On this week’s Frequent Miler on the Air podcast, Greg and Nick addressed a reader question which I think perfectly highlighted one of the common hangups for points and miles beginners. Namely, the misunderstanding that you should collect the miles of the airline you intend to fly.

It’s not that simple, unfortunately.

How to think through your earning strategy when you have a specific destination in mind

You can start by watching the Question of the Week segment below where Nick dismantles the (I think understandable) assumption that you should collect miles for the airline you intend to fly. It’s a little more complicated than that, which Nick and Greg will explain in the episode…

Below, I’ll include a summary of the discussion along with a few other helpful resources for those getting started.

Reader Example: Which miles should Alex collect to visit Korea?

Our reader Alex explained that they wanted to visit Korea with their family. They did some initial flight research and came up with three possible strategies for getting to their destination:

- Delta: Collect or transfer Amex Membership Rewards to Delta in order to book on Delta, flying Delta or Korean.

- Korean Airline Miles: Somehow collect Korean Airline Miles

- United: Earn Chase Ultimate Rewards, then transfer them to United to book Asiana flights on United.com.

Greg and Nick’s feedback for each suggested option:

- This would be more limiting than you might think, and Delta typically has pretty pitiful business reward prices

- There are no great transfer options for Korean Airline Miles, so that’s unlikely.

- This option is a possibility…if there’s availability once you’re ready to book…

So what is Alex to do?

You don’t necessarily know which points you’ll need the day you’re ready to book, so optimize for optionality.

The goal is to aim for the easiest-to-accumulate transferrable points currency (like Chase, Amex, Citi, Capital One, Bilt), because availability is a big factor in this equation and the reward options you see in your research now may not be a good demonstration of what you’ll actually see available when you’re ready to book. Collecting transferrable point currencies helps you maintain optionality, which helps with the problem of unpredictability for availability.

With this strategy, you would not transfer your points until you’re ready to book.

When you do find something available, then you’ll also have some flexibility to book the award with a currency well-suited for that booking. This is not always intuitive and there are so many partnerships that there may be more ways to book a specific flight than you think. As an example, if you find a suitable United flight, rather than just transferring Chase points to United and booking through united.com, you may actually be better off transferring Amex Membership Rewards to ANA and using those miles to book the United flight. You could also book through Aeroplan or LifeMiles.

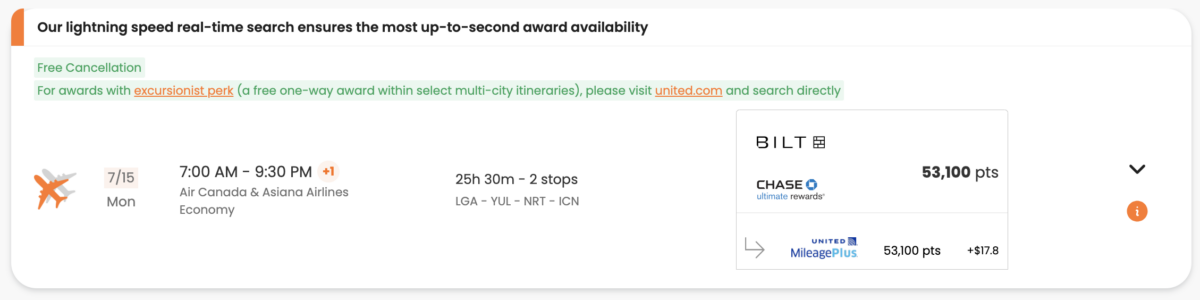

If this all sounds extremely complicated, don’t worry! There are tools to help show you what transfer options are available to you for a flight you have in mind. Points Yeah is a powerful but free award search tool which can help you see which points you could use for a given flight.

You may also want to familiarize yourself with some award sweet spots and anomalies. There could be amazing sweet spots or nuances which are specific to the destination you have in mind.

Like some of you, I don’t know all of these things off the top of my head, so I still have to lean heavily on our blog resources when I research awards.

For example, here’s what I might do when creating a strategy with a specific destination in mind:

- Browse our “Best Awards by Destination” resource, to familiarize myself with any of those award gems which may be useful for me.

- Use a tool like Points Yeah to familiarize myself with not only the flight options available to me, but the paths I could take for booking that flight.

- Then, I’d browse the Best Offers page to familiarize myself with the different bonuses available to me. Hopefully by this point I’d recognize some options that match with the things I just learned in step 1 and 2.

Some of you may already be award booking experts. Are there other resources you find yourself referring to during your award booking research? Comment below!

Thank you for the post Nick! I’m really late to the party but I recently visited Seoul Korea and I was able to fly business both ways with points. I had a bunch of points in Emirates because of the phantom menace. I was able to find a business class ticket in business on Korean air through Emirates for 88k points one way for our return flights. I know, not a great redemption, but I had to use those Emirates points. Only one business class ticket was available, so my (adult) daughter had to fly economy for 44K Emirates points, but she said it was the best economy flight she’s taken. For our outbound flights, I was able to find business class award space last minute on Asiana through Air Canada for both of us for 75k points each. I knew Asiana was releasing last minute award space about a week out because I had been watching it, however the award space for our flight was not released until the day before. Luckily I still had time to cancel my back up flight. I transferred the points from my Capital One card and they showed up instantly. There was also a last minute flight on United business on Air Canada for 75K but it was not direct so we chose the Asiana flight instead. Overall I liked the Asiana product more than Korean Air’s but it was my first time in international business so for me it was all amazing! All from LAX. It was a great trip to Korea.

wow such a good post thanks a lot its really usefull

<a rel=”nofollow” href=”https://tehradio.com/”>tehradio.com</a>

<a href=”https://tehradio.com/” rel=”nofollow”>دانلود آهنگ جدید</a>

And when you do find United partner award space to Korea, let me know because I believe in unicorns too.

Not hard. I booked Asiana biz class LAX-ICN with Aeroplan.

Congratulations, that should be a great flight. But my post was about United.

There aren’t transfer options for Korean, but there are 4 Korean Air US bank credit cards with signup bonuses, so that’s absolutely in play…certainly the biz card with 50k/$5k MSR which won’t impact 5/24 status should be an option, and better to hit US bank early on right?

In any case, wouldn’t you recommend not to focus only on one trip/destination, but to just start accumulating points in a variety of ecosystems based on the current outstanding offers? The sooner you start accumulating, the more options you will have.

for most beginners the idea of randomly acquiring points in all ecosystems is too overwhelming. It’s easier for them to start with a specific goal, learn what they’ll need and work to that first.

Well, as Beth says, no — I wouldn’t recommend that someone get a Korean Airways credit card because having airline miles in a specific program that you may or may not find a use for is a quick spiral to nowhere for a beginner. I think I said this on the show (or I know I have before), but I (very ironically) think that collecting airline miles in a single specific airline program is a much more intermediate/advanced play for someone who understands all of the various rewards programs enough to know what the strengths of that specific program are and how those fit into their regular redemption patterns.

Neither would I recommend someone “just start to accumulate points in a variety of ecosystems”. I actually typically recommend that a beginner start with a specific trip in mind because otherwise this stuff becomes overwhelming. For a beginner, the idea of opening an Amex Gold card that costs $250 a year for 90K points and a Capital One card that costs $395 for 75,000 points and this and that, etc, starts to sound too complex and I think it leads to that person quickly giving up or not getting engaged more often than not.

I do of course think that flexibility is king in this game. And that’s why we ultimately recommended that you start with a single ecosystem (at least for flights) like perhaps Amex Membership Rewards points and then use an award search tool and limit results to programs that are transfer partners from that credit card system. That starts to give you a good idea of what your options are with that type of credit card point.

I think it would probably also make sense to open a hotel credit card that’s going to give them a shot of covering their hotel for at least several nights of the trip — so that would be my additional card mixed in.

But I think it makes sense to focus on that first destination a bit because that first redemption is important. If a beginner takes too much of a scattershot approach, I think the odds increase greatly that they just end up booking everything via the credit card portals using points for statement credits at poor value because it’s easy. That’s just my opinion. Sure, if you get someone really willing to dive in, then collecting a bunch of currencies can work out well — but most beginners are looking to put their toes in the shallow end first.

Well, I’d just say if the beginner is very poor in basic financial skills then I’d agree. However, if they are generally competent financially, and are good at planning, I’d say absolutely you should advise to accumulate points regardless of their primary travel plans, focusing of course on flexible currencies and currencies they are more interested in. It’s the same philosophy I use, accumulate points in programs I value. I see no reason to alter that just because someone is new