There are many good reasons to buy $500 Vanilla Visa cards. Here are a few:

- To earn 5X Ultimate Rewards Points with a Chase Ink card (see “Almost too good to be true”) at Office Depot.

- To earn 6X Hilton points with the Hilton Honors Surpass Amex cards at a US Supermarket or US gas station.

- To earn 6% cash back with the Blue Cash Preferred Amex at a grocery store.

Once you have the Vanilla Visa, you can simply use it for day to day spend. Or, you can liquidate it in one step by paying taxes. Quite a while ago a reader told me this was possible, but I hadn’t tried it until last week. It turned out to be incredibly easy! Below is a step by step guide:

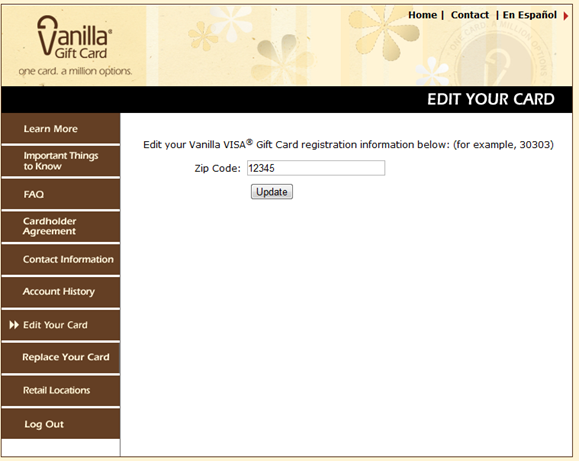

Step 1: Register your zip code online

Go to www.vanillavisa.com and log in by entering your card’s number, expiration date and cvv (the 3 digit code on the back of the card). Next register or edit your card to enter in your Zip code information:

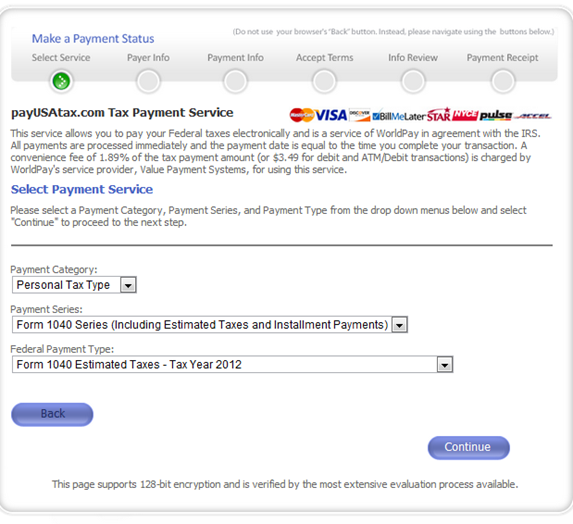

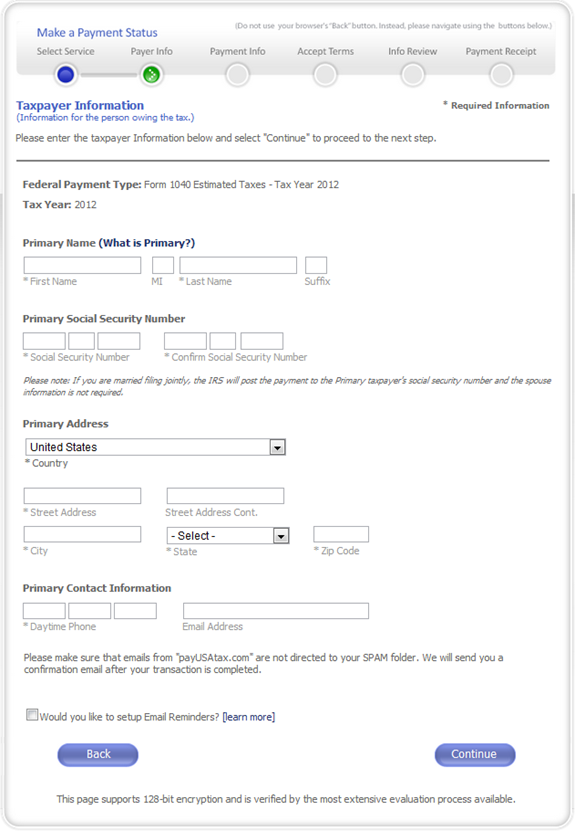

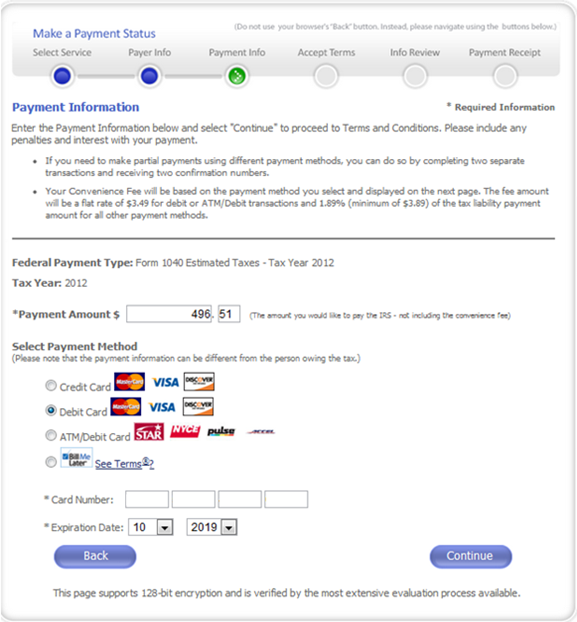

Step 2: Go to payUSAtax.com and “Make a Payment”

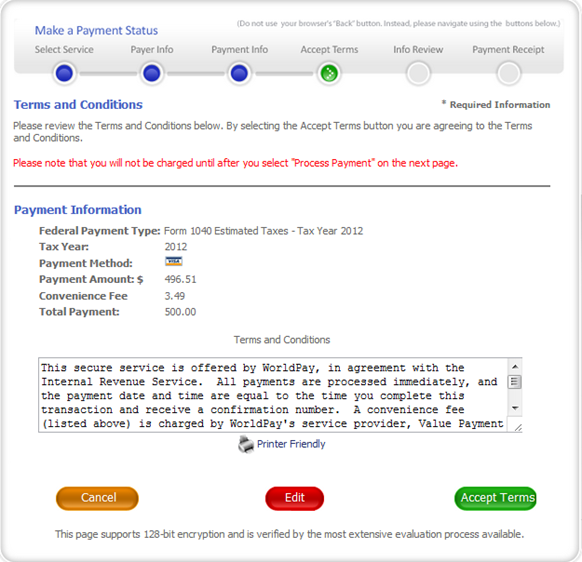

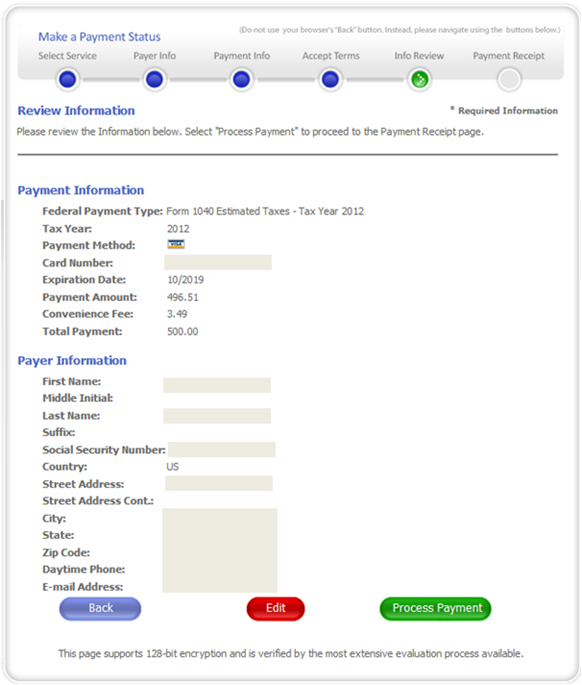

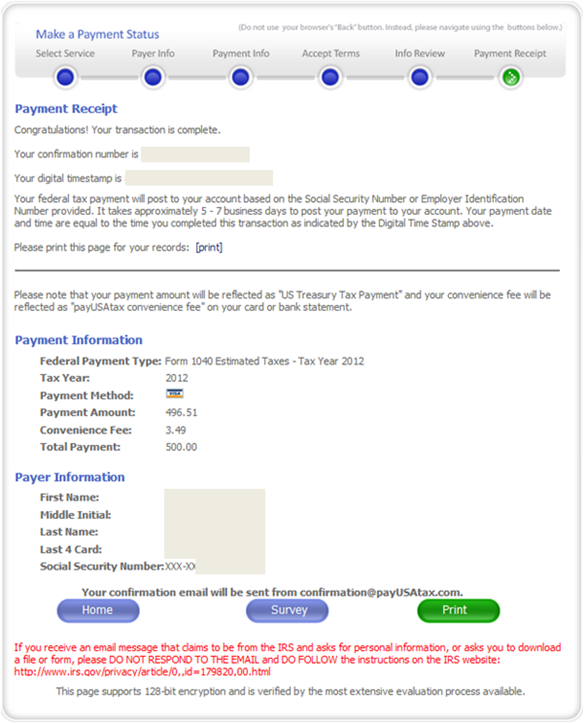

Once you click the “Make a Payment” button you’ll see the following screens. Fill out each screen and press “continue”. In the screen shots below, I made an estimate payment for my 2012 taxes. My payment was for $496.51. payUSAtax.com charges $3.49 for debit transactions, so the total comes to exactly $500. Personal information on the screens below has been masked.

Be careful to select “Debit card” in order to get the lowest fees:

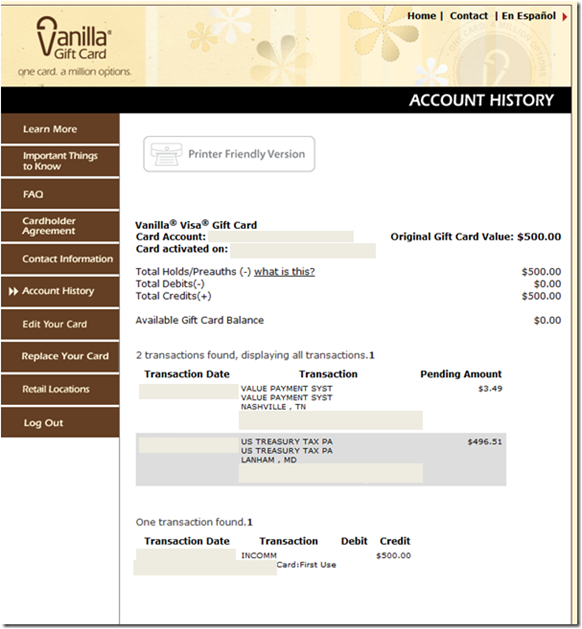

Step 3: Confirm that the payment went through

This step isn’t really necessary, but personally I wanted to make sure that my card’s balance was zero before tossing the card in the trash. So, I logged back into www.vanillavisa.com to take a look at my Account History:

Available balance: $0.00. Great!

Notes

- Cost: When you consider both the purchase fee for the Vanilla Visa ($4.95) and the debit card fee for paying taxes ($3.49), the cumulative cost to pay taxes this way comes to 1.7%. Compare this to the credit card processing fees of 1.89% for Visa, Mastercard, and Discover; or 2.29% for American Express. It’s hardly worth the effort for the savings unless you earn bonus points when buying the Vanilla Visa.

- PIN: Even though this was processed as a debit transaction, I was never asked for a PIN number. This is good news since you do not get PIN numbers with these cards.

- Limits: Different types of tax payments have different limits. For example, you can only make 2 estimated payments per quarter. This FAQ has a list of similar limits.

- Questions: payUSAtax has a great FAQ page. Please read this if you have questions about paying taxes online: www.payusatax.com/faq

- Vanilla flavors: For more information about Vanilla Visa cards, please see “The many flavors of Vanilla”.

- Other Cards: The approach to paying taxes shown above should work with most other debit and prepaid cards, but you’ll have to figure out for yourself whether it makes financial sense to do so. You can also pay via credit card, but be prepared for the 2.29% fee for American Express cards (via valuetaxpayment.com) or the 1.89% fee for other cards (via payUSAtax.com).

Has anyone tried this in 2016? Great info. Thank you!

You can find updated info here: https://frequentmiler.com/go/pay-taxes

Has anyone tried this in 2016? Great info. Thank you

[…] About Vanilla Visa Gift Card Balance: Visa Gift Card Card Balance Federal Taxes Vanilla Visa var dd_offset_from_content = 40; var dd_top_offset_from_content = 0; This entry was posted in […]

[…] How to pay Federal taxes with a Vanilla Visa […]

@JW

https://frequentmiler.com/2012/08/08/the-many-flavors-of-vanilla/

May I ask if OneVanilla Prepaid Visa card can be used as debit card to pay income tax? I thought you could but this is what was said on OneVanilla.com :

At time of purchase, give your Card to the cashier and sign the receipt or push “credit” on the keypad. Although it states “debit” on the front of the card, most cards do not come with a PIN, therefore your purchase will be declined if you push “debit.”

Any help is much appreciated!

Need to wait at least 20 mins between payUSAtax.com transactions. It doesn’t let you do them quicker to prevent inadvertent duplicative payments.

Sajer Guy: Good tip. Thanks

@Nancy – Thanks for the tip. I am going to try that with a Vanilla Visa! $16 for 5,000 UR is not a bad deal!

Great news for Illinois: use payILtax.com and get charged a flat 3.95 for Visa debit payments and no maximum on number of times you do it. There are 2 other sites you can use, but they charge 2.49% (that’s a $12.45 fee on a $500 payment).

I can’t believe I just wrote ‘great news’ in a comment about Illinois taxes…

Karla — you’re right, I didn’t notice that Vanilla pre-paids are debit cards. Some of the similar ones for sale in other office stores are credit only.

–

–

Ikonos — Mio for example, or the upcoming MyVanilla reloadable, which I think are both run by the same company. It all depends on which reload packs you’re able to buy with CC in your town. NS might work too, but most people report being shut down eventually after high debit transactions.

@rick b What are the better alternatives to NS and AMEX prepaid?

@rick – This was the Vanilla Visa gift card that you can put $20-$500 on. The one in the gold package. Worked great as a debit card once I registered my zip code! No pin required.

Please ignore that last post. It really helps to read ALL instructions. I neglected to register the zip code. All working great now! 🙂

Karla: the fixed value gift cards are credit only, not debit, so you will still incur the 1.89% fee. Even the AMEX pre-paid that’s reloadable with Vanilla packs is credit. You need to get a true debit card like Netspend (or one of its much better alternatives), that allow PIN debit transactions.

Just tried to make a payment. Verified 500 balance on Vanilla VISA. Selected Debit. Tried to pay 446 to allow for fee. Got this message:

Your federal tax payment was declined by your card issuer. Your federal tax payment has not been received and there will be no charge to your account.

Any ideas?