Over the weekend, we published an update to this post about Chase pre-qualified offers. In short, many more people were seeing pre-qualified black-star offers in a different place in their accounts (under “Credit Cards” in the desktop browser or under “Open an account–>Credit cards” in the app). When those offers include a set APR (that is to say not a range like 18.24%-25.24% but a set number like 22.24%), they have been known to bypass 5/24. That doesn’t mean automatic approval, just that it is possible to be approved for those offers when over 5/24 (and I’d say that anecdotally, it seems that approval has been more likely than not when seeing a set APR). However, it gets a bit more interesting: some folks figured out a pattern and have thus discovered links to set-APR offers on many Chase cards. I don’t know whether or not these offers will actually bypass 5/24. It is important to note that these links were likely not intended to be public. There is therefore certainly some risk in applying and we recommend caution and considering the risk for yourself before applying.

In Greg’s post, Why Chase shutdowns have increased and how to avoid them, he notes that, anecdotally, applying for a new Chase credit card can sometimes be a trigger that causes Chase to evaluate your overall behavior (applications with other banks, spending patterns, etc). In some cases, that may increase the likelihood of a shut down.

In this case, the unknown origin of the links may increase the likelihood of account review further. Chase tends to be less aggressive than Amex in terms of shut down for leaked application links, but we just don’t know how they’ll handle applications through these links and therefore urge caution. Still, after contemplation, it seemed that the proper thing to do is to notify readers that these links exist and allow you to evaluate risk and make your own decisions.

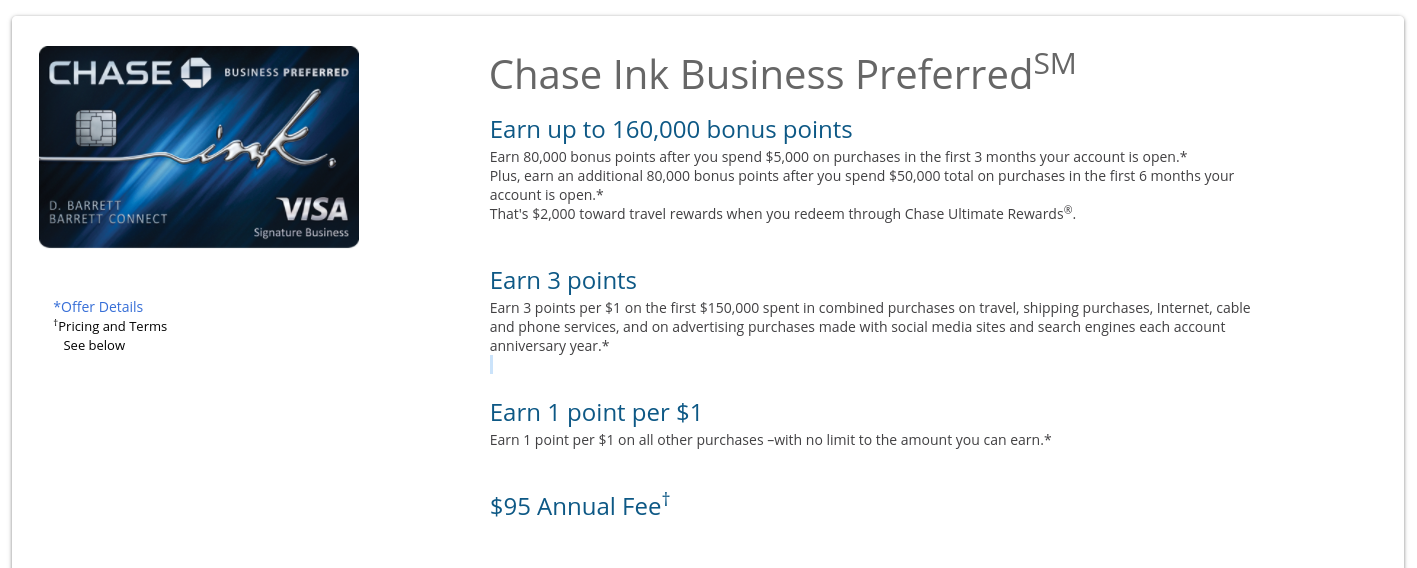

Here is a link to the Ink Business Preferred 160K Offer:

And here is the Sapphire Preferred 70K offer:

If you’re interested in other Chase cards, reader Zz at Doctor of Credit supplied the information last night about how to populate offers for other cards.

Again, the commenter supplying the codes above cautioned twice that he/she thinks these are risky and they certainly may be. On the other hand, we’ve seen non-public Chase links work in the past. Examples that come to mind are so-called “zombie links” that have existed for some cards after they were discontinued — for example, when the Chase Ritz-Carlton card, the Chase IHG Rewards Club Classic card, and Fairmont credit cards were discontinued, there were non-public links that continued in some cases days beyond the date when application links were pulled from Chase’s site. In those instances, I don’t recall shutdown stories. However, in the 2019 environment, it would be prudent to think before leaping. If your other activity is relatively mild (i.e. you’re not applying for tons of cards with other banks and MSing large numbers on Chase cards), my gut instinct is that you may be OK. Whether or not you want to risk your portfolio of Chase cards on a gut instinct is for you to decide. In my case, I don’t think I will use these links to apply as I don’t feel like the long-term risk is worth the short-term reward in my shoes. YMMV.

H/T: reddit user JonLuca via Doctor of Credit

Does anyone have a working link at the moment for the Sapphire preferred? Thank you! I am in urgent need of it.

[…] there were also some reports of shut downs related to people applying for links that were not sent to them originally (link […]

Can someone share how to go about this for united mileage plus card ?

40/24 and instant approval for Chase Sapphire Preferred.

So much hate here. I love the blog and appreciate what you guys do.

Sorry, I’m on the ‘delete this’ side on this. IMHO, this does more harm than good to the overall community. I appreciate your transparency and all, but this doesn’t need to be publicized. Reposting Greg’s chase shutdown post would’ve been more beneficial than this. But it’s your blog, so it’s your call.

F the haters. this is one of the best blogs on the planet. thoughtful.

Maybe Drew can post another $100 offer.

Wow at some of these hater comments…. the link and codes have been shared with my coworkers as well as my boss all were immediately approved if you guys need any DPs.

If anyone wants the google doc with all the codes please let me know

Please send to t e c h f a t h e r AT g m a i l. Thank you!

I’d love to see it. Tmoworkpackage at gmail

aarvard.aback at gmail.com please

littlebritchessji at gmail

Thanks!

This sounds like someone from the Chase marketing department, or the Amex RAT team doing competitive research. You’re doing God’s work man. Should have done some name dropping while you’re at it.

i am interested in personal southwest cards , any codes for that ?

kingofkingsforu at gmail.com

Can you please email me the list?

yvrstasonice AT gmail.com

Can you please email me the Google Doc as well? updownok991991 at yahoo dot com

I would very much appreciate as well. Thank you.

Looks like I have to post without the at sign. pdakk1 and aol.

please send to pumpalert At g m a i l. Thanks !

Delete this. You are like the 15th most popular CC blog. No one even reads you guys. This isn’t how you gain readers.

They are easily in top 5.

Which are the 14 better ones I want to sign up on theirs too ?

CHEERs

If no one reads the blog then there is no reason to delete the post. Your comment makes no sense.

I am usually on the side of publishing tricks and ways to do things to beat the system. When others didnt like the fact that you shared a full guide to MS I supported your decision in making such a guide. But not on this Greg. I thought about it quite a bit yesterday after Doc posted it and here what I think will happen after the flood of applications: Chase will see that there have been hit for many points and will reevaluate the whole point granting system. Second CIP, MDD, and other methods will be revealed by their internal analysis and they will make terrible changes to those things.

An All new low for FM will it be a pubic Hanging or better yet a burning at the Stake . If I post u can get more points by jumping off the Hoover Dam over-pass I bet most would do it .

CHEERs

The reason we published this is that these links have been floating around the internet and we believed that the responsible thing to do was to publish our concerns about these links. If we stayed quiet, there would be plenty of people who wouldn’t know the risks involved and might go forward with the links unaware.

In my opinion, Nick did an awesome job of presenting the risks involved here.

The more it is out there, the more likely it will get emailed to Chase and every single sign up through it will be reversed. Do you really think, now that the information is not out there publicly, you are serving some sort of public interest by keeping it up?

The public interest aspect of it is the warning that using one of these links is risky, so if somebody comes across this information on another site that isn’t as well thought put they may think clicking through the links thinking it is a risk free endeavor.

I do tend to agree with one of the other posters though that the screen shot of actual codes could probably be blurred or deleted to preserve them. I am not really sure they bring too much to the overall story especially if the story is to just make people aware that this is a thing and it does carry some risks

Maybe, but at least remove the screenshot from Zz with all the codes in it. This is the only public place that still has that list, as far as I know. Which undercuts the “for our own good” argument.

Greg, with respect, this doesn’t hold water. It would be one thing to say “hey, here are shutdown risks for things that have been going on related to targeted offers.” It’s another to say (a) “hey readers, here is exactly how you do this risky thing” and (b) “hey Chase, here is the exact way to do this risky thing that others are doing, you should apply some extra scrutiny to those who have signed up.” This post isn’t consistent with your ethos generally and you should reformulate it as you have done before.

Greg

Where’s Steve’s post on the matter ? Is he Sleeping on the floor @ a local airport or in the luggage compartment of a Greyhound Bus ..

The Pack does Turn on the Hand that feeds them Fast Don’t They ?

I think u have better things to post on .

CHEERs

Sorry everyone. I’m trying to understand your concerns, but I feel like I’m missing a piece of the puzzle. In my mind, posting this was the responsible thing to do. I don’t believe that Chase would change their behavior as a result of this post except maybe to change their coding so that people can’t generate signup offers. And that’s something that, as a business, they should do. I can see Matt’s point that the screenshot of the codes doesn’t add to the story, but it seems like people are upset about more than that and I honestly don’t get it. Please try to explain without resorting to name-calling or fedora blaming.

Perhaps, and hear me out, Chase will *learn* of this *through* your post and *shutdown* the people who signed up by *using the explicit steps you lay out in your post*

Publishing this post increased your readers’ risks. You did not “help” reader understand the risks, but you might have brought more risks to your readers. Period.

I’ve attempted 14 different variations to explain it, but I have to keep editing as I can’t create an explanation without Fedora blaming

Oh give me a break

Long time reader of your blog and recently of your podcast. In your recent podcasts you’ll spoke about the aspire card and where to draw the line and how to give subtle hints about something that doesn’t cross the line. Also, I’ve seen you draw flak from some readers when you mention public information about say rakuten credit card (some folks just don’t like any mention to this card, at all). With this background, I know you guys tread the line quite well.

This post is where you’ll failed. This is not public information, it puts any reader using these links at risk. I imagined when you would see the original sources being deleted and after having some time to digest the feedback, you would delete this post too. Unfortunately that didn’t happen and this post is the low point of this blog since I started reading it.

Thanks for updating the post.

This is the right move. I understand that it’s going to upset some people, but it’s a group of people who are super deep in the game at lol/24. That group already understands the risks they are taking on by signing up under links that Chase hadn’t intended to distribute. You can’t go around blaming people for spreading the word, when that’s how you discovered it in the first place. Obviously word was going to keep spreading and you should realize that.

On the flip side, someone else might be innocently searching the web for a good deal for the CIP and sign up for the 70k deal because they see that it’s higher than the 60k. Now they are taking on the same risk without even realizing it. It totally sucks for them to potentially get shut down when they didn’t realize they were clicking on a manufactured link. I think it’s important to warn the general public, even if it will upset a few deep in the game.

Bring on the thumbs down!!

is that CIP offer even worth it? I mean you could just open 2 cards under SsN and EIN and get the same number of points with 1/5th the spend

Then don’t do the $50K part of it. It’s still 80K after $5K. It’s just a matter of whether or not you want to do another $45K spend. If you’re over 5/24, you won’t be able to get a second one. Again, I’m not saying you should apply — but if your question is about why someone would consider it, the answer is because they are above 5/24 and can’t get a second one but still find 80K points for $45K unbonused spend worthwhile. I don’t expect everyone to be in that boat, but some are.

Guess that makes sense, i didn’t really follow that it was one of the offers that might bypass 5/24 and thus be available to somebody who would not be able to get a CIP let alone 2 in the first place

Any datapoints on getting the BA card if you are greater than 5/24. No codes and when I go through the website, it shows me a variable APR.