NOTICE: This post references card features that have changed, expired, or are not currently available

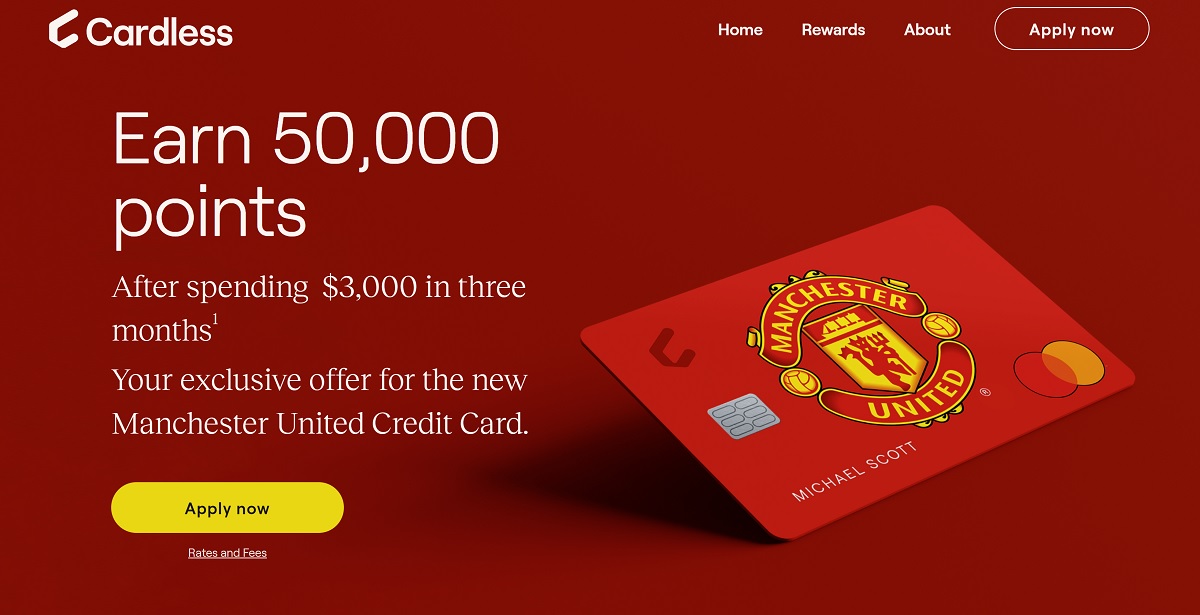

View from the Wing seems to have a unique link to a signup bonus for this credit card oddity. A Manchester United credit card for U.S. residents? Okaaaay… This credit card is produced by a startup named Cardless. I *think* this is a virtual card rather than a physical card, but I couldn’t find confirmation online. It looks like a physical card in the picture, but I doubt that a company named Cardless offers physical cards. On the other hand, I would have doubted the introduction of a Manchester United card in the U.S. as well, so don’t go by my doubts. Update: The Cardless card is a physical card after all. The welcome email after approval says: “Your physical card will arrive by mail in 3–5 business days.”

Note that this (maybe cardless?) card currently requires having an iPhone or iPad or some other device running iOS:

Hard pull, but no 5/24 Impact

View From the Wing asserts that this card will not add to your Chase 5/24 count if you sign up soon because “When an issuer is brand new, their first accounts don’t get reported to credit bureaus. That will certainly change soon, but it’s accurate as of the date I’m writing this.”

I applied for this card today and there was a hard pull against my Experian credit report.

Fees

- No annual fee

- No foreign transactions fees

Earning Rate

- 5x points at bars/restaurants on match days

- 5x points on rideshare and streaming services

- 1x points on everything else

Points worth 1 cent each if you apply by May 26

The Cardless website says that you must apply by May 26 for higher lifetime redemption rates. Apply now and your points will be worth a penny each as statement credits. Supposedly, if you apply later, your points will only be worth a half cent each. I wrote “supposedly” because my guess is that they’ll keep stringing out that date to later and later. Otherwise, why would anyone get a card that earns half a cent on most spend?

Application Link

Here’s View from the Wing’s link: vftw-links.com/manu

My Take

If you have an iPhone and you can spend $3,000 easily, this sounds like an easy $500 win. The issued card is a Mastercard, so it should be possible to use it with Plastiq to pay just about any bills, including rent or mortgage payments. If you pay $3,000 that way, Plastiq’s 2.85% fee will cost you only $85.50. You’ll still end up with over $400 in profit.

[…] FM说虽然此卡申请时有hard pull,但此卡批准后新卡不会上报给信用局,所以不会被计入Chase 5/24卡数。不过我个人的看法是,现在不上报可能仅仅是因为这个信用卡的发卡机构太新了,以后总有一天会上报的,所以最好不要抱有太大的期望。 […]

[…] FM说虽然此卡申请时有hard pull,但此卡批准后新卡不会上报给信用局,所以不会被计入Chase 5/24卡数。不过我个人的看法是,现在不上报可能仅仅是因为这个信用卡的发卡机构太新了,以后总有一天会上报的,所以最好不要抱有太大的期望。 […]

[…] FM说虽然此卡申请时有hard pull,但此卡批准后新卡不会上报给信用局,所以不会被计入Chase 5/24卡数。不过我个人的看法是,现在不上报可能仅仅是因为这个信用卡的发卡机构太新了,以后总有一天会上报的,所以最好不要抱有太大的期望。 […]

Cardless is super slow with payment processing and it may take a few days for a payment to post, anyway to work around it? Thanks

That was fast! I already earned the 50K bonus. I also got a $90 Manchester United gift card. What am I going to do with that?

How did you get that? I earned the 50k bonus but haven’t received the gift card yet for spending $1k.

It just came as an email with the subject heading: “You’ve earned your Cardless sign-up bonus!”

I had no idea that was part of the deal.

Got my card today. Be sure to mail in your Arbitration Opt Out request within 30 days of opening your account. Extract of T&C’s and instructions here:

b. Opting Out. If you do not want the requirement to arbitrate a Claim to apply to you, you may opt out of such mandatory arbitration by sending us written notice of your decision within thirty (30) days of the opening of your Account. Such notice must clearly state that you wish to cancel or opt out of the mandatory arbitration requirement of this Agreement. It should include your name, address, Account number, and your signature and must be mailed to: 350 Townsend St #610, San Francisco, CA, 94107. If you opt out of arbitration, this Arbitration provision will not apply to you, excluding the provision captioned “No Class Action or Jury Trial,” which will continue to apply to you to the greatest extent permitted by law.

[…] Frequent Miler – Cardless Cards? […]

[…] FM说虽然此卡申请时有hard pull,但此卡批准后新卡不会上报给信用局,所以不会被计入Chase 5/24卡数。不过我个人的看法是,现在不上报可能仅仅是因为这个信用卡的发卡机构太新了,以后总有一天会上报的,所以最好不要抱有太大的期望。 […]

[…] FM说虽然此卡申请时有hard pull,但此卡批准后新卡不会上报给信用局,所以不会被计入Chase 5/24卡数。不过我个人的看法是,现在不上报可能仅仅是因为这个信用卡的发卡机构太新了,以后总有一天会上报的,所以最好不要抱有太大的期望。 […]

[…] FM说虽然此卡申请时有hard pull,但此卡批准后新卡不会上报给信用局,所以不会被计入Chase 5/24卡数。不过我个人的看法是,现在不上报可能仅仅是因为这个信用卡的发卡机构太新了,以后总有一天会上报的,所以最好不要抱有太大的期望。 […]

Tried yesterday and they declined with bogus “unable to verify your identity”. They did not even pull the credit as otherwise I would have received a monitoring notification. Seems they were getting ready to shut down the offer already. Probably ran out of marketing funds as people jumped on the offer.

I don’t think this logic works — there’s a substantively identical offer on the Cavs card that nets to $500. They probably just want to balance things out between their two offerings.

Which one is the Cavs card?

This one. https://www.cardless.com/cavs-limitedmay21?utm_campaign=cavs-100kpromo&utm_medium=organic-social. It’s .5cpp but you get twice as many points, so still $500.

That is dead too. Did anyone get both ManU and Cavs cards?

Dead? link doesnt direct to $500 offer

Yep, it seems to be dead. Thanks for letting us know.

There’s a substantively identical offer on the Cavs card.

This will count against 5/24, just not right now. It takes new issuers some time to get their reporting set up, but the new account will eventually appear on your credit report. Could be tomorrow, could be in 3 months, we do not know.

VFTW indicated as such in an earlier post about this card

Apple did the same thing with their Apple Card.

Hi Grey!

I’m really interested in this card.

But I do have 2 questions:

As you said:” it doesn’t count against 5/24 if you apply this week.”

I guess it probably means this card will not be reported to the credit bureau

So either open or close this card will not affect my credit history(except the HP part)

If it is true this card will be very cool

My first question is where did you find this? Could you post the link?

My second question is, will they report this credit card to the credit bureau after they change the rule?

Declined 🙁

And I’m actually a Manchester United fan!