/Prestige/Premier accounts then you’ll be able to transfer to all travel partners. Hat tip to FM […]

Are VGC a points earning possibility for the double cash card?

Yes

[…] I am surprised that Citi is indeed going ahead with allowing Double Cash cardholders to exchange their cash rewards to Thank You Points. I did not think they would go ahead with it. And now I think this is not going to last. I guess time will tell. I am no thought leader with this stuff you guys, just an old timer whose eyes have seen a lot in this “hobby”. Update: Only with a Citi Premier or Prestige card it makes sense! […]

I was told if you combine Premier and Prestige Thank You accounts, the higher level card (Prestige) is the thank you point account that survives, and you can’t take advantage of the Premier 1.25 point value.

That’s not true. I have both combined and have shown that you continue to get 1.25 for all travel plus can combine that with 4th Night Free

Thanks Greg. In order to benefit from respective “superpowers” of the Premier and the Prestige, do you recommend merging the Prestige’s TY account into that of the Premier’s or vice versa? Or does it not matter?