NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

This post is a reminder that the coming days are your last chance ever to sign up for a couple of the cards from the Marriott portfolio, while the limited-time welcome offer for a Southwest Companion Pass with a single credit card is set to end on Monday. Read on for a summary of key dates and info.

Last chance ever on two Marriott cards

Both the Chase Marriott Rewards Premier Business card and Starwood Preferred Guest Credit Card from American Express are set to stop taking new applications after February 12, 2019. As of last night (2/8/19), Chase had already pulled the Marriott business card and its landing page from the main Chase site. Doctor of Credit published a working link last night that we have also included on our Chase Marriott Rewards Premier Business card page. Furthermore, reports still indicate that this card is not subject to the Chase 5/24 rule, which means that might be possible to be approved even if you have opened 5 or more new credit cards in the past 24 months.

Here is the current offer information for both of these cards:

| Card Offer and Details |

|---|

ⓘ $-99 1st Yr Value EstimateClick to learn about first year value estimates None Non-Affiliate This card is no longer available$99 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Earning rate: 6X Marriott ✦ 4X dining, internet, cable and phone service ✦ 4X gas stations and shipping ✦ 2X everywhere else. Card Info: Visa Signature Business issued by Chase. This card has no foreign currency conversion fees. Noteworthy perks: 35K free night award each year upon renewal ✦ Gold status ✦ 15 elite night credits each calendar year ✦ Free in-room premium internet ✦ 7% discount off the standard rate for a standard room at participating hotels when you book direct (Terms and Conditions apply) See also: Marriott Bonvoy Complete Guide |

| Card Offer and Details |

|---|

ⓘ $-47 1st Yr Value EstimateClick to learn about first year value estimates This card is no longer available for new applications Non-Affiliate $0 introductory annual fee for the first year, then $95 Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Earning rate: 6X Marriott ✦ 2X on all other eligible purchases Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Marriott Gold Elite with $30K annual eligible spend (note this threshold will increase to $35K on January 1, 2019) Noteworthy perks: 1 Free Night Award every year after your Card account anniversary up to 35K points (subject to resort fees) ✦ Receive free premium internet at Marriott properties. See also: Marriott Bonvoy Complete Guide |

Greg has previously compared the various cards under the soon-to-be-launched Marriott Bonvoy program. See these posts for full details on the full range of Marriott cards, including new names, earning structure details, etc:

A brief summary: The Chase Marriott business card (soon to be called the Bonvoy Premier Business), which will no longer be available for new applicants after 2/12/19, is set to have a lower annual fee than the Amex business card offering in the long run (though see the “Which Marriott Bonvoy card is best” post linked above for more detail on how the annual fee increase on the Amex card is being phased in). The current Starwood Preferred Guest Credit Card (consumer version) will be the coolest-looking of the new Bonvoy cards and this represents the last chance for those who have never had this card to earn a welcome bonus on it since it will no longer be available for new applicants after 2/12/19.

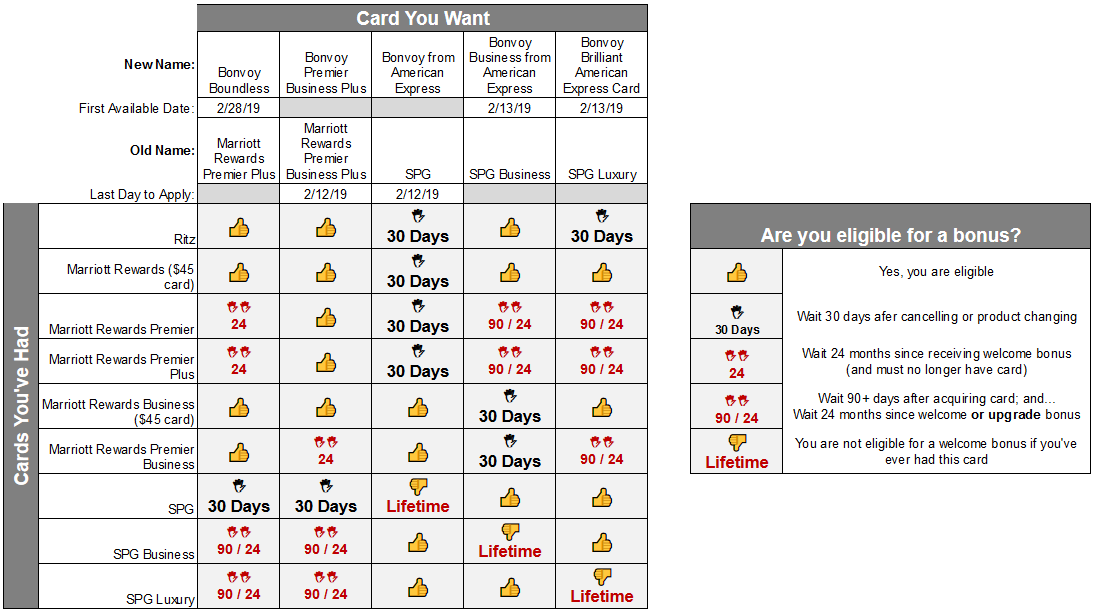

As noted within those posts, you’ll also want to make sure you are eligible for a welcome bonus before applying for a new Marriott/SPG card as the rules have become pretty complicated. See the chart below for a quick-reference guide, but you’ll also want to read Navigating Marriott’s Byzantine Credit Card Rules for more.

Whether you are eligible for a new bonus or just value an extra annual free night more than the annual fee, this is a last chance to grab either of these two cards. We’ll continue to monitor our links to make sure they are still working in the coming days, but keep in mind that we don’t know exactly when the links will be shut down.

Chase Southwest Companion Pass offer ends 2/11/19

All three of the Chase Southwest credit cards are currently offering a welcome bonus of 30,000 Southwest Rapid Rewards points and a Southwest Companion Pass valid through 12/31/19 after making $3,000 in purchases in the first 3 months.

| Card Offer and Details |

|---|

ⓘ $107 1st Yr Value EstimateClick to learn about first year value estimates Companion Pass + 20K points ⓘFriend-ReferralThis is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer Companion Pass valid through 2/28/27 + 20K points after $3K spend in the first 3 months$99 Annual Fee Alternate Offer: 50K points after $1K spend in the first 3 months After clicking through, be sure to manually select the exact Southwest card in which you are interested. This card is subject to Chase's 5/24 rule (click here for details). Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 85K points after $3K spend in the first 3 months (Expired 12/16/25) FM Mini Review: This card can be great for its new cardmember bonus, but its ongoing perks are worth the annual fee only if fully used each year. Earning rate: 2X gas station and grocery (up to $5K in purchases combined per anniversary year) ✦ 2X Southwest Card Info: Visa Signature or Platinum issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: If you earn 135,000 points in one calendar year, you'll get a companion pass good for the rest of that calendar year and all of the next year. Noteworthy perks: 3000 bonus points each year upon card renewal ✦ 10,000 Companion Pass qualifying points each year ✦ First bag free for cardholder and up to 8 companions ✦ Receive a 10% promo code each year on cardmember anniversary (Excludes Basic fare) ✦ Complimentary Instacart+ for 3 months (must activate by 12/31/27) ✦ $10 monthly Instacart credit ✦ Group 5 boarding ✦ Standard seat selection up to 48 hours pre-departure (if available) |

| Card Offer and Details |

|---|

ⓘ $169 1st Yr Value EstimateClick to learn about first year value estimates Companion Pass + 30K points ⓘFriend-ReferralThis is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer Companion Pass valid through 2/28/27 + 30K points after $4K spend in the first 3 months$149 Annual Fee Alternate Offer: 50K points after $1K spend in the first 3 months This card is known to be subject to Chase's 5/24 rule. Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 85K points after $3K spend in the first 3 months (Expired 12/16/25) Earning rate: 3X Southwest ✦ 2X restaurants and grocery (up to $8K in purchases combined per year) ✦ 1X on all other purchases. Card Info: Visa Signature or Platinum issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: If you earn 135,000 points in one calendar year, you'll get a companion pass good for the rest of that calendar year and all of the next year ✦ Earn 1,500 TQPs for each $5K in purchases Noteworthy perks: 6000 bonus points each year upon card renewal ✦ 10,000 Companion Pass qualifying points each year ✦ First bag free for cardholder and up to 8 companions ✦ Receive a 15% promo code each year on cardmember anniversary (Excludes Basic fare) ✦ Complimentary Instacart+ for 3 months (must activate by 12/31/27) ✦ $10 monthly Instacart credit ✦ Group 5 boarding ✦ Standard or Preferred seat selection up to 48 hours pre-departure (if available) |

| Card Offer and Details |

|---|

ⓘ $201 1st Yr Value EstimateClick to learn about first year value estimates Companion Pass + 40K points ⓘFriend-ReferralThis is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer Companion Pass valid through 2/28/27 + 40K points after $5K spend in the first 3 months$229 Annual Fee Alternate Offer: 50K points after $1K spend in the first 3 months This card is known to be subject to Chase's 5/24 rule. Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 85K points after $3K spend in the first 3 months (Expired 12/16/25) FM Mini Review: Great for frequent Southwest flyers - this card could easily be a long-term keeper. Earning rate: 4X Southwest ✦ 2X gas & dining ✦ 1X on all other purchases. Card Info: Visa Signature or Platinum issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: If you earn 135,000 points in one calendar year, you'll get a companion pass good for the rest of that calendar year and all of the next year ✦ Earn 2,500 TQPs for each $5K in purchases Noteworthy perks: 7500 bonus points each year upon card renewal ✦ 10,000 Companion Pass qualifying points each year ✦ First bag free for cardholder and up to 8 companions ✦ Complimentary Instacart+ for 3 months (must activate by 12/31/27) ✦ $10 monthly Instacart credit) ✦ Group 5 boarding ✦ Preferred seat selection at booking (if available) ✦ Extra legroom upgrades up to 48 hours pre-departure (if available) |

TPG has previously reported that Monday, February 11, 2019 will be the last day to apply for this offer. While the traditional 2-card approach (which requires a Southwest Business credit card and a Southwest personal credit card) yields a Companion Pass that can be valid for nearly 2 years, the current offer has the advantages of requiring only 1 card and less spend. This offer isn’t right for everyone and this has been the subject of disagreement (See: FM vs DoC: Southwest Companion Pass with 1 Card. A great deal or quite weak?), but I maintain that this offer makes sense for some. If you’re on the fence, you’ll need to choose a side quickly.

Bottom line

If you have any of these cards on your mind, time is running out. You’ll want to make a move or decide to stay put within the next day or two.

[…] and how applying now will affect your future welcome bonus eligibility. See this post for more: Last Chance Cards: Marriott/SPG cards being pulled, Southwest offer ending. Here is the offer information on the two cards being pulled for new applicants (click the card […]

I currently have the personal and business Amex SPG cards (not Luxury) and am under 5/24. I have never had a Marriott card. Anyone suggest a move here before the change?

i did the application because the only real downside i saw was that a bigger bonus would come out after the switch. there’s always secure messaging to ask for a match in that case – no guarantee though. i can wait on the spg lux card, have done the spg pers and spg biz.

Which card did you apply for?

marriott business – wont affect 5/24.

Curious about the eligibity if it is based on SSN or Marriott/SPG acct number (i.e. have SPG biz 6/2018 and want Chase Marriott and bonus -its pop up bases on SSN) Would a new Marriott acct # bypass bonus? Any DP?

@Nick Reyes

“this card is not subject to the Chase 5/24 rule, which means that might be possible to be approved even if you have opened more than 5 new credit cards in the past 24 months.” -Nick

I know you know but it’s more than 4 (5 or more), not more than 5.

Great point. Fixed, thanks.

Beware, the 30 day language is still there in the offer terms when applying for the SPG guest, but the pop up doesn’t say 30 days. CSRs not helpful either.