NOTICE: This post references card features that have changed, expired, or are not currently available

On January 30th 2020, Delta credit cards issued by Amex changed drastically. As a result, we had a small window of time to make the most of our cards under the old rules. If you have the Delta SkyMiles Blue Amex, the Delta SkyMiles Gold consumer Amex, or the Gold Business Amex then you’ll find that most of the changes are positive. For example, the Gold cards gain a $100 Delta Flight Credit after $10K/year spend. On the other hand, the news is decidedly mixed for Delta Platinum and Delta Reserve cards. On the positive side, the cards gain benefits and category bonuses. On the negative side, the annual fees will go up and we’ll lose the ability to earn bonus miles when hitting spend targets.

This post is specifically for those who use the Delta Platinum and/or Delta Reserve card to earn Delta elite status through spend. Is there an ideal strategy? Should we spend a lot now or wait until the new benefits kick in?

For the purpose of this discussion, the most relevant January 30th 2020 changes are:

- Increased limits for MQM earnings

- Old: Delta Reserve cards allowed earning up to 30K MQMs with $60K calendar year spend

- New: Delta Reserve cards allow earning up to 60K MQMs with $120K calendar year spend

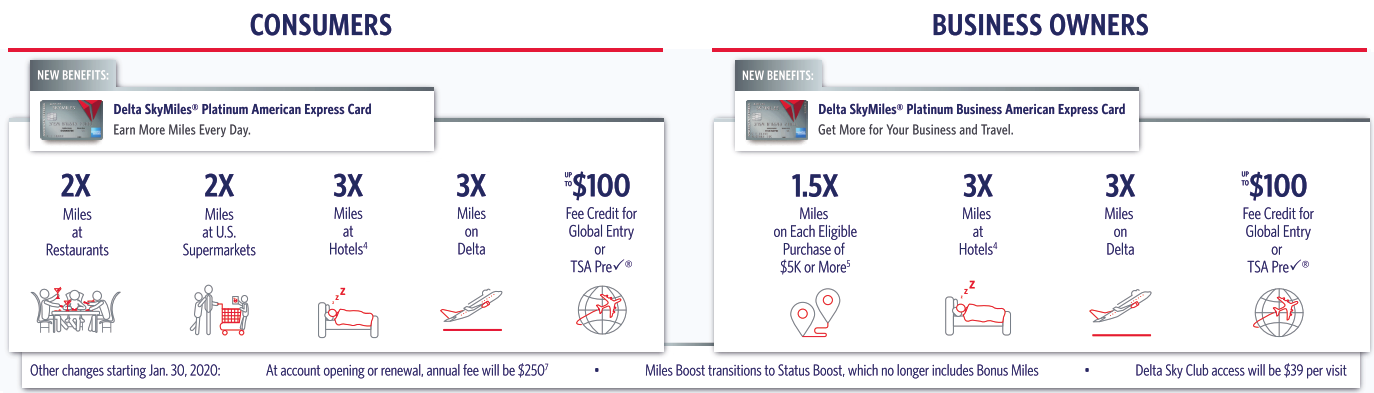

- New category bonuses as of Jan 30th 2020:

- The Delta Platinum consumer card will earn 2X miles at US Supermarkets and restaurants; and 3X miles at hotels and on Delta.

- The Delta Platinum business card will earn 1.5X miles for eligible purchases of $5K or more (max 50K extra miles per calendar year), and 3X miles at hotels and on Delta.

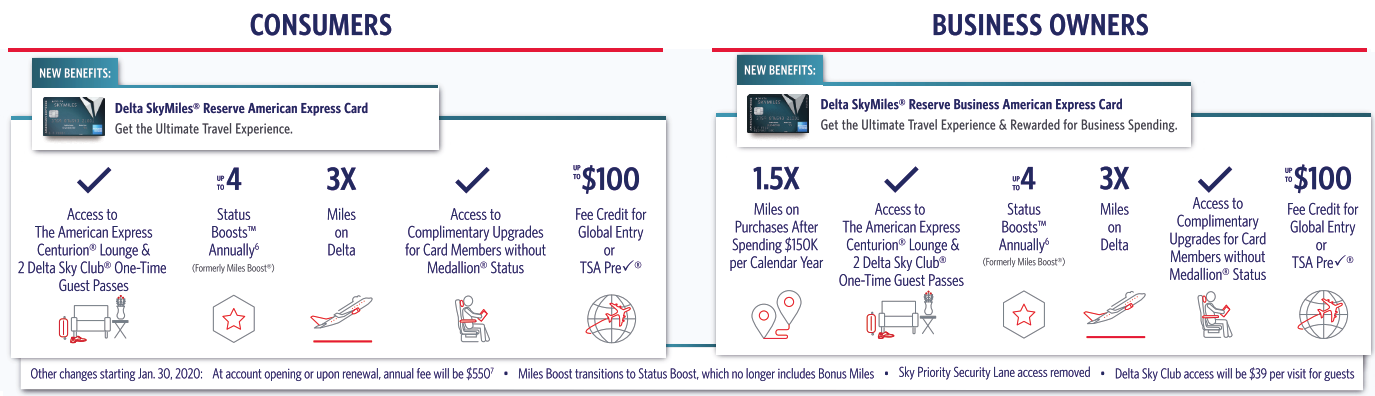

- The Delta Reserve consumer card will earn 3X miles on Delta.

- The Delta Reserve business card will earn 1.5X miles on purchases after spending $150K in a calendar year, and 3X miles on Delta.

- Decreased redeemable miles earned on big spend

- Old: Each time you earned a Miles Boost through high spend, you would earn both MQMs and redeemable miles

- New: Each time you earn a Status Boost through high spend, you will earn MQMs but no bonus redeemable miles.

Most of the basics regarding earning elite status through spend stay the same:

- Delta Platinum cards earn 10K MQMs with each $25K of calendar year spend (capped at $50K spend)

- Delta Reserve cards earn 15K MQMs with each $30K of calendar year spend (previously capped at $60K spend, but moving to $120K on Jan 30)

- Earn an elite MQD waiver with $25K calendar year spend good for Silver, Gold, or Platinum elite status (Starting Jan 30 you need a Delta Platinum or Reserve card to earn this waiver).

- Earn a Diamond Elite MQD waiver with $250K calendar year spend.

- MQMs earned with Delta Reserve Status Boosts are giftable. You can gift the 15K MQMs earned from each Status Boost to a family member or friend.

General spend strategy

With any of the Delta Platinum or Reserve cards, there is a short term opportunity to earn extra miles by reaching status boost thresholds by Jan 29th. For example:

- With either Delta Platinum card, spend $25K by January 29th and you’ll earn 10K MQMs and 10K bonus miles. If you spend $50K by January 29th, you’ll earn another 10K MQMs and 10K bonus miles.

- With either Delta Reserve card, spend $30K by January 29th and you’ll earn 15K MQMs and 15K bonus miles. If you spend $60K by January 29th, you’ll earn another 15K MQMs and 15K bonus miles.

Assuming none of the above spend is on Delta (where each of the cards currently earn 2X miles), you’ll earn miles at the following rates if you exactly hit a spend threshold by January 29th:

- Delta Platinum: 1.4 miles per dollar

- Delta Reserve: 1.5 miles per dollar

With the Delta Reserve cards, you can’t do better than 1.5X on your first $30K or $60K of spend since the new category bonuses for the Reserve cards aren’t too interesting. So, if you have either of those cards and you’re able to spend big quickly, I’d recommend doing so by January 29th.

With the Delta Platinum cards, the strategy is less clear. Starting January 30th, you can do better than 1.4 miles per dollar, as follows:

- Delta Platinum consumer card: Earn 2X miles at US Supermarkets and restaurants; and 3X miles at hotels and on Delta.

- Delta Platinum business card: Earn 1.5X miles for eligible purchases of $5K or more (max 50K extra miles per calendar year), and 3X miles at hotels and on Delta.

If you tend to spend a lot at grocery stores and you have the Delta Platinum consumer card, then you’re better off waiting until January 30th to start spending. Similarly, if you tend to spend a lot on very large purchases ($5K or more) and you have the Delta Platinum business card, then you’re better off waiting until January 30th to start spending.

Spend strategy summary: Spend big before January 30th on the Delta Reserve cards in order to earn bonus miles with each status boost. Consider waiting until January 30th to spend big on the Delta Platinum cards in order to take advantage of new category bonuses.

even if you spend $60,000on Delta Reserve card before January 30, 2020, Amex is not giving 30000 bonus miles any more

What makes you think that? The announced changes were pretty clear about when they kicked in.

I can confirm this, I still haven’t received my 15k bonus delta skymiles for $30k spend on the reserve card. Spend was completed 1/14, statement closed 1/27, miles for spend posted 1/28 with bonus MQMs, but no bonus 15k skymiles.

My Delta Platinum 10K bonus miles just posted today (Jan 31) even though I received the MQM bonuses earlier in the month. And my wife got both her Platinum and Reserve bonus miles Jan 29th and Jan 30th.

I think it is just taking them a while to process these.

good to know, sure hope you’re right! Im going to stay patient before contact amex

Does anyone else find it odd that the cheaper Platinum card gets more benefits on spending then the Reserve card? 2X on supermarkets restaurants and 3x on hotels and delta VS Reserve card 3x only on delta?? Seems like I should change back to Platinum card.

That used to be the way it was with all premium cards. For example, Amex Platinum cards used to offer only 1X for all spend while Amex had cheaper cards with better earnings. I think Chase really changed the dynamic when they brought out the Sapphire Reserve and then Amex, Citi and others followed along with bigger rewards for the most expensive cards. So, from a historical perspective, it’s not surprising that the Reserve has worse spending bonuses than the cheaper cards, but it is surprising given recent trends.

I don’t completely understand how the Reserve card works. I’ve had the Platinum for about 5 years. In November, I called and asked to be upgraded to the Reserve. My wife still has a second Platinum associated with my card. So I have the reserve, but she has the Platinum with the same number as my Reserve. I’m the primary card holder, and she is the secondary. I may be understanding this all wrong, but it sounds like spend requirements begin Jan 1 2020 and end Jan 30 2020, but that doesn’t sound right. So that leads me to believe that my spend from January 2019 to January 30 2020 which include the period of time I had the Platinum before changing to the Reserve would meet the spend requirements??? Any help here, understanding this. From what I am reading, it seems like I made a mistake in changing the card from Platinum to Reserve. I made the change before I knew the cost of the card was going up $100 more on Jan 30 2020. I’ve met the 30K from last year, but I’m confused about the spend for this year.

For several years, I have held a Pers Delta Reserve as well as a Pers and Bus. Delta Plat (primarily for MQM bonuses). With the changes, I’m going to get rid of one of the Platinum cards. Since I don’t use these cards for Supermarkets (soon to be 2x category for Pers Plat) or spend >$5K/transaction (soon to x1.5 on Pers Bus), I think I’ll jettison the Personal card. Any advantage to keeping the Personal and ditching the Business instead? Thanks!

Will we be able to hit a threshold spend and then “start over” on January 29 under the new rules and continue to earn MQM’s under the new rules or would be be “done” earning MQM’s for the year because we hit a threshold?

I’d think it will not start over as this stuff is all typically calendar year for amex.

If you still have capacity to reach the next threshold then you can keep going. For example, if you spend $25K on a Platinum card before Jan 30, you can still do the next threshold afterwards. With Reserve cards it gets better since the threshold limits go up. For example, if you could do $60K before Jan 30 (for two 15K MQM bonuses), you’ll still be able to get two more by spending up to $120K before the end of the calendar year.

Thank you very much for the clarification!!

Greg,

Most frustrating part of all of this, is the “pain in the ass” factor. Yeah, I could covert my wife’s reserve to a plat, but I really don’t want to have to run to the grocery store that much. As it stands, likely cancer her reserve, and just gc.com my reserve to 90-120K and accept the redeemable mileage cut.

Dealing with this issue now. I have three kids in college, all with tuition bills due in January. Only two schools take Amex, and both have final payment due dates next week. My credit limit on the Reserve is 15k (Amex won’t raise any higher as have only had the card about 6 months) so am maxing out, paying electronically, rlnse, repeat. Hoping to get 2 more cycles done by the due dates.

Are you paying fees on those tuition payments?

If you’re ok with a 2.5% fee to pay the third school who doesn’t take AMEX, look into paying that tuition through Plastiq using AMEX. I’ve done that for a couple of years to achieve these threshholds. Plastiq generates and mails a check to the university and it gets there in 7-10 days (again for 2.5% fee)

@ Greg — Isn’t the Resrve bonus for $30k spend by Jan 29 equal to 15k MQM + 15k SM (you say 10k SM)?

Is there any way to pay 2020 taxes by Jan 29, or just 2019? If not, any idea if the IRS frowns on massive, intentional over payments to MS?

Thanks. Yes that was a typo. Fixed.

I don’t know whether you can pay estimated 2020 taxes yet. I’d guess that you probably can. Regarding overpaying 2019, I do think there’s a chance that it would make you more likely to be audited, but that’s just a guess. I’ve never heard any examples of the IRS getting upset about getting what amounts to a fee free loan for them from a big overpayer.

Watch what ur doing I’m paying mine Monday .Then try 2020 after 1/15 if it works fine if not it’s up to the service .The IRS is run by the same type of people who run the banks as in not very well.

I always over pay like $10k once that’s why u need a good CPA .

CHEERs

I have a good CPA, and she thinks I am crazy for paying my taxes by credit card.

Correct she is ” Crazy Just like a Fox ” .. Been TOAD that every time I visit them. Remember u pay to hit the min. then the rest by Check ..

Been a Gold Mine for me need a 1k points to get the award no MS stuff pay ur future Taxes the Gov Loves it . Don’t forget ur property taxes too to Hit the Min..

CHEERs

Pay1040 (for example) doesn’t accept 2020 1040-ES payments until 3/1/2020.

The convenience fee for paying 2017 taxes with credit cards ranges from 1.87 to 2 percent of the payment, depending on the third-party service used. You can also pay by credit card if you use tax preparation software that has e-file and e-pay built in, though the fees tend to be higher.Apr 6, 2018

Just not worth it. Show me a CPA who can generate a better return over 2 cents/mile.