Marriott devalues its Bonvoy loyalty program in March of each year and I was particularly pessimistic about its prospects for 2023 because they’d be removing the anchor for how much properties could increase by.

With the program going fully dynamic, I’d predicted back in January that Marriott points would become worth a consistent 0.55-0.6cpp (cents per point) from late March 2023.

It turns out that I’ve been far more pessimistic than warranted. Marriott’s devaluation came and went in late March and, unlike previous years, pretty much no one noticed. Part of the reason for that is because Marriott no longer has hotel categories, so there’s no easily identifiable qualitative data (e.g. x number of properties have gone up a category, y number of properties have gone down a category). I did my best to put together a qualitative assessment of this year’s Marriott changes and rather than coming across the bloodbath I’d been expecting, this year’s deval is more of a bird bath and, in many cases, isn’t a devaluation at all.

View From The Wing briefly covered the changes in late March, particularly noting that the maximum award cost had been increased from 100,000 points per night to 150,000 per night. That’s a terrible change for anyone who has the Marriott Bonvoy Brilliant and/or Ritz-Carlton credit cards that come with a certificate at renewal each year valid for up to 85,000 points. With Marriott allowing you to top up certificates with up to 15,000 points, that previously meant you could effectively redeem those certificates at any property in the world. With 100,000 points no longer being the limit, there will be properties out of reach of those certificates, thereby making the certificates worth less or, at the very least, less desirable than they were previously

Something worth noting is that the 150k upper limit seems to have been in place since before the devaluation. When recording the data for future comparison in mid-March, some properties were already showing the 150k pricing.

Measuring Marriott’s Devaluation

Back in mid-March I used StayWithPoints to gather some Marriott data in a couple of ways. First, I made a record of the percentage of nights of award availability for each of the hotels that StayWithPoints tracks (80 properties). The expectation had been that award availability would improve post-devaluation because hotels would be able to charge more for award stays and therefore would be more amenable to releasing award space.

I then picked 36 properties and kept a record of how many points were being charged each night for the next year. That would enable me to compare pricing after any changes had taken place.

The findings surprised me, mostly in a good way.

Marriott Award Availability Is Better, But…

StayWithPoints has an interesting feature which lists the percentage of nights in the next year where there’s award availability. As noted above, we expected to see award availability get better after Marriott’s latest round of changes. That is indeed what happened on the balance of things, but not to the extent as anticipated.

Of the 80 properties that they automatically track:

- 41 properties have more availability

- 17 properties have the same availability

- 22 properties have less availability

As you can see, 72.5% of properties have either had an increase in award night availability or remained the same. Still, 27.5% of properties we compared have seen a reduction in how easy it is to book a stay with points which is surprising. 7 of those 22 properties have only seen a reduction of 1% which could be the result of natural booking behavior rather than the hotels proactively reducing availability.

Some reductions are much more significant though, with award availability percentage dropping by double digits. For example, The St. Regis Aspen Resort had 53% award availability in mid-March but only 43% when checking again this week. Laluna, Grenada, a Member of Design Hotels went from 52% all the way down to 36%. JW Marriott Phu Quoc Emerald Bay Resort & Spa dropped from 86% to 74%, while The Ritz-Carlton, Kyoto went from 89% to 78%.

The good news is that the maximum reduction was 16%. When it comes to increased award availability on the other hand, some hotels added award nights representing up to 27% of additional nights in the next year.

For example, The Royal Hawaiian, a Luxury Collection Resort, Waikiki went from having 70% of award availability up to 97%, as did The Ritz-Carlton, Kuala Lumpur.

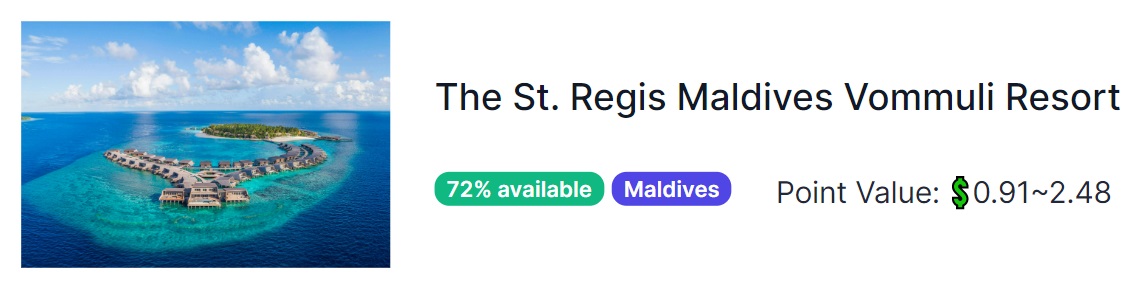

If you’ve been keeping an eye on booking award stays at The St. Regis Maldives Vommuli Resort there’s good news – they went from 50% of nights having award availability to 72% now, making it much easier to use points and free night certificates there. Unfortunately this is one of the properties that now charges up to 150,000 points per night. Having said that, “only” 36 nights in the next year are priced as high as that; many nights cost 88,000-94,000 points per night during the off-peak period which runs from May through the end of September. The cents per point value at this property is good too, ranging from 0.91-2.48cpp depending on your dates.

Perhaps the most notable change in terms of award availability is at The Ritz-Carlton Maui, Kapalua. This hotel went from a paltry 1% of availability in mid-March to 27% when checking this week. That’s a huge increase, even if it does mean that just under 3/4 of the year is still not bookable with points.

Award Pricing Has Gone Down In Many Cases

The other factor I’d been keeping an eye on was award pricing. Comparing pricing for all 80 Marriott properties that StayWithPoints tracks automatically would’ve been quite time consuming, plus quite a few hotels only have 0%-1% of award availability and so the results for those would’ve been fairly meaningless.

As a result, I picked 36 properties where there was already a significant amount of award availability and recorded the award pricing for every night over the course of the next year back in mid-March. I did the same again this week and compared the results.

Something I should note here is that I compared like-for-like availability. When seeing if pricing had increased or decreased at each hotel, I only compared pricing on dates where there was availability both before and after the “devaluation”. The reason I did this is because increased or decreased award availability could otherwise have a significant impact on the results. For example, if an extra two months of rooms bookable with points became available post-devaluation, taking those into account would make it look like pricing was more expensive even if they were priced exactly the same as other nights.

Here were the results:

- 12 properties increased in price on average

- 24 properties decreased in price on average

I was very pleasantly surprised by this result, especially because some of the increases were minimal. For example, The Ritz-Carlton Kyoto now charges an extra 4,000 points across the entire year. That’s the net result across the year, not that they’re now charging an average of 4,000 points per night more.

To give a better sense of what I mean by this, 77 nights saw a decrease in price and 130 nights saw an increase in price. The price increases were mostly minimal though, resulting in a total increase of 726,000 additional points across those 130 nights. The price decreases were more substantial, with the 77 nights dropping a total of 722,000 points, thereby resulting in the net increase of only 4,000 points across the entire year.

Some hotels have seen much more drastic increases though. Worst off is The Ritz-Carlton Key Biscayne in Miami. They’re now charging a total of 763,000 points more across the entire year. 27 nights saw a reduction in pricing ranging from 1,000 to 15,000 fewer points per night. However, those were in the minority as 139 nights increased in price ranging from an extra 1,000 points up to an extra 28,000 points per night.

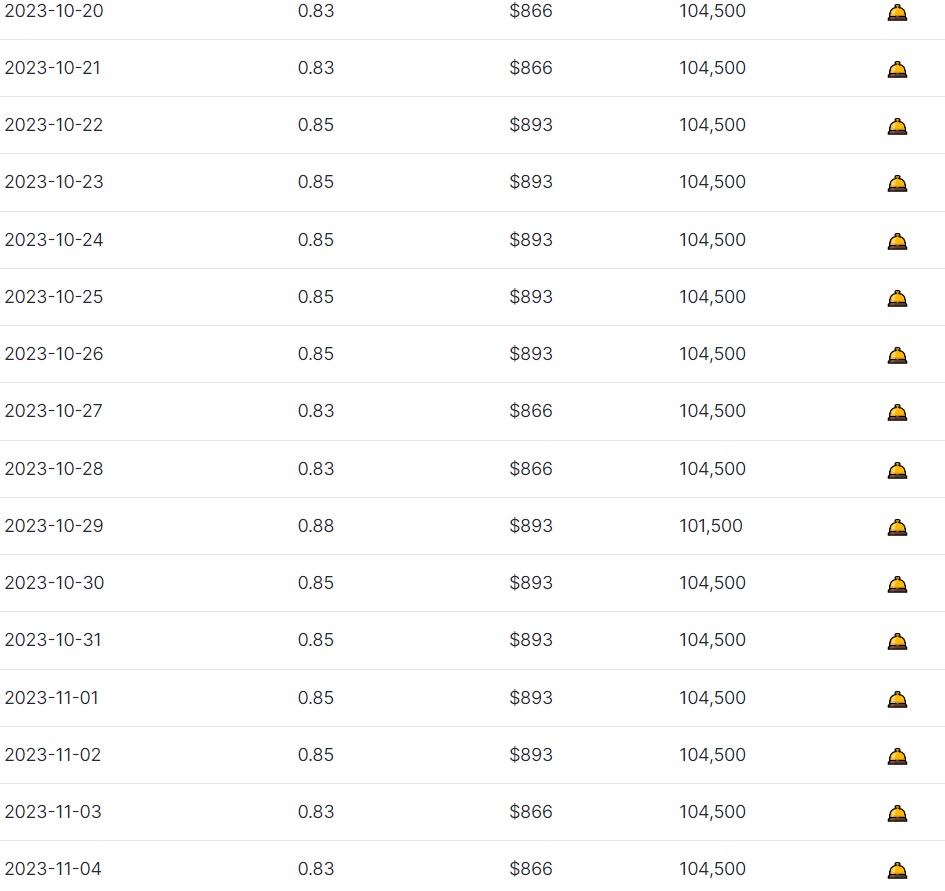

The Wellesley Knightsbridge, a Luxury Collection Hotel, London is another hotel taking full advantage of dynamic pricing. If you were to book every available award night now that could also be booked back in mid-March, you’d now have to fork out an extra 652,000 points. Only 23 nights decreased in price, although some of the reductions were as high as 31,500 points. To be fair to this hotel, the point increases weren’t as notable, with the highest increase being only 10,500 points but most increases only being 4,500 points. However, 229 nights increased in price which is why the results look so bad.

Something worth noting with this particular hotel is that many nights used to cost 100,000 points. With a substantial number of those going up to 104,500 points per night or more, they now won’t be bookable with 85,000 point certificates as they’ll be out of range of the top up limit of 15,000 points per night.

On the positive side of things, two-thirds of the properties where I compared pricing before and after have seen a net decrease in cost. Some of those net decreases have been minimal, but others have seen substantial decreases over the course of the year.

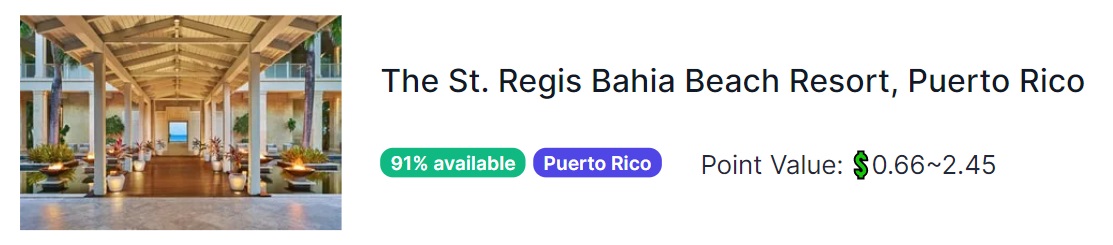

The largest overall decrease is at The St. Regis Bahia Beach Resort, Puerto Rico. Only 3 nights increased in price, whereas a whopping 286 nights decreased in cost. Decreases range from 2,000-38,000 points per night, with the majority of nights being in the 2,000-8,000 range of decreases. If you booked every available night today that was also available back in mid-March, you’d have to redeem 2,462,000 fewer points (ignoring Marriott’s Stay For 5, Pay For 4 benefit).

If this has you wanting to rush to book an award stay at this hotel, be sure to check the cash cost. While the cents per point value can be as high as 2.45cpp, it can be as low as 0.66cpp.

The second largest overall decrease is at The St. Regis Maldives Vommuli Resort, although that’s partly thanks to how much award nights cost there. 61 nights have increased in price; most increases were either 2,000 or 4,000 points per night, but about two weeks worth of dates increased between 24,000 and 54,000 points per night.

While that sounds bad, 102 nights have reduced in price. Similar to the increases, quite a few decreases were in the 2,000-4,000 point range. However, 37 nights have decreased in price by 30,000-62,000 points per night. As a result, if you now booked every available night that was also available back in mid-March, you’d have to redeem 1,216,000 fewer points.

Other properties seeing an overall decrease include The Ritz-Carlton Dove Mountain, The Ritz-Carlton Maldives Fari Islands, Le Méridien Maldives Resort & Spa, JW Marriott Istanbul Bosphorus, Sheraton Maui Resort & Spa and more.

Final Thoughts

Marriott’s 2023 devaluation appears to have been more of a revaluation than a devaluation. Two-thirds of the properties I checked now charge fewer points over the course of the year than before, while award availability has improved or remained the same at almost three-quarters of the hotels automatically tracked by StayWithPoints.

It’s not unadulterated good news. Several properties now cost more than 100,000 points per night on at least some dates which means they can’t be booked with 85,000 point certificates and topped up with points.

Cents per point value can also vary greatly. Of the 80 properties tracked by StayWithPoints, 20 have at least some award nights where you’d get less than 0.5cpp of value by redeeming points. That’s not the case every single night at those properties (with the exception of The Ritz-Carlton Kuala Lumpur which gives an appalling 0.27-0.44cpp of value every single night which can be booked with points), so be sure to always check cash rates before booking an award stay in case that provides better value.

What’s important to remember regarding this analysis is that Marriott has 8,000 properties, so my findings only represent a small percentage of their hotels. That means that across their entire portfolio the findings could be different; it’s just much harder to ascertain that nowadays due to dynamic pricing rather than with fixed award categories that they’d used in past years.

Something else to bear in mind is that dynamic pricing means pricing can change at any time. Rather than in the past when Marriott would re-allocate hotels into different categories, that no longer happens. As a result, although there seemingly wasn’t the anticipated devaluation in late March, that could be because properties decide to gradually – but continually – increase the cost of award redemptions over the course of the next year. A hotel which increased its average award cost in late March by 2% doesn’t seem bad, but if that happens every month over the course of a year you’re looking at a compounded increase of 26.8% by the following March. That’s not to say that any Marriott properties are planning on doing that, but it’s one of the downsides of dynamic pricing – it’s much harder to identify if and when gradual devaluations like that are happening.

Please skip Ritz Key Biscayne and save your points for St. Regis Bal Harbour. Ritz has a Marriott feel, service is light years better at St. Regis.

Now that Bonvoy has gone fully dynamic any ideas as to why all nights aren’t bookable with points?

This could be because the loyalty program does not want to have to pay out when the hotel is mostly full, so they block the nights from redemption when they predict the hotel will be over 90% occupancy, or whatever their cut off is . The rate the loyalty program pays hotels is based on occupancy level on the nights stayed and the loyalty program want to be doing what is most profitable for the program (not hotels).

As always, a thorough and insightful article!

Marriott points are being Hiltonized…I could only find value in IHG and Hyatt now.

Why do you think so?

How many data points did you collect before concluding this?

@Stephen, how expensive are these properties and where are they located? Are they all aspirational properties in richer/touristy areas, or are there some airport Fairfields in the mix too?

I’m curious as to how pricing has changed for the most common redemptions (the ~25k-50k redemptions)

You can see the full list that I was looking at here: https://staywithpoints.com/Marriott/ As you’ll see, they’re more aspirational properties than your average Fairfield Inn, Courtyard, etc.

Having said that, Greg’s also gone through and recalculated the Reasonable Redemption Value for Marriott and found the value to be the same. His calculations look at different properties to the ones I looked at – there’s more about his methodology here: https://frequentmiler.com/what-are-marriott-bonvoy-points-worth/

Throughout this piece, the responsibility for setting rates is placed on the properties, but do we know if this is the case? It’s been my understanding in the past that the program actually determines the redemption rates. When it used to be priced by category, this was based on average annual revenue rates, while under dynamic pricing presumably it’s now based on the (current? historical?) revenue rate on the night you want to book.

This may sound like an immaterial distinction (does the hotel set the rate or does Marriott set it), but it gets to the heart of unpacking dynamic pricing. If dynamic pricing is based on daily rates, why is there such lopsided value? Are some hotels being “greedy” or “generous” because the redemption values are under their control, or does the Marriott dynamic pricing engine just price things wonky based on the unknown parameters it’s given? For example, if it’s based on historical rates for the dates in question, that won’t always match up with how they’re pricing today, producing some of the variation in value we’re seeing.

In any case, I would bet that hotels have little to no control over how they’re being priced in points, but we still have no idea how dynamic pricing actually works. The good news is that there’s still value to be unpacked today, but my guess is that Marriott’s pricing tool “improves” over time and starts to flatten out what you can extract from redemptions.

Hotels are paid a different % of their average daily rate by the loyalty program based on occupancy the night of the stay. The fuller the hotel is, the more the loyalty program pays the hotel.

I believe the redemption rate is determined by the loyalty program, not the individual properties, and with the goal of benefiting the loyalty program’s finances.

I would expect the points rate to be determined by the historical and projected occupancy rate for any given night rather than the $ rate the hotel is charging. This way, guest are encouraged to use their points on low occupancy dates where the program doesn’t have to pay out nearly as much to the property owner.

If the property considers they could not have sold those rooms anyway, they haven’t lost much accommodating points redemptions even at very low renumeration rates.

For me, the real issues with Marriott Bonvoy are: (Is there an echo?)

1) Whether a given property pops to 101k or more to render the 85k FNCs unusable. Marriott needs to fix this.

2) Whether a given property only offers the basic standard room category for award redemptions. No premium standard rooms or suites.

For me, the real issues with Marriott Bonvoy are:

1) Without award categories, you never know how much a property will cost. That makes it really, really difficult for someone just starting this game to ever accumulate enough points for that bucket list redemption.

2) This really hurts the mediocre, every day properties across multiple brands. The entire Bonvoy program is based on customers like me spending a certain number of nights every year at Courtyard, Fairfield, or whatever branded hotel in the middle of no-where, likely on work’s money. The kind of mediocre hotels that I would never stay at if they weren’t flagged under Marriott. In exchange, I get points that I can use later at a much nicer or much more desirable hotel somewhere else. If I can never get enough points to redeem for that aspiration, bucket list trip then what’s the point of staying at the random Courtyard or that dumpy old Residence Inn? Moreover, in some cities like Paris and elsewhere, why would I stay at a Renaissance or Marriott if a nicer branded hotel is about the same number of points? I do think there should be some correlation between brand and points per night.

3) I think Marriott needs to be more transparent. How does a brand-new Sheraton or Westin start out at 70,000 points per night? Meanwhile, a nicer, more established property somewhere else is 40,000 points per night. Do hotels or management get to determine their minimum per night points cost?

In answer to: “How does a brand-new Sheraton or Westin start out at 70,000 points per night? Meanwhile, a nicer, more established property somewhere else is 40,000 points per night.”

The logical answer seems to me that the loyalty program is trying to maximize their finances. The brand new property doesn’t have good historical occupancy data so they price higher at least until they gain that kind of data.

Hotels are paid a different % of their average daily rate by the loyalty program based on occupancy the night of the stay. The fuller the hotel is, the more the loyalty program pays the hotel.

I believe the redemption rate is determined by the loyalty program, not the individual properties, and with the goal of benefiting the loyalty program’s finances.

I would expect the points rate to be determined by the historical and projected occupancy rate for any given night rather than the $ rate the hotel is charging. This way, guest are encouraged to use their points on low occupancy dates where the program doesn’t have to pay out nearly as much to the property owner.

If the property considers they could not have sold those rooms anyway, they haven’t lost much accommodating points redemptions, even at very low renumeration rates.

In response to:

“3) How does a brand-new Sheraton or Westin start out at 70,000 points per night? Meanwhile, a nicer, more established property somewhere else is 40,000 points per night.”

This makes sense if the loyalty program is doing what is most profitable for the program (not hotel). The rate they pay hotels is based on occupancy level on the nights stayed and the loyalty program has little data to project the daily occupancy variance at a new property, so plays it safe with higher points costs. See my earlier comment for further explanation.