NOTICE: This post references card features that have changed, expired, or are not currently available

| First, a reminder: Thanks to their Olympics promo, the US Bank personal and business FlexPerks Travel Rewards Visa cards currently have sweet signup bonuses: Each card offers a total of 34,500 FlexPoints after $2,000 spend (the usual signup bonus offers only 20,000 points). Since points are worth up to 2 cents each, each 34,500 point bonus is worth up to $690. More realistically, you’ll get about 1.7 cents value per point, for a total bonus value of over $580 (details here). That’s still excellent! And, for those wondering: no, I do not earn a commission for this offer.

The Olympic medal promo offer is available only through 9/3/2016 (Saturday!) |

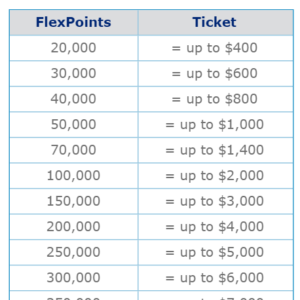

If FlexPerks was your only travel rewards program, it would probably drive you batty. Points can be quite valuable when used to book flights, but only when the cash price of those flights is near the top of one of their rewards bands. For example, flights costing up to $400 require only 20,000 FlexPoints. That’s great for a $400 flight, but quite a poor value for a $200 flight. And if the flight you really want costs $401? That extra $1 in price will cost you an extra 10,000 points. Another irritation is that multiple seats on one itinerary don’t stack. That is, if you want to buy two $200 tickets so that you and a companion can travel together, you’ll be charged 20,000 points per ticket, rather than 20,000 points for the whole $400 itinerary.

You can find the FlexPerks award chart and expected values for points here: FlexPerks award charts for flights, hotels, car rentals, and annual fees.

You can find the FlexPerks award chart and expected values for points here: FlexPerks award charts for flights, hotels, car rentals, and annual fees.

I love having FlexPerks’ FlexPoints around, not as my primary source of points, but as a backup. When I’m booking a paid flight and the price just happens to fall near the top of a band… FlexPoints to the rescue!

Another great use is for cheap upgrades. Particularly with domestic flights, it’s not unusual to find that first class isn’t too much more expensive and sometimes can be had for the exact same price with FlexPerks points. For example, I once had to buy a one-way flight that would have cost around $345 for economy or approximately $390 for first class. With FlexPoints the price was the same: 20,000 points. Obviously I went with first class. And, sometimes you’ll find that first class is about $200 more expensive. In those cases, it will usually cost just 10,000 more FlexPoints. Is it worth 10,000 extra FlexPoints for the upgrade? Depending upon the flight, it very well may be!

Another cool little perk (I guess I should call it a “FlexPerk”) is the $25 Airline Allowance. On the day you fly, any charges made directly to the airline (including gift card purchases) can be reimbursed up to $25. Unfortunately, to take advantage of this benefit, you have to call to request the credit each time. Sometimes it can make sense to book two one-way flights instead of a single round trip in order to get two $25 credits. Just make sure that the total price in FlexPoints isn’t increased by breaking up the trip this way.

Free in-flight Gogo, only with the personal Visa Signature

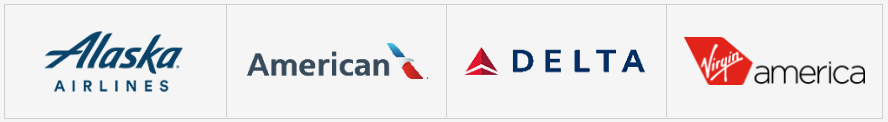

FlexPerks cards come in several varieties, including an Amex card. My favorite variety is the FlexPerks Travel Rewards Visa Signature because it is the only one that includes 12 free Gogo inflight wi-fi passes per year. Note though that these passes are only valid for domestic flights, and only on the following Gogo partners: Alaska, American, Delta, and Virgin America. If you don’t regularly fly one or more of those carriers, this benefit won’t be of much use to you.

3X Charity via personal Visa Signature or Business Edge Visa

If you donate a lot to charities, the FlexPerks personal and business Visa cards are probably your most rewarding options. Both offer 3 points per dollar. Since points are worth up to 2 cents each towards flights, that’s a rebate of up to 6%. It’s interesting to note that charges made by charities for non-charitable expenses get the same bonus. For example, Kiva loans also earn 3X points.

As an aside, another great option for charity expenses is the no-fee US Bank Cash+ card which offers 5% cash back in categories you choose (including Charity) up to $2,000 in spend per quarter.

2X Grocery or Gas via personal Visa Signature; 2X Gas via Business Edge

One of the more infuriating aspects of the FlexPerks Visa cards is that some of their category bonuses are dependent upon which categories you spend more on each billing cycle. For example, the personal card offers 2X points for gas, grocery, or airline purchases. You won’t get 2X points on all three. You’ll only get 2X points on the category that you spent the most with for a given billing cycle. The business version of the card has a similar benefit: 2X gas, office supplies, or airline purchases, whichever you spend most.

The solution is to pick the category you’re likely to use the most and where you don’t already have a card that offers good rewards. Use your FlexPerks card for that category, and other rewarding cards for the other categories. For example, a reasonable approach would be to use your FlexPerks Visa Signature card for groceries (2X), and your Citi Premier card for gas and airline purchases (the Premier card earns 3X on both).

Visa varieties: No annual fee with high spend

The personal Visa Signature card offers an annual bonus of 3,500 points each cardmember year in which you spend $24,000 or more. They also let you redeem 3,500 points to cover the card’s $49 annual fee. In other words, as long as you spend $24K or more per year, you can think of the card as having no annual fee.

The Business Edge Travel Rewards Visa is even more explicit with its big spend benefit: Every year in which you spend $24,000 or more, they’ll credit your account with the amount of the annual fee: $55 (or more if you paid for employee cards).

The Business Edge Edge: No 5/24 or Utilization impact

The Business version of the card has one huge advantage over the personal versions of the card: US Bank does not report business cards to the personal credit bureaus.

For those hoping to sign up for Chase credit cards, this can be a big deal. With most of their cards, Chase enforces the infamous “5/24 Rule” where they reject credit card applicants who have opened 5 or more cards (with any bank) in the past 24 months. They get this data from the credit bureaus. So, business cards like the Business Edge Travel Rewards Visa do not hurt your chances of getting Chase cards in the future. See: Business card advantages (and a straw man plan).

Another advantage is that utilization is not reported to credit bureaus. If you run up large spend on this card, it won’t hurt your credit utilization ratio which accounts for 30% of your credit score.

Pick a card

Each of the US Bank FlexPerks cards are worth picking up for their signup bonuses and waived first year fees, but whether or not to keep them long term depends upon many factors. If you decide that you want to keep one, I’d suggest:

- The FlexPerks Travel Rewards Visa personal card is best for those who value Gogo Wi-Fi passes

- The FlexPerks Business Edge Travel Rewards Visa Card is best for those with high spend, especially charity spend

- The FlexPerks Gold American Express card is best for those who value it’s 3X restaurant spend

I, too, have been getting sick of the limited flights allowed on my Visa Flexperks as of late. I would like to get a different Visa card after I use up my points on this card, as we are obligated to use Visa now at Costco. The choices were much greater in the past for flights. I would appreciate any recommendations for a different Visa that may have more reward value for flights. (I use my AMEX as much as possible and Visa for places that don’t take AMEX.) Too bad you can’t get Starwood points on Visa..:( Thank you in advance for any suggestions for a new and better Visa!

If you want to keep things simple, consider the Fidelity Investment Rewards Visa. 2% cash back with no annual fee. Another great option is the Alliant Cashback Visa Card which offers 3% cash back first year and then 2.5% thereafter. Details here: https://frequentmiler.com/2017/03/22/26250/

For the $25 airline charged purchase reimbursement, does that only work on the day you fly on a ticket purchased with miles? Or on any day you fly on a ticket purchased with the Flexperks Visa card?

Yes, only when you purchase a ticket with points

I just read your article, an intriguing read about a very different and rather overwhelming market of flight and mile deal hunting that is vastly different from when I last looked!

My question is thusly. Given you said this was your ideal backup card (and I’ve been on this with my family since it was the Northwest Skymiles even, and vividly recall when it was not only easier to book, but you could upgrade to first class for a pittance of miles if you knew how to do it). Now of course things are different, despite the evolved Visa Flexperks Signature card I still have doing a decent job still nonetheless:

So my question is, for someone who really wants finding flight deals easier (I am so tired of amassing random flight metasearch engines that barely help and only produce awful options with 12 hour layovers at high prices and no way to approximate best travel times and deals), possible business class upgrades, and everything the flexperks cannot do, what is the top card, or your favorite, with flexperks being, as you put it, a backup? Would really like to know at this point as I’m lost in a lot of senses about booking fun easy quick and possibly comfy flight options with my reward miles (tempered by the idea that I also may have been spoiled a little bit by watching my father take advantage of programs just no longer feasible due to how many more people do this stuff now).

*Oh, and since I dont really stick to this or any other frequent mile review site (also so many! I have no solid place to even look for feedback on this stuff either) hopefully me leaving my email helps! Since I would love to remember/see your response to my query if you have a solid one.

My single favorite travel rewards card today is the Chase Sapphire Reserve. For those who spend a lot on travel and dining, it is very rewarding. See this page for more: https://frequentmiler.com/chase-sapphire-reserve-complete-guide/

Of course, if you don’t spend a lot in those categories, then I would recommend something else!

We have been using USBank Flexperks cards for our small business for years and really loved the travel rewards; in fact, it was our main reason to use these cards. However, I just logged in today (12/15/16) to look at some flights, and the whole thing has changed. The interface looks different, and the choices for flights and hotels are now very limited. Where I used to see about 20 flights, I see 3 . Same with hotels. Also, it looks like now you can’t choose you return flight, both flights come prepackaged. With hotels, we used to be able to get an upgraded room for the same amount of points as a basic one, now that option is gone. Very frustrating.

FrequentMiler and Community,

Anyone attempt to utilize the FlexPerks $25 airline credit by purchasing an airline gift card on award travel dates? Success or failure? Furthermore, do you buy the airline gift card at the airport with customer service or online on the same day of travel?

Program rules state: “Qualifying Purchases must be made using a FlexPerks Reserve, FlexPerks Travel Rewards or FlexPerks Business Travel card on the Award Travel dates. Qualifying Purchases must be through the airline carrier which is inclusive of a checked baggage fee, on-board food or beverage purchases and airline lounge memberships.”

Greg, may want to add details on redemption for $25 credit.

“Cardmember is required to contact Cardmember Service within 90 days after travel to request the Airline Allowance, which is credited to the FlexPerks account and will appear on the statement within 4–6 weeks (or a notification regarding a decline will be sent). The Airline Allowance is only eligible for FlexPerks® Travel Rewards Visa Signature® Cards.”

Contact Cardmember Service: 877-978-7446

I haven’t done it myself, but I know people who have. I think that you can buy the gift cards online as long as the purchase is processed directly by the airline.

[…] Take the same example as above: let’s say that you can buy a $400 economy flight, or book it with 25,000 airline miles. If the $400 economy flight is with an airline other than the one you selected as your preferred airline with your Business Platinum card, then you won’t get a rebate if you pay with points. In this example, it seems clear that you should book the flight with airline miles (unless you have FlexPerks points, but that’s another story). […]

I used one of the free gogo passes a week ago on a United flight from Mexico. Of course no connectivity until we approached US airspace.

they will combine them if you call in to request.once combined you can cancel one and still retain the points

Thanks, good to know!

[…] FlexPerks: The best backup travel rewards program – Why FlexPerks is a program worth looking at, even if it probably isn’t the best primary travel rewards program. […]

[…] A decent review of the FlexPerks rewards program. I don’t think US Bank will do the Olympics promo again

I have the Flexperks personal Visa. I’m considering getting the Amex for its 3x on restaurant spend. If you have multiple Flexperks cards, are the points pooled, or are they tracked separately for each card?

I don’t know. My guess is that they’re separate but that US Bank would let you combine them. Anyone else know for certain?

FYI – I went into US bank a few days ago and the banker said both my dad and I were pre-approved for Flex Perks. He also said best to apply in branch as not always recognized by applying online.

There is a very nice $150 checking account bonus that is easy to meet. See Doc of credit for details. Just two bill pays or a direct deposit in 60 days.

Did they offer you the Olympics promo in-branch?

Any data points on getting approved for a business card with US Bank?

I like the sounds of it to get the use of Flexperks but try to fly under 5/24. US bank doesn’t get a lot of play on the boards and blogs and I’m trying to figure out my odds. I’ve got Ink Plus & Cash for my Sole Proprietorship but those are the only two.

US Bank is showing the Visa and Amex when I check for recommended cards based on my address and last 4 of SSN but I don’t see a similar opportunity to get recommended cards for business.

I haven’t heard one way or another. I remember having an easy time getting the Club Carlson business card several years ago, but sometimes co-branded cards are easier.

Your tip about stacking tickets is a real killer.

If you don’t intend to put additional spend on the card (after meeting the minimum) it would seem like you’re only able to purchase 1 airline ticket – up to a value of $600.

We’re a family of 4, so I was intending to use the 30K points (after sign up and minimum spend) for 2 roundtrips in the $250-$299 range or perhaps 4 one-ways in the $100-$150 range.

Now it doesn’t seem like that is possible.

Am I missing something?

make it as 4 different itineraries. instead of booking 4 tickets in the same itinerary .

I read that booking a dummy SW ticket very close to the threshold works, but you have to call, then cxl it for credit. Then use the credit for your family as desired…assuming SW works for you.

Short of doing something like Jedi’s trick, I agree that this wouldn’t work for your purpose.

Hmmm, I plan to apply for the Sapphire Reserve next week after Sept 4 when a couple of cards hopefully drop off my credit report, so I just applied for the FlexPerks Business VISA assuming it would not affect the personal credit as you said. But immediately CreditKarma added an inquiry and so I am concerned that this will affect my 5/24 situation negatively. As it is I am about 19/24 but have CPC – just don’t want it to look like one more hurdle to overcome with Chase.

In addition I wasn’t immediately approved! Annoying.

What do you think about the effect on my Chase application next week?

you’re mixing up inquiries with new accounts… those are two different things.

Yes, that’s true. Thanks.

I think you’ll be fine. If your app goes pending and you have to call into the reconsideration line you will be able to find out if you are over the 5/24 rule. If they say you are you can let them know that this was a business card application. Some people report getting approved after clearing that up with Chase.