Many cardholders don’t realize they can transfer rewards between their own accounts online. I can even transfer cash back from my wife’s Spark Cash card to miles on her Venture or Venture X card at a conversion rate of $0.01 = 1 mile.

Why is this exciting?

Why is this exciting?

This can be very exciting for several reasons:

- Capital One offers several cards that earn excellent category bonuses on dining, grocery, entertainment, and so on. By converting, you can earn 3x airline miles in those categories.

- It’s possible to convert welcome bonuses from cashback cards (including those earned on the business side) into miles.

For instance, the Capital One Savor Cash Rewards Credit Card has no annual fee and earns 3% back on dining, grocery, and entertainment, which means 3x miles per dollar if rewards are converted 1:1 to the Venture X, Venture, or VentureOne cards.

Remember that the Venture X, Venture, and VentureOne cards convert to airline and hotel partners at the same ratios. Someone who wants to earn airline miles for dining and entertainment purchases could theoretically pair the Savor card with the VentureOne card and earn 3x on dining and entertainment without an annual fee and convert 1:1 to partners like Avianca LifeMiles, Wyndham, Asia Miles, and more. That’s awesome.

Furthermore, since Capital One allows you to combine rewards with other cardholders, it should be possible for a Savor cardholder to share their rewards with another cardholder who has the Venture or VentureOne card as well.

A key Capital One weakness is that there aren’t many ways to earn Capital One miles through new card or category bonuses. Converting opens up additional card and category bonuses from other Capital One credit cards. In fact, it can even open up earning and sharing between the business and personal sides.

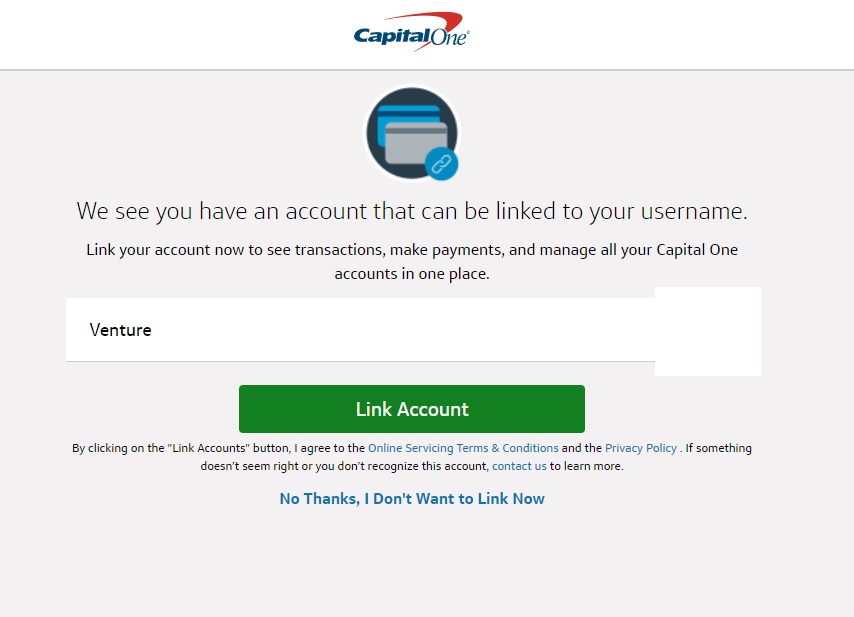

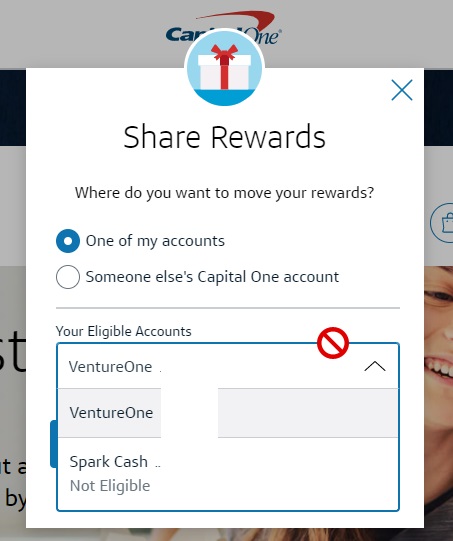

For instance, my wife has the Capital One Spark Cash Business credit card. She also has both the Venture and VentureOne cards. If she goes to her Spark Cash account and clicks on “View Rewards? and then “Move Rewards” to one of her own accounts, this is what she sees in the drop-down menu:

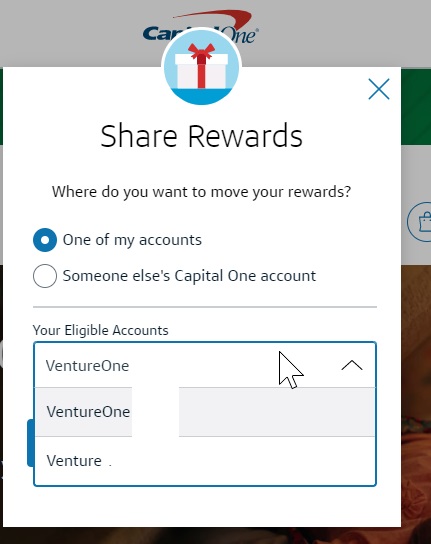

You might assume that she could only transfer rewards between the Venture and VentureOne accounts. However, when she goes to her Venture account and chooses to move rewards to one of her own accounts, this is what she sees:

Note that it says her Spark Cash card is not eligible. In other words, she can’t convert Venture miles to her Spark Cash card. However, in the opposite direction, it does not indicate that her Venture accounts are not eligible — so converting cash back earned on a Spark Cash card to miles works.

That’s huge because we sometimes see very big bonuses on the Spark side — being able to convert a $1,000 or $2,000 Spark Cash bonus into 100K or 200K miles is awesome. Furthermore, spending on the Spark Cash would make more sense than spending on a Venture card because the Spark Cash card offers the flexibility to redeem rewards for straight cash (not just to reimburse travel purchases) or convert to miles.

How to move rewards

In order to move rewards, go to your Capital One card account and click “View Rewards” under your card name in the top left of the card account.

Then select “move rewards”.

If you want to move rewards to someone else’s account, you’ll need to call the number on the back of your card and provide the card number of the person to whom you are moving rewards.

Bottom line

It’s possible to convert rewards earned on Capital One cash back to miles on a Venture X, Venture, or VentureOne card, which is terrific for those looking to accumulate miles with bonus categories or welcome bonuses.

Don’t know if this reply will get eaten because I’m linking to a competitor blog but omaat, who it bears mentioning was prominently sponsored by Cap 1 recently and therefore likely has solid contacts there, states that the transfer issue is temporary.

https://onemileatatime.com/news/capital-one-mileage-transfers-unavailable/

@Nick Reyes – working again.

Any update on this?

I’ve been told that this feature has been discontinued

WoW, so I guess Cap1 just destroy their dual set up. I thought it was down and will be back eventually. I might need a new card for Dining/Grocery now. I guess it’s time to apply for the Gold card

Told by a rep? Not sure I’d believe a single rep, but then again sadly it wouldn’t surprise me. My problem is my Venture card is up for renewal and I’ve got 85k points there. I was hoping to transfer to my Venture X card and cancel….but now I’ve got to decide if I want to pay $95 AF for basically nothing or to speculatively transfer miles to a program I’m unsure I’ll use. Uuuugggggg!!!! Sure hope we here something definitive soon.

I wouldn’t even have a dilemma there — 85K points is enough to fly business class to almost anywhere in the world with Capital One’s array of partners. I think it would be silly not to pay the $95 in that spot. Obviously I hope to see the ability to move rewards come back and I wouldn’t want to pay that in perpetuity — I’d prioritize using the Capital One miles for your next couple of trips rather than other rewards — but I’d pay the $95 for now.

Yeah, no doubt. And I’ve actually got to get home from Europe here in about 3 weeks, but I also… speculatively transferred to Lifemiles from AMEX when they recently had their transfer bonus, so was hoping to use those up on a LH flight. But….just frustrating. Thanks Nick.

I stopped using SavorOne and Venture X since I cannot transfer rewards from Savorone to Venture X now. This is so irresponsible of Capital One to do without any notice about it. I got SavorOne for 3 points for groceries to transfer to Venture X, but now I am using all my Chase cards. Just to protest! No I am not letting Capitalise get a penny of my money any more unless they restore that function. I am back to c my hase Trifecta.

I just talked with our rep. They are saying it has been temporarily disabled, and when it comes back, it will be better. Sounds like they have been talking to Delta. Until it comes back, we are shifting our spend to other cards.

Interesting. I tried to move Savor rewards to Venture X a couple weeks ago and the system said this wasn’t an eligible transfer (the reverse was).

I called and got an agent who talked over me incessantly and kept saying “it’s totally possible to convert cash to miles but never the reverse!”

And I kept saying buddy, listen, I’m staring at my screen, I ONLY can convert miles to cash online, so that’s definitely possible, and I CAN’T convert cash to miles which is what I’m trying to do.

After telling me 1000 times that I was wrong or that it was a problem with my own web browser, he finally just did the conversion (cash to miles) for me. But dear lord. Never wanted to call again.

I’ve never heard of or seen the ability to move cash back to miles. You’d be the first data point I’ve heard of doing that if you’re telling me that you had been able to move Venture miles to the Savor. As the agent said, the reverse has been true (cash to miles), but not the opposite to my knowledge either.

but even if it were possible, why would you bother doing that since you can always redeem miles as cashback at 1c per point. What am I missing here?

They can only be redeemed for 1cpp toward travel purchases. If you want a general statement credit / “cash”, then you get 0.5cpp. Yes, I understand that it’s possible to still turn miles into pennies without the step of converting, but I’m sure that some people would rather just convert to cash back rather than book and cancel something. I imagine people interested in that are likely mostly folks who would like to turn welcome bonuses into cash rather than use them for travel.

The system on that particular day allowed me to choose Venture X as the source and Savor as the destination; it didn’t allow me to choose Savor as the source and Venture as the destination.

The agent said Venture X as the source (miles) and Savor as the destination (cash) is absolutely not possible, but it was clearly possible that day, and the only possible choice for me.

It required that the agent be the one to move the Savor cash to the Venture X card, which they did successfully over the phone (while repeatedly telling me I should be able to do this on my own and it was my fault that I wasn’t able to).

Very odd. Like I said, you’re then the only person I’ve ever heard of being able to do it in that direction (Venture X to Savor). I wonder if they shut it down because they were trying to make it easier and somehow enabled that accidentally. Did you only see that option (to go Venture X to Savor) one time? If not, how long was it available on your account?

This was the first any only time I tried; checked the date, it was Sept 12. You may be right – maybe this was why they took it down? It did strike me as an odd (and undesirable) option.

I think you meant “I’ve never heard of or seen the ability to move miles to cash back.” 🙂

yes, i called the other day too and got the same answer. it is a gltich but they have no idea when it will be back. i hope soon too!

Yeah, that option is now gone online. Better get it back soon!

Did they remove this feature? I used to be able to do this up until a few weeks ago. now it appears the option is no longer available to me. Is anyone else having this problem?

Nevermind, please delete.

I called Cap1 to transfer cash back rewards from my Spark Cash to a Venture X on which I am an authorized user and was told it could not be done.

When logged into the Spark Cash account online, clicking on the button “Move Rewards” gives me a message saying “You don’t have any other Capital One accounts.”

You can’t do it yourself online. You can only move rewards online between accounts on which you are the primary cardholder.

However, you can move rewards to any other primary cardholder.

I think it sounds like you tried to move rewards from your card (where you are the primary cardholder) to a card in your name that is an AU card on someone else’s account. You can’t do that.

Instead, move rewards from your Spark Cash to the primary cardholder on that Venture X account. It doesn’t matter whether or not you are an authorized user — that wouldn’t even come up in the conversation.

For example, my wife moves rewards from her Spark Cash card to my Venture card. Neither of us is an authorized user on the other person’s card — she just calls up and says she wants to move rewards from her Spark Cash to another cardholder and gives them her Spark Cash card number and my Venture card number and that’s it.

Thanks, I successfully transferred cash back to my wife’s (primary cardholder) Venture X card.

[…] like the Capital One Savor card into Venture Miles. This is still not 100% confirmed but multiple sources have indicated that this is true. The reason this would be a big deal is that it opens up the […]

I called Capital One this morning and they confirmed that you can move cash back to miles, but not the other way around.

This has been possible for at least two years. I’m not sure why it’s getting reported as if it’s brand new.

C1 cards have been solid for a long time and the fact that they are often crapped on by community groupthink is kind of outdated.

Did you see the quotes in the post from 2018? I made it clear that it isn’t new, but was news to me (and based on the reaction to the post, it was news to many other folks as well whether or not the functionality itself was new). We all knew you could move miles to miles, but being able to move cash back to miles was the piece that wasn’t widely known.

Wasn’t just you. I saw a few other sources presenting as if it was a change C1 just made.

[…] Huge if true: Convert Capital One cash back to miles by moving rewards by Frequent Miler. […]

[…] program even with cash back earned from several other credit cards. The information comes from Frequent Miler and Miles Talk. The cash back rewards earned on the Capital One Savor, SavorOne, Capital One […]

I have a VentureOne and a Spark Cash Select for Business (both converted from the respective annual fee cards years ago). The cards have separate logins with Capital One, one for personal and one for business. The separate logins seem to create an issue with transferring rewards. When logged into either account, if I click “Move Rewards” > “One of my accounts”, I get the error message: “You don’t have any other Capital One accounts.” If I click “Move Rewards” > “Someone else’s Capital One account”, I get the error message: “We’re working on making this something you can do online, for now, please call the number on the back of your card.” I have not yet called the number to try to do this because I don’t have any rewards accrued in my Spark Cash Select account, so I’m not sure if this option would work for this case.