UPDATE: The magical Rakuten Visa card will no longer earn 3X for gift cards purchased through the Rakuten portal. As a result, I no longer recommend this product unless you frequently shop through the Rakuten portal. Rakuten has been sending out the following email to cardmembers:

Dear Member,

Starting February 15, 2020, Rakuten Cash Back Visa® Credit Card purchases made through Rakuten on GiftCardMall.com, GiftCards.com and Raise.com will be eligible for 1% Cash Back instead of an extra 3% Cash Back.

Due to circumstances unique to the retail card business, Rakuten is no longer able to offer an extra 3% Cash Back for purchases from these stores.

All other benefits remain the same. You’ll continue to earn an extra 3% Cash Back on qualifying purchases made through Rakuten.com, In-Store Cash Back offers, Rakuten Hotels and Rakuten travel.

The Rakuten (formerly Ebates) portal suddenly became exciting when they introduced the ability to earn Amex Membership Rewards points instead of cash back. The combination of the Rakuten portal with the Rakuten Visa credit card is arguably the most exciting event in the points & miles world since… um… Redbird maybe? Regardless, it’s been a while since we’ve seen anything this interesting. You can read all about it here: In one fell swoop, Ebates shakes up portal and credit card rewards.

OK, are you already back from reading the “Ebates shakes up portal and credit card rewards” post? Great. So now you know why you want the Rakuten Visa so that you can earn an 3X points on all of your Rakuten shopping in addition to the points offered by the portal itself. But before you sign up, there are some things you need to know:

Follow these steps

- First, you need an Amex card that earns Membership Rewards. There are lots of good ones (found here), but if you want one with no annual fee then go for either the Blue Business Plus or the Everyday Card. Previously it was necessary to have a consumer Amex card, but that requirement is no longer in place.

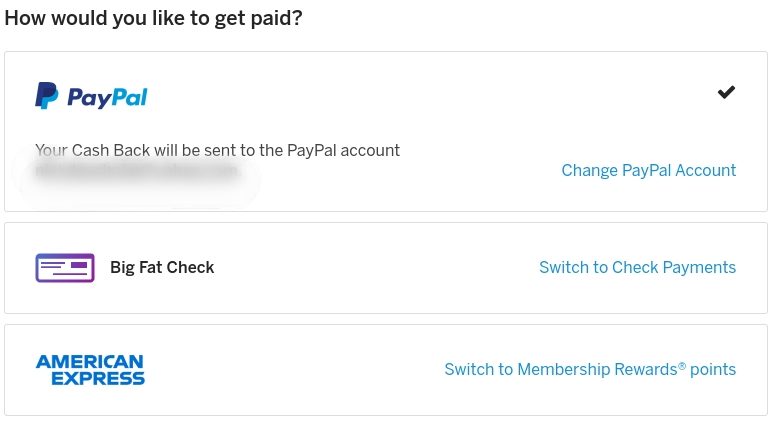

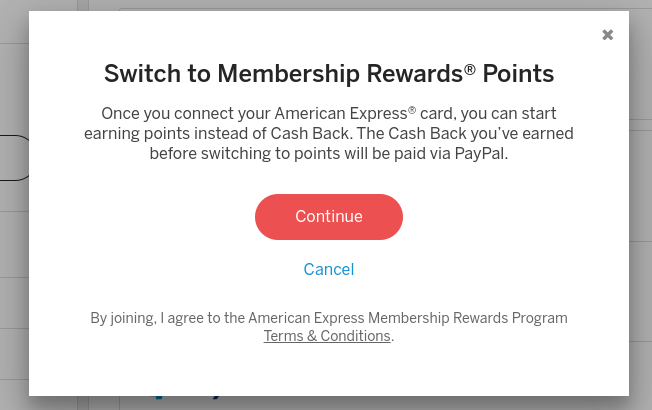

- Next, you need an Rakuten portal account. If you don’t already have one, you can sign up here (this is not an affiliate link): www.rakuten.com/american-express. At the time of this writing, there’s a signup offer of 1500 Membership Rewards points after making $25 or more in qualifying purchases through the portal. If you already have a cash back version of the account, you can change it to a Membership Rewards account (see below for details).

- Next, make sure you apply for the Rakuten Visa with the same email address as the one linked to your Rakuten portal account. Best bet is to log into the Rakuten portal first and click on the Rakuten Visa ad. Yes, it is advertised as a cash back card, but as long as it is linked to a Rakuten account that earns Membership Rewards, it will earn Membership Rewards. If you don’t see the ad when you log into your Rakuten account, you can find a current signup link here.

You can now change your cash back Rakuten account to a Membership Rewards account

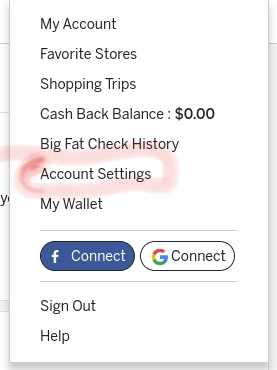

To switch your Rakuten portal account to Amex Membership Rewards, log into the Rakuten portal, select Account Settings (found in the menu under your name), and change how you would like to get paid:

The Rakuten card is surprisingly hard to get approved for

My son (a college student) was denied. A retiree that I know was also denied. It’s not surprising that they were denied credit in general, but I expected that a portal branded credit card would be easy to get. I was wrong.

A number of readers (see the comments in this post) have also been denied despite having high income and solid credit scores.

There is a trick for getting approved

Readers report success getting approved for the Rakuten Visa card after freezing Sagestream and ARS credit reporting. You can find instructions for freezing your reports here:

A great resource for how to freeze both Sagestream and ARS can be found here: Two Credit Bureaus You Should Freeze Before You Apply For A U.S Bank Credit Card (even though the Rakuten Visa isn’t issued by US Bank, the instructions are relevant).

It is possible to go from nothing to earning points in a matter of minutes

Once you are approved for an Amex card that earns Membership Rewards, you should be able to sign up for Rakuten with Membership Rewards immediately.

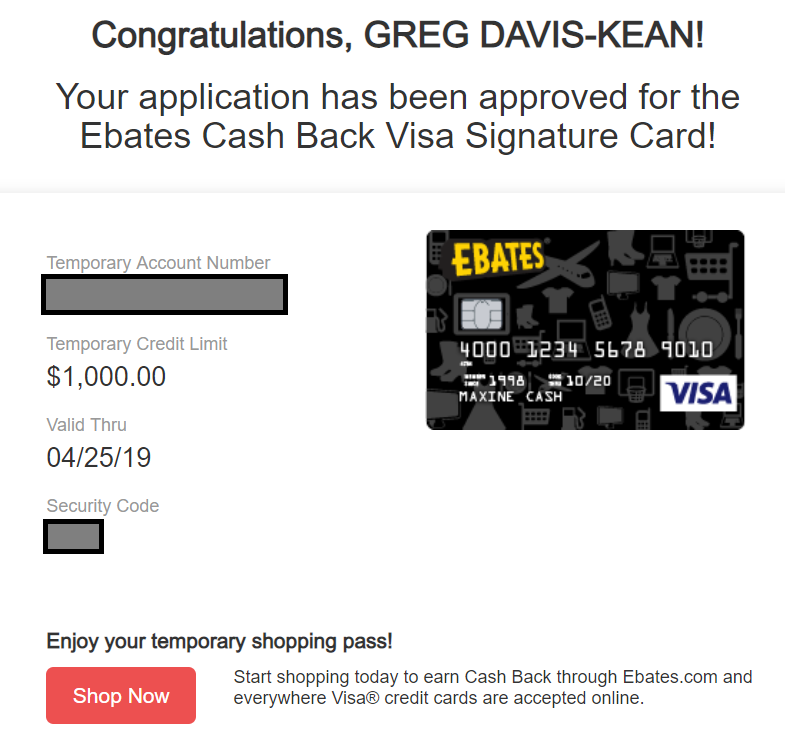

Then, if you are instantly approved for the Rakuten Visa, you will be presented with a temporary card number instantly. You can start shopping right away as long as your purchase is under $1,000.

The Rakuten Visa’s 3X rewards are based on the entire purchase price

This may seem like a stupid statement. After all, all credit cards reward you based on the entire purchase price, right? Right, but I wasn’t sure in this case. After all, the Rakuten portal itself doesn’t usually reward the shipping and handling and sales tax portion of a purchase. And remember that the Rakuten Visa offers 3X rewards for purchases made through the Rakuten portal and only 1X rewards for other purchases. So, it seemed logical to me that the Rakuten Visa may work in any one of these three ways:

- 1X rewards applies to the entire purchase amount, and the additional 2X rewards apply only to the purchase amount tracked by the portal. Wrong answer #1.

- 3X rewards applies only to the amount tracked by the portal. Wrong answer #2.

- 3X rewards applies to the entire purchase amount inclusive of shipping and handling and taxes. This is the right answer.

Thanks go to members of the Frequent Miler Insiders Facebook Group for helping to answer this question definitively.

[…] As always, check cashbackmonitor.com to be sure you’re getting the best rate. That said, since Rakuten gives you the option to instead earn the same rates in Membership Rewards points rather than cash back, you may value these payouts more. If you’re not yet earning Membership Rewards points through Rakuten, remember that it is possible to change your earning preferences. Also see our guide to the Rakuten Visa with Membership Rewards. Everything you need to know. […]

[…] See also: Ebates Visa with Membership Rewards. Everything you need to know. […]

Anyone else having a problem with Synchrony not restoring your credit line after payment? I owed $7400 and paid after the month closing date. That was Feb 4. Payment was made from Wells Fargo. Synchrony has not restored my credit line and it has been 8 days. Anyone else had that problem with them?

I would at least like to get one more swing at the 4% back before the 15th.

I called and they released the funds. I will keep the Rakuten Visa, because it does provide 3x to some, but not all, things. I use my ATT More for Amazon in which I always get 3x for it there. It has been hit and miss at Amazon with Rakuten and the Visa. We are taking a big trip soon and Rakuten gives a pretty big cash back on tours, but i use the CSR for the actual booking due to 3x on travel things, plus the good insurance. Even with the demise of the 3x for GiftCardMall, there are other, not as lucrative, ways to earn points. I knew this one was going to be too good to be true. Too bad it got hit too hard. Kind alike the Marriott conference thing. My only regret is I did not have my wife doing this too.

Bryon, that is typical of the card, especially early on. I think with my card it get released a little faster, but just plan it can really mess up timing unless you can cover the the float.

Truly rotten turn of events this past year for MS. This was the last ray of good cheer – will be sorely missed.

Greg,

Betting your valuation of the Gold card just shot up. 🙂

Did not get the email yet either so thanks for the heads up. Just enough time to get in one final round

[…] h/t Frequent Miler […]

@ Greg — So, why don’t you recommend this product anymore? 3x MR points is awesome. What am I missing?

Opportunity costs. If you want to MS you will continue to get the 1x at the gift card shops and the other percentages for other stores. But now other cards will earn additional for that spend (2x Double Cash for example) and is the Ebates Visa now really worth a 5/24 slot? Not really, unless you purchase so much stuff through Rakuten were you’ll still get the additional 3x

I have zero interest in MS (too much work IMO since the death of the RedCard), but you make a good point regarding volume of purchases through Rakuten. I mainly use it for IHG reservations, and then I already pay with a 3x travel card.

It’s only 3X points through the Rakuten portal or at stores where Rakuten is offering in store cash back offers. And that 3X now excludes gift card purchases at the aforementioned sites. The upside just isn’t really worth the credit card slot if it doesn’t include 3X for gift cards, since it’s now basically just 3X for online shopping (and only places where Rakuten gives cash back, at that)

Well, yes 3X is better than the 2X everywhere you can get with the Amex Blue Business Plus card or the Citi Double Cash card, but often there are other portals that offer better rewards than Rakuten. So, with a 2X card, you can shop around to find the best portal deal. The Rakuten card is only best when Rakuten has the best portal rewards AND when you don’t have another card that offers 3X or better for your purchase. For example, if buying from Staples, you’re better off paying with an Ink Cash card to get 5X (at office supply stores).

If you’re loyal to the Rakuten portal and you shop online often, then yes this is still a great option for you.

I’m also surprised with the strong no longer refer and don’t agree with it as the value is still very high for everyday purchases. . Using this card through Rakuten earns not only 3x MR but also the “cash back” percentage that Rakuten is offering and that is paid in MR. There is no annual fee on the card so good luck finding cards that pay out 7x to 10x in MR which I frequently get on this card. Plus if you value MRs at 1.5 cents each than even if Rakuten is not giving the most cash back this is better than straight cash back. I don’t MS so I never used it for that. But if you value MR then Rakuten and this card are amazing for clothing, concert tickets, some travel, meal delivery plans, etc…

How long has language excluding gift cards been in the terms of service?

https://www.rakuten.com/help/article/terms-conditions-360002101608

8. CASH BACK EXCLUSIONS

8.1 Cash Back is earned on your net purchase amount, which excludes taxes, fees, shipping, gift-wrapping, discounts or credits, returns or cancellations, and extended warranties. Purchases of gift cards do not qualify for Cash Back. Cash Back amounts vary by store and product category and may contain exclusions in the terms of the offer and/or the applicable store page. Please review these terms carefully.

I think that’s been there a long time. It doesn’t apply to sites like gift card mall.

Hmmmm, I never got an email from them about killing the 3% back. What is strange is that I had a $7K bill and paid it prior to the due date. That was 10 days ago and CL sits at $75. I called and they some crap about payments over a certain amount they held for awhile. Citi, Amex, and Chase do not do that to me. I paid this off my Wells Fargo account, and that account has been void of that amount for 10 days. Synchrony sells credit cards to all those folks wanting a discount at the clothing store. They know they can just jerk them around. I would guess they got hit pretty hard since last October. I just want my CL restored for one more go at it for 3%. Every year the cash cow rolls around. One year it was the IHG elevator thing, then Iberia did the crazy thing for 90K in points, now this. There will be something else. I just want one more go of it. Makes me wonder if Rakuten cried foul, or did Synchrony cry foul.

Any rakuten/synchrony knowledgeable folks out there? Need help fixing a rakuten visa denial. Well i had Froze TU and EX cuz i saw a DP somewhere of someone getting approved when they froze those and they said synchrony pulled EQ instead. So I did that and synchrony tried TU and EX and both blocked as expected but synchrony never pulled EQ. Then i unfroze EX and called synchrony, and they wouldn’t tell me why i was denied, but they said they would try again if i unfroze EX. Boom this time HP EX (still nothing on EQ) and still denied, this time for too many new accounts or applications for credit…. but that’s BS cuz no new accounts since July 2018 and only 3 HPs in 12 mos. To top it off i was pre-approved (email). #irritated

P.s. didn’t know to freeze sagestream and ARS… if i freeze them how long should i wait to reapply?

I just applied yesterday and instantly approved. I had unfroze all 3 bureaus when applying. I applied last August and denied because not all 3 were unfroze. Unfortunately, i used a different email than my MR Rakuten acct. I guess some people had success fixing email in Rakuten Visa acct so hopefully that works for me too.

Got my Rakuten cc today. So, I don’t actually have to update my email. My email for my card and Rakuten website are different. Cash back from cc purchase via Rakuten.com shows up in Rakuten site.

Did you freeze ARS or Sagestream?

No, I did not. Just unfroze the 3 credit bureaus Experian, Equifax, and Transunion..

Applied 30 days after initial denial and froze only Sagestream and got approved! Not too bummed about MSing.

Well, looks like I dodged a bullet getting denied!

Any other reports of gift cards from giftcardmall and giftcards.com only giving 1x bonus instead of 3x? I have seen different reports on reddit stating such.

GiftCardMall is still working as usual for me

My latest purchase from giftcardmall, today, did not show the normal 3% message if using Rakuten Visa, and while the 1x points show from Rakuten, there is nothing showing under the section for the Rakuten Visa.

Just wondering if anything has changed.

Any update on whether you received your 3x points?

Yes, I get the 3x points. You have to be patient. Do not order a big load of gift cards at one time, or the order will not go through. Stay smaller and don’t get noticed. I have learned just order $1500, and no shipping fee from giftcardmall and the orders goes through without a hitch. I mix plenty of other spend. This is a good deal and no one needs to be milking it for all it is worth.

I am still amazed that I can spend on a Visa card and get Amex points. That is a very sweet deal.

subscribe

Greg, or anyone, know if there have been any shutdowns by Synchrony or Rakuten on just buying gift cards with the Rakuten Visa? How many $’s per month is anyone doing on the Rakuten Visa.

I just don’t know how aggressive I can be. Looking for data points.

Approved, $1000.00. That’s it I am done, no more applying for cc for 6 months or so. In recent, I have been trying to get a credit card with price protection! Would not get approved for USA Bank or Citi AA because of too many inquires, over 5/24. Now that I have got this. I am going to garden. Came to this post through the Points Guys and was able to get more info from all comments. I do have relationship already with Synchrony Bank, Paypal Card 25K if that helps. I might try to call and increase the limit once I get it.

Are you sure your permanent credit line is only $1,000? As I wrote in the post, everyone gets a temporary $1,000 credit line until their card is delivered and activated.

Oh that’s even better news! I guess will wait to see when I get the card. Thank you

My hopes are go get a 5K credit line and do 5K per month on gift cards. That would be 240,000 MR in a year. That plus other normal spending would be plenty of points for a nice trip somewhere.

Just got approved for only a $1000 credit line. I put a freeze on the two credit places and waited a few weeks. I picked up the Green Card and Double Cash since placing the hold on credit reports.

Just did a $1000 giftmall order and it went through. Just wondering if Amex will squawk, when this is one bank removed from Amex dishing out the points.

Anyone with any data points on this?

Anyone got the credit limit increased?

Anyone having any issues buying gift cards with this card?

Are you over 5/24? Just curious

Are you sure your permanent credit line is only $1,000? As I wrote in the post, everyone gets a temporary $1,000 credit line until their card is delivered and activated.

Will not know until the actual card arrives what the credit line will be. And for K-Man, I am about 8/24 right now. Too many good deals coming through on cards right now. However, if this 3x + 1x works out like I hope, this could be the sweetest deal in a long long time. I do not plan to hit it hard so as to screw up a good thing.

Lastly, than you very much for what you and Nick do to help all of us. Sometimes things work out and sometimes they do not. But that is OK.

Hey John. How do you plan to liquidate the GC you bought from giftcardmall?

Thanks 🙂

Just bought 5K today from giftcardmall. I pay an extra $2 to get them shipped UPS. Our post office screws our mail up enough, that it is worth having it on my front porch. I have a WM 5 miles from my house. I go there 3-4 times per week for grocery runs. Since my credit line is 7.5K on this card, I will not milk it for all it is worth. I will just do slightly less than $1000 each time to keep from handing over my license and hopefully stay under the radar. I will leave a few cents on the card to stay under the 1K. Then I go 2 miles further to WF and do a ATM deposit. I once did the rabbit run and got shutdown at a couple of places. This time I will be the rabbit. Hope everyone else is too. If you watch pointchaser, you will see she spreads her MS across alot of cards.

Just wondering a bit how a Visa card is giving Amex points. Not wondering long if the points keep flowing.

Hey Byron. You’re doing MOs at WM, right?

(Not sure if you’re using loadable cards or something else)

Thank you.!

No reloadables. Strictly Metabank Visa Debit cards from gift card mall. I never say the words “gift card” at WM. I tell them I have two ea. $500 debit cards and I want one $999.00 money order.

By the way, when I order $5K I always pay a little more to get these delivered to my front door. We don’t have porch pirates here.