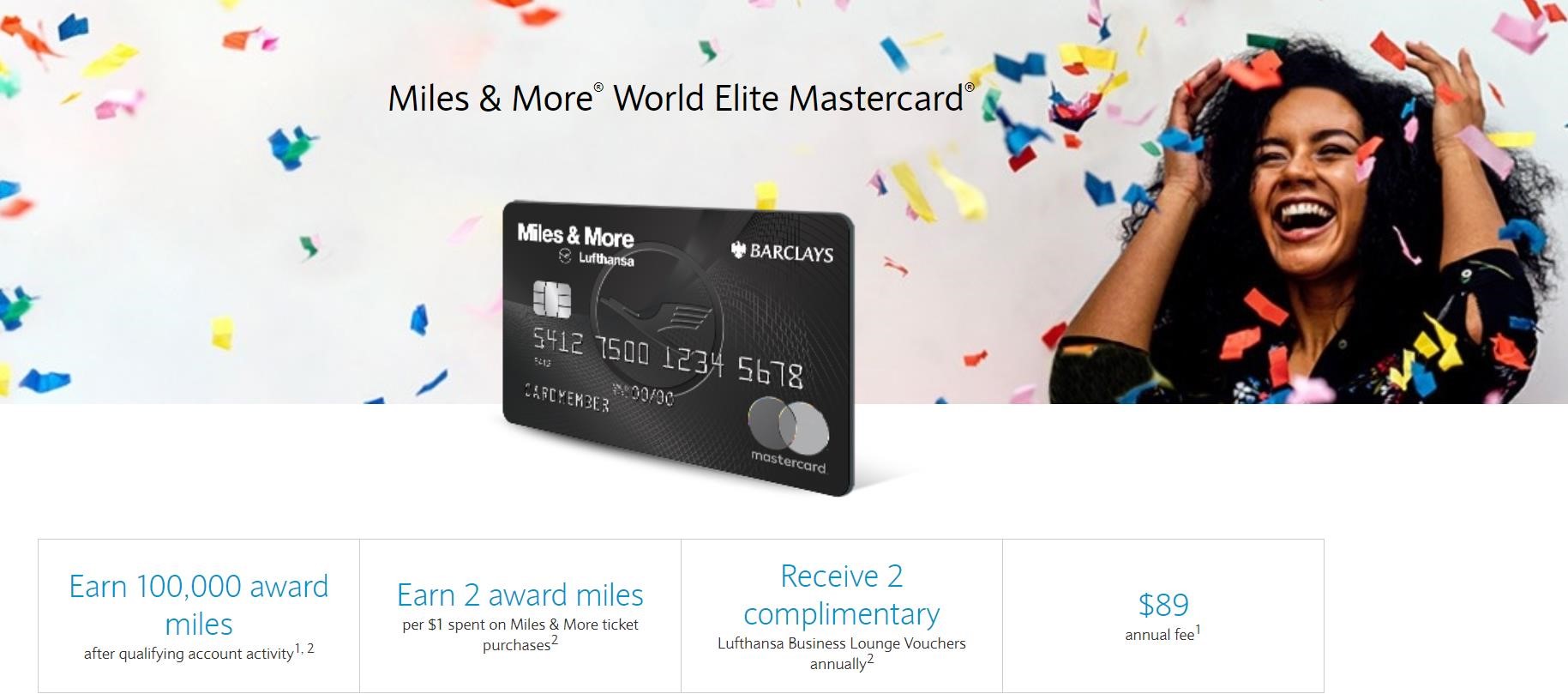

Barclays has increased the welcome offer on the Lufthansa Miles & More credit card to match the highest that we’ve ever seen. Now, get up to 100,000 bonus miles after spending $3,000 within the first year. This puts this somewhat obscure card in the top-5 of consumer cards on our Best Offers page.

The Offer & Key Card Details

To learn more about this card and find an application link, click the card name below to go to our dedicated page for the Lufthansa Miles & More card.

| Card Offer and Details |

|---|

ⓘ $637 1st Yr Value EstimateClick to learn about first year value estimates 60K Miles Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler 60K Miles after $3K spend in the first 90 days + payment of the annual fee$89 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: Expired 1/1/23: 100K Miles after $3K spend in the first 90 days Earning rate: 2X Miles & More Card Info: Mastercard World issued by Barclays. This card has no foreign currency conversion fees. Noteworthy perks: Cardmembers receive a companion ticket and two complimentary Lufthansa Business Lounge vouchers after first purchase and each year after paying the annual fee |

Quick Thoughts

Miles & More is a pretty niche program since it doesn’t partner with any of the major transferable currencies. That makes this credit card, or actually crediting flights to Lufthansa, your main method of topping off your miles. It goes without saying that this would be slow going at 1x unless you are a heavy spender (and if you are, you probably shouldn’t be using this card). Lufthansa does have some decent sweet spots, but for most folks there won’t be many ways to easily replenish the coffers after going through the miles from the initial welcome offer.

That said, for those who CAN use Lufthansa miles, this is a very good offer, especially given the modest $3k in minimum required spend. Miles & More is perpetually thought to be about ready to devalue, so if you do take the plunge, get rid of those miles sooner than later.

Best uses of Lufthansa Miles

- Book Lufthansa First Class up to a year in advance. Lufthansa has an excellent first class product (it's one of Greg's favorites). Partners only have access to first class awards within 15 days of departure, at most. Miles & More members can book it as soon as the schedule opens.

- Business class to Australia/New Zealand/South Pacific from 71K on a Star Alliance partner award. Lufthansa groups Australia, New Zealand and the South Pacific islands into its Australia, New Zealand region. You can book a one-way Star Alliance business class award from the U.S. to Australia, New Zealand, Fiji, etc for as little as 71,000 miles. Economy class starts at 40,000 miles. Taxes and fees one-way should be between $50-$75.

- Business class to Southeast Asia from 71k on a Star Alliance partner award. Lufthansa also offers good value on its award to Southeast Asia, which includes Malaysia, Indonesia, Thailand, Vietnam, etc. One-way business class awards start at 71,000 miles and economy awards start at 40,000. One-way taxes and fees should be between $25-50.

- First/Business class within North America for 20K. There can be good value in using Miles & More to book Star Alliance business awards within North America on either United or Air Canada, with first/business class starting at 20,000 miles on a one-way award. This includes some of both airlines' more exotic (and expensive) flights to the far north. Taxes and fees one-way should be around $50, with Air Canada being slightly more expensive than United.

- 25% award discount for children under the age of 11

Barclays Application Tips

Consumer: Click here to check your application status |

I’d like to propose that you update the wording in the above “stock” paragraph description. M&M did substantially devalue their program effective 1/1/2024 — so much so that I am sadly reconsidering my loyalty and a Lufthansa Senator member.

Looks like there is lifetime language?

=

This offer is valid for approved applicants. Any bonus associated with this offer may only be earned once. You may not be eligible for this offer if you currently have or previously had an account with us in this program. In addition, you may not be eligible for this offer if, at any time during our relationship with you, we have cause, as determined by us in our sole discretion, to suspect that the account is being obtained or will be used for abusive or gaming activity (such as, but not limited to, obtaining or using the account to maximize rewards earned in a manner that is not consistent with typical consumer activity and/or multiple credit card account applications/openings). Please see the About This Offer section of the Terms and Conditions for important information.

Yes, that’s actually been there for some time and is only selectively enforced. Thanks for the reminder though, I need to add a note about that into the application rules guide.

[…] I never had a Lufthansa credit card and likely never will. But if you are into flying the airline in business or first class to areas like Australia and Southeast Asia starting from 71k miles and within North America for 20k miles, it may be for you. It is with Barclays Bank, which is a weird bank, you have been warned. Lufthansa Miles & More Credit Card: 100k welcome offer (matches previous high). […]

I would caution people about applying for this card, especially if it would be your first with Barclays. The application process was such a headache and required me to fax in a copy of SSN and drivers license, which apparently still wasn’t enough. I ultimately gave up as it wasn’t worth the hassle.

Does anyone know if I would need to cancel my current downgraded no-annual-fee version of the card before Barclays would approve me for this card?

What’s the expiration policy with these miles?

36 months

If you email Chase when a better offer comes along not long after you took a poorer one, they’ll retroactively credit you. Any chance with Barclay’s?

I messaged them and received an incoherent ‘no’.

I’ve been a die-hard Lufthansa Group flyer (including flights on Swiss and Austrian… also Brussels and Eurowings and more) for 15 years and finally earned my first and highly prestigious Status Star. The airline even sent me a new Senator card with it!

I would definitely not describe Miles & More as a “niche” program when it is the joint program of the largest number of flights across the Atlantic and within/to/from Europe.

It is worth pointing out that LH in particular has an awkward relationship with Turkish dating back to around a decade ago when Turkish tried to poach LH’s best customers in an aggressive marketing campaign. Read all the fine print if you are at all inclined to credit Turkish flights to M & M.

In my view, the Miles & More devaluation took place at the start of 2024 when major changes to the program finally took place after being deferred 2 years by the pandemic — not the least of which was to insulting “simplify” the length of the Frequent Traveler/Senator tier from two years to one year (you know, to align it with all the other programs). I was livid about this.

The best use of LH miles for me is to upgrade trans-Atlantic to PE for 25,000 or to Business for 50.000 (no K. L, or T fares though!!!) And I do that from Europe to the USA so I can enjoy the food and the service.

I flew business class from ATH-MUC-EWR earlier this month for 56,000 miles about about $350. There is also an option to do this for 78,000 miles and a small amount of cash (but it isn’t worth it).

Senator and HON Circle members do not pay an annual fee to use this credit card…and when I lose my Senator statis on March 1st and Barclays bills me for the annual fee, I will drop the card like a hot potato.

I would think 1 way in F on Lufthansa from Germany would be top use since many of us can’t book in a 2-week out travel window. Being able to book a year in advance is worth a lot to me.

Exactly. And the fact that HON & Senator members get 50% off companion awards. Bloggers love to boast about booking LH First last minute using LifeMiles/Aeroplan but that is not practical for 99% of people.

P2 has one of these and it was very useful on a trip to Europe last month. AMS-ATH tickets at relatively short notice and with date/time constraints were pricing out at nearly $500 each plus bag fees, and M&M had AMS-VIE-ATH for 28K miles in Business (nothing great; row 1 with the middle seat blocked off) but it also included 2 free bags.

Question: Is there a way P2 can close reapply without losing existing LH points?

If someone has miles in a certain program, closing a credit card affiliated with that program won’t cause those points to expire. The only time points expire when closing a card is when the points are proprietary like Amex Membership Rewards, Chase Ultimate Rewards, Citi Thank You points, etc.

I didn’t phrase my question correctly. If you don’t have a card, then the 36-month Lufthansa mileage expiration clock starts. But there are two exceptions: high status, and hold the Barclays LH card. So if the card is canceled and you re-apply after 6 months – does it freeze the clock, or re-set the clock?