NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

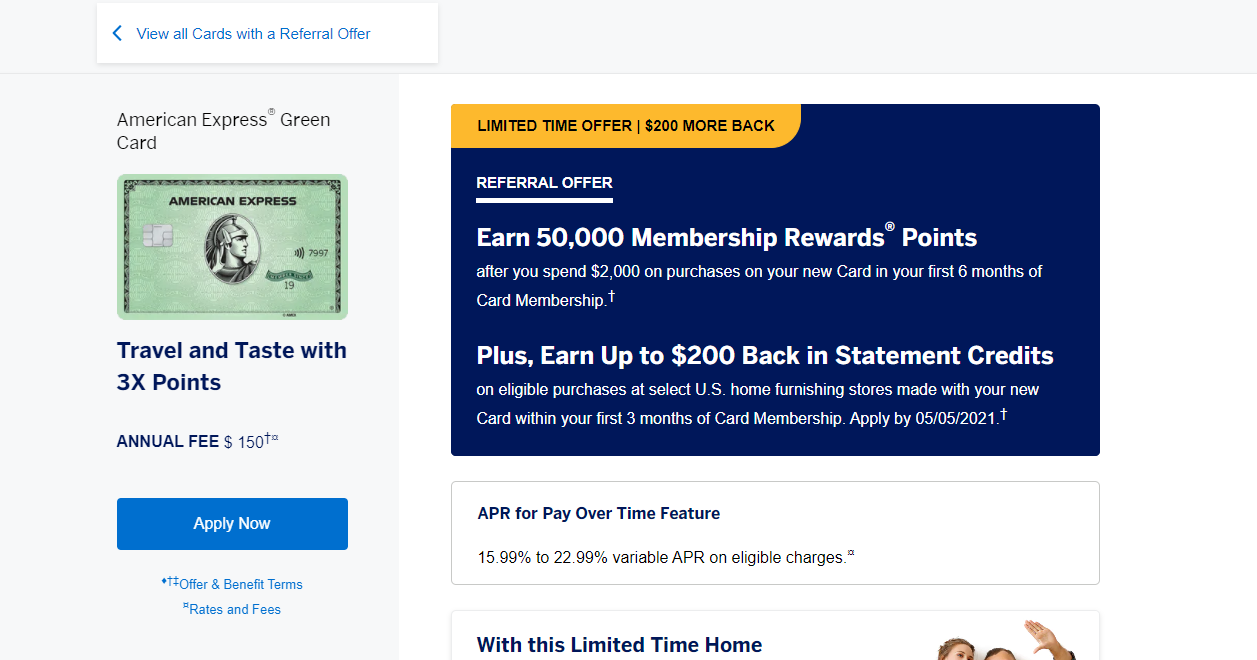

Amex has truly gone off their rockers with amazing new referral offers on most consumer Amex cards — adding $200 in statement credits at select US home furnishings stores (including Lowe’s, The Home Depot, Bed Bath & Beyond, and more) on top of already-excellent welcome offers on most of the consumer card lineup. What’s more, in some cases the person referring a new customer will also get +4x / 4% back on eligible purchases at US home furnishing stores for 3 months on up to $25K in purchases. This is awesome all around.

The Deal

- Amex has added tp the welcome bonus on most consumer cards when applying through a referral link. In many cases, you can get the welcome bonus points/credits plus $200 in statement credits for purchases at select US home furnishings stores (including Lowe’s, The Home Depot, Bed Bath & Beyond, Anthropologie – Home & Furniture, CB2, Crate and Barrel, Crate and Kids, Terrain, and The Container Store). Cards with increased offers include:

For more information and to find a link to apply for the offers shown below, click the card name to go to our dedicated Frequent Miler card page.

| Card Offer and Details |

|---|

ⓘ $988 1st Yr Value Estimate$100 Delta Stays credit valued at $50 Click to learn about first year value estimates Up to 90K miles ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Limited Time Offer: Earn 70,000 Bonus Miles after you spend $3,000 in purchases with your new Card, and an additional 20,000 bonus miles after you make an additional $2,000 in purchases on the Card, both within your first 6 months. Terms apply. Rates & Fees (Offer Expires 4/1/2026)$0 introductory annual fee for the first year, then $150 Alternate Offer: Dummy booking offer of 50K + $500 credit. See this for more details. FM Mini Review: Priority boarding, and free checked bag make this a reasonably good option for Delta flyers who do not have elite status. However, those who can make use of an annual companion certificate would do better with the Delta Platinum card. Earning rate: 2X Delta ✦ 2x eligible restaurants worldwide ✦ 2x US supermarkets Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: $200 Delta flight credit after $10K in purchases in a calendar year Noteworthy perks: 15% off when using miles to book an award flight (Delta metal only) ✦ Get up to $100 back per year as a statement credit for prepaid hotels or vacation rentals booked through Delta Stays on delta.com/stays ✦ Up to 6 months of statement credits for Uber One membership (must enroll by 6/25/26) ✦ Priority boarding and first checked bag free on Delta flights. Terms and limitations apply |

| Card Offer and Details |

|---|

ⓘ $758 1st Yr Value Estimate$150 Delta Stays credit valued at $75 Click to learn about first year value estimates Up to 100K miles ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Limited Time Offer: Earn 80,000 Bonus Miles after you spend $4,000 in purchases with your new Card, and an additional 20,000 bonus miles after you make an additional $2,000 in purchases on the Card, both within your first 6 months.Terms apply. Rates & Fees (Offer Expires 4/1/2026)$350 Annual Fee Alternate Offer: Dummy booking offer of 70K + $400 credit. See this for more details. FM Mini Review: Good choice for frequent Delta flyers who can make use of annual companion certificate Earning rate: 3X Delta ✦ 3X purchases made directly with hotels ✦ 2X eligible restaurants ✦ 2X US Supermarkets Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Earn 1 Medallion Qualifying Dollar (MQD) per $20 spent Noteworthy perks: 15% off when using miles to book an award flight (Delta metal only) ✦ Receive $2,500 Medallion(R) Qualification Dollars each Medallion Qualification Year ✦ US, Caribbean, or Central American economy companion certificate (subject to taxes & fees) each year upon card renewal ✦ Earn up to $150 as a statement credit each year after booking prepaid hotels or vacation rentals with your Card through Delta Stays on delta.com/stays ✦ Up to $10 per month in statement credits for US purchases with select rideshare service providers [enrollment required] ✦ Up to $10 per month in statement credits on eligible purchases with U.S. Resy restaurants [enrollment required] ✦ Priority boarding ✦ First checked bag free on Delta flights ✦ Up to 12 months of statement credits for Uber One membership (must enroll by 6/25/26) ✦Complimentary upgrades: get added to the complimentary upgrade list after Delta elite members and Reserve cardmembers ✦ Cell phone protection ✦ Terms and Limitations Apply. |

| Card Offer and Details |

|---|

ⓘ $712 1st Yr Value Estimate$200 Delta Stays credit valued at $100 Click to learn about first year value estimates Up to 125K miles ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Limited Time Offer: Earn 100,000 Bonus Miles after you spend $6,000 in purchases with your new Card, and an additional 25,000 bonus miles after you make an additional $3,000 in purchases on the Card, both within your first 6 months.. Terms apply. Rates & Fees (Offer Expires 4/1/2026)$650 Annual Fee Recent better offer: 125,000 bonus miles after you spend $6,000 in eligible purchases on your new card in your first 6 months of card membership. (Expired 10/29/25) FM Mini Review: Excellent choice for frequent Delta flyers who can make use of Delta Sky Club® access and companion certificate. Also a good choice for big spenders seeking Delta elite status. Earning rate: 3X Delta Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Earn 1 Medallion Qualifying Dollar (MQD) per $10 spent Noteworthy perks: 15% off when using miles to book an award flight (Delta metal only) ✦ Receive $2,500 Medallion(R) Qualification Dollars each Medallion Qualification Year ✦ Companion Certificate on a Delta First, Delta Comfort, or Delta Main round-trip flight to select destinations each year after renewal of your Card. (subject to taxes & fees) ✦ Delta Sky Club® access when flying an eligible Delta flight: 15 visits per year to be used from February 1 until January 31 of the next calendar year (after 15 visits have been used, additional visits can be purchased for $50 each) or to earn an unlimited number of visits, spend $75K or more on eligible purchases each calendar year. ✦ 4 Delta SkyClub one-time guest passes ✦ Centurion Lounge access when flying Delta same day (flight must be booked with your Reserve card) ✦ Earn up to $200 as a statement credit each year after booking prepaid hotels or vacation rentals with your Card through Delta Stays on delta.com/stays ✦ Up to $20 per month in statement credits on eligible purchases with U.S. Resy restaurants [enrollment required] ✦ Up to $10 per month in statement credits for US purchases with select rideshare service providers [enrollment required] ✦ Complimentary upgrades: get added to the complimentary upgrade list after Delta elite members ✦ One statement credit every 4 years for up to $120 Global Entry application fee or one statement credit every 4.5 years for up to $85 TSA Precheck application fee ✦ Priority boarding ✦ First checked bag free on Delta flights ✦ Up to 12 months of statement credits for Uber One membership (must enroll by 6/25/26) ✦ Hertz President's Circle Status [Enrollment required] ✦ Terms and limitations apply. |

| Card Offer and Details |

|---|

ⓘ $96 1st Yr Value EstimateClick to learn about first year value estimates 10K miles ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 10K miles after $1000 spend in the first 6 months. Terms apply. Rates & FeesNo Annual Fee Note an unusual restriction: Welcome offer not available if you've had another Delta consumer card in the past 90 days. FM Mini Review: This card offers an OK welcome offer for a no annual fee card, but many/most other cards offer better return for spend. Earning rate: 2X eligible restaurants worldwide ✦ 2X Delta ✦ 1X on all other eligible purchases Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Noteworthy perks: 20% statement credit on in-flight purchases of food, beverages, and headsets. Terms and limitations apply. |

| Card Offer and Details |

|---|

ⓘ $424 1st Yr Value EstimateClick to learn about first year value estimates 40K points ⓘFriend-ReferralThis is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer 40K after $3K spend in first 6 months. Terms apply. See Rates & Fees$150 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 60K after $3K spend in first 6 months + 20% off travel and transit purchases for first 6 months. [Expired 8/21/23] FM Mini Review: This card is worth considering as your go-to travel card, but only if you value its CLEAR+ credit. Also note that Amex cards continue to have limited acceptance in many international destinations. Click here for our complete card review Earning rate: ✦ 3X on travel & transit (including flights, hotels, taxis, and rideshares) ✦ 3X dining ✦ 1X points on other purchases. Terms apply. See Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Noteworthy perks: Up to $209 CLEAR+ credit annually Terms Apply. |

| Card Offer and Details |

|---|

ⓘ $140 1st Yr Value EstimateClick to learn about first year value estimates This card is no longer available for new applications Non-Affiliate This card is not currently available for new applicants.No Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: Great choice for keeping Membership Rewards points alive if you choose to cancel other Membership Rewards earning cards. Click here for our complete card review Earning rate: ✦ 2x points at US supermarkets, on up to $6,000 per year in purchases (then 1x) ✦ 1x on other purchases Card Info: Amex Credit Card issued by Amex. This card imposes foreign transaction fees. Noteworthy perks: Make 20 or more purchases in a billing period and get 20% more points, less returns and credits ✦ Low intro APR: 0% for 15 months on purchases and balance transfers, then a variable rate, currently 13.24% to 24.24% ✦ Terms apply. See Rates & Fees |

| Card Offer and Details |

|---|

ⓘ $122 1st Yr Value EstimateClick to learn about first year value estimates This card is no longer available for new applications Non-Affiliate This card is not currently available for new applicants.$95 Annual Fee Alternate Offer: Some people click through and find that they are targeted for an offer of 30K points after $2K spend in the first 3 months. Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 30K after $2K in first 3 months FM Mini Review: Thanks to the 50% bonus on points earned, this is, in my opinion, one of the strongest mile-earning cards available. Click here for our complete card review Earning rate: ✦ 3x points at US supermarkets on up to $6,000 per year in purchases (then 1x) ✦ 2x points at US gas stations ✦ 1x points on other purchases. Card Info: Amex Credit Card issued by Amex. This card imposes foreign transaction fees. Noteworthy perks: Earn 50% more points: Use your Card 30 or more times on purchases in a billing period and get 50% more points on those purchases less returns and credits. Terms apply. See Rates & Fees |

| Card Offer and Details |

|---|

ⓘ $-60 1st Yr Value EstimateClick to learn about first year value estimates Up to $300 back ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer As High As $300 Cash Back. Find Out Your Offer. You may be eligible for up to $300 in cash back after spending $3,000 on your new Card in the first 6 months. Welcome offers vary, and you may not be eligible for an offer. Cash back is received as Reward Dollars, redeemable for statement credit or at Amazon.com checkout. Terms Apply Rates & Fees$0 introductory annual fee for the first year, then $95 FM Mini Review: Solid cash back option (cash back given in the form of a statement credit), especially for those who spend a lot at US Supermarkets and US gas stations Earning rate: ✦ 6% cash back at U.S. supermarkets on up to $6,000 per year in eligible purchases (then 1%), 6% cash back on select U.S. streaming subscriptions ✦ 3% cash back at eligible U.S. gas stations and on transit (including taxis/rideshare, parking, tolls, trains, buses and more) purchases ✦ 1% cash back on other purchases. Cash Back is received in the form of Reward Dollars that can be redeemed as a statement credit and at Amazon.com checkout. ✦ Terms apply. Base: 1% Grocery: 6% Gas: 3% Card Info: Amex Credit Card issued by Amex. This card imposes foreign transaction fees. Noteworthy perks: Receive a monthly statement credit of up to $10 when you use your enrolled Blue Cash Preferred(R) Card on an eligible subscription purchase at disneyplus.com, hulu.com, or plus.espn.com. Valid only at Disney Plus.com, Hulu.com or Plus.espn.com in the U.S. Subject to auto-renewal. Terms Apply. |

| Card Offer and Details |

|---|

ⓘ $158 1st Yr Value EstimateClick to learn about first year value estimates Up to $200 back ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer As High As $200 Cash Back. You may be eligible for as much as $200 cash back after spending $2k in purchases on your new Card in the first 6 months. Welcome offers vary and you may not be eligible for an offer. Cash back is received as Reward Dollars, redeemable for statement credit or at Amazon.com checkout. Terms Apply. Rates & FeesNo Annual Fee Earning rate: ✦ 3% cash back at U.S. supermarkets, 3% cash back on U.S. online retail purchases, 3% cash back at U.S. gas stations, on eligible purchases for each category on up to $6,000 per year in purchases (then 1%). Cash back is received in the form of Reward Dollars that can be redeemed as a statement credit and at Amazon.com checkout. ✦ 1% cash back as a statement credit on other purchases ✦ Terms apply. Base: 1% Grocery: 3% Gas: 3% Card Info: Amex Credit Card issued by Amex. This card imposes foreign transaction fees. Noteworthy perks: Get $7 back each month after using your Blue Cash Everyday card on an eligible subscription purchase at disneyplus.com, hulu.com, or plus.espn.com. Subject to auto-renewal. Terms Apply. |

Quick Thoughts

These offers are absolutely fantastic. In some cases, they represent the best I recall ever seeing. For instance, I can’t think of a more valuable offer previously on the Amex Green card (50K plus $200 is fantastic!) or the Blue Cash Preferred (a total of $500 in statement credits and 6 months to meet the main spending requirement!). Note that while the statement credit notes that it is for purchases at select US home furnishing stores, the list includes places like Lowe’s, The Home Depot, and Bed, Bath & Beyond, which sell many things beyond furniture (and all of which offer the ability to furnish your wallet with a shiny new gift card as you see fit).

This might also represent a great time for folks who have held out on some of the lesser Amex cards because of the typically low welcome bonuses. For example, maybe you’ve had the Everyday Preferred card in the past few years (and as such are not eligible for the new cardmember bonus on that card), but you never bothered with the Everyday card because of the lower bonus. Now might be the time to consider the Everyday card (though obviously if you’re eligible for the Everyday Preferred card, you’d probably want that right now given the great new bonus). The same could be said for the Delta Blue card or either of the Blue Cash cards.

Of course, if you’re eligible for the Delta consumer cards, the consumer Gold and Platinum offers now easily beat out the business versions of those cards (though they come at the expense of a 5/24 slot on the consumer side).

Great deal for those referring new customers

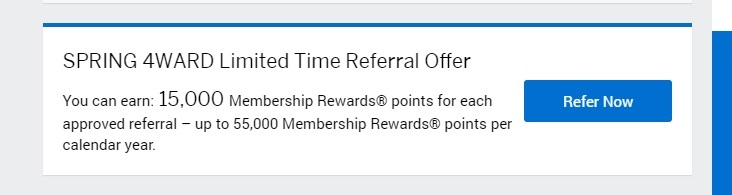

In some cases, these new referral offers are excellent for the person referring a new cardholder as well: some cardholders see the following “Spring 4Ward” promotion advertised with their referral links:

If you see that in your Amex account, you should also see the following limited time referral bonus after clicking “refer now”:

LIMITED TIME REFERRAL OFFER

Refer A Friend to apply by 5/5. Once they’re approved, you can earn +4 Membership Rewards® points per dollar on your eligible purchases at the following select U.S. home furnishing stores, on up to $25,000 in combined purchases for three months: Anthropologie – Home & Furniture, Bed Bath & Beyond, CB2, Crate and Barrel, Crate and Kids, The Home Depot, Lowe’s, Terrain, and The Container Store. Terms apply.

You can earn an extra +4x (or 4% on cash back cards) when you refer a friend and they are approved by 5/5/21. That extra 4x / 4% will be on purchases at select US home furnishing stores on up to $25K in purchases for three months.

Again, given that the extra 4x is valid at stores that sell many things beyond furniture, that should be a great chance to take advantage of bonus earn. I can imagine this could be a points bonanza for someone working on a remodel this year.

Bottom line

Amex is out with new referral offers that include $200 in statement credits for purchases at places like Lowe’s, The Home Depot, Crate & Barrel, and more for the new cardholder applying through a referral link. Sweetening the deal, in some cases the person referring a new cardholder will also get an extra 4x / 4% back at US home furnishings stores for 3 months also (on up to $25K in purchases). Given that in many cases these are the best offers we’ve seen on these cards, it should be a great opportunity to score a great deal either way for many cardholders / applicants. It’s very good to see new card offers continue to heat up. As always, you’ll find the best publicly-available offers (like these) on our Best Offers page.

Following up on below comment. I got the 30K offer for referring someone to AMEX Gold, but if I have them use the generated link and scroll down to other family cards and have them select Delta Gold, how do I know/ensure I am getting 30k for the refer?

This has been possible for a couple of years now — you just give them your link and they can choose another card and you still get the 30K bonus. Just make sure they use your link. Here is a post explaining how it works:

https://frequentmiler.com/cross-brand-amex-referrals-possible/

If you really want to be sure they don’t mess something up, just open your own link and then hit the “view all cards with a referral offer”, navigate to the Delta Gold, and then copy the link in the address bar and send that to them (it’ll be a really long URL). That link will bring them directly to the Delta Gold card.

“and all of which offer the ability to furnish your wallet with a shiny new gift card as you see fit).”

Just, no. AMEX is well known for going after folks gaming SUBs and they don’t like GCs. That’s not worth risking a shutdown, or missing your SUB because they disqualify certain spend.

I guess if you’re shopping at a store that doesn’t send, what is it, Level 4 data?, you might be safe, but doesn’t sound worth it to me.

Marathon, not sprint.

We talk about this on the podcast publishing on Saturday. Sure, it’s possible they could claw that back. On the other hand, I’ve never heard a single claw back data point over an amount as small as $200 on gift cards at Lowe’s / Home Depot / etc. Think of the average consumer: would they have any reason to think that buying a couple of gifts at Lowe’s would be a problem?

As I say on the podcast, if I took a random person off the street and asked if they thought their credit card issuer would be cool with buying $25K in VGCs at the mall, I think the average person would raise an eyebrow and say no way. Ask that same person if they think they could buy $200 in gift cards at Lowe’s with their credit card and they’d still raise the eyebrow, but this time saying “Uh, of course. Am I supposed to carry $200 in cash? Of course I can use my card for that.” I just don’t see Amex squabbling over that low of an amount. Now if you spend all $4,000 of the welcome bonus spending requirement on gift cards over two purchases at GiftCardMall or over two days at 4 Staples stores, sure maybe you’ll have an issue. If you shop like a normal consumer, who wouldn’t bat an eye about buying a gift card while at the hardware store, I think it’s unlikely to be any issue at all.

Obviously don’t do something you’re not comfortable with, and if you have other stuff you need at the included stores by all means buy that stuff, but I think the paranoia about gift card purchases extends far beyond reality.

And that’s really good clarification, Nick, that will help the random newbie who stumbles across your post and sees that sort of comment for the first time.

100% agree with you that a small GC purchase mixed in with other products is likely to not be a problem, but I think it was way too easy for someone new to this to think they could load up on GCs risk free based on your post.

BTW, I have yet to understand why the card companies care about GCs in the first place. They get their swipe fees either way; all that really comes to mind is that it allows more folks to wash money through their accounts with less likelihood of paying interest if they’re buying GCs then converting them to cash to pay the card bill right away – which I’ve read a lot of people did back in the ‘good ol’ days’; sadly before I understood the value of this hobby.

I think a post that dives into that would be instructional, and while there may be one or more out there, I haven’t seen them.

Thanks for the response and clarification.

SPRING4WARD referral on our Gold cards X (2) @ 30,000 points each! I could not believe it. Yes, AmEx off their rockets in a Great Way. Now 2 questions, could one use the Gold referral above for a Delta Business Gold card? To me the best value of the current AmEx Delta offerings. Second question, is there a way or is it stated how long a referral is good (use by xxxx date)?

1) Yes, you can absolutely use your Amex Gold card to refer someone to the Delta Business Gold and you’ll get the 30K + 4x for referring them.

2) These offers say they expire 5/5/21. I can’t say for sure whether the 30K will last until then, but I expect that at least the +$200 and +4x parts will stick around until then.