NOTICE: This post references card features that have changed, expired, or are not currently available

Best Buy has released their Black Friday ad today. The surprising thing is that many of the items are available for purchase at full price today. That’s fantastic because you can take advantage of price protection with your credit card. Buy the item today, fill out a price protection claim with the Black Friday ad, get the difference back. Oh yeah — and earn portal rewards on the full price — including the current Holiday Shopping Bonuses. Santa is filling the sled as we speak.

Best Buy Black Friday Ad Link

Some deals are available right now

A number of deals are available right now. Several of Best Buy’s advertised laptop deals can be purchased right now at Black Friday prices. I also see things like this Ring doorbell currently available at the Black Friday price. It’s worth cross referencing your list to see if items you want are available now at low prices.

One example price protection deal

In the Best Buy ad above, you see that TV in the middle? It’s a 50″ Sharp 4K Ulta HD TV. It will be on sale on Black Friday in-store only for $179.99. You could spend your Thanksgiving waiting outside the store….or you could click through the link in the ad and buy the TV right now for full price.

If you use a card with credit card price protection, you can then file a claim to get back the difference. Note that you may have to wait until the physical ad comes out as the online ad doesn’t show the model number in the “Doorbusters” image at the top of this post — but the model number will almost surely be in the print ad that comes in the paper. However, the online ad links through to the TV right now.

I just used a Citi card to buy the TV above. Citi Price Rewind covers a price difference up to $500 (up to $2,500 total per year). In this case, $399.99 – 179.99 = $220. Unfortunately, I’ll pay tax on $399.99 — price protection does not include tax.

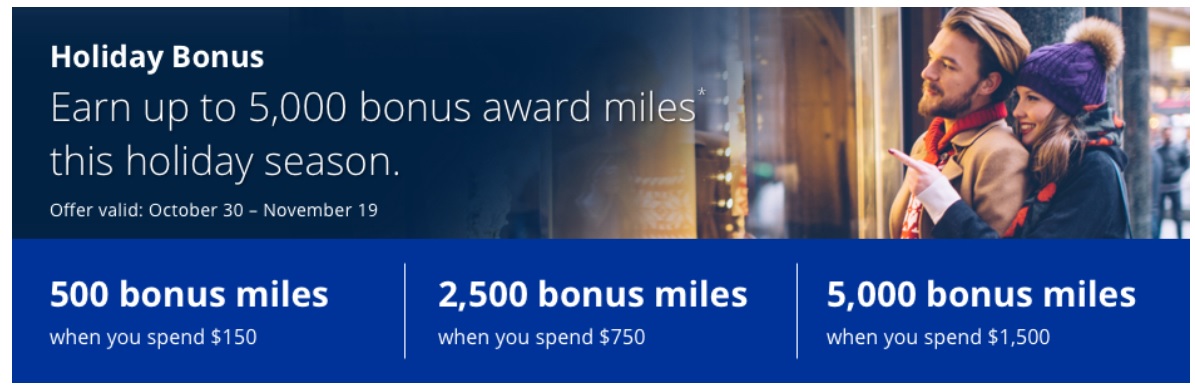

Fortunately, the United portal is offering 2 miles per dollar at Best Buy today. This also stacks with the current airline Holiday Shopping portal bonuses. I’m actually going to buy 2 of this TV for a total of $799.98. That should earn me 1600 miles at 2x plus a bonus 2,500 miles for a total of 4,100 miles to sweeten the deal.

Don’t forget that there are simultaneous portal promotions through American, Delta, Alaska, and Southwest. Read about all of them here.

Which card offer price protection?

Lots of cards offer price protection – though be sure to check the terms of the card you use to be sure you understand any exclusions. In this case, I used my Citi AT&T Access More card (no longer available for new applicants, but might be possible for a product change) for the first purchase because I should earn 3x at BestBuy.com. For the second purchase, I’m going to use a Barclay Aviator — because Mastercard offers its own price protection that should be valid on this purchase. Update: The general “Mastercard” protection excludes Black Friday, though Barclaycard had documentation that does not show a Black Friday exclusion. I may go with three purchases to hedge my bets and use both my Aviator and a Chase card.

Will that negate portal rewards?

A major advantage to using price protection right now is being able to take advantage of all of the portal promotions. Since the refund comes from your credit card issuer, not the merchant, it won’t affect your portal rewards. This will make it a lot easier to max out the promotions through each of the portals. I recently gave a presentation about ancillary credit card benefits at the Chicago Seminars and price protection is one of my favorite benefits. More on this to come.

Bottom line

Not every Black Friday deal is a great deal, so do your price research before buying. That said, I suggest getting in on the deals you want sooner rather than later. Best Buy usually doesn’t make as many doorbusters available online before Black Friday as they have this year — and they often begin restricting purchase of Black Friday items in the days leading up to the holiday. I wouldn’t be surprised if some of these become unavailable online in the not-so-distant future.

H/T: Slickdeals for posting the Black Friday ad

DP: My Citi Price Protection Request came through for $220.00 (Citi unfortunately will not pay for tax or shipping). I used my Dividend card for 5% though and I received 500 best buy rewards points, which is good for a $10 gift certificate. My total out of pocket when you consider the $10 as cash was $135.

I purchased the 50″ TV from Best Buy, however, the results of my claim with Chase decided it was no eligible for price protection Black Friday is considered a seasonal sale. I purchase on Chase Sapphire Reserve card.

Had success with Citi Price Rewind. Price differential credited to account already. Here’s a link for the reduced price ad if you need.

https://www.dropbox.com/s/zidk3osutj4awqh/Sharp%2050_%20Class%20%2849.5_%20Diag%20_6.pdf?dl=0

Bought the 50″ Sharp TV before Black Friday, submitted a manual request on 23rd, still haven’t heard from them. In your experience, how long does it usually take? Thanks!

Typically a week or two. I definitely wouldn’t expect that a request made on Thanksgiving will be answered over the holiday weekend. Did you use Citi or Discover?

Thanks for sharing. I use Citi AT&T. Will they deny my request given it now shows “sold out” on bestbuy.com?

Read your T&C. I haven’t had that issue with Citi

[…] the 50″ Sharp doorbuster shown above, which I picked up a couple of weeks ago — see: (Get many Black Friday items NOW at Best Buy). Sure, there are always some exciting doorbusters. And it can be fun to go out shopping just for […]

Nice presentation at FTU Expo, btw. On this topic, I have the $1500/month retention offer on the Citi Prestige. Do you have any experience regarding the impact of a price refund on minimum spend? In my online research, I only found one source, from 2015, that mentioned it … in passing – that a refund check would not affect minimum spend. $800+ spend for $360 isn’t too shabby if you’re going to use both TV’s (in your example).

Source: https://singleflyer.com/2015/05/07/citi-price-rewind-benefit/

Thanks.

Great question! I have no idea.

My instinct is that the refund check would not affect minimum spend because the check is actually sent by a third party claims administrator. However, I’m not sure I’d chance messing up a good retention offer on my hunch.

I tried using the citibank price rewind, but I couldn’t find the model number for the 50” sharp tv on the pricerewind website. I did find the tv with different model number. Would Citibank still refund the money?

You may have to do a manual request.

You will have to do a manual request. Should be able to do it with a screen shot of the ad.

Does someone have a copy of the ad/screenshot that I could have? they initially declined the claim saying:

The advertisement provided was not for an identical item. We attempted to locate the

advertisement on your behalf, but it could not be located. Please provide the original advertisement

or screenshot of the online advertisement showing this information.

Slickdeals has it posted: https://slickdeals.net/forums/attachment.php?attachmentid=6243807&d=1511126488

never mind – I called and they claimed denial was b/c it was black friday not anything to do with the ad. so much for chase price protection.

Hi Jeff,

How would you submit a price claim for your product in this case ?

Would you need to get a printed ad from Best Buy and submit that scan ?

Have you done this before ?

To subscribe to comments.

I had success buying the exact same model of TV in my store as well.

It’s possible they might have some kind of reserve limit that they have to keep in stock for Black Friday- I asked to buy one, and the person assisting me had to “go check and see how many they have in stock”- but that’s just speculation on my part. Still might be best to buy sooner rather than later if you’re considering the in store attempt.

Today’s also the last day for the 1% in store Ebates cash back.

Now to swing by after the 19th, pick up the print ad, and make sure the models match- fingers crossed!

Hey, Nick, question for you.

Citi Price Rewind’s page says “To be eligible for the Citi Price Rewind benefit, you must pay for the item at least in part with your Citi card. You will only receive the lesser of the actual amount paid for with your Citi card or the maximum benefit per item.” If I’m reading this right, I only need to put $220 on my Citi card so that I can get a refund of $220 later. My plan is to buy a $210.99 gift card ($399.99 + tax = $430.99) on my Amex to go towards my AmEx $25 off $250 offer, and that should leave $220 to be charged to my Citi card to later.

Any problems with my plan?

That’s a great idea to use this benefit in conjunction with the AO offer. Nick or a FM, I would love your take on if you suspect this will work.

Update – after being late to the online offer and getting the not available in your store message, I decided to visit my local best buy. They did have all the TV’s in stock. I lost out on portal points, but was able to secure the tv with my Citi card. Thanks for the tip!

Did you at least get the eBates 1% in store cash back?

Nick thanks for the info.

Will over at Doctor of credit did a great post on Price Protection Policies Compared: Chase, Citi, Discover & MasterCard

https://www.doctorofcredit.com/price-protection-policies-compared-chase-citi-discover-mastercard/

IIRC, Chase specifically excludes Black Friday sales… which is fine by me — Citi won’t mind my extra spend this quarter, I’m sure.

Out of the game on this one. In store only now and not available within 250 miles of my zip code. Glad to have read the article as I was unaware of this benefit. Thanks Nick.