NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

Update 1/1/21: This deal has been extended through 1/31/21. Phone number under “The Deal” has been updated to a line many readers have reported as being more direct.

Update 12/11/20: It looks like the latest round of bonuses on this account posted on 12/8. This one has worked out well for many readers and is available through 12/31.

Update 11/11/20: Bonuses are posting for people who opened in September. This looks like an easy $1300 win for a couple playing in 2-player mode. Thanks to Josh and Jake for sharing relevant data points in the comments below.

The updated original post follows:

HSBC is offering what appears to be a very sweet bank account bonus that looks like an easy $600 with relative minimal effort — and a couple playing in 2-player mode may be able to eke out an easy $1300 total. The easiest form of the deal requires opening your new checking account over the phone via a referral code, but it otherwise beats their current online offer in terms of reduced requirements. A caveat here: I haven’t personally tried HSBC’s referral system, so I don’t know for sure how easy this deal will work out to be (update: as noted above, we now have positive data points about this account working out as expected) — based on the one commenter at Doctor of Credit who has done this and the wording of all of the terms, this deal looks fast and easy. I thought it was worth reporting given the unusually high value ($600 cash) — which beats many new credit card bonuses — and what may be quite easy bonus requirements. Read on for more detail and analysis.

The Deal

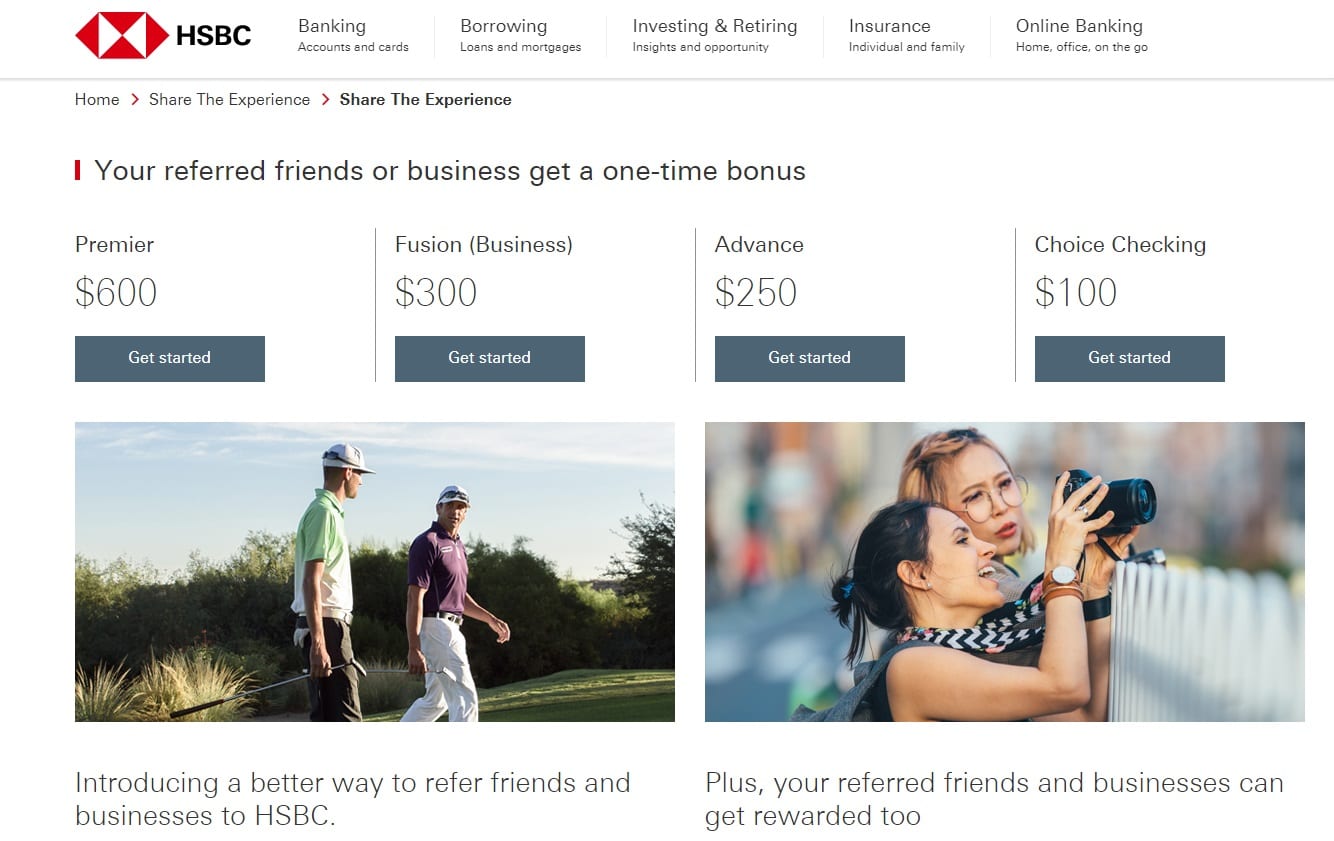

- HSBC is offering referral bonuses for several of their account types. The best deal (outlined in this post) is a new HSBC Premier account, which offers a $600 account opening bonus (that theoretically posts within a month or so – potentially without any direct deposit requirements — see more detail below). If you refer others, you earn $100 per referral up to a cap of $2,000 per calendar year.

- To open over the phone, you’ll need to call

800.975.HSBC (4722).According to the comments, the Premier Checking account needs to be opened by calling the “Premier Relationship Team”. Several readers have had success with this phone number as the most direct line: 716-841-6408. You can also try (866) 788-5583. You’ll want to mention that this is the “Share The Experience” offer. That department is open Monday to Friday 9am to 4pm Eastern- My referral code:

- Nick’s wife’s code (Samantha Axtell): S015111090

(those are zeros – the only letter is S)

- Nick’s wife’s code (Samantha Axtell): S015111090

- My referral code:

- Link to more information (though note that for the referral deal, which does not require keeping the account and may not require direct deposit, you’ll need to open over the phone or in-branch)

Key Terms

- Expires

12/31/201/31/21 -

The new referral’s Eligible Account must remain open for at least 15 business days.

-

Consumers who currently hold, or have held in the past 3 years, an HSBC consumer deposit or investment account are not eligible.

-

Businesses who currently hold, or have held in the past 3 years, any HSBC business account are not eligible.

-

The individual you refer must provide your personalized referral code at account opening for you to qualify to receive credit for the referral bonus.

- Consumer New Customer: This offer is only valid for new Eligible Accounts opened during the Offer Period in a U.S. HSBC branch or through HSBC’s customer service line 800.975.HSBC (4722) during which a valid personalized referral code is provided by the new customer. The new account must meet qualifying requirements within 90 calendar days of account opening pursuant to the relationship requirements discussed below.

-

Account opening date is considered day one of the 90 calendar days count.

-

Consumer Accounts/Assets that are ineligible from qualification requirements for this offer include: insurance products; fixed and variable annuities; 529 College Savings Plans; any retirement accounts including but not limited to IRAs, Keogh, Simple IRAs and 401(k) Plans; UTMA and UGMA; commercial accounts; and revocable or irrevocable trust accounts.

-

Customers who currently hold, or have held in the past 3 years, an HSBC consumer deposit or investment account are not eligible.

-

You will automatically receive the $600 referral bonus to the new qualifying HSBC Premier checking account, a $250 referral bonus to the new qualifying HSBC Advance checking account, a $100 referral bonus to the new qualifying HSBC Choice Checking within 8 weeks from the date the new account is fully qualified.

-

The new Eligible Account must be open without being changed to a product with lower requirements and in good standing at time of gift fulfillment.

-

Limit one Referral Bonus per new customer, including all individual and joint accounts — the first line name on the joint account is considered the customer for gift purposes.

-

A customer can use only one referral code at the time of account opening.

-

For both you and the individual who referred you, the bonus deposit(s) to your Eligible Account will be reported on the applicable IRS form.

Thoughts

Note that a key exclusion is that “Customers who currently hold, or have held in the past 3 years, an HSBC consumer deposit or investment account are not eligible.” There has recently been a savings account bonus available through Slickdeals. If you’ve done that bonus, I assume you are not eligible for this one.

To break down the way this works based on the terms and the experience of commenter Jay at Doctor of Credit – link to his comment here (note that many readers have reported the same type of experience):

- The new account holder needs to open an HSBC Premier account using a referral code either in-branch or over the phone (via the Premier Relationship team. See the phone numbers under “The Deal” above as several readers have reported more direct lines. This seems to be available nationwide. (Note: There are also some other account types you can open for lesser bonuses: HSBC Fusion Business ($300 bonus), Advance ($200 bonus), or Choice Checking ($100 bonus), but given the easy requirements it makes the most sense to go after the Premier bonus. See more below for why I recommend this).

- The new account must remain open at least 15 business days according to the terms. Realistically, you will need to keep it open a month or two for the bonus to post. Jay reported that his bonus posted on the first day of the calendar month following account opening, but most readers have reported it posting near the beginning of the second month after opening (and it isn’t on a predictable day – bonuses seem to all post on the same day, but the date can vary anywhere between the first and tenth of the month so far. YMMV).

- The new account must “meet qualifying requirements within 90 calendar days of account opening pursuant to the relationship requirements discussed below.” I’ll interpret that to mean that you may need a direct deposit of $5K per month until the bonus posts, though this may not be as big of a hurdle as it sounds (see this data point and this data point). Readers who have reported receiving the bonus have met the $5K requirement.

The highest bonus ($600) requires opening an HSBC Premier account. I think that’s the one to do for most people, so that’s what this post focuses on. The usual requirements to keep an HSBC Premier account fee-free are one of the following:

- Balances of $75,000 in combined U.S. consumer and qualifying commercial U.S. Dollar deposit and investment* accounts; OR

- Monthly recurring direct deposits totaling at least $5,000 from a third party to an HSBC Premier checking account(s); OR

- HSBC U.S. residential mortgage loan with an original loan amount of at least $500,000, not an aggregate of multiple mortgages. Home Equity products are not included.

- Consumers who maintain Jade status.

- A monthly maintenance fee of $50 will be incurred if one of these requirements is not maintained.

Two keys here: first, ACH transfers from an external checking account have been triggering the direct deposit requirements (I’ve written about it here. See methods that might work here.). Update: Given the attention this deal has generated, it is certainly possible that ACH transfers may stop working at some point. Phone reps say that ACH will not work, but reader experience thus far has been that it has indeed worked for many readers.

You typically need a total of $5,000 in direct deposits over the course of the calendar month (not necessarily a single deposit) to keep the account fee-free. However, I’m not sure whether or not you actually need to keep the account free-free as paying the monthly maintenance fee seems to me as though it maintains the Premier relationship (and I’m not sure they even charge this fee in the first month or two). Again, phone reps indicate that direct deposit (or the mortgage or $75K balance requirements) must be met. Thus far, I think that all of the success reports we have received in earning the bonus have come from those who have met the $5K direct deposit requirement.

The key snag here is needing to open the account over the phone or in-branch for this version of the offer that posts the $600 bonus in one shot. There is also a $600 online offer (see this Doctor of Credit post for full details), but that offer is structured differently. The online offer gives you a bonus of 3% of your direct deposits up to a max of $100 per month and a max of $600 over the first six months, so that online version requires you to keep up with the direct deposit requirements for longer if you want the full bonus (and given that the bonuses for that account begin posting 2 months after you meet the requirements, you’ll need to keep the account open 8 months under the online offer to get the full bonus). I am currently working on the same type of online-opening bonus (my offer was a smidge higher at up to $120 per month / $700 total, since expired). The referral offer seems substantially better than the current $600 online offer since you’ll have the option of closing the account earlier if you want to — and if you have a second player to refer, the referral offer puts an extra hundred bucks in your household’s collective pocket.

That said, I have to say that I’ve been pleasantly surprised with HSBC. They have some kind of archaic stuff in terms of setting up your online account and generating a security code with the phone app, but once you get it set up I’ve found it quite easy. The slightly frustrating thing is that scheduled ACH transfers are kind of slow. However, once you have established an external payee by making a bank-to-bank transfer the old-fashioned way, you can then use the app to send real-time transfers of up to $2500 at a time (up to $5K per day) if your external bank participates, so I’ve been able to move $5K out of the account instantly (immediately posting to my external account – no need to wait even a single a business day). I’ve found that convenient. I was also targeted with an offer to earn $30 per month for six months by using my debit card for 10 transactions per month ($15) and to make 3 bill payments ($15). That will total an additional $180 (note that this offer is targeted, but keep your eye out for emails from HSBC).

Ultimately, whether you like and want to keep the account or not, the quick $600 bonus here looks like an easy win. Indeed, it is as good or better than the welcome bonus on many credit cards with no purchase requirement. The reader comment I’ve linked to above indicates that his bonus posted the very next calendar month after opening, though readers have now reported bonuses posting about two months after opening.

Overall, this $600 bonus looks pretty good. HSBC has offered referral bonuses in the past that were not as good as the online offers, but given that this offer is for as high a bonus as the online offer and it posts in one shot with a very low minimum timeframe for keeping the account open, it looks to me like a substantially better deal than the online offer and probably the best bank bonus I can think of in recent memory. A couple playing in 2-player mode could make a nice splash here:

- Player 1 opens through a referral and collects the $600 bonus

- Player 1 refers Player 2, earning a $100 referral when Player 2 opens the account

- Player 2 collects a $600 bonus

That’s $1300 cash for a 2-player team. If you know others who might be interested in that, it can get $100 better for each person you refer. My wife and I opened our accounts under the online deal (when it was up to $700 each) and I’ve honestly been thrilled at the prospect of picking up $1400 in essentially free money between the two of us for a few clicks of the mouse — but in our case, it’ll take 8 months with monthly direct deposit to get there, so I don’t think this offer is substantially worse (and I’m sure some would prefer the quick hit of cash).

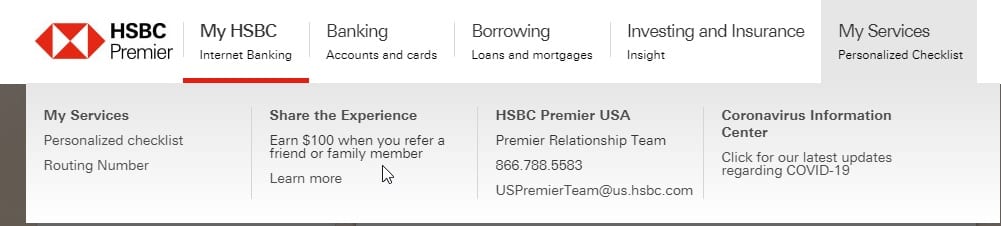

Note that it says that “If you’ve recently registered for Personal Internet Banking it may take up to two business days to receive your personalized referral code”. You can find your referral code here:

Clicking “learn more” brings you to a page where you’ll find your referral code under “Step 1” of “Two Easy Ways To Share The Experience”.

Keep in mind of course that bank bonuses are typically reported as interest income, so expect a 1099 and to pay tax on them. The juice is still worth the squeeze if you ask me.

Any hope of getting HSBC to post a bonus manually if it doesn’t post automatically? Is contacting HSBC about the bonus not posting a dead end?

Bumping this. Any hope of reaching out to HSBC and successfully getting them to post a bonus manually if it doesn’t post automatically?

Has anyone been hit with a monthly maintenance fee lately I didn’t have any but I just saw one now how do I get around this I don’t have a direct deposit from employer that’s $5000 monthly

Anyone receive a June bonus yet this month?

Was wondering the same. Also, has anyone who has not received a bonus yet had any success communicating with HSBC?

Turned off adblock looking at the HSBC site to see if a chat icon would pop up, and noticed an offer

Starting 04/01/2021, you can earn up to $180 ($30 max per month) over six consecutive months when you start using HSBC for your everyday transactions. Offer ends 09/30/2021.

It pays as $15 for using debit card 10x and $15 for using bill pay 3x.

Has the round of bonuses for May posted yet?

Still waiting on mine after opening in December. Already received referral bonuses and P2 got theirs $600 credit like two months ago.

Yes, it has. May 3rd. Sorry, forgot to comment here.

Any suggestions for getting a stubborn bonus to post? Hoping to avoid getting charged the $50/mo maintenance fee when the 6mo fee waiver for these accounts expires.

Argh. Still no $600 bonus for me either.

Any way to get HSBC to post a bonus manually if it isn’t showing up or is this deal a complete dead end if the bonus doesn’t post automatically?

This offer ends June 30, 2021.Get 3% Cash Bonus

(up to $600) for new customers who open an eligible HSBC Premier

checking account with qualifying activities.

This offer is available only online for applications completed using the Apply now button on this webpage. Applications submitted through other pages on our website will not qualify for this offer.

To qualify for 3% Cash Bonus (rounded up to the nearest dollar) on Qualifying Direct Deposits up to $600 ($100 max per month), during the first 6 calendar months after account opening you must: (1) open your new HSBC Premier checking account from April 1, 2021 through and including June 30, 2021 and (2) set-up recurring Qualifying Direct Deposits from a third party to an HSBC Premier checking account at least once per calendar month for 6 consecutive calendar months following account opening month. The 6 calendar months from account opening begins with the first full calendar month after your Premier checking account is opened. You will automatically receive the 3% Cash Bonus in your new HSBC Premier checking account approximately eight weeks after completing that month’s qualifying activities. Qualifying Direct Deposits are electronic deposits of regular periodic payments (such as salary, pension, Government Benefits or other monthly income) made into your HSBC Premier checking account from third parties at least once per calendar month. Customers who held an HSBC consumer deposit or investment account from March 31, 2018 through and including March 31, 2021 are not eligible for this offer.

To qualify for an HSBC Premier relationship, you need to open an HSBC Premier checking account and maintain:

Yup, that’s the online offer. It’s been on for a long time (the online offer is mentioned in this post). As I noted, the referral offer was a better deal for many people because it posted faster (and because you could refer P2 for an extra $100). But we wrote about the $600 online offer after this referral offer ended:

https://frequentmiler.com/600-hsbc-checking-bonus-extended-requires-monthly-direct-deposit/

DP – Bonus-earning and account-closing data points:

– 9/8/2020 – Account (Premier Checking) opened

– 10/19/2020 – $5,000+ transferred in from PNC

– 11/12/2020 – $600 bonus deposited into account

– between the 16th and 22nd of each month through 3/17/2021 – $5,000+ transferred in from PNC

– 4/21/2021 – Requested that account be closed (via phone call).

– 4/22/2021 – Account closed

No bonus here either.

Since I did legit work DD + Schwab push, I called the premier customer service to ask. The 2 agents I spoke with both said, the bonus will pay 2 months after maintaining 3 months the $5K DD requirement. It seems many got their $600 bonus quickly but some must wait up to 8 weeks after the 90-days for the bonus.

1/6/21: Account Opened

1/12/21: Pushed $5300 from Schwab Checking

1/15/21: pushed $5000 from Schwab Checking

1/19/21: work DD

1/29/21: work DD

2/12/21: work DD

2/16/21: Pushed $5000 from Schwab Checking

2/26/21: work DD

3/9/21: $100 share the experience bonus posted, but no $600

3/15/21: pushed $5000 from Schwab checking

3/15/21: work DD

3/31/21: work DD

4/15/21: work DD

4/15/21: pushed $5K from Schwab checking

That’s so strange. That’s the same thing people were told when I first posted this (that they needed to maintain $5K DD for 3 months), yet all but a few people got it after 1 or 2 months (with no clear rhyme or reason as to which it would be). Wish I understood why the last few folks here aren’t getting it! But assuming you’re meeting the requirements with work DD also, I think you should be in a good place to follow up until they give it to you. Frustrating for sure though (doubly so for @Micahel and @Jay above, who know that transfers worked for the people they referred but not for them. So weird.

Today is bonus day :-). Log in if you were waiting on a bonus!

No bonus for me. 6 $5k+ pushed exclusively from Capital One, but nothing. I received my $100 referral bonus last month though. And the person I referred got his $600 last month with transfer from Capital One exclusively.

I’ll repeat this sentiment. I did an account for me and another for my wife. I received the bonus 2 months ago. She has not received hers. The transfers were the exact same.

Are you going to keep trying until 6-month grace period is up?

I got a bonus, but it was only $400! I applied on 1/26 when the bonus was still $600, using the referral code and everything as describe here. I’m super frustrated, but I’m dreading trying to call and get it straightened out. The first call took me two hours, and I’m afraid this would be just as bad. Has anyone else been given the lower bonus amount?

Account opened in December. 4x $5000 push transactions from Ally since. No bonus yet. Planning on contacting HSBC this week.

When you do fake DD don’t expect HSBC to reward you. That’s the gamble WE all take.

Anyone have a bonus post yet this month (April)?

Nope. I didn’t see bonus in mine yet…

P2 still hasn’t gotten her bonus. Opened account 1/28/21 I believe, so I’m hoping it comes in the next couple of days, otherwise I may have to just call it.

I recommend holding off on calling until bonus day for April happens. Typically, everyone gets their bonus on the same day, the day just varies each month. I wouldn’t waste the time and frustration of calling until you know you didn’t get it with this month’s posting. I doubt April bonus day will pass without someone reporting it here (and I’ll certainly comment if I hear anything).

Oh I just meant “call it” like forget about it. I don’t plan on actually calling about it, especially since P2 would have to do it and she hates calling banks.

Yep, I hope to get the bonus when it’s paid for April. My referrals P2 and P3 also haven’t received their bonuses.

Still nothing…

Anyone see April bonuses post yet ?

Still nothing for me…

I haven’t heard of anything, but now I see a single data point at Doctor of Credit from someone who did the online account who got their monthly bonus (the online account is paid out as 3% of your direct deposit up to $100 per month). They said they got it on 4/1/21. I thought that the online and “share the experience” bonuses had been posting on the same day, so that data point would suggest that 4/1 was bonus day this month. I’m surprised that nobody here has reported getting a bonus this month though (and only one person reporting a bonus at DoC on the online account). Weird.

got the $15 bill pay bonus on 4/1 as well

p.s. cash app (and venmo etc. per chat) apparently doesn’t work for the debit card purchase bonus

Hi Nick. So do you think it’s safe to close these accounts after the bonus posts? I didn’t notice any specific minimum time to leave account open.

All I know for sure is what I wrote under “Key Terms” in the post:

Got my $600 & $100 bonuses one month after $5000 ACH from Ally. Worth the hours on the phone with the worst rep. P2 got her’s also but the rep was much better.

Signed up using Samantha’s referral in January. I didn’t try to do *real* DD cuz I didn’t want to bother switching things up for me and P2, so I checked DoC for other methods that count. I figured even if it didn’t end up working, I don’t lose anything for trying. And it worked! I got my $600 bonus this week, and now I’m just waiting for P2 to get hers next month so I can get my extra $100 referral bonus. Thank you for the post and extra reminders to jump on this!

Not to beat this dead horse, but has anyone closed? I’d be interested in hearing how soon someone did this after opening.

Closed via chat today. It has been a little over 100 days since opening.

And no issues to report?