NOTICE: This post references card features that have changed, expired, or are not currently available

Yesterday, a reader named Brian asked me the following question:

If the cost of an appliance (and its delivery, say) were the same at Home Depot, Lowes, and Sears, where would you buy the appliance and why and how would you do it?

I really like this question because it shows a real world situation and an opportunity to earn lots of points and/or save lots of money. I don’t know how much money Brian intends to spend, but for the sake of this post let’s assume he’ll buy a total of $3,000 worth of appliances. What is his best option?

Forsaking credit card warranties

Most opportunities to maximize point earnings and savings involve buying and using gift cards. It is important to understand, though, that when you buy things with gift cards you give up the automatic protections offered by your credit card. A good credit card will offer price protection and extend the manufacturers warranty by a year. How much is this piece of mind worth to you? Buying gift cards could save you 10% or more. If you were about to spend $3000, would you be willing to give up $300 for the peace of mind offered by your credit card? For the rest of this post, I’ll assume that the answer is no. Let’s take a chance that things will go right!

The Home Improvement gift card

If I were asked the same question six months ago, I would have said that step one is to go to Office Depot with your Chase Ink card and buy $3K worth of $500 Home Improvement gift cards. I had done experiments showing that I could triple dip with Sears and Lowes by buying Home Improvement gift cards to get 5 points per dollar, then going through an online portal to buy Sears or Lowes gift cards to get more points, and then going through a portal again to Sears or Lowes to use the gift cards. Since then, though, most of the steps described above have broken down. Office Depot no longer allows the sale of Home Improvement gift cards with a credit card (although some readers say that their local Office Depot stores still allow it – mine does not). Sears stopped allowing the purchase of their gift cards with Home Improvement gift cards. And, some readers have reported problems trying to buy Lowes’ gift cards this way as well.

If you have a card that offers bonus points at a grocery store or drug store, the triple dip described above might still work with Lowes: 1) buy the Home Improvement card at a grocery store or drug store; 2) go through a portal to buy Lowes’ gift cards; and 3) go through portal to use gift cards. That’s a lot of work, though, for a payoff that might not happen. For this post, I’ll assume that Home Improvement cards are not an option.

Buying gift cards

Assuming we know that we’ll be spending $3,000, the first step is to find the best option for buying $3,000 worth of gift cards. In the post “Best options for buying merchant gift cards,” I listed quite a few good options. Let’s examine some of them, in detail:

Secondhand gift cards

GiftCardGranny.com shows current rates for buying secondhand gift cards from resellers. At the time of this writing, GiftCardGranny lists the following rates (ignoring EBay auctions):

- Home Depot: 9.9% discount

- Lowes’: 9% discount

- Sears: 7.4% discount

It makes sense to also check Kmart and Lands’ End gift cards since they also work at Sears:

- Kmart: 7.1% discount

- Lands’ End: 7.1% discount

As you can see, you could save from 7.4% to 9.9% off the bat by buying gift cards from resellers. In practice, though, it might not be so easy. Often a reseller will have just a few cards available from any one merchant so getting $3K worth of gift cards could be tough. And, as you’ll see below, we can do better…

Ink + portal + Staples.com

Staples.com sells Sears, Home Depot, and Lowes gift cards online. And, if you buy e-gift cards, there is no fee for shipping and handling. Go to Staples.com via an online portal and pay with a Chase Ink card to get 5 points per dollar. Portal rates change frequently, so it makes sense to search for the best current option through a portal finder such as cashbackholic.com and/or evreward.com. At the time of this writing, the best options are 3X through the Ultimate Rewards Mall or 5% cash back through uPromise. Let’s assume for now that we’ll go for 5% cash back. In that case, after buying $3000 worth of gift cards and paying with a Chase Ink card, you would earn $150 cash back and 15,000 Ultimate Rewards points.

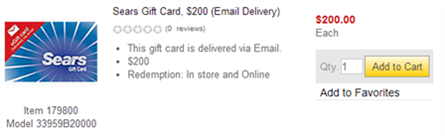

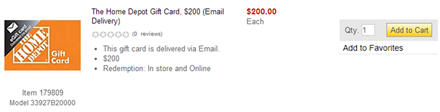

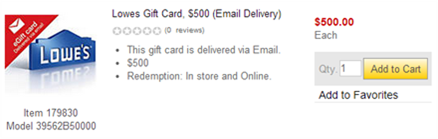

Sears and Home Depot gift cards top out at $200 each whereas Lowes’ gift cards top out at $500 each.

SimplyCash + OfficeMax.com

OfficeMax.com does not award portal points or cash back for gift card purchases, but they do provide automatic cash back via American Express’ OPEN Savings program. All Amex small business cards include OPEN Savings. With OfficeMax.com and OPEN Savings, you get 5% cash back for online purchases up to $250, and 10% cash back for online purchases over $250. If we mix in the Amex SimplyCash business card which earns 5% cash back at office supply stores automatically, you then have an easy path to 15% cash back! OfficeMax.com sells only physical gift cards and they charge a 99 cent fee for each. Both Home Depot and Lands’ End (e.g. Sears) gift cards are available in denominations of $100:

With this approach, you would have to buy 30 $100 gift cards and pay $29.70 in fees. In return, you would get 15% cash back. $3029.70 x 15% = $454.46. Your profit would be $454.45 – $29.70 = $424.75, which is equivalent to 14.16% savings!

ShopDiscover + Plink + Sears

A third option is to sign up for Plink and enroll your Discover It card and put Kmart in your Plink wallet. Then, go through Shop Discover to Sears to buy physical gift cards. To maximize Plink rewards, buy just one $50 gift card at a time, complete check out, then go back through the portal and start again. For each purchase, you should earn $3 (6%) in Plink points, $5 (10%) from ShopDiscover, and 50 cents (1%) from the Discover It credit card. That’s a total of 17% savings! You can do even better by redeeming your Discover cash back for Lands’ End gift cards at 20% off. Let’s walk through an example:

- Using the above method, buy $2650 worth of Sears’ gift cards. You’ll earn $291.50 in Discover Cash and $159 worth of Plink points.

- When redeeming Discover Cash, you can buy $100 Lands’ End gift cards for $80 or $50 Lands’ End gift cards for $40. Use $280 of your $291.50 in Discover Cash to buy three $100 cards and one $50 card. You now have a total of $3000 worth of Sears’ (plus Lands’ End) gift cards, $11.50 in Discover Cash, and $159 worth of Plink points.

- Remember that you’ve spent only $2650 out of pocket, so you saved 11.67% right off the top and you earned $159 + $11.50 = $170.50 worth of rewards, which is an additional 5.7% giving you a grand total of 17.4% savings.

This is obviously an extreme option. It would require 53 separate Sears’ gift card purchases and a potentially long wait for Discover rewards. If you skip the part of using Discover cash to get Lands’ End gift cards, you can speed things up a lot and still do almost as well, but that would mean 60 separate Sears’ gift card purchases. And, when you go to use those gift cards, can you even imagine having to scratch off 60 little silver strips and type in all those numbers. No thanks. This is a great option for maximizing savings, but a terrible option if you value your time!

ShopDiscover + Plink + Sears option 2

In the fourth quarter, the Discover It card offers 5% cash back (up to $1500 in spend) for online purchases. You can simplify savings by going through the ShopDiscover portal to Sears to buy physical gift cards and pay with your Discover It card. Of course, wait until the promotion begins on October 1 and make sure to register for the 5% promotion. This would be a nice easy way to get 15% cash back for $1500 worth of Sears gift cards. I would recommend breaking the purchases into at least three separate $500 purchases, though. Sears seems to take much longer to pay out to portals when purchases are very large.

Buying gift cards, quick summary:

- Buy secondhand: 7.4% to 9.9% savings.

- Buy $200 Sears, $200 Home Depot, or $500 Lowes gift cards with Ink card at Staples.com via portal: 5% savings plus 5X points.

- Buy $100 Lands’ End (Sears) or $100 Home Depot gift cards at OfficeMax.com with SimplyCash card: 14.16% savings.

- Buy $50 Sears’ gift cards via ShopDiscover: up to 17.4% savings.

- Buy three $500 Sears’ gift cards via ShopDiscover in the fourth quarter: 15% savings.

Buying online

When you’re ready to buy your appliances, you can save even more money or earn even more points by shopping through an online portal and paying with the gift cards you bought earlier. Even though ShopDiscover often has the best cash back rates, I don’t recommend using this portal if you plan to pay with gift cards. Some people have had their cash back clawed back in those situations. Instead, consider the following current options:

- Sears: 5X via the Ultimate Rewards Mall; or 8% cash back via MrRebates

- Lowes: 5% cash back via uPromise; or 3X via Ultimate Rewards Mall, or 3X via AAdvantage eShopping

- Home Depot: 4X via the Ultimate Rewards Mall; or 5% via TopCashBack

As you can see above, the current options for cash back and point earnings are fairly small compared to what’s possible when buying gift cards. As a result, if you can get a better deal in-store, go for it.

Moving coupons

If you’re planning a move, you might as well make the most of it and get 10% off coupons from Lowes and Home Depot. To get your coupons, sign up at the following sites:

Last I checked, Lowes will send a coupon good for 10% off, up to $3000 in spend (in-store or online). And, Home Depot will send a coupon good for 10% off, up to $2000 in spend (in-store only). Keep in mind that each store will honor the other’s coupons.

Sales, promotions, price matching, and more

The premise of this post was that all three stores offered the same appliances for the same price. In real life, that’s unlikely, but you should be able to get any of these stores to match the best available price at any other store with a physical presence in your area. In fact, both Lowes and Home Depot have price match guarantees in which they say that they’ll meet the competitor’s price and give you an additional 10% off. To get these discounts, though, you will most likely have to buy in person and give up the 10% moving coupon. That is, you’ll have to give up the extra 10% if you don’t know the trick of how to apply both (see “Extreme savings at Lowes“). So, even once you’ve committed to a particular store (by buying lots of gift cards, for example), keep your eye on sales, at all stores, for the products you want. You may be able to save even more.

Also watch out for special promotions. Sears often offers their ShopYourWayRewards members special promotions in which they can earn 5%, 10% or even more back in the form of ShowYourWayRewards points (normally, you earn just 1% back).

For an overview of even more extreme opportunities, please read “Extreme savings at Lowes“.

The approach I’d take

If it were me and I had some time, I’d watch and wait for special promotions to crop up. Keep an eye on sales on the appliances you want and be ready to jump on them when they pop up. An ideal situation would be one in which a store offers an excellent promotion (such as Sears offering 25% back in rewards) and a competitor offers the items at a great discount. In that case you could buy the items from Sears to qualify for the promotion, and submit an online price match form to get money back. With this watch and wait approach, you need to be able to get gift cards quickly. So, I would have my Chase Ink card ready to buy e-gift cards from Staples. These are usually delivered overnight. This wait and see approach doesn’t deliver the biggest savings through gift card purchases, but it leaves you open to jump on the best sales and promotions as they appear.

Waiting to hear Brian’s solution

I’m hoping that Brian will let us know what approach he decides to take. And, even better will be to hear about the experience once he has completed his purchases. Did his expected savings (or point earnings) materialize? What went right? What went wrong?

Related posts

- Extreme savings at Lowes

- Best options for buying merchant gift cards

- Maximizing Home Improvement Spend

- The Home Improvement gift card

- Home Improvement gift cards lose their luster. Now what?

- Million Mile Madness: Banking on Lowe’s

- Million Mile Madness: A setback from Sears

- Million Mile Madness: Bumps in the road

- Million Mile Headaches: Lowes, Round 2

Would I get Chase UR points back via portal for using a HIGC to purchase Lowes gift cards via lowes.com?

Maybe, but the most recent report in the FM Laboratory shows no points earned for buying a Lowes gift card through a portal. https://frequentmiler.com/laboratory/

I know this is an old post…but do you know if any portals will still give CB if i use a movers coupon as well? Thanks!

I would be surprised if any portals did not give cash back when using a movers coupon. Even though most portals claim that you can’t use coupons not found on their site, I can’t remember ever seeing that actually enforced.

Update: found out why the HI purchase did not work. The Sears GC order on sears.com is going through as a kmart.com transaction, so HI won’t work.

I wonder if there’s a problem with buying Sears GC with the HI card. I tried to buy a $499 Sears GC with my $500 and got an error message. Maybe I did something wrong…???

TTN: That option stopped working a while ago. I think that since the physical gift cards are sold by Kmart, the HI card doesn’t work. People have been able to use it to buy e-gift cards, but you probably won’t get points that way.

Lowes has10% off coupons, and you can buy them on Ebay, I would buy the appliances and charge them on my LAR, NS Pay the LAR bill off with 6 HI card that I would buy at my Indy OD store

Lowe’s will match other internet officers

So 10% off the purchase and 5X on the $3,000, $300.00 savings and 15,000 points,

You can also use coupons at HD, and copy it as many times as you like, but it can only be used once at Lowe’s.

Lowes has10% off coupons, and you can buy them on Ebay, I would buy the appliances and charge them on my LAR HI card that I would buy at my Indy OD store

So 10% off the purchase and 5Xon the $3,000, $300.00 savings and 15,000 points,

You can also use the coupons at HD, and copy it ass many times as you like, but it can only be used once at Lowe’s.

Greg,

Thanks very much for the great post! I am the Brian who submitted the question.

Your advice in the section “The approach I’d take” strikes me as a good overall balance of techniques to optimize money savings, time savings, and point accrual.

I have a few months to make my purchases, so time is on my side. Here’s my current plan:

1. I’ll sign up for whatever reward programs there are for Home Depot, Lowes, and Sears. That way I can get in their systems and begin receiving coupons or promotion notifications.

2. I will get one or more 10% off Lowes moving coupons and maybe some Home Depot ones just for good measure.

3. Then I’ll figure out which specific appliances I want (a lengthy but “fun”—if you’re sick like I am—research project in itself).

4. I need to research further the extended warranties that might come with purchases made on certain credit cards, and I need to decide if I’m willing to forsake those warranties in order to make purchases with gift cards. In general I think I am. One factor may be how long the warranty is on a particular appliance. If the warranty is, say, five years long, then extending it to a sixth year by virtue of buying it with the right kind of credit card seems like a small marginal value—one that I’d probably be willing to live without. If, however, the warranty were just one year, say, then doubling the warranty coverage by purchasing the appliance with the right kind of credit card may be a worthwhile investment.

5. Then I will wait for some combination of the appliances going on sale and/or one of the stores offering some kind of meaningful promotion that would apply to the purchase.

6. If the following kind of situation, which you described, arises then I may well do exactly as you suggest: “An ideal situation would be one in which a store offers an excellent promotion (such as Sears offering 25% back in rewards) and a competitor offers the items at a great discount. In that case you could buy the items from Sears to qualify for the promotion, and submit an online price match form to get money back.”

7. In the absence of that specific kind of situation, when a sale arises at one of the three stores I will check at a local Home Depot or Lowes (whichever store is *not* offering the sale) to make sure they sell the appliance I want and will honor the 110% price-match guarantee that I understand both Home Depot and Lowes offer.

8. Once I’ve verified that the store will honor the price-match guarantee on that specific item, I will then use my Ink Bold card to go through the Ultimate Rewards portal to Staples.com to buy e-gift cards for the store in question. (Or I will go through another portal if a different one is offering what I would consider to be a better deal than 8x UR points.)

9. With e-gift cards in hand I will go to the store in question. I will attempt the trick to apply the 10% off Lowes moving coupon while also getting the 110% price match.

To recap, if this strategy were to work I think I could save 30-50% in these ways: (1) buying on sale, (2) earning 8x UR points, (3) receiving a 110% price match, (4) using a 10% off mover’s coupon.

Now if Frankenfurter doesn’t think 30-50% savings on thousands of dollars of appliances is worth it, then he is entitled to his opinion. But I tend to agree with Grant: *EXPLOSION*!

Brian: Best of luck! I can’t wait to hear how it turns out. Please let us know!

Lowe’s gives you 5 percent off with a Lowe’s credit card so if you have that already (probably not worth wasting a slot for another card though), it might be a good option to stack with an online portal and the moving coupon.

As far as I’m aware, the Home Depot card just gives you interest free financing (probably not worth it on a $3,000 appliance purchase, but could be helpful for a $20,000 kitchen remodel).

I haven’t dug through the terms and conditions, but it might be an option if you want the purchase protection through a credit card.

Here is another option… Kroger fuel points. What the blue cash amex that’s like 6%off. Buy the gift cards. 3000 dollars worth would be 12000 points on 4x points on GCs 12000 points could be 12 1 dollars off fill ups up to 35 gallons bring two cars and that could be up to $420 off on gas alone if you needed 12 fill ups in a two month period(how long fuel points are good for) plus 180 cash back on 3k… I’ll admit slight more realistic on a smaller purchase I don’t know anyone who buys 420 gallons of gas in two months…

Nice analysis of all the options but to make it even more complicated, opportunity cost should be taken into account. For example, the ShopDiscover + Plink + Sears option 2, if you use up the $1500 4Q ShopDiscover quota, you won’t be able to send $1500 via Amazon Payments, which qualifies as online shopping and almost all readers should be able to do that for an easy $75.

WeddingSpend: That is true!

charles alan satterwhite: Yep, for some, fuel points are a great way to go.

Rachel: Thanks for that added info

@FM, no, I don’t have any business cards of any kind … but plenty of other ones.

Kalboz: If you have a Discover card, then see the section about about Plink and Discover. For your situation I think it would be an excellent way to go. Otherwise, I’m not sure you can do any better than buying gift cards from a reseller (or Scrip, as Anita suggested), then go through a portal to make your purchase.

Great post – I’ll save it. From my recent experience doing a kitchen redo (sorry I didn’t know all these tricks) I can add one of my own. Shop searsoutlet.com

you can get the exact appliance you need by patiently searching. They are new with full guarantees and warantees, probably were delivered & customer changed mind. Sometimes slight dings (pictures and details on websites). As much as 50% off.

An example, my expensive cooktop not available for months and not in the immediate area. Checking every few days I found one in Springfield Mo (I’m NYC based)

Took a miles trip to check it out and send it by Fedex Ground (saving $150 in delivery charges) and added a great few days in Branson Mo. BTW I saved $900 on the cooktop and it’s perfect not a blemish. I got my searsrewards points and bought through a portal–no gift card tricks unfortunately.

I agree that the second hand gift cards is by far the simplest way (and you get actual cash back). However, you forgot to mention that the second hand gift card merchants also offer cash back through portals so its even more than the 9%-10%….

john: I avoided the conversation about cash back with gift card resellers because there are few options left in that area other than cardpool and it’s confusing to explain how cardpool cashback is limited to $1K lifetime.

.

Bacc: Great suggestion, thanks.

@Sott C/FM:

Good to know that and thanks for the clarification.

Hi FM,

You can also buy email Home Depot gift cards through UR at Staples online. Did last week and got all points.