NOTICE: This post references card features that have changed, expired, or are not currently available

Update: Just as this post published, we received word from Gift of College that they have changed their approach and have lifted the daily limits for redemptions. I believe that Gift of College will maintain a $2K/day purchase limit (though perhaps YMMV in terms of local store policy), but redemption limits are being lifted. The original post follows.

~~

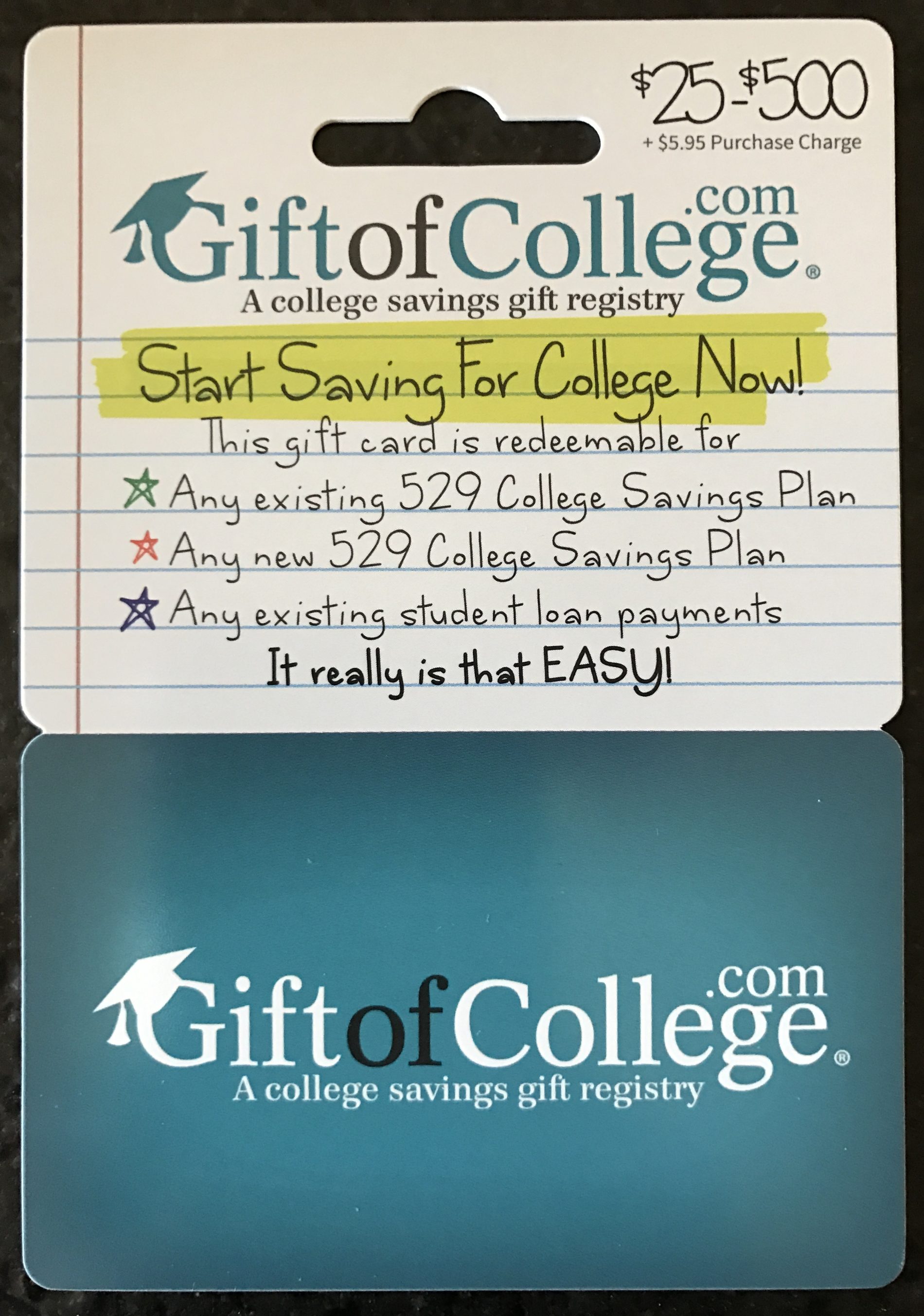

Gift of College provides a way to fund college savings with a credit card indirectly by purchasing Gift of College gift cards and then using them to fund a 529 plan. Greg has written extensively about this in the past — see Miles for College for more. Gift of College gift cards are not as widely available as they once were, but I thought it was worth a post for those planning to fund a 529 that Gift of College now only allows $2,000 to be loaded per day. (See the update above)

When my son was born last year, I wrote a post about how I was already

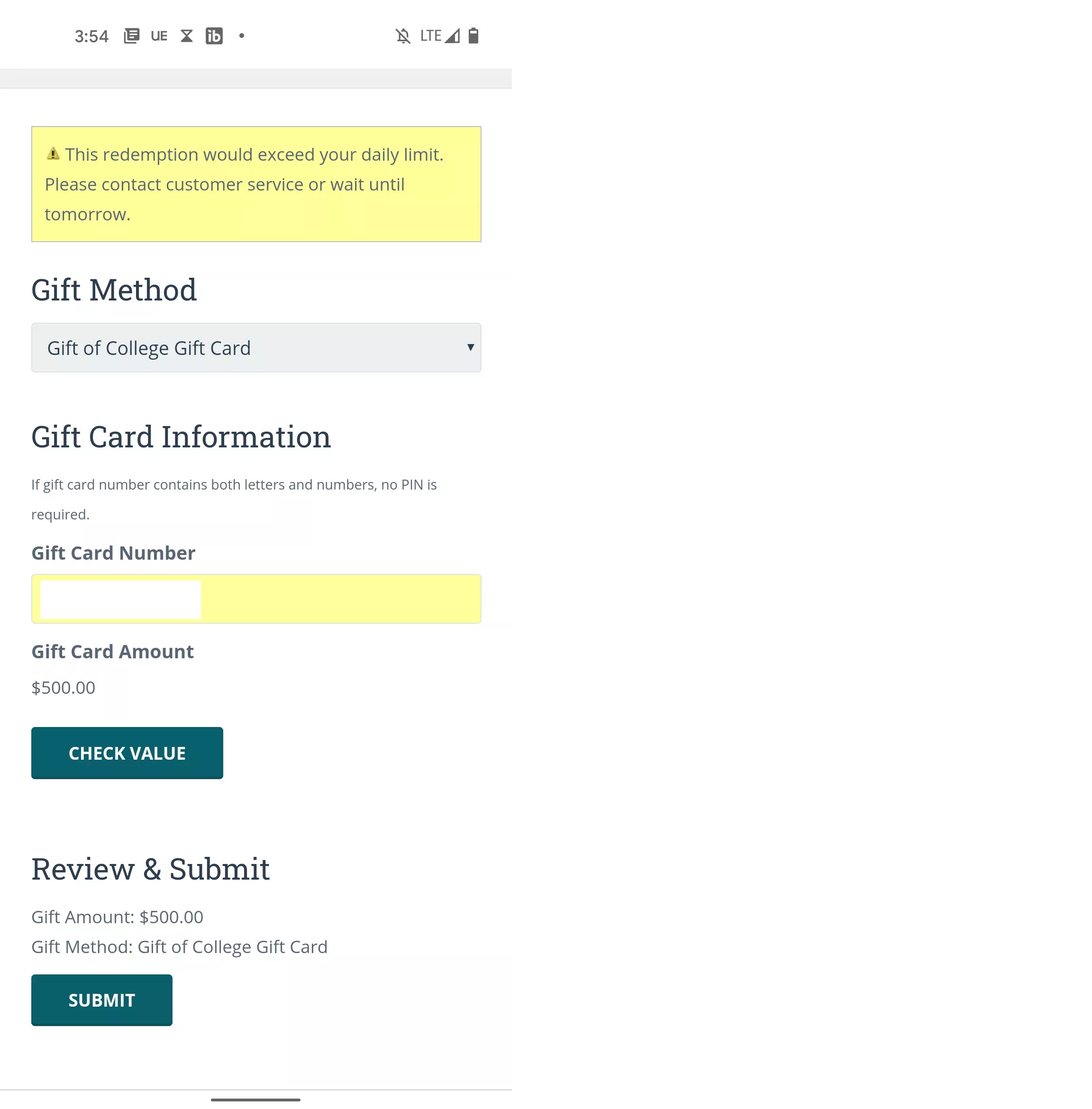

When my son was born last year, I wrote a post about how I was already using him taking advantage of opportunities to let him help us earn points (See: Bundle of points with our bundle of joy: Nearly 200K points earned in the first month of life). One of the ways I picked up points was buying Gift of College Gift Cards at a regional gas station chain during a time when Chase was offering 10x points on Marriott and Ritz credit cards for gas station purchases. I loaded a quantity of those cards last year, but left a few thousand to contribute this year. When my wife went to load them to Gift of College the other day, she got the following error after having loaded $2,000 and trying to add an additional $500.

I contacted Gift of College about that error as both Greg and I have loaded more than $2,000 at one time in the past. Gift of College confirmed this $2,000 limit per day when loading an account as per the following statement:

We’ve implemented this daily limit for gift card redemptions. It follows the regulatory daily purchase dollar limit of gift cards.

That’s an odd take on gift card limits in my opinion. While they wouldn’t be the only company to limit institute a purchase limit of $2,000 in gift cards per day, but limiting the redemption of gift cards already purchased is new to me. It seems a bit nonsensical to me to prevent a gift recipient from redeeming their gifts. In this case, we have two sons. We loaded $2,000 to one son’s account and tried to load $500 to our other son’s college savings (which is under the same Gift of College account) and received that error, so the limit seems to apply to anyone under a single Gift of College login. Again, that seems strange to me. I’m not sure what would have happened if, for example, some other family member had tried to give a Gift of College contribution on the same day, but I think they would have received the same error.

Update: As noted above, Gift of College has walked back this policy and is no longer limiting redemptions.

This isn’t a major issue as it is easy enough to spread out contributions. I imagine that most readers don’t have an option to buy Gift of College gift cards locally and even those who do might be making smaller contributions anyway. On the other hand, some states offer a tax deduction for 529 contributions and so there are situations where you may want to load more than $2,000 to an account. Be aware that if you want to do that, you’ll need to split it up over a few days to load them to your account.

I am having the an error that appears to be me running into some sort of purchase limit with the new website design. Some goofy nonsense string “AuthorizeNet.Api.Contracts.V1.messagesTypeMessage[]” which literally means nothing to like 95% of people. I purchased $1000 in giftcards (5 x $200) just fine before it started appearing and now appears on every card I try.

So I would kind of think that they’ve re-introduced purchase limits with this new ugly website design. Every day something changes for the worse.

Was able to load >24 hrs later. Seems there’s now some sort of speed limit on these.

Anyone else having issues with GOC redeeming giftcards? I’ve never had an issue until today. It looks like they revamped the website. My GC are a mix of letters and numbers and no PIN should be required, but it says it’s an invalid GC. Please help! Thank you in advance!

When you go to redeem a gift card the first box says “Gift Number or Pin” if your gift card only has a Pin, then you only use that box. The other box says “4 digit Pin” . You only need to fill out that section if you have a 4 digit pin. I redeemed one yesterday in this way.

I tried again a few hours later and it started working again!

[…] [Update: Fixed] Gift of College limiting loads to $2K per day by FM. […]

Hey Nick – I assume you can’t buy these cards with Amex as it will count as a cash advance right?

I highly highly highly doubt that buying a gift card at a gas station or grocery store is ever going to code as a cash advance. You have to remember that the vast, vast, vast majority of American Express cardholders have no clue that points and miles blogs even exist. Can you imagine how many angry calls they would get from Sue Cardholder if every gift card purchase incurred a cash advance fee? I think the wording on the cash advance thing is a lot of bark without much bite honestly. Maybe if you’re buying from Simon or something like that they’ll code it as a cash advance, but I can’t imagine that buying from a place with a gift card rack is going to code that way any time soon.

That said, it’s certainly not impossible that they’ll see the gift card purchases (if they get Level III data) and not award points for those purchases. They’ve been known to not award points or claw back points from heavy gift card purchasers. There is always some element of risk there. On the flip side, I’ve bought plenty of gift cards on Amex cards when not working on a welcome bonus and not had a problem yet. It could happen tomorrow, but I honestly think the fear on that is overblown. I accept that there is some risk of not getting rewards when I buy gift cards with an Amex. I won’t cry myself to sleep if that happens because I know it’s a possibility and at the same time I won’t stay awake at night worrying about it because it won’t be that big of a deal if it doesn’t work out since I’m not going to buy huge volume at once on my Amex cards.

All that said, the bigger problem for me is that when I went back to my records I remembered why I hadn’t bought any of those Gift of College cards on an Amex. At the time, they were offering 10x points at gas stations on the Amex Marriott Business card, but every time we tried to buy Gift of College cards, the transaction got declined. I imagine that was more because of the size of the transaction (nobody is spending a grand on gas at the gas station), but we couldn’t get a transaction through on an Amex (whereas we had no issue with Chase). If you live somewhere that you can get the cards at a grocery store or pharmacy or something, I imagine you wouldn’t run into that particular issue.

But, again, I think the likelihood of Gift of College cards coding as a cash advance is very low.

Nick – thanks for your insights. In this case, I would be purchasing them from a grocery store. $1k from a grocery store is not unheard of – but perhaps not too common. If I can do this, I would do multiple trips and purchase on a card receiving good grocery store benefits. CSR is limited to $1k for the next 2 months. So, I’d need a different card to max some of these purchases.

Why can’t you use them to lay tuition bills? I don’t have any loans or one of those accounts

where does one get them these days? I used to buy them at Toys R Us but have not found them anywhere near where I live.

https://giftofcollege.com/Buy-In-Store/

Most of the options are regional these days. I bought mine at Cumberland farms, a gas station chain that’s only in a couple of states. You’ll want to see this post:

https://frequentmiler.com/best-options-buying-gift-college-gift-cards/

I’m in California. Some, not all Lucky Supermarkets carry them.

Thanks for this info.! Dumb question if anyone has time to answer: can you use the GofC cards to upload money into any type of 529 college savings account? Ours are through USAA. I can’t find on the GofC site where you can upload the funds to .

See the Miles for College post I linked to in the first paragraph for full information about how to figure that out:

https://frequentmiler.com/miles-for-college/

Thank you!!!