NOTICE: This post references card features that have changed, expired, or are not currently available

It’s been almost two years since I first wrote about the American Express Campus Edition card. At the time, I found the card interesting, but there were better and easier point earning opportunities available. As a result, my Campus Edition card languished in a drawer.

For review, here are the basics of the card:

- One per person

- Loadable at Barnes & Noble Campus Bookstores with a credit card for a $3.95 fee

- Maximum register load: $500

- Maximum register loads per month: $1000

- ATM fee: first withdrawal per month is free; then $2

- ATM limit: $400 per withdrawal; $400 per day max

Two years ago, I found this card to be not worth bothering with. The campus bookstore requirement made loads inconvenient. The $1000 per month limit was paltry compared to other readily available options. And, at the time, I was readily earning 5X Ultimate Rewards points which I valued much more highly than the 5X ThankYou points which could be earned through the combination of this card and my Citi Forward card.

Now, circumstances have changed and I now find a lot to like. Unfortunately for others, as you’ll see, my situation may be fairly unique…

I moved

The biggest reason this card is now interesting to me is that last year I moved closer to downtown Ann Arbor. Our campus bookstore is now less than a mile and a half from my home. For lunch, I often walk that direction anyway, so visiting the bookstore is no longer an inconvenient chore.

I found a convenient $2 ATM

The easiest way to liquidate the money loaded onto these cards is via ATM withdrawals. Most downtown ATMs charge $3.50 or more, but I recently found one that charges only $2. And, best of all, this ATM is on my way home from the campus bookstore and very close to another bank where I can deposit the withdrawn cash.

I can still get 5X at bookstores

Last year, Citi stopped taking new applications for the Citi Forward card. This is unfortunate since the card offers 5 ThankYou points per dollar at bookstores, restaurants, and a few other venues. Luckily for me, I got the card before then and Citi has continued to honor the 5X benefit.

ThankYou points are gaining in value

Citi recently added the ability to transfer ThankYou points to various airline mile programs. To me, that increases the value of ThankYou points quite a bit. Full details can be found in these posts:

- Thank you, Citi, Singapore is looking sweet

- Citi changes the dating game

- Citibank ThankYou points can be transferred to airline miles

-

Citi ThankYou adds transfer partner: Airfrance/KLM Flying Blue

5X Ultimate Rewards have become harder to get

It used to be possible to run into Office Depot with a Chase Ink card and buy various money-like products (Vanilla Reload cards, Vanilla Visa cards, etc.). By paying with a Chase Ink card (which earns 5X at office supply stores), this was a great and easy way to earn 5 Ultimate Rewards points per dollar. Since that time, Office Depot stopped allowing credit cards for these products. Now, the best bet for most people is to buy $200 Visa or MasterCard gift cards at Staples with a Chase Ink card. This is still lucrative, but not nearly as great as the Office Depot approach used to be. And, dealing with many $200 cards is much more hassle than dealing with a few $500 cards.

My exercise plan

My campus edition exercise plan is simple:

- Once a month, walk to the campus bookstore and load my card with $1000 (requires two separate transactions). Cost: $1007.90. Points earned with my Citi Forward card: 5040.

- Withdraw cash from ATM, $400 at a time. The first $400 withdrawal per month will cost $2 (charged by the ATM). The second and third withdrawal will cost $4 each ($2 charged by Amex + $2 charged by the machine). Note that I will only have to do a third withdrawal once every other month as long as I’m willing to let $200 float on the card for a month. So, on two-withdrawal months, total ATM fees = $6. And, on three-withdrawal months, total ATM fees = $10. Average monthly ATM fees = $8.

- In total, I should earn 5040 points per month for a total cost of $17.90. This amounts to buying points for only about a third of a cent each: .32 cents per point.

Going wide

Given this card’s $1K per month bookstore load limit, I can earn at most 5040 x 12 = 60,480 points per year with this card. That’s not bad, but its not an amazing bounty either. There is a theoretically easy way to scale up, though: get more cards. The idea would be to get cards for other family members and use those in the same way as I described using my own card. With 2 cards, I can earn over 120K points per year. With 4 cards, I can earn over 240K per year, etc. The only limit I can think of is if the Citi Forward card has an annual limit on 5X spend (anyone know?).

Trouble getting cards

As I described in my original Amex Campus Edition post, Amex often rejects applications for new cards. The application seems to go through, but then you get an email stating that they could not complete the order for the following reason: undefined. That’s what happened two years ago, and I find that it’s still happening. The main difference is that I now get the rejection notice within minutes or hours rather than in weeks as before. The only solution seems to be to keep trying.

Forward-free options

If you don’t have a Citi Forward card and you’re not interested in marrying someone who has one, there are other options:

- The Barnes & Noble MasterCard earns 5% cash back on all Barnes & Noble purchases. Please see my analysis here: Why the Barnes & Noble MasterCard might be worth a look.

- The SallieMae World MasterCard earns 5% cash back at bookstores, up to $750 per month (it also offers 5% at gas stations and grocery stores up to $250 per month). Plus, get a 10% bonus by moving rewards into an accompanying Sallie Mae savings account, for a total of 5.5% cash back.

- You could also consider the US Bank Cash+ card which lets you select bookstores as a quarterly 5% cash back category. The 5% benefit is limited to $2K per quarter.

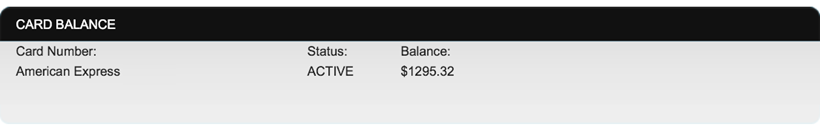

$1K balance limit, not so much

One of the ugly limitations made clear in the Campus Edition Frequently Asked Questions (FAQ) is that you “cannot exceed a balance on the Card of $1,000 at anytime” when money is loaded at campus edition bookstores. If true, this would be a nuisance. In reality, they do enforce the monthly load limit of $1K, but in my experience they do not enforce a $1K balance limit:

UPDATE

It appears that there is a $6K per rolling year register load limit. So, I will change my process to load just $500 per month per card and one $400 ATM visit per month. I’ll unload the remaining $100 once every 4 months via a $400 ATM withdrawal. This makes it even more important to “go wide” and get extra cards.

[…] a nice little point earner for those with a credit card that earns a bonus at bookstores (see “Exercising the Amex Campus Edition card”). Unfortunately, Amex has sent an email to cardholders saying that beginning February […]

I had both Citi Forward & Premier, and have been loading Amex Campus for a while. Is is possible to transfer regular TYPs from Forward to more valuable transferable TYPs? I couldn’t find any info on Citi’s website.

Yes, when you have multiple cards, the points pool together. Or, if a friend has the Prestige or Premier card, you can transfer points to them and then they have 95 days (I think I remember that correctly) to use those points.

[…] the past I’ve written about the American Express Campus Edition card. Most recently, I wrote: Exercising the Amex Campus Edition card. This card can be bought and reloaded at Barnes & Noble Campus bookstores. Those with easy […]

[…] me an authorized user, and I’m now I’m get huge points. If you still have that card, check out Frequent Miler’s post on how to capitalize on […]

thanks for the tip! From your experience, could you give any suggestion on which ATMs to withdraw for the lower fee? thanks!

If you can’t find free one’s (check local credit unions), try Costco or MacDonalds for cheap ones.

Not sure what you mean by “rolling 12-month limit” in the Update — can you elaborate? It would seem like the fastest route to fully load/unload the annual limit is over the course of 6 months loading $1k/mo — no?

Once you have loaded $6K to the card, you can’t load more until 12 months have passed from the first time you loaded it. Yes, you can max it out in 6 months then wait 6 more months before loading again.

When I was signing up for a 200,000 drawing on American I was in their shopping portal and on the Sears site it was 9x instead of the normal 3x for Sears purchases and under gift cards they had Visa cards up to $500 with I think a 3.95 fee or maybe 6.95. So I was wondering if I purchased a gift card for $500 would I get 4500 miles plus possibly 500 for the credit card dollars.

Thanks this is in reply to tour question.

I see. Unfortunately, only Sears and kmart gift cards result in points earned when buying from Sears

What the hell has happened to Evolve?

They limited payments to each biller to 1 payment per month.

Can you buy visa gift cards through American Airlines online portal and get the current bonus of 9x which is more than the normal 3x and get the 9x miles

Thanks Mike

Which store sells Visa gcs and is at 9X through the AAdvantage portal?

I heard someone saying that a while back that once you hit the $6k annual limit, you can cancel the existing card and apply for a new one. Haven’t tested that myself, but it’s something you can consider.

I just hit my $6k limit this week. I did try one additional load, but it was declined. (It would be nice if they listed this policy somewhere in their T&C or FAQ, but whatever….) I cancelled the card on Monday and reapplied for another card on Tuesday. I got an email confirmation saying that my order was approved, so this strategy seemed to work for me.

Thanks, great suggestion (thanks Paul as well). In my case it took so many tries to get the card in the first place that I’d be scared to close the card. I think I’ll just stick with $500 per month per card.

Back to comment 1. Is anybody really hammering 250k a year per card? Wouldn’t this get you shut down?

It would be risky

Thanks for this suggestion. Has anyone tried loading using B&N gift cards?

Yes, tried a long time ago. It didn’t work.

no limit on TYP @ 5x with Forward

Awesome. Thanks.

Are you sure a $2 fee ATM is your best option? In Michigan MSFUCU is fee free. Although looks like no options in Ann Arbor. Murphy’s gas stations is fee free but only $200 withdrawals at a time.

For other people looking for fee free atms I put together this list which they might find helpful: http://www.doctorofcredit.com/low-fee-no-fee-atms/

@Matthew The Sallie Mae card is actually 5.5% cash back, you get an additional 10% when you put the rewards into your savings account with them.

I’m sure that $2 is not my cheapest option. In Ann Arbor, the ATMs at Costco are cheaper. But, in downtown AA, where I can walk to, $2 is the best I’ve found.

Under the section labelled ‘Forward-Free Options’ don’t forget to mention the Sallie Mae MasterCard from Barclay’s. 5% cashback on books, for up to $750 in bookstore spend a month. I have that card, and unfortunately I live more than 30 miles in any direction from a B&N Campus store right now, or I would be all over this.

Thanks! I actually meant to include that one but forgot 🙂