During the pandemic times, JetBlue joined the other major US airlines in offering free cancellation and redeposit of award tickets. While that is certainly convenient, over the weekend I was reminded of the most inconvenient aspect of the way that JetBlue handles its award cancellations: taxes & fees are not refunded to your original form of payment, but rather added to your TravelBank. Annoyingly, those travel bank funds can not be used to pay the taxes on a new award ticket. While that may not be a big deal on a domestic award, it really annoyed me over the weekend when I rebooked an international award with more than $300 in taxes and fees and the experience will make me think twice about booking an international award with JetBlue again.

JetBlue’s award cancellation policy

Like most major US Carriers, JetBlue offers “free” cancellation on award tickets (and on all other tickets except “Blue Basic” tickets, which incur a $100 fee for travel in North America, Central America, and the Caribbean or $200 on other routes). See our Airline Change Fee Quick Reference Chart for comparison points. JetBlue began offering “free” award cancellation in 2021 (See: JetBlue Removing Change & Cancellation Fees Except For Blue Basic, Guaranteeing Overhead Bin Space).

However, I put the word “free” in quotation marks intentionally: while JetBlue will immediately redeposit your TrueBlue points upon award cancellation, JetBlue does not refund the taxes & fees paid on an award flight to the original form of payment. Instead, taxes & fees go into your Travel Bank funds to be used for a future flight.

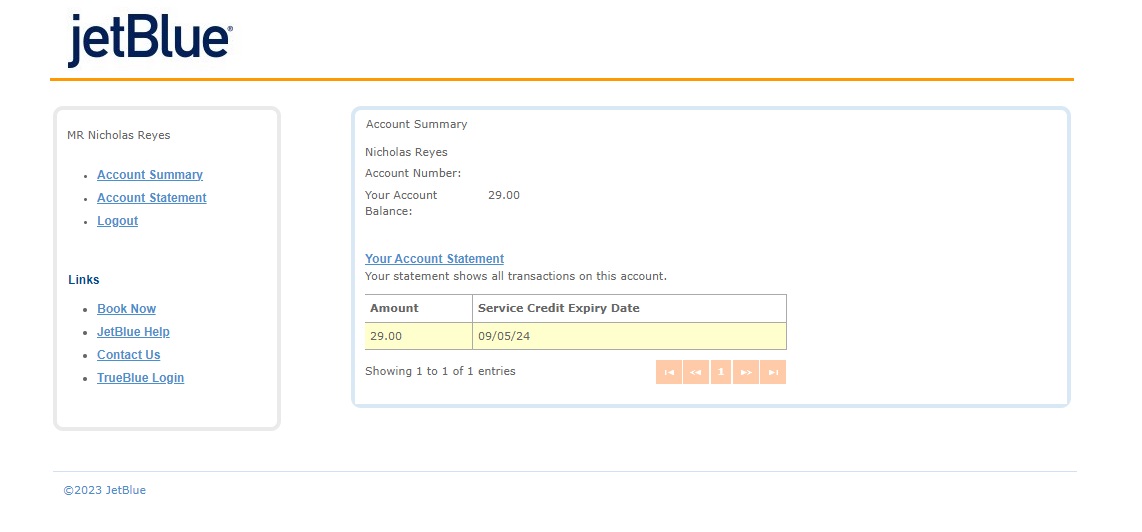

While JetBlue does not take a fee out of your funds, the fact is that they don’t refund the taxes but rather they hold on to the money, forcing you to spend it on a future flight. That feels decidedly less “free”. Furthermore, the funds expire a year from the date of original ticketing — and it isn’t particularly easy to find the expiration of Travel Bank funds.

But what really put me off was the restriction on use.

A cheaper flight might cost you….

Flights are priced dynamically. Anyone who has ever watched a particular route for a few weeks or months (or maybe even a few days) has likely noticed that prices swing up and down. These days, with all of the major US carriers frequently pricing award flights in some type of relation to cash prices, this means that award prices also constantly fluctuate.

I recently booked a trip for travel next year to a Caribbean island. I originally booked the outbound on a different airline, but JetBlue was my best option on the return leg. Unfortunately, tickets were expensive at about 26K TrueBlue points per passenger, but cash rates were also high and we didn’t have a better option. Despite the high price, my dates were set so I booked my family of four for about 104K TrueBlue points one-way.

I was kind of surprised at the high price given the relatively empty seat map when I bought my award ticket, but I figured that maybe a lot of passengers had purchased “Blue Basic” revenue fares, which wouldn’t include free seat selection. Furthermore, I knew that JetBlue offered free cancellation, so I figured it would be no big deal to cancel and rebook if prices dropped.

As is the case with many foreign destinations, there were additional taxes on the leg departing the foreign country to fly to the US. We paid about $90 per passenger in taxes & fees (~$360 for my family of four).

Then, over the weekend, I received a Slickdeals alert about a JetBlue airfare sale on the exact same route. I immediately pulled up the JetBlue app and sure enough, tickets that we had purchased for ~26K per passenger were now just 8,300 TrueBlue points per passenger. Over four passengers, that would make for a savings of almost 70,000 points.

I saw the alert as I was walking in to a Savannah Bananas baseball game and literally stopped in my tracks to try to cancel and rebook (I eventually walked into the stadium because the app and website gave me a headache cancelling and rebooking . . . ).

Rebooking a JetBlue award isn’t as easy as it is with Southwest

What happened next is somewhat a function of my familiarity with Southwest Airlines and frequently mistaken impression that Southwest and JetBlue share more similarities than they really do. I should know better by now . . .

Here’s what I mean: When the price drops on a Southwest award ticket, you can simply log in, click to “change” your ticket, select the same flight you’re already booked on, and pay a negative number of points (i.e. get a refund for the difference in a situation where the price has dropped). The taxes remain applied, you just get points back.

Unfortunately, JetBlue *does not* work the same way.

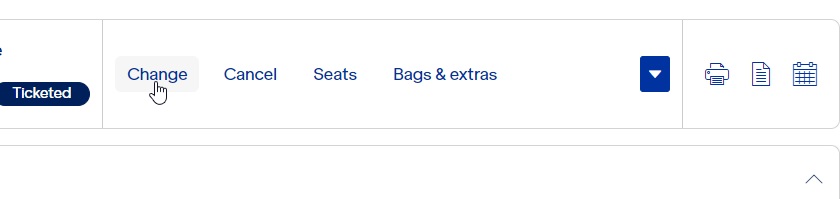

JetBlue has a button within your award reservation to “change” the booking……

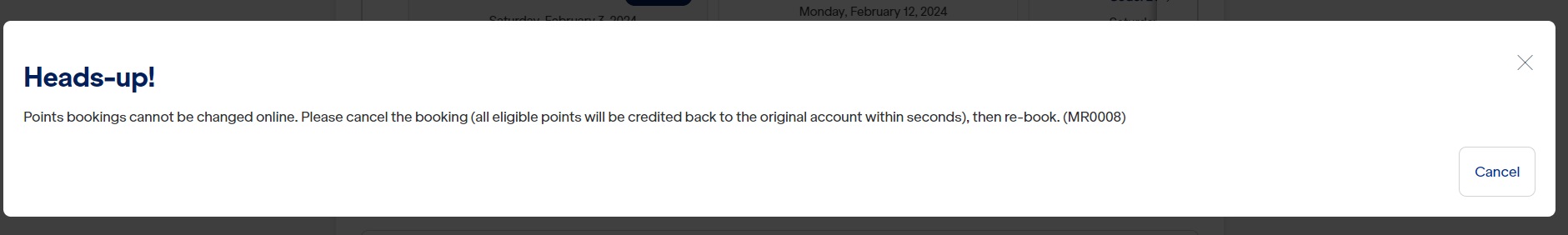

But in reality, JetBlue doesn’t allow you to change an award ticket online. Instead, it prompts you to cancel and rebook, explicitly calling out that the points refund will occur within seconds, so you can immediately re-book.

And once again, unfortunately, cancelling an award ticket with JetBlue *does not* work the same as it does with Southwest.

With Southwest, if you cancel an award ticket, you have the option to refund the taxes to your original form of payment or hold the funds with Southwest for future use.

It generally makes sense to just take those taxes as a refund (unless the taxes were initially covered by an airline incidental fee credit and you don’t want a refund to your original form of payment but rather a credit that you can use later, but that’s a different story).

With JetBlue, the only option for the taxes when cancelling an award ticket is to receive the refund as “Travel Bank funds” (i.e. like a store credit balance with JetBlue). To me, that’s not exactly “free” cancellation since it means essentially giving JetBlue an interest-free loan for those taxes. Worse yet, the Travel Bank funds expire a year from the date of original booking. That may not be a problem if you fly JetBlue a lot, but I rarely ever fly JetBlue, so it is not very likely that I’d be able to use Travel Bank funds within a year.

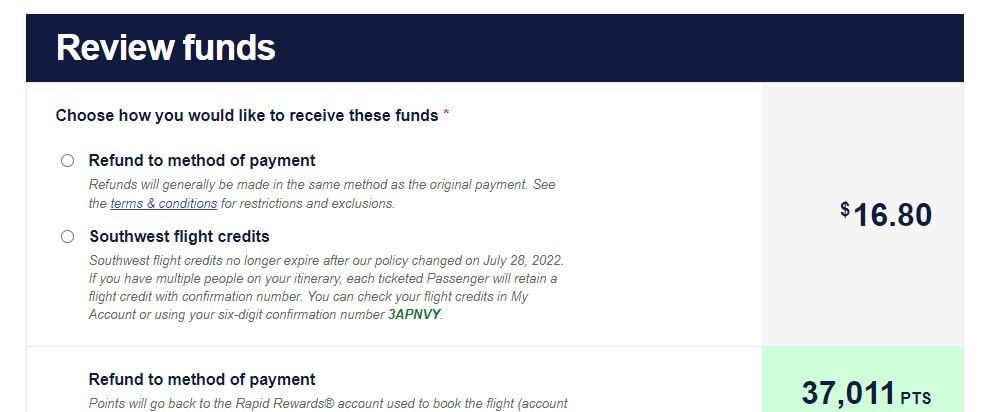

I actually noticed this problem (of the taxes only being refunded as Travel Bank funds) earlier this summer when I canceled an award to Canada. The only option for the ~$22 I’d paid in taxes was for the money to go into my JetBlue Travel Bank. In that case, I rolled my eyes, but I figured that if I essentially lost $5.60 per ticket (by never using the credit), that’s still a very cheap cancellation fee.

But I didn’t feel the same way this weekend, when the ~$360 I had paid in taxes on my award flight was going to be held hostage with JetBlue. I saw during the cancellation process that I had no choice but to accept the money as Travel Bank funds. Initially, I figured that I would just use those funds to re-book the same flight for fewer TrueBlue miles, but my immediate concern had been that I thought this might cause a complication with credit card insurance since the taxes on my rebooked flight would be covered with Travel Bank funds instead of a credit card.

But it was worse than that.

You can not use JetBlue Travel Bank funds to pay for the taxes on an award ticket online [but you can dot his over the phone]

In what felt to me like a bizarre plot twist, I found that one can not use JetBlue Travel Bank funds to pay the taxes on an award ticket. That $360 in Travel Bank funds that had just been created as a “refund” of my award taxes can’t be used to pay the taxes on an award online.

That stinks. While JetBlue touted that I could cancel and rebook, that was really a half-truth: I could rebook, but if I wanted to rebook an award ticket, I would need to pay the ~$360 in taxes again even though I had the same ~$360 in Travel Bank funds from the same-route same-date award I had cancelled moments ago in order to save points since the price had dropped.

Update: As noted at the top, you can use Travel Bank funds to pay the award taxes of the new flight if you call JetBlue to book (note that you must have enough Travel Bank funds to entirely cover the cost of the new ticket — you can not use points, Travel Bank, and a credit card together). I didn’t think to try calling since the website messaging was clear that they couldn’t be combined. In my case, calling wouldn’t have been practical in the moment — I wish that JetBlue would make this possible online!

In the moment, I didn’t feel like I had much of a choice since I had already cancelled our seats and needed to rebook the flight. I rebooked to save about 70,000 points and once again charged ~$360 to my credit card.

At that point, I was down $720 (that’s $360 for the original taxes, which were now a Travel Bank credit, and then $360 again for the new booking) and I had one award for my family and a $360 JetBlue credit that expires in a year.

A few minutes later, I realized that because of the same sale, JetBlue now had a far superior nonstop flight option for the outbound for my trip than the itinerary I had booked on another airline. I thus decided that I would book our “outbound” flights via JetBlue.

As it turned out, the cash cost of those “outbound” tickets was about $170 per passenger. My TravelBank credit could therefore cover two passengers ($340) on the outbound and I would then have the option to make a separate booking for two passengers using miles. However, I didn’t love the idea of making a revenue booking for two of us and a separate award booking for two of us. I preferred to have all four passengers on a single PNR. I also wanted to have credit card travel protections for all four of us….but if I used my Travel Bank funds to completely cover the cost for two passengers in a separate booking, those two passengers would technically not qualify for credit card protections (maybe I could have upgraded their seat or added some other small charge in advance to have charged “part” of their fare to a credit card and qualified for travel protection?). If I wanted all four of us on a single PNR, it would cost a total of $680 — so after my $360 in Travel Bank credit, I would have to go out of pocket for another $320. Furthermore, if I ended up needing to cancel the trip, I knew that I’d be stuck with more Travel Bank credit that would expire.

I didn’t want to compound my mistake by forking over more cash to JetBlue, so I booked the four of us on award tickets on the outbound, using about 40K TrueBlue points and charging the ~$22 in taxes (departing the US) to a credit card.

That still left me with ~$360 in Travel Bank credit thanks to the not-so-free “free” cancellation of my original one-way award itinerary.

Finding the expiration of Travel Bank credit isn’t easy.

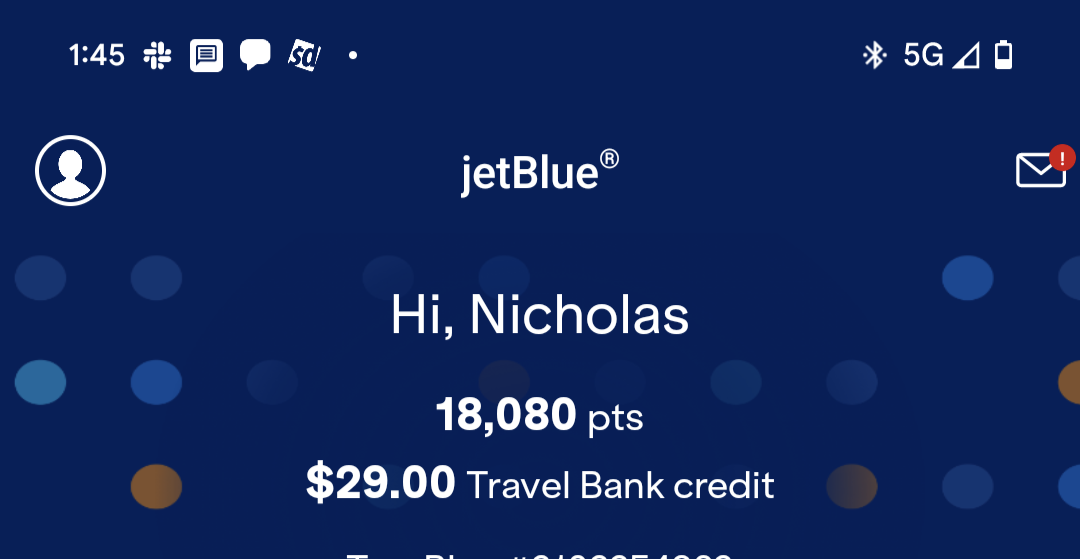

The JetBlue app shows your Travel Bank credit right at the top of the app on the home screen.

Unfortunately, finding the expiration of those funds is not intuitive. I couldn’t find any way to check the expiration date in the app despite clicking around all over the place. I could find how to change my preferred temperature measurement unit from Fahrenheit to Celsius in the JetBlue app, but not the expiration date of my Travel Bank credit.

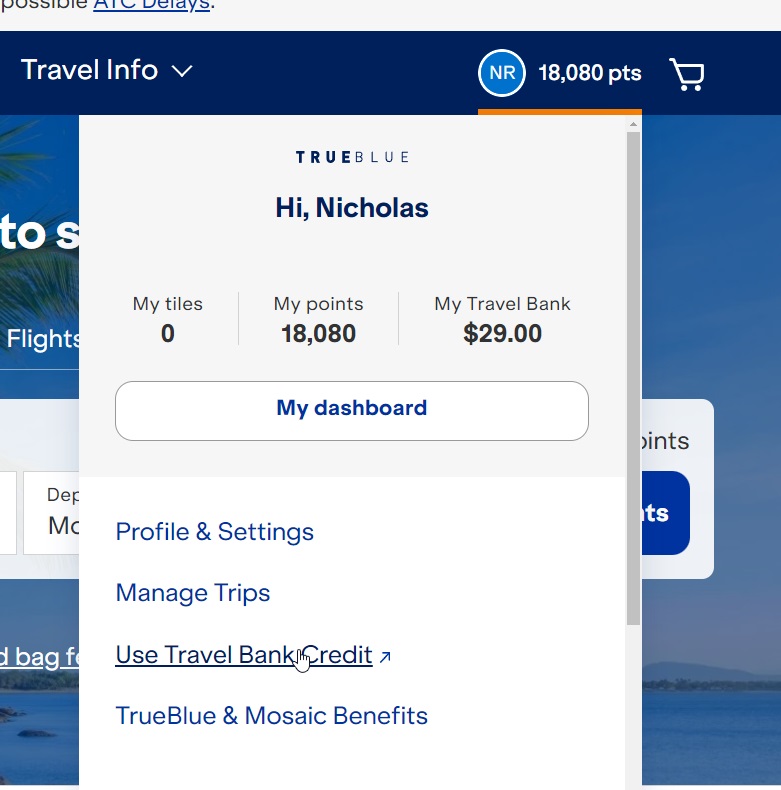

I next went to the desktop JetBlue page and spent a few minutes clicking around in my profile unsuccessfully until I eventually stumbled on the fact that I had to mouse over the drop-down and click “Use Travel Bank Credit” in order to be taken to an outdated-looking page that shows the expiration date of my credit.

If you’re paying close attention, you may have noticed that the above only shows $29 in Travel Bank credit. That’s because the good news is that Travel Bank credit can be used to book travel for anyone. Lucky for me, shortly after this happened, a family member asked if I could help her book a flight — and sure enough, it presented an opportunity to use up my Travel Bank credits.

Ultimately, that stroke of luck meant that I walked away from this learning experience relatively unscathed for now, but it nonetheless left a bad taste in my mouth from JetBlue. And if we ultimately need to cancel our trip (like if one of the kids gets sick unexpectedly), I’ll be stuck with $360 in credit once again that expires a year from the date when I originally booked the first award — meaning that if my trip next year gets cancelled, I’ll only have until next September to use the resulting Travel Bank credit. I don’t fly JetBlue often enough for the prospects there to be good, so it makes booking an award a risky proposition.

Other US airlines mostly refund the taxes & fees to the original method of payment

As a point of contrast, American, Delta, United, and Southwest all offer mostly free award cancellation (Delta does not allow free cancellation on basic economy awards). In the event of award cancellation before your first flight, all four of those airlines will refund the taxes & fees to your original form of payment.

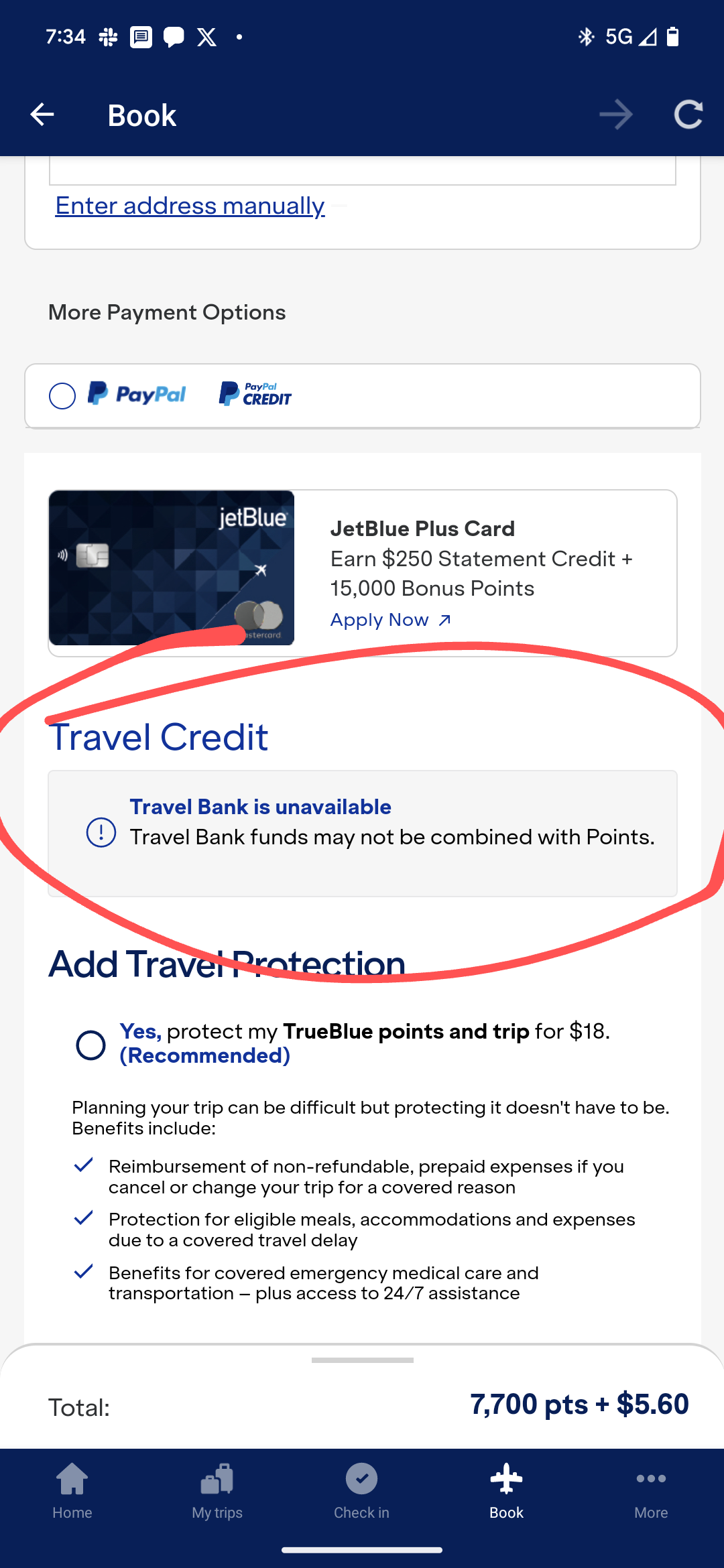

JetBlue’s policy is significantly less customer-friendly. I imagine that most JetBlue awards are domestic US awards or awards departing the US where taxes only amount to $5.60 per passenger, and in that case you may not care much even if the funds get returned to JetBlue Travel Bank and go unused.

However, this restrictive JetBlue cancellation policy means that I will certainly think twice about booking an international award ticket with JetBlue in the future. While it is nice that the credit can be used for any passenger, it is decidedly not so nice that it can’t be used to rebook the same award itinerary online since Travel bank credit can not be used to cover taxes online. I am glad to have learned that you can use the funds to pay the taxes if you call to book over the phone, but that isn’t terribly convenient. “Returning” your money by moving it to a travel credit that expires in a year and can only be used for award taxes if you call to book your ticket over the phone isn’t really a refund of the taxes in my mind.

Bottom line

While the major US airlines have all eliminated award change and cancellation fees in most instances, JetBlue’s form of “free” cancellation differs significantly: JetBlue TrueBlue award tickets can only be cancelled (not changed) and the value of taxes originally paid can only be refunded to Travel Bank credits. What’s more, those Travel Bank credits can not be used to pay the taxes on an award ticket if you’re booking online (nor if they do not cover the new taxes & fees entirely) and they expire one year from the date you originally booked your ticket. That’s significantly less customer-friendly than the award change and cancellation policies of other major US carriers. While JetBlue has always been a bit different, this is one way in which being different isn’t desirable.

Wow. I just found out TAP REDEMPTIONS were now available but the keeping of taxes and fees sounds horrid. Thanks for alerting us to this.

[…] is easy. Unlike regular tickets, there are no fees for canceling award flights, no matter the class5. You can cancel your flight and get your points back. Only the taxes and fees you paid will be […]

IDK. I just canceled and rebooked a Mint booking to JFK. I got my points back and $5.60 as travel credit. I then used the $5.60 for the new booking. No drama. But it was domestic. Does that make a difference?

This will be my last reservation on JetBlue! Booked a roundtrip flight using travel bank credit back in March. I had to cancel the return flight today (Oct). Seems that the travel bank monies I used expired somewhere between when I booked the trip and when I cancelled the return. So, they don’t refund taxes and fees – AND they keep the credit that expired.

Nice gig. -.-

Another twice the unnecessary face post.

Error: [but you can dot his over the phone]

The comical thing is this clearly isn’t a business choice. It doesn’t pencil to poke your customer’s eyeballs with a screwdriver for five bucks. This is just a sad underinvestment in IT. What else are they underinvesting in? Scary.

This is old news. JetBlue took away using travel bank for awards earlier this year or late last year. It definitely sucks. Although it wasn’t as seamless as WN, it was very easy to cancel and rebook. Now the hassle is having to call them to apply the credit, which of course in this environment, could be multi hours. Work around was their chat but it hasn’t been working for me.

Jetblue is run by scam artists and it’s very unethical how they are able to get away with this loophole. I filed a DOT complaint but never heard anything.

Is travel protection really needed for your children? They would stay in a hotel with you and take the same taxi. I find as long as one adult has travel protection you are covered for the big expense for a hotel. My spouse would stay in the same room, same taxi and eat at the same restaurant. Never need to buy clothes as carryon has everything. I don’t over think travel protection if you can save money on companion tickets.

This is a pretty good point. My main reason for caring about it in this case is the potential for the hotel to be very expensive if flights are getting canceled. The one time I had to file a trip delay claim, my hotel alone (in Washington, DC, which isn’t typically a very expensive market) came to almost $500 — with food and Uber to and from the airport, the $500 in coverage didn’t quite cover me for everything (it was a weather situation cancelling everything, so hotel prices surged). There is also the fact that JetBlue doesn’t have a daily flight from the destination where I’d be stuck, so if my flight were canceled, it is possible that I’d be stuck there for multiple days….on an island with zero chain properties (so no award rooms).

There’s also the fact that since my kids are very young, I couldn’t have booked them with the travel credit and my wife and I separately with miles (unless maybe my 5yr old and 3yr old can be booked on a PNR without an adult over the phone?). I’d have therefore needed to have booked my wife and one son with the credit and then me and the other son with points (or vice versa). Then I’d have to make sure to remember which of us has credit card protection and make sure that our checked baggage got tagged in the names of the two of us with credit card protections. You are right that it’s all doable, but it adds complication.

Of course, if I had been able to use the Travel Bank credit for the taxes on the new flight, I technically wouldn’t have had any travel protection at all since my ticket wasn’t purchased with a credit card but rather with a travel credit….though in practice, since I was rebooking the same seats on the same flight for the same amount in taxes, I don’t know that a claims administrator would know the difference. Nonetheless, I was expecting no travel coverage – so you could certainly make the argument that if I were willing to accept zero travel coverage, I should have done what you said and booked two separate reservations to use that up.

Jet Blue trip interruption/ cancellation is GARBAGE. Our connecting flight was cancelled due to weather (FAA ground stop) and they would not pay for a rental car and hotel. Insurance denied our claim stating it’s not covered and now we are stuck with travel funds and hundreds of dollars spent to get home. I wonder if you get the free luggage if you use points with travel funds? The travel funds were from a flight that was purchased with a jet blue card.

When I first noticed this, it was really not a good impression of B6 trying to use these delusional tricks. Luckily it was a domestic ticket and I still have $5.60 sitting in my Travel Bank.

Thanks for the PSA, could you update the linked “Airline Change Fee Quick Reference Chart“ article with this information (I have that one bookmarked)

Thanks for the post – I literally just ran into this last night as I cancelled a JetBlue domestic flight (3 tickets total $16.80 taxes and fees) as I replaced it with an American Airlines one, and used the points to book a JetBlue flight to Mexico for a different trip ($138 taxes and fees) and figured I’d probably just have to eat the $16.80 travel bank credit (as I’m unlikely to book JetBlue again before their expiration) but was concerned if I have to cancel the Mexico one (I am hoping that the airline incidental credit picks this one up though) – glad to know now at least there is a way to use the credit for taxes and fees by phone in case I have to cancel (or choose to change if a better deal arises!)

I base in New York and I was originally planning to get JetBlue status due to the pet fee waiver perk. I recently found out the “free” cancellation travel bank issue too for my booked cash flight. Also there is no lounge available in JFK terminal 5 where all JetBlue flights depart and the terminals are not connected past security. I would need to choose another airline for loyalty now and still haven’t decided yet.

I am just wondering how it is even legal to collect taxes, not give an avenue to refund with cancellation, and then confiscate them after a year? I mean, the taxes go to the government and are based on sales, I imagine? So if the sale is cancelled, they aren’t on the hook to pay for them…This isn’t how it works with any other thing one can purchase and return/cancel, so I just don’t get it. Someone please enlighten me.

I had that same thought, but then I realized that the airlines must have a rule carved out for this because if you book a cash ticket, some portion of that is actually taxes and most cash tickets are nonrefundable (you don’t get the taxes back if you cancel a revenue fare).

True. Ugh. It just seems so unethical. I used to be very loyal to Jetblue since I’m based in NYC/Boston. Now, not so much, and this isn’t the only reason. I also can’t stand their online booking site, it’s constantly glitching out and such a pain to work with.

I also ran into this trap and sent my concern up through Robin’s office (the CEO). It seemed crazy to me (and I thought potentially illegal) you could not use the travel bank credit for the same use it was issued for (in my case, taxes on an award ticket).

They couldn’t help me on the phone either, so they may have taken away that option as well.