NOTICE: This post references card features that have changed, expired, or are not currently available

UPDATE: Terms for the surcharge credit are now live. Please see: BA Visa $200 Award Fee Credit. 8 things you need to know.

I recently posted a list of “must have” cards from Chase. Chase has a lot of great cards but, thanks the 5/24 Rule, you can’t have them all. In my prior post on this topic, I listed the following as “must have” cards (see the original post for more details):

If you are able to sign up for business cards, then I recommend the following line-up of Chase cards:

- Sapphire Reserve: Earn 3X Ultimate Rewards points for travel & dining. Points worth 1.5 cents each towards travel. It may make sense to start with the Sapphire Preferred card (since it has a higher signup bonus) and then upgrade to the Sapphire Reserve later.

- Ink Business Cash: Earn 5X Ultimate Rewards points at office supplies and 5X cellular/landline/cable (on up to $25,000 in total purchases in 5x categories annually); and 2X gas and restaurants.

- Ink Business Unlimited: Earn 1.5X Ultimate Rewards points for all other spend.

- United Explorer: When the annual fee comes due after a year, consider downgrading to the no-fee United card which preserves this card’s best features: Improved economy saver award availability, and last seat standard economy award availability.

- World of Hyatt: Keep for the annual free night certificate. Consider spending $15K per year for a second certificate, especially if you pursue Hyatt status since you’ll earn 2 elite qualifying nights with each $5K spend.

If you are not interested in signing up for business cards, then I recommend the following Chase cards:

- Sapphire Reserve: Earn 3X Ultimate Rewards points for travel & dining. Points worth 1.5 cents each towards travel. It may make sense to start with the Sapphire Preferred card (since it has a higher signup bonus) and then upgrade to the Sapphire Reserve later.

- Freedom Unlimited: Earn 1.5X Ultimate Rewards points for all other spend.

- United Explorer: When the annual fee comes due after a year, consider downgrading to the no-fee United card which preserves this card’s best features: Improved economy saver award availability, and last seat standard economy award availability.

- World of Hyatt: Keep for the annual free night certificate. Consider spending $15K per year for a second certificate, especially if you pursue Hyatt status since you’ll earn 2 elite qualifying nights with each $5K spend.

The only airline-specific card I included int he above lists was the United Explorer card. And I included that one because it’s remains valuable even after downgrading to the no-fee version of the card. But now I’m wondering if the British Airways Visa ought to be added to the list?

New card features

According to One Mile at a Time, Chase and British Airways have announced enhancements to the BA Visa card:

- 2X on hotel purchases

- Up to $600 per year in rebates for carrier imposed surcharges on awards

- $200 for BA first or business class

- $100 for BA premium economy or economy

- Max 3 rebates per year

2X on hotels is not interesting at all. Many cards offer that much or more for travel purchases. But the fuel surcharge rebate is very interesting.

Why the fuel surcharge rebate is interesting

If you’ve ever searched AA.com for business or first class awards to Europe, then you already know why this matters. At first, you’ll see a wonderful calendar full of promise, like this:

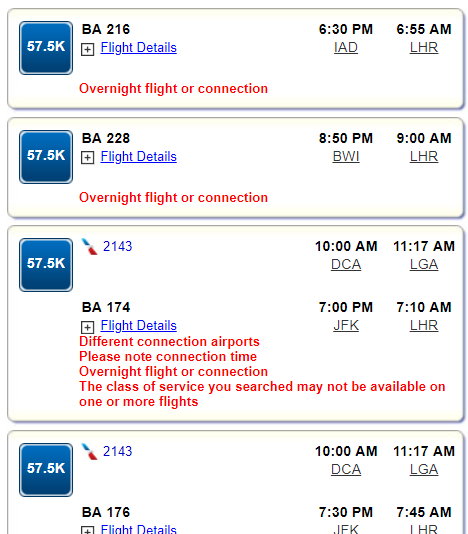

But when you click through to a particular day, reality hits. All of the overseas flights are on BA metal:

This matters because BA flights include absurd surcharges. In this example, you would have to pay $628.70 for the privilege of using your miles for a one-way business class flight. If you can find a flight on AA metal, you’d pay only $5.60 in fees!

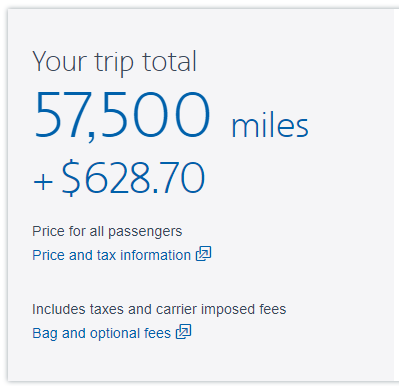

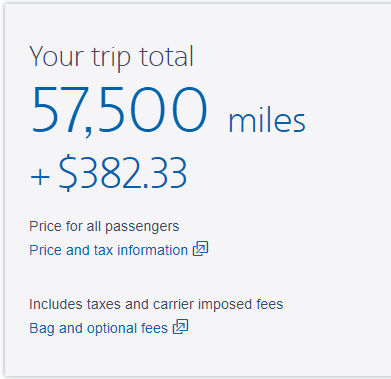

Surcharges are lower going in the opposite direction, especially if you don’t start in London. For example, if you book Rome to Washington DC via London, the taxes and fees currently come to $382.33:

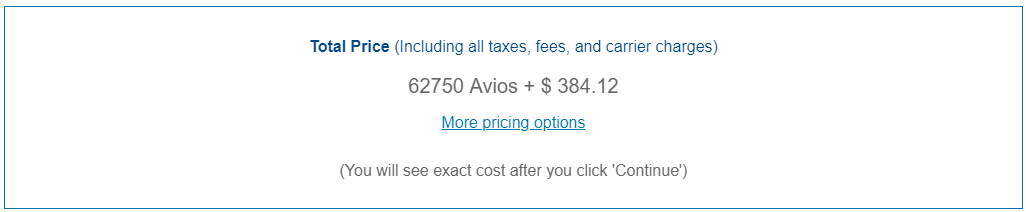

While the number of miles will usually differ a lot, taxes and fees are usually similar when you book the same flights with British Airways Avios. In this case, a search on BA.com revealed a slightly higher point price, but very similar fees: 62,750 Avios plus $384.12 in fees.

One Mile at a Time says that it’s not yet known whether the surcharge rebates will work on one-way awards. If it does, though, the ability to get back $200 per one-way flight on up to three flights per year is great. It won’t make BA awards cheap, but it will make them somewhat reasonable.

| Update: It appears that one-way awards do work, but only those that originate in the US. See: Please see: BA Visa $200 Award Fee Credit. 8 things you need to know. |

It’s worth noting too that booking BA awards as two one-ways rather than one round trip can save you money (this works with Virgin Atlantic awards too). For example, consider flying from Washington DC to Rome and back in business class, booked as two one-way awards:

- DC to Rome, May 25, 2020: 75000 Avios + $ 641.82

- Rome to DC, June 1, 2020: 62,750 Avios + $384.12 (off-peak award pricing)

- 2 One-Way Total: 137,750 Avios + $1,025.93

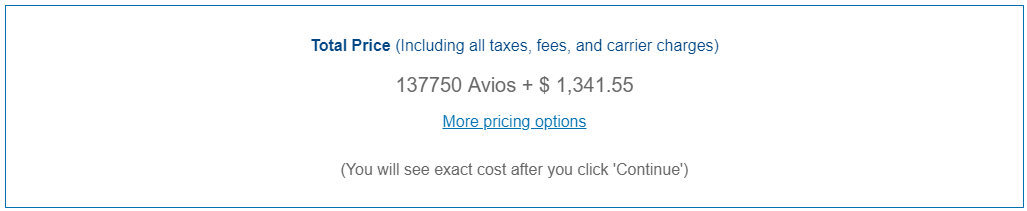

Compare the above to booking a single round-trip award:

- Round Trip Total: 137,750 Avios + $1,341.55

In this example, you would pay $315 more for the privilege of booking round trip instead of as two one-way awards!

With the BA credit card rebate, the difference will be even greater ($200 more). If rebates work on one-way awards, then you would get two rebates for this flight by booking the flights separately. Your new total when booking one-way would be:

- DC to Rome, May 25, 2020: 75000 Avios + $ 641.82 – $200 = $441.82

- Rome to DC, June 1, 2020: 62,750 Avios + $384.12 – $200 = $184.12

- 2 One-Way Total: 137,750 Avios + $625.94

Vs. the following round-trip cost:

- Round Trip Total: 137,750 Avios + $1,341.55 – $200 = $1,141.55

After the $200 rebates, the difference between booking two one-way awards and one round trip award has grown to $515!

The possible round-trip requirement would make the rebate worthless

If the BA card requires round trip awards in order to get the surcharge rebate, then the rebate would be practically worthless. I didn’t realize this nuance until I wrote the above section. Consider the flights I detailed above. Before considering the rebate, booking two one-way awards results in saving $315 over booking round-trip. If the new card perk requires booking round trip, then all it will do is reduce the round-trip penalty from $315 to $115! In other words, even with the rebate you would pay more than by booking two one-ways without the BA Visa card.

I imagine that there are some awards with little or no penalty for booking round-trip. For example, I’d guess that intra-Europe awards don’t have this issue. But then those awards also don’t include high surcharges in the first place.

| Update: It appears that one-way awards do work, but only those that originate in the US. Further, intra-Europe awards won’t work. See: Please see: BA Visa $200 Award Fee Credit. 8 things you need to know. |

Assuming one-way rebates, is the card a “must have”?

If it turns out that one-way awards can trigger the rebate, then this new feature is obviously valuable to anyone who frequently books BA transatlantic awards. You could save up to $600 per year in exchange for the card’s $95 annual fee. That’s a nice win.

| Update: It appears that one-way awards do work, but only those that originate in the US. See: Please see: BA Visa $200 Award Fee Credit. 8 things you need to know. |

What if you don’t already book these awards regularly? In my case, I’ve almost always found other better options than to pay BA’s high surcharges. If I had the BA card, though, I would consider booking BA, especially for one-way return flights from Europe. This would be nice since I can use Virgin Atlantic miles to book Delta One one-way to Europe very cheaply (50K miles + $5.60), but Virgin Atlantic charges hefty surcharges for the return flight. I’d still prefer to fly back on a Star Alliance carrier using Avianca Lifemiles or United miles in order to avoid surcharges altogether, but at least BA would be a not-horrible option if I can’t find Star Alliance availability.

The last phrase answers my question. Is the new BA card a “must have”? For most of us, I think that the answer is “no”. The ability to turn an awfully expensive option into a not-horrible option does not make this a “must have” card. Not to me. Don’t get me wrong, if they allow rebates on one-way awards I’d like to have this card. I just wouldn’t prioritize it above the others on my current “must have” list.

“no-fee United card which preserves this card’s best features: Improved economy saver award availability, and last seat standard economy award availability.”

can you tell what card is that? Chase mentioned just United Bank & United Reward for downgrade options.

I think it is just called “United MileagePlus Card”. You don’t want the travel bank card.

Would this work for BA surcharges on flights booked with american miles?

No, you have to pay with BA Avios according to the terms

Bummer. Would be a must-have if it included American bookings, IMO.

[…] Hat Tip to reader philco for finding the terms for the rebate online. […]

Terms are posted on the Chase site I would include a link but probably not allowed in comments. The good news is it would appear to work for one-ways but bad news is it only works on trips ex-US so you are going to have to pay the higher fuel surcharges ex-US that makes this far less valuable though perhaps not useless. That assumes of course the implementation aligns with the terms (i.e., it is possible we will get lucky).

I likely won’t keep the card for this but will need to run some numbers.

Relevant part of terms from Chase site (Google snippet of this to find rest of terms):

d. The booking must be for a transatlantic international travel itinerary redeemed from Cardmember’s Executive Club account with the transatlantic portion departing from the United States solely on aircraft operated by British Airways. The booking may include a connecting flight on a code share partner for the non-transatlantic portion of the itinerary.

Thanks! I don’t think the terms were live when I wrote this yesterday. I’ve added a link at the top and will add more as I read through the terms.

Where I’ve been using BA redemptions recently is as a backup. Book a one-way to Europe at 330 days knowing that I can get a seat back in miles with a somewhat reasonable redemption (especially since I can plug into the LHR-AUS flight coming home). So far I’ve been able to avoid having to book it but it is nice to know it is an option.

I don’t want to be a nag, but let’s stop calling them “fuel” surcharges, a term the airlines cannot use, since regulatory authorities noticed they really have nothing to do with fuel. They invented that term to make it look like these were a reasonable response to rising costs of fuel (at the time), but guess what, when fuel prices fell, the surcharges didn’t go away. On award tickets they are simply a co-pay charge that some carriers make to generate revenue. On paid tickets they have other purposes as well, none of which is related to fuel.

BA has long been the most insanely offensive in its use of these surcharges, sometimes even to the point that an award ticket costs more out of pocket than a paid ticket. I have plenty of Avios, and redeem them regularly for reasonable value, but have not flown BA in eight years, and then only intra-Europe. I hope the fact Chase is offering this new perk is a response to resistance to the card from people who are tired of the “we charge them because you’re dumb enough to pay them” BA surcharges. The article correctly points out that if the new Chase card perk applies to one ways, it will be a solid enhancement to the card for quite a few people. If not, the change is useless. One thing I like about this site is that you will very likely be the first to know and report on that.

You’re not nagging — you’re spot on about them capturing the ignorant dollars out there. I haven’t flown BA for decades — but I always have BA “Avios” (<– stupid name) because I can get some pretty cheap AA flights on them.