UPDATE: As of January 2024, it is no longer possible to manufacture million miler status through credit card spend. Now, million miler status is earned only through actually flying a million miles. Additionally, the levels of status achieved with each million miles has changed (for the better), but I’ve left this post intact with the original details…

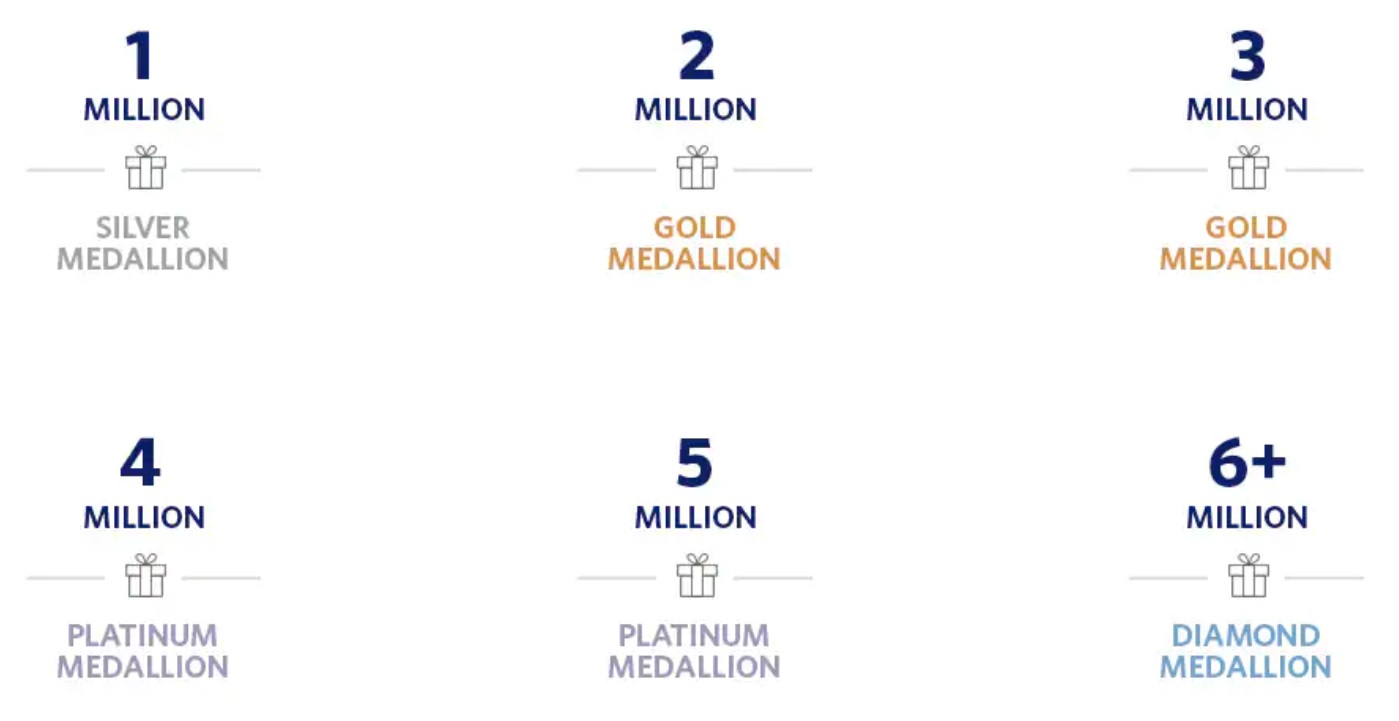

Delta offers lifetime elite status to those who earn 1 million or more Medallion Qualifying Miles (MQMs). Delta calls this status “Million Miler Status“. Each time you reach 1 million MQMs, you get “a special gift box and an electronic Delta Gift Card.” Plus, at specific million mile thresholds, you earn lifetime elite status, as follows:

- 1 Million MQMs: Silver

- 2 Million MQMs: Gold

- 4 Million MQMs: Platinum

- 6 Million MQMs: Diamond

That last one is new. It used to be that the highest lifetime tier was Platinum at 4 Million MQMs, but now Delta has made lifetime Diamond status accessible to anyone who earns “only” 6 Million MQMs.

A fun thought exercise

Regular readers know that I’ve been earning Delta Diamond status each year through (very large) credit card spend. For details about how this works, see: How to earn Delta elite status through credit card spend.

The new ability to earn lifetime Diamond status has me intrigued. I wonder: can one manufacture lifetime Diamond status through spend alone? Could one work really hard to get there quickly and then enjoy status until the end?

Note: This is meant to be a thought exercise. Do not take the following as advice. Please.

What’s so great about Delta Diamond status?

The chart above shows a summary of my favorite Delta elite benefits. As you can see from the chart, Diamond status doesn’t offer many tangible benefits beyond those offered for Platinum status. But the difference in what you get with Choice Benefits is huge. When you reach Platinum status, you can pick 1 Choice Benefit and when you reach Diamond status you can pick 3 more. But the choices differ. Most notably, only at Diamond status do you get to pick 4 Global Upgrade Certificates as a single Choice Benefit. These allow you to upgrade dirt cheap economy flights to Delta One, even for long haul international flights. This makes it possible, for example, to fly in a Delta One Suite (which includes a lie-flat seat, a closable door, a huge entertainment screen, etc.) for the price of economy.

Do Lifetime Diamonds get Choice Benefits?

The question I have about Million Miler status is this: Are Choice Benefits awarded every year, for life, to Platinum and Diamond Million Milers? If yes, then lifetime Diamond status would be very valuable. If no, then not so much.

Delta’s website is silent on the question. Delta’s Million Miler page says nothing about Choice Benefits, but does state this:

Annual complimentary Medallion Status is valid from beginning to end of the Medallion calendar and benefits associated with complimentary Status are awarded annually.

The key here is the phrase “benefits associated with complimentary Status are awarded annually.” So, that begs the question: are Choice Benefits associated with complimentary status? Well, Centurion card members get complimentary Platinum status, so we can look to see what happens with them:

Delta’s Medallion Benefits Terms & Conditions page states the following:

Centurion Card Members who are awarded complimentary Platinum Medallion Status must fly a minimum of eight Medallion Qualification Segments (MQSs) after Status is awarded to be eligible for Choice Benefits.

So, the answer seems to be a solid “probably.” Based on the Centurion card example, it seems that Choice Benefits do qualify (sort of) as “benefits associated with complimentary Status.” It seems unlikely to me that Delta would require lifetime elites to fly 8 qualifying segments each year to earn their Choice Benefits, but it’s possible. If they do require that, it shouldn’t be hard at all for a lifetime Diamond elite to achieve. After all, if you don’t fly at least 8 segments per year, you won’t get much value from your status anyway.

30 years of crazy-high spend

Delta Platinum and Delta Reserve Amex cards offer the ability to earn MQMs with big spend, as follows:

- Delta Platinum and Delta SkyMiles® Platinum Business American Express Card. For each $25K of calendar year spend (up to $50K), earn 10K MQMs (12.5K in 2021). Total per card per year: Spend $50K, Get 20K MQMs (25K in 2021).

- Delta Reserve and Delta SkyMiles® Reserve Business American Express Card. For each $30K of calendar year spend (up to $120K), earn 15K MQMs. Total per card per year: Spend $120K, Get 60K MQMs (75K in 2021).

It’s possible for one person to have all four of the cards listed above. If so, you could max out the spend on each one in order to earn up to 160K MQMs each year with $340K spend. Note that you’ll also earn at least 340,000 Delta SkyMiles per year from your spend.

If we assume that you’ll also earn 40K MQMs through actual flying each year, then every 5 years you’ll hit another Million Miler milestone. If you’re starting from scratch, you’ll earn lifetime Diamond status after “only” 30 years.

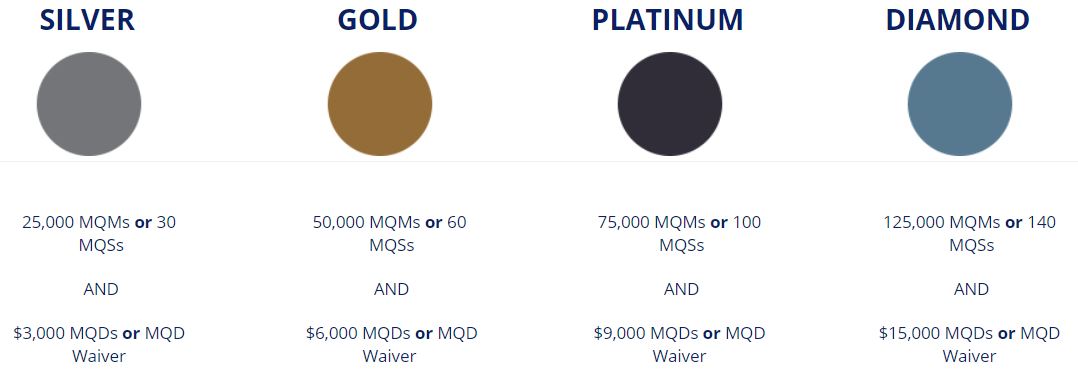

The good news about this approach is that you’ll get Diamond status each year while working towards lifetime status. Diamond status requires 125,000 MQMs and either $15,000 MQDs (actual spend on Delta flights) or a MQD waiver from spending $250K across Delta credit cards. You’ll get both the MQD waiver and more than enough MQMs from your annual $340K spend in order to earn Diamond status each year.

Speed up with help from friends

MQMs earned via high spend on Delta Reserve cards are giftable. Each time you earn 15K MQMs from $30K spend, you can choose to add the MQMs to your own account or to gift them to a friend.

If you have a lot of friends who trust you a lot and who would like airport lounge access when flying Delta, you could theoretically do the following with each friend:

- Friend signs up for Delta Reserve card (business or consumer)

- Friend adds you as an authorized user.

- You spend $120,000 within a year on that card and you pay the friend’s credit card bill for those charges.

- Your friend keeps the 120,000 Delta SkyMiles earned, but gifts you the 60,000 MQMs.

- Your friend pays the card’s $550 annual fee. In exchange, they get airport lounge access when flying Delta (that’s a Delta Reserve card benefit) and they get 120,000 miles from your spend. That’s a great deal for your friend! Since Delta miles can be used for a minimum of 1 cent per point value towards flights, they would be getting lounge access plus at least $1,200 worth of flights for only $550 each year.

Depending upon how you manufacture spend, your costs when generating the spend will vary. If we assume a flat 2% cost of spend, then it will cost you $2,400 to generate $120,000 of spend and to receive 60,000 MQMs. Your cost would be 4 cents per MQM.

At the extreme end, with 100 friends who each get one Reserve card or 50 friends with 2 Reserve cards, you could get to lifetime Diamond Status in one year. Your total cost (with 2% cost of spend): 100 x $2,400 = $240,000. My most recent valuation for Delta Diamond status is $3,000 per year (see: What is Delta elite status worth?). This investment, then, would start to pay off after 80 years of lifetime status. LOL. And that’s only if Choice Benefits are awarded each year. In other words, it’s a very bad idea.

MQD Workaround

Usually, in order to earn Delta Diamond status you need to either earn $15,000 Medallion Qualifying Dollars (MQDs) or a Diamond MQD Waiver with $250K Delta credit card spend. The interesting thing about lifetime Diamond status is that it’s now possible to earn Diamond status without ever earning enough MQDs and without ever earning a MQD Waiver. Lifetime Diamond status does not have a MQD requirement. All you need are a measly 6 million MQMs. Easy! 😉

Wrap Up

Before doing the math, it was exciting to think that there’s now a way to manufacture lifetime Delta Diamond status. After doing the math, its more daunting than exciting. By fully maxing out spend on 4 different Delta cards and starting from scratch, it would take 30 years to achieve this without help from friends. Personally, I already have about 1.5 million MQMs, so it will “only” take me about 22 or 23 more years to get there. With how quickly things change with loyalty programs, 22 years is an eternity. Who knows if Delta Diamond status will still be valuable by then or if the Million Miler program will even exist? Not me. I don’t know and I wouldn’t bet on it.

[…] status. Sometimes the best ideas are born from unbelievable propositions. In this case, it was a fellow travel blogger writing about how to spend your way to the whopping 6 million Medallion Qualification Miles needed […]

[…] status. Sometimes the best ideas are born from unbelievable propositions. In this case, it was a fellow travel blogger writing about how to spend your way to the whopping 6 million Medallion Qualification Miles needed […]

[…] status. Sometimes the best ideas are born from unbelievable propositions. In this case, it was a fellow travel blogger writing about how to spend your way to the whopping 6 million Medallion Qualification Miles needed […]

[…] status. Sometimes the best ideas are born from unbelievable propositions. In this case, it was a fellow travel blogger writing about how to spend your way to the whopping 6 million Medallion Qualification Miles needed […]

[…] status. Sometimes the best ideas are born from unbelievable propositions. In this case, it was a fellow travel blogger writing about how to spend your way to the whopping 6 million Medallion Qualification Miles needed […]

[…] status. Sometimes the best ideas are born from unbelievable propositions. In this case, it was a fellow travel blogger writing about how to spend your way to the whopping 6 million Medallion Qualification Miles needed […]

[…] status. Sometimes the best ideas are born from unbelievable propositions. In this case, it was a fellow travel blogger writing about how to spend your way to the whopping 6 million Medallion Qualification Miles needed […]

[…] status. Sometimes the best ideas are born from unbelievable propositions. In this case, it was a fellow travel blogger writing about how to spend your way to the whopping 6 million Medallion Qualification Miles needed […]

[…] status. Sometimes the best ideas are born from unbelievable propositions. In this case, it was a fellow travel blogger writing about how to spend your way to the whopping 6 million Medallion Qualification Miles needed […]

[…] status. Sometimes the best ideas are born from unbelievable propositions. In this case, it was a fellow travel blogger writing about how to spend your way to the whopping 6 million Medallion Qualification Miles needed […]

[…] status. Sometimes the best ideas are born from unbelievable propositions. In this case, it was a fellow travel blogger writing about how to spend your way to the whopping 6 million Medallion Qualification Miles needed […]

[…] status. Sometimes the best ideas are born from unbelievable propositions. In this case, it was a fellow travel blogger writing about how to spend your way to the whopping 6 million Medallion Qualification Miles needed […]

[…] status. Sometimes the best ideas are born from unbelievable propositions. In this case, it was a fellow travel blogger writing about how to spend your way to the whopping 6 million Medallion Qualification Miles needed […]

[…] status. Sometimes the best ideas are born from unbelievable propositions. In this case, it was a fellow travel blogger writing about how to spend your way to the whopping 6 million Medallion Qualification Miles needed […]

[…] status. Sometimes the best ideas are born from unbelievable propositions. In this case, it was a fellow travel blogger writing about how to spend your way to the whopping 6 million Medallion Qualification Miles needed […]