Flexibility is undoubtedly valuable. But how valuable is it? How much does “free cancellation” cost? (Not a trick question)

Last month, I had planned to take an epic trip to Fiji, but we had to cancel at the last minute because our kids got sick. In response to that post, reader Jules said:

@Nick Reyes: Glad you were able to mostly recover your miles/points via straightforward cancellations. A few months ago I commented on one of your Avianca LifeMiles posts about why I avoid that program like the plague due to their horrible customer service (in case of IRROPS) and high cancellation fees. I wonder if this experience has now changed your perspective a little…

The point Jules was making is that Avianca LifeMiles are notoriously inflexible in the sense that award cancellation fees are high and customer service gets low marks. And on the Frequent Miler on the Air podcast, Greg has mentioned his preference to book through United Mileage Plus over Avianca LifeMiles because of the additional flexibility through United. But another recent discussion we had makes me wonder how much flexibility is worth.

Comparison: How much is award flexibility worth?

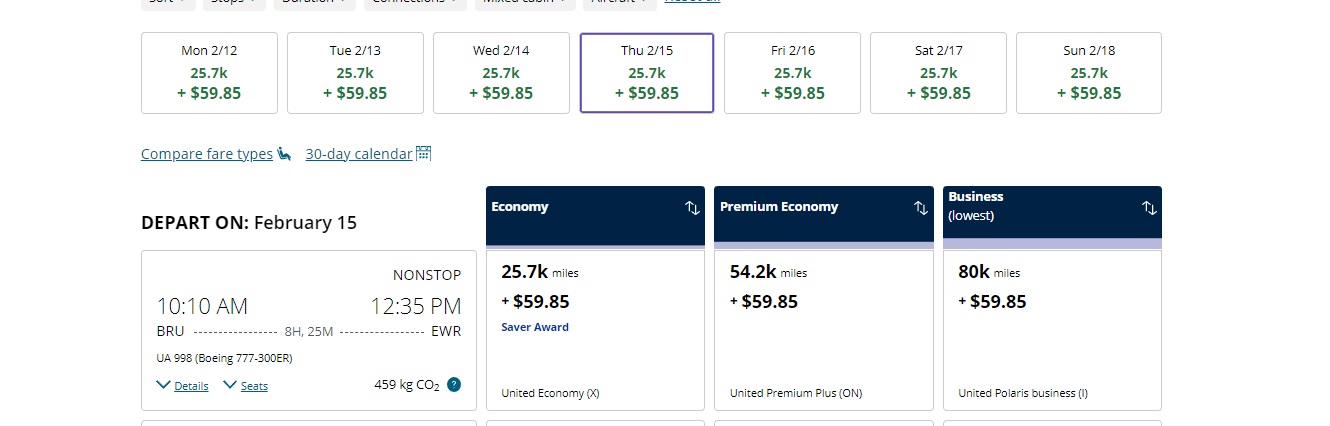

As an example flight, consider this United flight from Brussels to Newark on February 15, 2023. As you can see, this award costs 80,000 miles one-way in business class when booked via United MileagePlus (Side note: When did United begin charging 80K for one-way business class to/from Europe?).

As that is a “saver” award (I-class space in business class), you could instead book the same United flight via Avianca LifeMiles for 63K miles in business class.

The downside is Avianca’s cancellation fee. If plans should change, it would cost $200 to cancel that itinerary and redeposit the miles (and note that the redeposit isn’t instant).

Is the flexibility worth paying 17K additional United miles over what Avianca would charge for that flight (80K)? If you already have a ton of United miles, perhaps it is…but I think it’s worth running the numbers.

If you book via United in this case, and you value miles at just 1c per mile, you’re essentially paying $170 extra to book through United. If you’re pretty confident that plans might change, that could make sense.

However, assuming that you value Avianca miles and United miles equally and at 1c per mile (unrealistic, but it keeps the math easy), you are essentially pre-paying 85% of Avianca’s cancellation penalty (17K miles = $170 in “extra” miles for a flexible United award versus booking via Avianca and paying an extra $200 only in the event that you cancel. You are essentially paying the majority of the cancellation penalty for the privilege of maybe cancelling. In other words, you’re paying the fee to cancel potentially without cancelling.

And in fact that hearkens back to a discussion that Greg and I had on a podcast episode a while back when we briefly discussed the option to use Air Canada Aeroplan for Star Alliance flights.

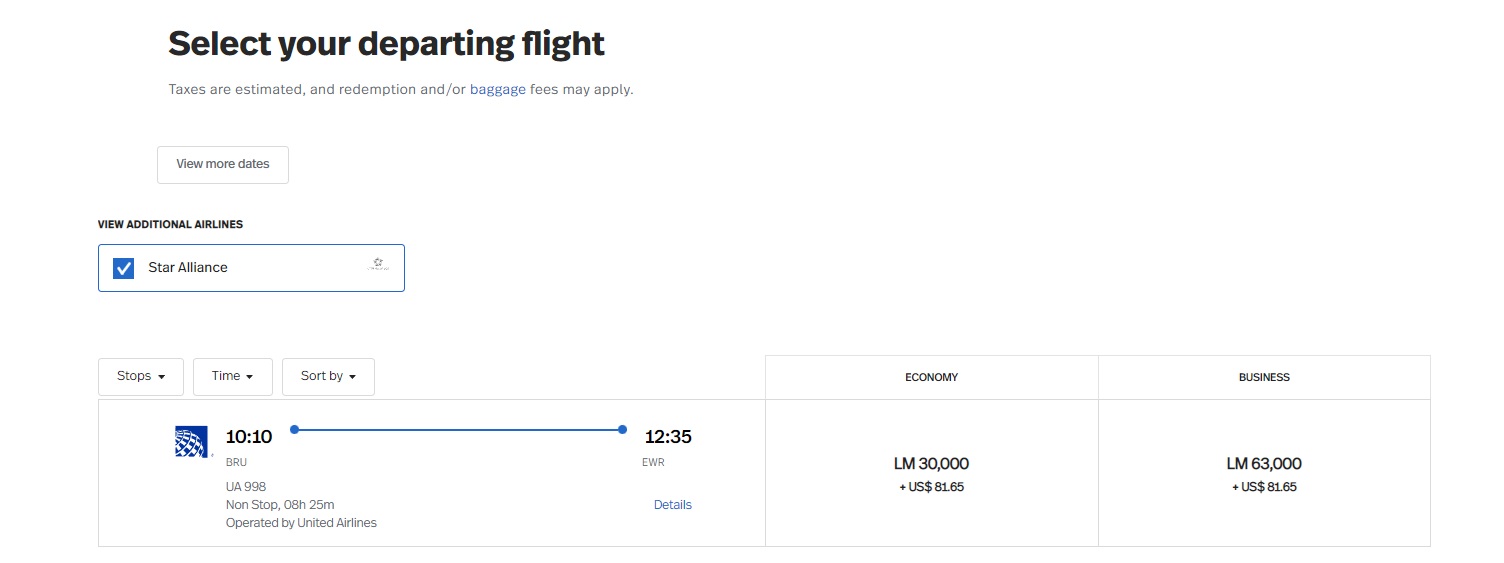

Air Canada only charges 60K miles per passenger for the “Lowest Reward” for the same itinerary:

However, you actually have two options for booking that United flight in business class via Air Canada Aeroplan: pay 60K miles for the “lowest reward” or pay 74K miles for a “flexible reward”. That “flexible” ticket has no change or cancellation fee. During the Frequent Miler on the Air episode I’m referencing (I can’t remember which episode — this was a quick bit of discussion), we both agreed that we never really consider Air Canada’s “flexible rewards” because it feels like we’re prepaying a cancellation penalty and we may not need to cancel at all.

Here’s what I mean: Air Canada’s change fee for a business class award is only $100 CAD (~$74). The cancellation fee is $150 CAD (~$111 USD). Again, let’s assume that you only value miles at 1c per mile to keep the math simple. By paying 74,000 miles for the flexible award instead of 60,000 miles for the lowest reward, you are effectively paying an extra $140 to have the option to change or cancel the flight . Since changing the flight would only cost $74 and cancelling would only cost $111, you’re paying more than the cancellation fee for the option to possibly cancel….and maybe you’re not going to cancel.

But the reality gets worse: if you value miles at 1.5c per mile (which is probably a more realistic floor value for someone who redeems miles for premium cabin international awards), you are essentially paying $210 extra (14,000 miles * $0.015 = $210) for the Flexible Reward option (at 74,000 vs 60,000). That just doesn’t make sense when you could alternatively pay 60K and have a worst-case scenario of paying a $111 USD cancellation fee.

Update: As pointed out by a reader in the comments, what I left out of that analysis is that when you cancel a “Lowest Reward”, you essentially lose $111. When you fly a “Flexible Award”, you “lose” 14,000 miles (the amount overpaid for a flexible fare). But if you cancel a flexible award, you get all of the miles back and don’t lose anything. This adds an extra dimension: the 14,000 extra miles is essentially an insurance policy that makes you whole in the case of cancellation, but causes you to lose if you actually travel (since you paid more than necessary for the ticket). In a way, it is a bet against your trip where you only “win” the bet if you cancel.

Therefore, part of your analysis needs to be the expected value of that bet. How often are you going to cancel? If you always book the flexible fare and you’re going to cancel 50% of the time, you’ll “lose” 14,000 miles half the time (by overpaying for those trips where you actually fly) and “win” $111 the other half of the time (the times when you cancel and you get all of your miles back without paying the $111 cancellation fee). If you value miles at $0.01 per mile (or more), that’s a negative expected value.

If you always book the flexible fare and you would cancel at least 56% of the time, you will come out slightly ahead in the long run with flexible fares. To illustrate this, let’s imagine that you booked 100 flexible trips paying 74,000 miles for the flexible fare rather than 60,000 miles for the “anytime” fare. You fly 44% of the trips and cancel 56%:

- On the trips where you fly, you have overpaid by 14,000 miles x 44 times = 616,000 miles. This means you’ll have spent 616,000 extra miles over what you could have paid for the lowest fare. Valuing miles at $0.01 per mile, that’s $6,160.00 “overpaid”.

- On the trips where you cancel, you’ll save the $111 USD cancellation fee x 56 times. That’s $6,216 saved by booking a flexible fare.

In other words, you’ll have come out $56 ahead of what the cancellation fees would have cost you over the course of 100 flights. This assumes that you only value the miles at $0.01. In reality, if you value miles at more than 1c per mile, you’ll need to cancel more frequently to come out ahead. For instance, if you would truly value the miles at 1.5c per mile, you would need to cancel 66% of the time to make the flexible fare the better expected value.

- On the trips where you fly, you overpay by 14,000 miles x 34 times = 476,000 miles. This means you’ll have spent 476,000 extra miles over what you could have paid for the lowest fare. Valuing miles at $0.015 per mile, that’s $7,140.00 “overpaid”.

- On the trips where you cancel, you’ll save the $111 cancellation fee x 66 times. That’s $7,326 saved by booking a flexible fare.

The spread is larger there — in reality, the “break-even” point isn’t an even percentage, but this gives you an idea as to how it works out. It is also worth noting that the math above applies to the specific scenario where the difference between the “lowest” award and “flexible” award is 14,000 miles. In reality, the spread will be different — and your lowest award may not have been with Air Canada.

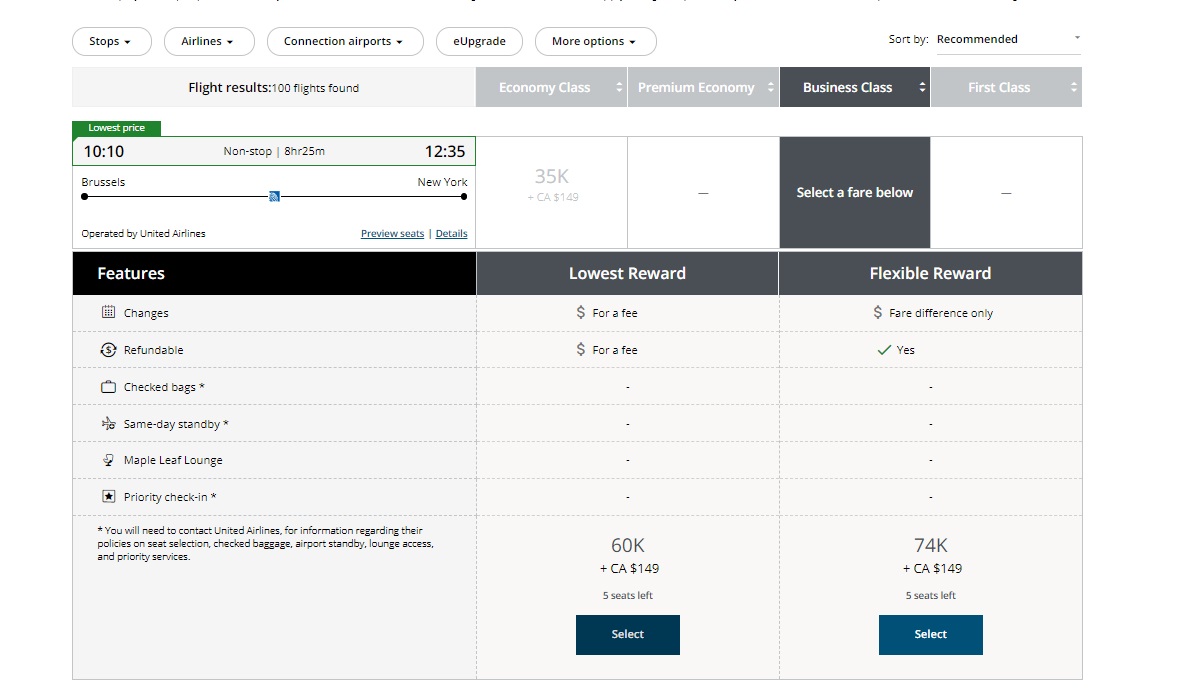

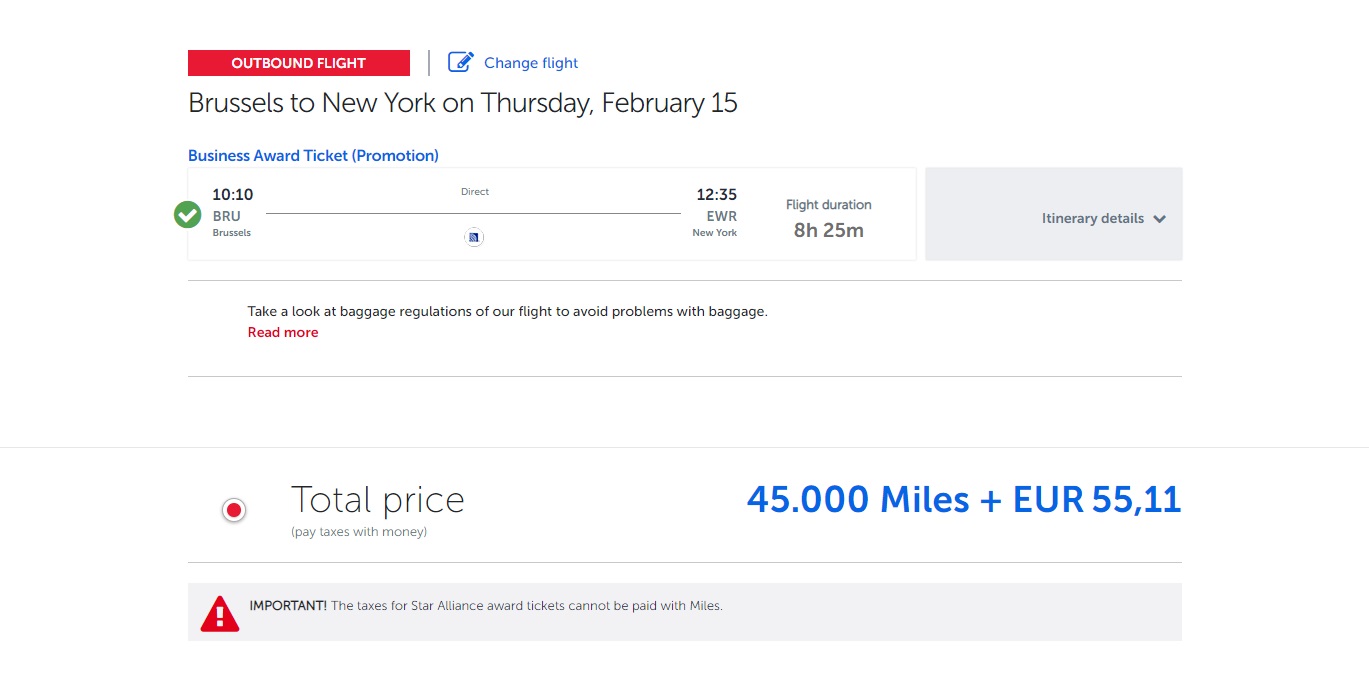

And of course, in this scenario, since United has no surcharges to worry about, none of the above would be your best option for booking that flight. You could instead book via Turkish Miles & Smiles for just 45,000 miles.

Turkish has a cancellation fee of $70. Again assuming that miles are equal and worth only $0.01 per mile, booking via United Mileage Plus effectively costs an extra $350 (the difference between United’s 80,000 miles cost vs 45,000 miles via Turkish is 35,000 miles). The times when you “win” the bet by cancelling the United award (and getting all of your miles back) would have to outpace the number of times you “lose” the bet (actually flying that United award and effectively having overpaid by $350) by a margin of more than 5-to-1 to make it better than booking the Turkish award and paying the $70 fee if you have to cancel.

Turkish has a cancellation fee of $70. Again assuming that miles are equal and worth only $0.01 per mile, booking via United Mileage Plus effectively costs an extra $350 (the difference between United’s 80,000 miles cost vs 45,000 miles via Turkish is 35,000 miles). The times when you “win” the bet by cancelling the United award (and getting all of your miles back) would have to outpace the number of times you “lose” the bet (actually flying that United award and effectively having overpaid by $350) by a margin of more than 5-to-1 to make it better than booking the Turkish award and paying the $70 fee if you have to cancel.

In other words, imagine that I booked that award via United (for 80,000 miles) and 3 out of 4 times, I ultimately cancelled the trip (getting all 80,000 miles back for no cost three times). One time, I take the trip. I’ve essentially “lost” $350 on the trip I flew by paying 80,000 United miles instead of 45,000 Turkish miles. If I instead booked all 4 trips with Turkish Miles & Smiles, I would have lost the cancellation penalty ($70) three times, which adds up to $210 lost. I would be better off booking via Turkish even if I cancelled 3 out of four trips.

I have to mention that there are additional considerations: in the event that you have a problem with your flight (like if there is a significant schedule change or some sort of irregular operations), you’re likely in for a headache dealing with Turkish. And if you transfer points from Bilt Rewards, Citi ThankYou or Capital One Miles to Turkish, you’re going to be stuck with Turkish’s firm 3-year expiration policy vs the ability to keep your United miles alive forever. But the savings via Turkish in that scenario is significant.

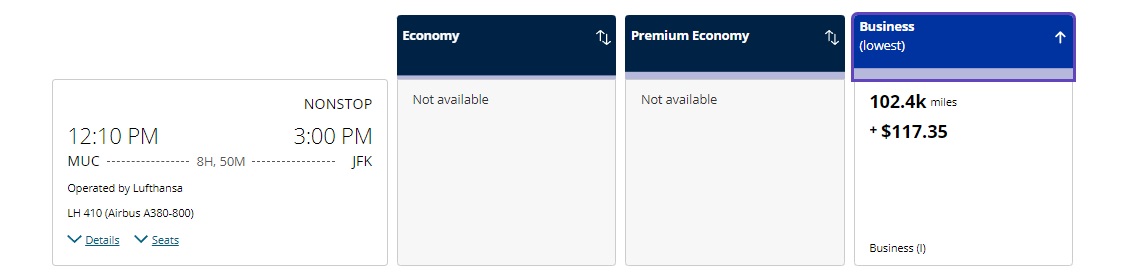

Interestingly, the same general trend continues even when considering airlines with high surcharges. For instance, here is a nonstop award on Lufthansa from Munich to New York-JFK. When did United start charging 102,400 miles for a partner award between the US and Europe??

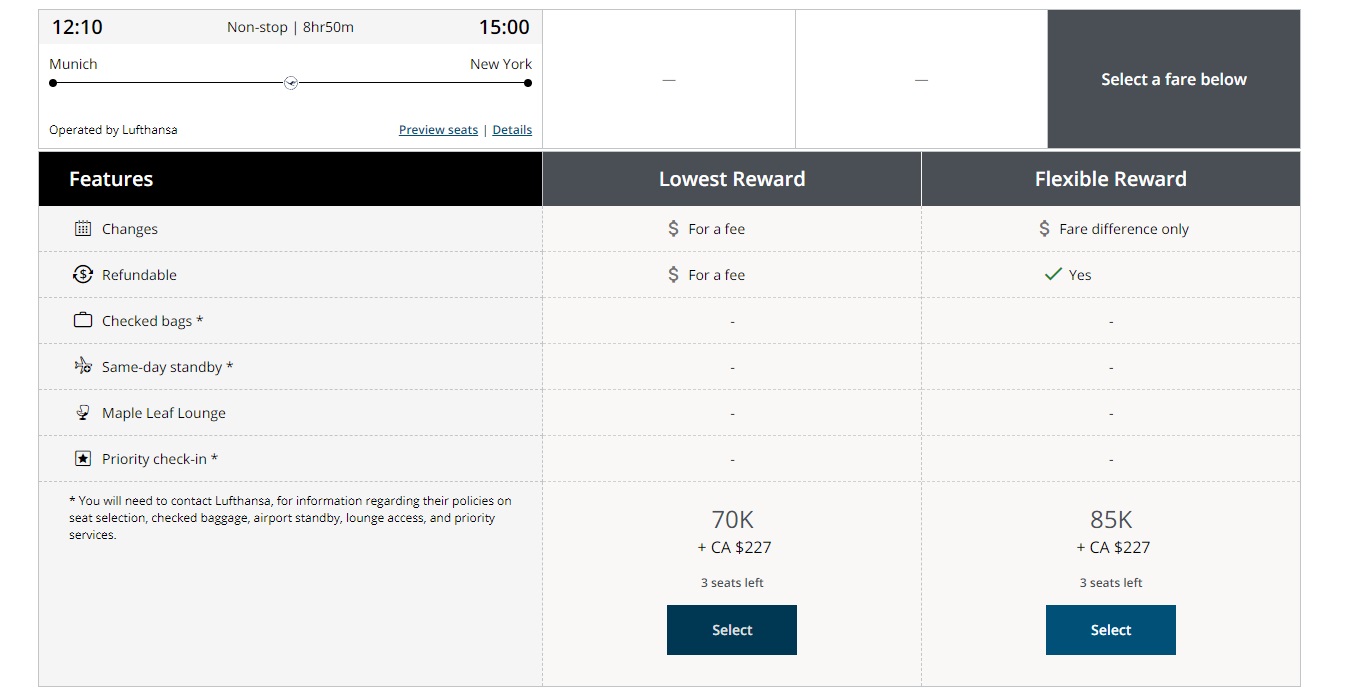

Once again, Air Canada Aeroplan rings in significantly cheaper even if you factor in the additional partner booking fee and the newly-added “USA tax recovery fee” on Air Canada bookings (which means the taxes & fees come to a total of about $51 more on the Air Canada award at about $168 in USD).

The fully flexible Air Canada “Flexible Reward” option costs 17,400 miles less than an also-flexible United award. But once again, it just doesn’t make much sense to book the flexible reward when you could alternatively book for 70K miles and only have to pay $100 CAD ($74 USD) for a change or $150 CAD ($111 USD) to cancel unless you intend to cancel more often than not. Again, the Flexible Reward is essentially pre-paying the cancellation penalty on an award that you may not cancel. Perhaps that makes sense if you anticipate making multiple changes / cancellations, but in the event that you might only do one of those things one time, I think it is tough to justify the extra 15K miles unless you really don’t value your Air Canada miles / transferable points at $0.01 per mile/point or higher.

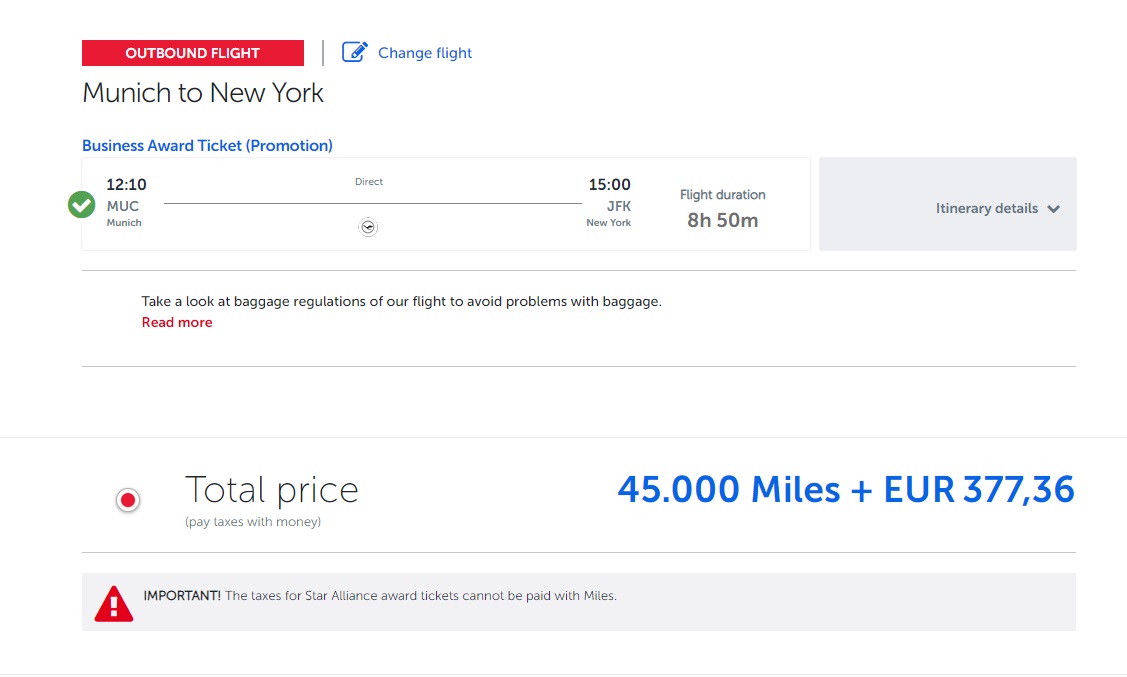

But, once again, Turkish should make you reconsider your infatuation with flexibility. Since they pass on some of the Lufthansa surcharges, you would have to pay 45,000 miles and 377.36 Euro to book the same flight.

Converting to USD at today’s rate, the taxes & fees on that itinerary via Turkish come out to $408.56. Of that cash total, $117.35 represents taxes you’ll pay whether you book through United, Air Canada, Avianca LifeMiles, or Turkish. That means that booking through Turkish costs an extra $291.21 in fees over the base taxes & fees charged by United or ~$240 more than the taxes & fees charged by Air Canada Aeroplan.

If we imagine that dollar figure as miles at a value of $0.01 per mile, that’s like paying an extra 29,121 miles for the Turkish award over booking via United — added together with the 45,000 miles that Turkish charges for the award, the total “cost” comes to 74,121 miles if you think of the surcharges as miles. Considering that Turkish only charges $70 to cancel that award and redeposit the miles, it is a far better deal than booking via United (again, unless you book tons of speculative trips and would cancel the vast majority of such awards).

Comparing it to Air Canada gets a bit more complicated since Air Canada has about $51 in additional fees over United. Therefore, the surcharge difference between Air Canada and Turkish is only about $240. If we mentally convert that difference to miles at $0.01 per mile, imagine the surcharges as an additional 24,000 miles. Added on top of the 45,000 miles that Turkish charges, you’re at a total of 69,000 miles….which makes the Turkish award a far better deal than Air Canada given that it costs 1,000 fewer miles you’ll only face a $70 cancellation penalty via Turkish vs $111 via Air Canada.

If you value miles more highly — say at 1.5c per mile — then the gap by which the Turkish award is a better deal only widens.

But what about those who want to minimize cash costs?

I know that many readers use airline miles to pay as little out of pocket as possible. High surcharges and/or cancellation penalties compound quickly when you’re traveling with a family of four (ask me how I know).

But let’s imagine that I have points in all of the transferable currencies and that I value them all equally (again, not realistic, but it keeps the math easy). Let’s imagine that I booked an Air Canada “lowest reward” and I had to cancel (which costs $150 per passenger). Since we have a Schwab Platinum card in my household, we could redeem 14,000 Membership Rewards points for $154. In other words, add 14K points to the “Lowest Reward” on Air Canada and that’s our cost to cancel if we want to cover it with points in order to minimize cash outlay. Covering the Avianca LifeMiles cancellation penalty with Membership Rewards points cashed out via Schwab would cost me just over 18,000 points per passenger. Rather than paying far more miles via United for the opportunity to cancel if I need to, I would be better off booking the cheapest awards via Air Canada and/or Avianca LifeMiles and cashing out Membership Rewards points only if I needed to cancel (assuming that I didn’t want to pay the fees out of my bank account and preserve the points for a more valuable use and assuming that I don’t plan to cancel repeatedly).

The same holds true with the Turkish Miles & Smiles awards: the additional $240-$290 in surcharges via Turkish Miles & Smiles could be covered with about 22,700 to 26,400 Amex points per passenger. To be clear, Amex points do not transfer to Turkish — I am merely demonstrating that even if my goal is to keep cash costs as low as possible, I could cash out points to pay myself back for the cash costs incurred and get a better deal with a program not named United Mileage Plus. (For those unfamiliar, points transfer to Turkish from Bilt Rewards, Capital One Miles, or Citi ThankYou rewards).

It is worth mentioning that I picked Europe because of its wide popularity as an award destination. The same comparison on awards to Asia or in Economy Class may shake out differently. But I think it is worth examining your take on which miles are best for Star Alliance awards.

Bottom line

Are we overvaluing flexibility? Sure, a program like United Mileage Plus offers easy award cancellation and redeposit. But is it worth the significantly higher cost of an award? Especially if you’re transferring to United from Chase Ultimate Rewards or Bilt Rewards, I would argue that it isn’t. On the other hand, if you have a lot of United miles because you fly United regularly for business and/or you’ve earned a bunch from United credit card welcome bonuses, it could certainly make sense to use them rather than transferring flexible points to Air Canada, Avianca, or Turkish. And the ease of cancellation, better customer service, and expiration policies of United miles all add some value as well. Is that enough value to make up for the cost difference? Maybe it is in your scenario, but it’s worth running the numbers — because “free” award cancellation isn’t necessarily free.

[…] reservations are also not new; but, flexibility does have value. Most car rentals have long had very flexible cancellation terms. And, many hotel […]

Is there an article that recaps all the airlines and the cancellation/reschedule policies for award tickets? That would be really handy.

Really great post, thanks. Helped clarify some of my thinking on the process.

One option I like to adopt for carriers that release little J at T-365, but release a fair bit at T-14/21 (eg ANA), is to book a flex Y with the intention of changing that to an inflexible J on/around my intended travel dates at T-14/21.

My takeaway from this fascinating discussion: wait, holy sh-t, my turkish miles will expire this year!!

[…] Reyes mentioned this in passing today, “Side note: When did United begin charging 80K for one-way business class to/from Europe?̶… and One Mile at a Time points out changes to partner award pricing as […]

Interesting post but I think it simply comes down is – at the time of booking, how likely are you to take the flight? If chances are high, then use less miles and hope it all goes smoothly. But if the chance of taking the flight is low, then use more points and enjoy the free cancellation option.

A few points:

1) value of flexibility depends also on your award travel style. I am one who almost always takes advantage of close in availability opening up, so my cancellation rate past 24 hrs is pretty low. If I’m booking 11 months out then it would be worth more to me.

2) I recently had to cancel an Avianca award even within 24 hours of booking, and cancellation was a PITA, and still waiting for refund. Lowered stress is valuable, it’s not just about the fees. I won’t be transferring to Avianca anymore, the stress is not worth the slight discount in miles.

3) having Aeroplan PYB greatly simplifies award cost math for me. All fees now are converted to miles at 1.25cpp. Sure you can have different miles valuations across programs, but it’s close enough. The Aeroplan card also gives pretty much all the travel protections as CSP. Only downside is losing carrier specific benefits like priority boarding, so I usually only use it for international F/J redemptions.

Hey Nick, this is an awesome post with lots of great tips!

I have 2 other questions / requests for you. Since this post covers Star Alliance to Europe, do you think you could do a similar post for One World and Sky Team to Europe? I would be curious to read which programs would shake out to be the best for those trips.

Secondly, regarding paying cancellation or change fees, have you tried paying with the JPM Ritz Carlton to count toward the $300 travel incidental fee? I assume the charge would look like a bag fee or seat assignment fee to JPM, so it should be possible to get reimbursed for those charges, right?

Thank you!

The ability to cancel is a financial/economic option. The extra miles required for the redemption aren’t the cost of the option, because you would get those extra miles back (i.e. you wouldn’t lose them) when you cancel. The value of the option, like any other financial option, is based on the probabilities of all possible paths/outcomes. In this particular case, it depends on the probability of cancellation, which you need to assess in your own situation. For whatever price (in extra miles) an airline charges for the option, you can compute the breakeven probability of cancellation. The option may be worthwhile for some people (when their own assessed probability is higher than the breakeven probability), but not for others.

Yes, thank you. I added a section about that.

Wow massive devaluation for UA J TATL, I see 97.1k for JFK-ZRH in March ’24 now vs 60k with AC.

An other point to book via united instead of partners, if you have a united points but don’t have points at Turkish or air canada, the transfer time can take some tune and by that time the award is no more available, especially if you don’t have a card that transfers and you need to upgrade first. I have seen saver award dissappear after a few minutes.

Nick – great posts. A couple of things that may change your analysis in some case –

1. Air Canada’s $100 change fee and $150 Cancellation fee is in C$, so that lowers the USD amounts that you’d actually use for comparison

2. For any Aeroplan booking, instead of canceling and paying C$150 fee, you can always change it to another random latitude booking (by paying C$100) and then cancelling that ticket for free. So in reality, your cancellation fee on AC is always C$100 (ask me how I know!)

BTW, when you talk about Aeroplan’s change and cancellation fees of $100 and $150 it’s in CANADIAN dollars which is $74 USD and $111 USD respectively, so the fees are lower making the case for NOT paying for flexible awards even stronger.

Ah, right! I forgot about that.

2 more reasons to book AC’s higher redemption: 1) it can be downgraded to the “standard” booking later and 2) for longhaul international AC flights originating YYZ, the higher redemption level includes access to the AC Signature Suite. As for the thorough calculations offered above, shouldn’t the value calculation also include ease of acquisition, which is entirely subjective? If that extra 15% cost for Flexible is 1% of your stash, you can easily afford to pay the 15% every time and my advice is put down your calculator, pay it and enjoy the superior flexibility. I’ts the same as “fly in the front, you can afford it”. If the extra 15% for Felixible is 10% of your annual points earnings, maybe you should not book Flexible. “What it’s worth, exactly” is interesting, but “what you can afford” is a non-trivial factor. We can all afford overpriced coffee, but rich people can afford overpriced air tickets. I love feeling rich and I love flexibility, so I tend to favour it, especially with carriers whose prices are wildly dynamic.

Till when can you downgrade from flexible to reg. And get back the difference?

Anytime, subject to current price and availability. One wouldn’t do this if the price had increased, or if no availability.

Do you mean to say that it’s not downgrading rather to just cancel it and rebook at the standard if it’s still available?

Hm I see what you mean. I’ve done one on the phone as a downgrade. Can’t remember if re-price (and fresh availability) was required. Maybe others can weigh in. Sorry if I jumped the gun

Yeah would make a huge difference lol

Making the aeroplan analysis more complicated, although you’re “prepaying” a good chunk of the cancellation fee by opting for the “flexible” fare, if in fact you do cancel, you receive all points (including the “ flexible surcharge”) back, so it works great if you do in fact cancel (costing you nothing). Thus, if using aeroplan as a speculative or backup flight, the flexible booking is not as expensive as noted in the post.