NOTICE: This post references card features that have changed, expired, or are not currently available

Background: Million Mile Madness was the mad quest to earn a million points in one month. Throughout March, I did everything I could to earn as many points as possible while keeping within my ethical boundaries. I didn’t expect to have a million points credited to my account by March 31st: points often take quite a while to get credited. Instead, I tracked all of the points that I expected, and I declared victory when the expected total topped one million.

Today I’ll present a breakdown of how I earned a million points and miles in a month. Please keep in mind that none of this should be considered advice on what you should do. This is simply a summary of what I did:

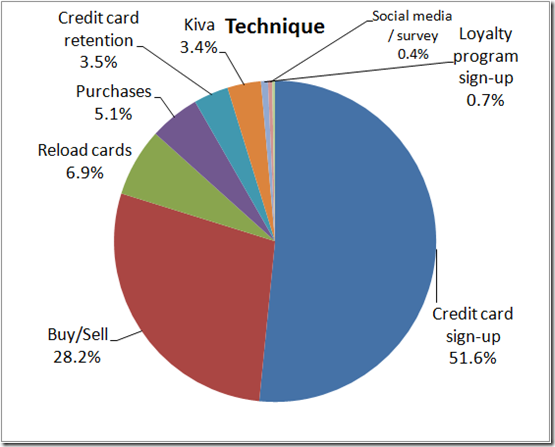

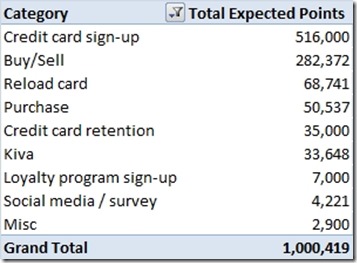

Credit card sign-ups 51.6%

It’s no fluke that credit card sign-ups accounted for more than half of my points. Sign-up bonuses continue to be the single best and easiest method for accumulating points quickly (for those who have good credit and always pay off their entire bill every month). I signed up for 11 cards at once and was approved for 10 of them. I do not recommend this as a good practice for others. I did this giant churn to achieve my self imposed goal of a million points in one month, but under ordinary circumstances I wouldn’t sign up for more than 3 or 4 cards at a time. For details about my credit card sign-ups, please see “Million Mile Madness: The big churn story.” You may also be interested in “Million Mile Madness: Credit scores and pulls.” All of the cards I signed up for can be found here: Best credit card offers.

Buy/Sell 28.2%

Almost 300,000 points were earned by buying merchandise (to get points) and then reselling the merchandise. I used double and triple dip techniques to earn 15X or more on my purchases. I took advantage of coupons and sales to keep costs down. I used Fulfillment by Amazon to resell items (Amazon does most of the work for me). It will still be a month or so before I’ve sold everything, so I don’t know how the final finances will turn out, but right now it looks like I will earn a small profit in addition to points earned. Amazingly, all of my purchases have been tracking correctly through the online portals so I feel confident about actually getting all of those points.

For more information see:

- Million Mile Madness: Preparing to buy & sell

- Million Mile Madness: buying, selling Kohl’s

- Million Mile Madness: Banking on Lowe’s

- Million Mile Madness: A setback from Sears

- Million Mile Madness: Bumps in the road

- Tips for selling on Amazon

Reload Cards 6.9%

Over the coarse of the month, I bought 19 Vanilla Reload cards and 8 PayPal cards. In most cases I took advantage of credit card bonus offers and category bonuses. Here are details:

- I took advantage of a 3X targeted offer for my Citi AA Amex card

- I used my Chase Freedom card which offered 5X at drug stores (among other places) last quarter.

- I used my Citi ThankYou Preferred card which offers 5X at drug stores for the first 12 months.

- My Hilton Amex continues to earn 6X at drug stores until May.

- The Club Carlson credit cards earn 5X everywhere, so this was a great way to meet minimum spend on those cards.

I was able to load all of the Vanilla Reload cards onto two Bluebird accounts (mine and my wife’s). With PayPal, each person can load up to $4000 per month, so I was able to load all 8 cards.

Purchases 5.1%

For everyday purchases that I would have made anyway, I did my best to earn as many points as possible. I used my new ThankYou Preferred card at grocery stores for 5X. I continued to use my Citi Forward card at restaurants, bookstores, and movie theaters for 5X. I shopped through online portals. I waited until March to make large purchases that would have been made earlier. I accelerated some purchases that would have been made later. In all, I spent a lot and averaged 3.67X across the board.

Credit Card Retention 3.5%

I earned 35,000 points by making two calls to cancel credit cards. Details are here: Million Mile Madness: Easy points.

Kiva 3.4%

I made over $17,000 in no-interest loans via Kiva. In my tracking spreadsheet I estimated that I would eventually get back 99% of that money, but in my experience I’ll get back a much higher percentage. I’ve always loved Kiva as a way to earn miles and do good. And, I’m fortunate enough to have enough money socked away in my savings to cover loans this big. For more information about Kiva, see “How to maximize points and virtue through Kiva loans,” and “Minimum spend requirements? Kivalens to the rescue.”

Miscellaneous Other 1.3%

I signed up for various frequent flyer programs, I took online surveys, I “liked” companies on Facebook. I earned a few thousand points.

Note: This week I’m on vacation, so please forgive me in advance for not answering comments.

Learn about Million Mile Madness:

- A crazy million mile idea. Should I do it?

- Million Mile Madness, it’s on

- Million Mile Madness: Strategy

- Million Mile Madness: Preparing to buy & sell

- Million Mile Madness: Tracking points and expenses

- Million Mile Madness: The big churn story

- Million Mile Madness: buying, selling Kohl’s

- Million Mile Madness: Banking on Lowe’s

- Million Mile Madness: A setback from Sears

- Million Mile Madness: Pending Success

- Million Mile Madness: Bumps in the road

- Million Mile Madness: Credit scores and pulls

- Million Mile Madness: Easy points

- Million Mile Madness: Success!!!!!

- Million Mile Madness: Which points?

[…] to be much harder than I expected, but in the end I was successful. You can read a summary here: Million Mile Madness: How it was done. Also see: Million Mile Madness: Final […]

[…] Million Mile Madness: How it was done […]

[…] Million Mile Madness: How it was done […]

FliesALot: I’m still working on selling a few last things, plus I have to deal with a couple of returns. I should be able to do a very-close-to-final summary in a week or so.

Follow-up? Everything get sold? Did you meet your goal of total out of pocket? Did all the points come through??

MilesAbound: True!

I think it does really show that right now credit card sign ups can’t be beat, particularly for those who are time constrained. Of course for the more hardcore among us who have gone through every single credit card as many times as we possibly can, the other tricks start to become more interesting. But they do take a whole order of more risk and complexity for diminishing returns

Jonathan: Yes, it was extremely nerve racking! With PayPal, I simply transfer to my checking account. I always leave a balance with PayPal and I’ve never had a problem

Ray: I’m not aware of any new great offers coming up. I do like the new 40k offer from Barclays for the Arrival card. Other than that, I’d to with the usual suspects: Ink Plus / Bold; Amex Mercedes, SPG; Citi Hilton Reserve, ThankYou Preferred (the one with 5x categories for a year); US Airways 35k, …

PJ: check the post Credit Scores and pulls

Nicely done, Greg! I bet it was a nerve racking experience, was it not?

I too am curious how you plan to ‘cash out’ your paypal balance. Do you plan to just use it for regular spend?

How much was the damage on your credit score?

i enjoyed the series, FM…. good work! im lookin forward to what else you have cooking up.

speaking of credit card bonuses, it seems that nothing very noteworthy has come up in the past couple months, besides a couple 75k AMEX offers… anything in the rumor mill ?

oh yeah, dont mind @scotttrick, he’s the “uncle ruckus” of point blogging

Enjoy the well deserved vacation

I just recently started reading miles and points blogs, after collecting points on my own for years. Boy, this community feels almost like a cult, with faithful followers and all!

IMO this is the most original and entertaining blog, thinking outside the box at its finest. I like TPG for most up to date info, but this blog is a great companion.No need

to bother reading others.

I have enjoyed this points quest very much. My next churn, you will be getting my clicks, you earned it.

I think both Bacc & Arlington traveler are the one’s who write some BS daily in MMS blog. Today they have mistakenly came to FM blog and made the same rant. Nothing more than that, I guess!