NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

Chase is offering the opportunity to earn more Premier Qualifying Points on the United credit cards. PQPs are points necessary for earning elite status. The additional PQP earnings here are slim and probably won’t make it worth spending on these cards if you weren’t already intended to do so for the PQPs.

The Deal

- Chase is offering additional United Premier Qualifying Points with credit card spend as follows:

- With the United Explorer, United Business, or New United Business:

- Earn an additional 500 PQPs for each $12K in new spend up to 1K extra PQPs (up to a max total of 2K PQPs with $24K spend)

- With the United Club, United Club Business, or United Club Infinite:

- Earn an additional 500 PQPs for every $12K in new spend up to 3K PQPs (up to a max total of 4K PQPs with $72K spend)

- With the United Explorer, United Business, or New United Business:

- Direct link to this promotion

Key Terms

- Only the primary Cardmember is eligible for this PQP promotion.

- “Net Card Spend” is spend based on card purchases of goods and services made by you or any authorized user on your account minus any returns or refunds, and do not include balance transfers, cash advances, cash-like charges such as travelers checks, foreign currency, and money orders, any checks that are used to access your account, overdraft advances, interest, unauthorized or fraudulent charges, or fees of any kind, including an annual fee, if applicable).

- Purchases made by authorized users will qualify toward the primary cardmember’s Net Card Spend total but authorized users are not eligible for the PQP promotion.

- See promotion page for full terms

Quick Thoughts

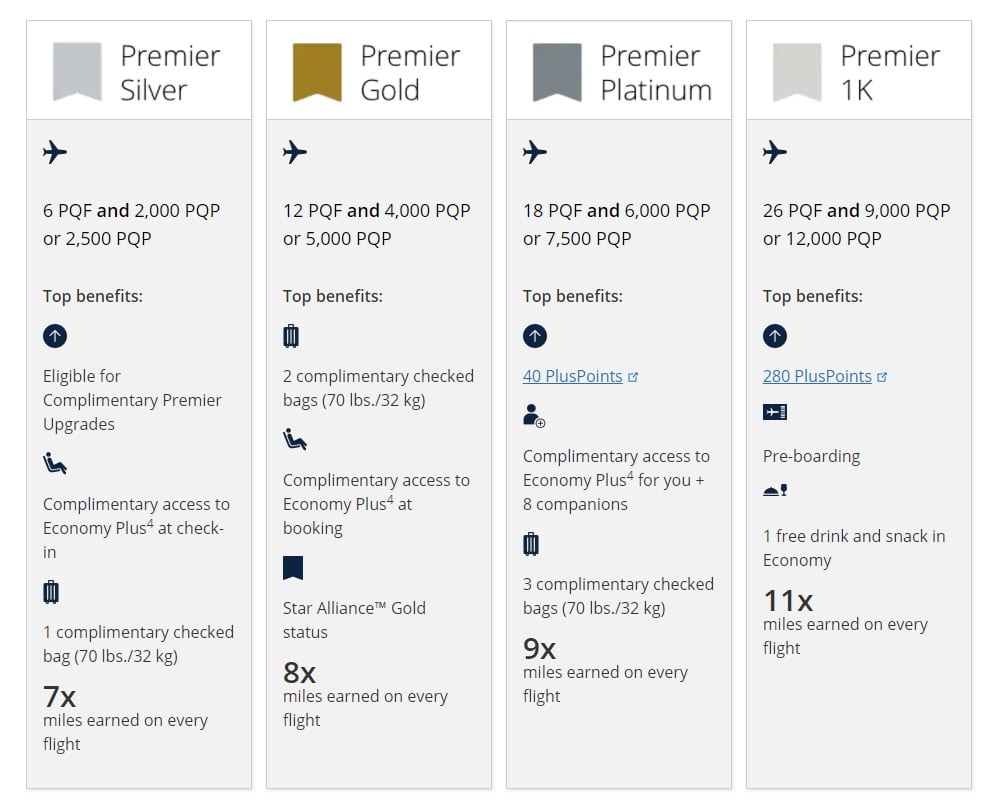

Keep in mind that United requires both Premier Qualifying Points (ordinarily based on airline spend) and Premier Qualifying Flights (segments) in order to qualify for elite status. The requirements for 2020 have been reduced as follows:

With this offer, you could certainly get to elite status a bit faster. That said, you’ll still need to fly several times. Personally, I wouldn’t go wild on spend on a United card for Silver or Gold status considering the number of flights also required, but if you’re flying United a lot and using your United card, this may be more appealing to you.

H/T: Doctor of Credit

[…] Earn more PQPs with United credit cards through 12/31 (Expires 12/31/20) […]

I was surprised to see this treated as news again when DoC posted it, this started in May and was announced back in April. What was the trigger here?

I was going to say that I didn’t recall hearing about it, but apparently that’s not true as I wrote about it:

https://frequentmiler.com/united-extends-premier-status-waives-some-redeposit-fees/

Definitely slipped my mind that it was a known known. I assume the same was true for DoC.

We make a passing mention of this sort of thing in the podcast we recorded yesterday and will publish tomorrow: my wife used her Amex Marriott business card at the grocery store a week ago (for just 2x Marriott points!). I saw the charge and I said I needed to give her a pop quiz: which card should she use at the grocery store? She said the Amex Bonvoy card — which tells me she at least thought she was using the right card. Greg and I note that with all of the short-term enhancements, it can be very easy to forget which is which and recall everything that has been added.

And to alleviate that, we have a post with a full list of COVID credit card enhancements — though I’m now realizing that the list is at least one card from full since we didn’t have this in there. I’ll make sure we get that updated now.

https://frequentmiler.com/covid-credit-card-enhancements-ultimate-guide/

Short story: I totally forgot about it. DoC probably did, too.

Ummm.. the only requirement is 4 flights if you go with the higher PQP option.