Bluegreen Vacations in conjunction with Choice Privileges currently has a terrific offer for those willing to sit through a Bluegreen Vacations timeshare “vacation ownership” sales presentation: you can get 80,000 Choice Privileges points and a 3-night stay (and a $25 Amex Gift Card if you book soon) for $279 + tax (just under $40 in tax in my case). I wrote about that deal here. I decided to take them up on this offer and I attended a Bluegreen Vacations sales presentation last week. It ran way over the promised time allotment, but overall my experience was still very positive. I didn’t initially intend to review my experience, so I didn’t take pictures of the property, but this deal worked out well in the end and I thought it was worth sharing my experience.

I should note that I generally don’t recommend buying a timeshare or “vacation ownership” if you’re interested in award travel. I think you can generally travel far more cheaply and comfortably with miles and points. Further, I don’t recommend attending these types of presentations if you’re likely to be influenced by sales tactics designed to part you from your money (which is something Stephen also asserted when he attended a similar presentation through Wyndham a few years ago). I fully recognize that these types of things can work out well for some people, but if it’s for you, then you can probably save a large bundle of money by looking to buy on the secondhand market. I’m not particularly interested in making a same-day decision to spend tens of thousands of dollars. I was willing to give them a shot for the promised incentives, but I recommend proceeding with some caution as you’ll find plenty of owners who regret attending these presentations (and also some who I am sure are thrilled).

The Offer

As I wrote about previously, there are several iterations of the current Bluegreen Vacations timeshare presentation offer:

- Choice Privileges is currently offering several different deals for attending a 2hr Bluegreen Vacations timeshare presentation. This isn’t published and could change at any time, but these were the offers a reader reported and I also got when calling last month:

- For $299, Choice Privileges is offering a 3-night Bluegreen Vacations resort stay, 40,000 Choice Privileges points, and a $100 American Express Gift Card. Plus get an extra $25 Amex Gift Card if you book within 30 days of purchasing the package.

- Pay $279, get 80,000 Choice Privileges points + $25 Amex Gift Card if you book within 30 days + 3-night stay (may be at a Bluegreen property or a third party hotel depending on the situation)

Pay $279, get 30,000 Choice Privileges points + $25 Amex Gift Card if you book within 30 days + 3-night stay (may be at a Bluegreen property or a third party hotel depending on the situation) - Pay $279, get a $300 American Express Gift Card + $25 Amex Gift Card if you book within 30 days + 3-night stay (may be at a Bluegreen property or a third party hotel depending on the situation)

- Note that you need to call to book at (855) 240-6573.

The second offer here (highlighted above) is quite strong at 80,000 Choice Privileges points and a 3-night hotel stay for $279 + tax. At a base level, our Reasonable Redemption value of 0.68c per Choice Privileges point means that you can reasonably expect to get about $544 in value out of the points when using them toward domestic Choice Privileges properties.

Keep in mind that you can certainly get far more value in some instances, particularly in Scandinavia, where many Nordic Choice hotels can otherwise be very expensive (and some of which include both free breakfast and free dinner!). Those interested in high end boutique hotel experiences can do well with the partnership with Preferred Hotels. And keep in mind that you can top off your Choice Privileges account by transferring Citi ThankYou points 1:2 (that’s 1 Citi ThankYou point = 2 Choice Privileges points) or by transferring from Radisson Americas (2 Radisson points = 1 Choice Privileges point) or you can buy Choice points through the cash & points trick or when on sale for less than 1 cent per point.

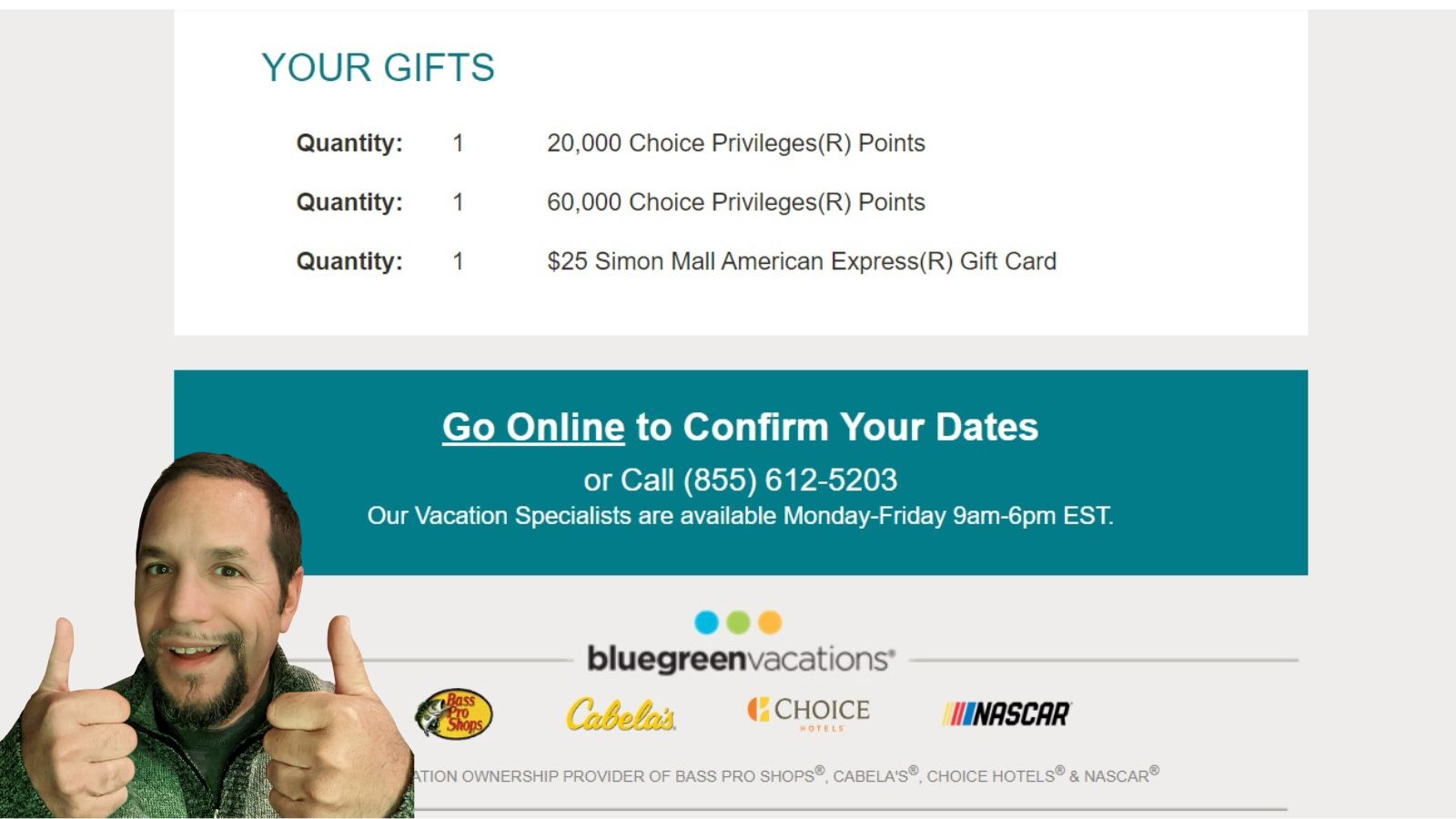

If you book within 30 days of buying the $279 package, you can also get a $25 American Express gift card on top of the 80,000 points.

All of that is a great deal for $279 — without even considering whether you want the included hotel stay.

Note that in some cases, you’ll be able to stay on-property in what is essentially like a 1-bedroom condo, but in my case in Orlando my only option for the 80K points package was to stay at a third-party hotel. That didn’t work out badly for me. I could have alternatively stayed on-property at the Bluegreen Vacations resort, but I’d have only gotten 40,000 points + a $100 Amex Gift Card. That’s certainly not a bad deal, particularly if you want all of the resort amenities, but I both wanted the 80K points package and I specifically wanted the hotel stay for reasons I’ll get back to.

In my case, I bought into this deal because I needed a 3-night hotel stay anyway. I’d have otherwise probably spent 15K or 18K Hyatt points per night to stay at the Hyatt Regency Grand Cypress (where I ended up spending the next 5 nights), so I was happy enough to pay just $279 for three nights and take them up on the bonus benefits. I hadn’t been to a “vacation ownership” presentation in about a decade, so I was also just curious to see what it would be like.

Booking the Bluegreen Vacations timeshare offer and checking in

I attended my Bluegreen Vacations timeshare presentation in Orlando. I was told both while booking and via email that I would need to stop by the Bluegreen “welcome center” on-property on check-in day to pick up a voucher for the hotel before I could head to the hotel and that I would schedule my presentation appointment at the welcome center upon check-in with Bluegreen.

The one small annoyance there is that I would have preferred to have known in advance when my presentation would happen, but I didn’t find out until I arrived at the welcome center on check-in day. As it so happened, the only opening for my presentation the next day was at the right time for us (11am). We were told to arrive 20 minutes before the presentation was scheduled to begin in order to process the incentives (the points and gift card).

I went from the welcome center to the hotel (a Residence Inn), where the front desk agent saw the voucher in my hand and collected it from me at check-in. More on the hotel later in this post. The check-in process was smooth: I needed to present my credit card to pay the ~$39 in taxes and as you’ll see later I got my Marriott elite benefits. Back to that in a bit.

The Bluegreen Vacations timeshare presentation experience

The next morning, we arrived exactly 20 minutes in advance of the presentation (10:40am) and were at the end of a long line of people waiting to check in for the presentation. It took almost all of the 20 minutes to get to the front of that line.

The agent checking us in for the presentation let us know that the 80K points had already been sent to Choice Privileges and may be showing up already in my account but said that it sometimes takes a day or two. She also handed us the $25 Amex gift card. When we walked away from check-in, I pulled up the Choice Privileges app and sure enough I had my 80K points before the presentation even began. I think this is a really smart move on Bluegreen’s part: rather than thinking about the incentive the entire time and wondering if I’d have to argue about it at the tail end of the presentation, they led by holding up their end of the bargain. It’s smart and it impressed me. They certainly started off on the right foot.

After completing check-in for the presentation, our salesperson introduced himself, told us to help ourselves to coffee or fountain soft drinks and then led us into a little room with theater-style seating where the opener would give the main presentation. We’d meet with him again after the opening presentation.

The opening salesperson gave a presentation that I thought was quite good. She was warm and enthusiastic and relatively funny and seemed honest enough about knowing that many of us didn’t intend to buy. She assured us that it would be a soft offer without pressure to buy and I can confirm that she was honest about that part. Some of the Bluegreen Vacations properties she highlighted looked pretty awesome. I’m particularly interested in checking out Big Cedar Lodge now.

I should note that they bill this as not being a timeshare presentation but rather vacation ownership, which is the same terminology I heard about a decade ago. They explain that you’re not buying a week at the same place each year but rather you’re buying Bluegreen points (not to be confused with Choice Privileges points). It’s the same overall concept: you pay a bunch up front and then an annual ongoing maintenance fee, but I guess they are billing it as being highly flexible, where you can travel to any of their resorts, whereas the old traditional timeshare deal was for a specific place for a specific week that you could maybe trade. I don’t know if anybody still sells that format as my understanding of the programs from Wyndham, Hilton, and Marriott is that they work the same as this Bluegreen deal.

In essence, you buy a subscription to a certain number of points (again, these are points with Bluegreen, not to be confused with Choice Privileges points) annually and then the cost of various properties varies from one to another and season to season. The opener had held up what looked like a phone book full of properties and their price points and she gave some examples.

As expected, some of the math they use to sell you on the reasons to buy a timeshare vacation ownership makes me appreciate my high school math teachers, because it doesn’t really add up the way that they explain it. For instance, they calculate how much money you’ll spend over the next 20 or 30 years on hotels and how much prices will go up during that time so that you have this big inflation-adjusted number in mind as to how much you’ll spend over the next couple of decades and then suggest that you could spend far less than that big inflation-adjusted number now to lock in your vacations, conveniently leaving out the fact that you’re giving up today’s dollars, which could otherwise grow over 20 or 30 years, and the fact that the interest on the loans they try to sell you means that you’d be spending more than the big inflation-adjusted number you started with if you actually financed through them.

They also almost completely dismissed the annual maintenance fee with the explanation that the guest is paying for maintenance and taxes whether you “rent” (stay at a hotel) or “own” (buy vacation ownership)….except that those things are included in the hotel price examples and not included in the cost of “vacation ownership”. I actually still don’t know how much the annual maintenance fee is on Bluegreen because they don’t explain it up-front anywhere except to say that you’ll pay those costs no matter where you stay.

Those tactics are par for the course. I wouldn’t have expected differently, it just makes me feel for the folks who don’t have the full picture in mind when they go to these presentations.

Still, despite some of the expected sales tactics, I’d say that the opening presentation was good overall, except….

The problem was that the opener went way. too. long. Her part of the presentation ran an hour and 40 minutes. That was unfortunate because our kids started running low on patience with sitting in the same seat by that point (there was supposed to be a kids’ club, but nobody seemed to know what we were talking about even when we pointed at the door that had a “kids club” sign on it). More importantly, it didn’t leave our sales guy a fair shot at doing his job because we went in with the expectation that we were attending a 2hr presentation.

Our salesman was friendly enough, but he spent way too long making small talk and asking about how we travel (and I think being genuinely amazed at how we travel with points). He was only 24 years old and I think he just didn’t know what angle to try to take and we puttered around on that for too long. By the time I realized that we had to go take a property tour, it was already almost 1:30pm. I legitimately wanted to get to the prices to see what they were offering, but by the time we got there it had been nearly 3 hours since the presentation began (plus the 20min early arrival) and my kids were beyond done and I was pretty checked out. I will say that the Orlando property (or at least the rooms they showed us, which were surely decked out like a model home) is quite nice. I’d definitely consider staying there in the future. A 1-bedroom or sometimes even a 2-bedroom condo goes for 30K Choice Privileges points per night, which can be a good deal depending on cash rates.

They explained that the cost of their properties will never change (of course, the cost of the new properties they build 10 years from now will probably double along with everything else, but we didn’t need to get into all that). The cheapest package, which included 10K points per year (which would basically get you about a week at some of the example resorts they highlighted, more at some and less at others) was $40,000….though they cut $5K off the price immediately. At that point, we were 3hrs into things and I wasn’t interested in negotiating to see how low they would go (for the sake of science). They asked how much I wanted to pay. I told them that the time to be discussing that was an hour and a half ago and that at that point we were well beyond the promised 2hrs. They only pushed back very lightly as I think it was clear that we were done.

The manager did come back over before we left with an offer to buy 24,000 points for $3,000. Given the examples they used in the presentation and our ability to plan travel around place and price, that was actually probably a good enough deal (and maybe I could have negotiated it further). However, to know whether that was a good deal, I’d have needed to have looked at the book for the resorts and pricing and asked more questions — I envisioned that I’d probably need 45 minutes to know whether or not that would make sense and we didn’t have another 45 minutes in us. If the opener had gone an hour and our guy had taken us on a tour and did his thing for 40 minutes, we could have gotten to the nitty gritty with enough time to maybe have made a deal on that “final offer” package (we almost surely wouldn’t have bought into the vacation ownership program since we can travel far more extensively and far far far far far far far more cheaply thanks to credit card rewards). But they just ran far too slow.

To be clear, my Bluegreen Vacations presentation wasn’t a bad experience. I’d still recommend doing it, I’d just recommend being firmer than I was on the time limit. Had I been clear after the opener that we had 20 minutes left and had to cut right to the chase, it might have been more productive. I didn’t really want to artificially push things along because I was curious about their process, but in hindsight I wish I had pushed.

A small pot-sweetener

There ended up being a small pot-sweetener that I had hoped for but wasn’t sure about. As noted near the beginning of this post, Bluegreen offered a stay at the Bluegreen Vacations property and 40K points or a 3-night stay at a hotel that came with 80K points. The hotel options included Marriott and Hilton properties, so I took them up on the hotel offer and stayed at a Residence Inn. I did that intentionally: Marriott’s current promotion doubles elite nights and adds 1K bonus points per night. Obviously I couldn’t expect to get those earnings when booking through a third party, but if I could get lucky enough to earn 6 elite nights and a few thousand Marriott points, that would be great.

The booking process for my hotel happened in a couple of steps.

Backing up to the very beginning of this deal, I had called the phone number listed under The Offer above and paid $279 exactly for the package with 3 nights of hotel and 80K points (I would owe about $40 in taxes at the hotel). That initial call was just with a salesperson who sells that package — they don’t actually book the hotel stay. They gave me a phone number to call to book the hotel portion. However, I was able to lock in a check-in date over the phone with that first sales rep if I wanted to (and I did). That worked out because, since I had a check-in date, Bluegreen automatically assigned me a hotel. They follow up with an email and call telling you that you must call them back to confirm it.

Bluegreen automatically assigned me a Residence Inn (which is a Marriott property). I called to see if I could switch to a “better” Marriott property, but there wasn’t a better option within the Marriott chain. The best two hotel choices offered were a Hilton Garden Inn or the Residence Inn Orlando Convention Center.

When I called the number to confirm the hotel reservation, I asked the rep if they had a confirmation number for my hotel stay. The agent was happy to provide that.

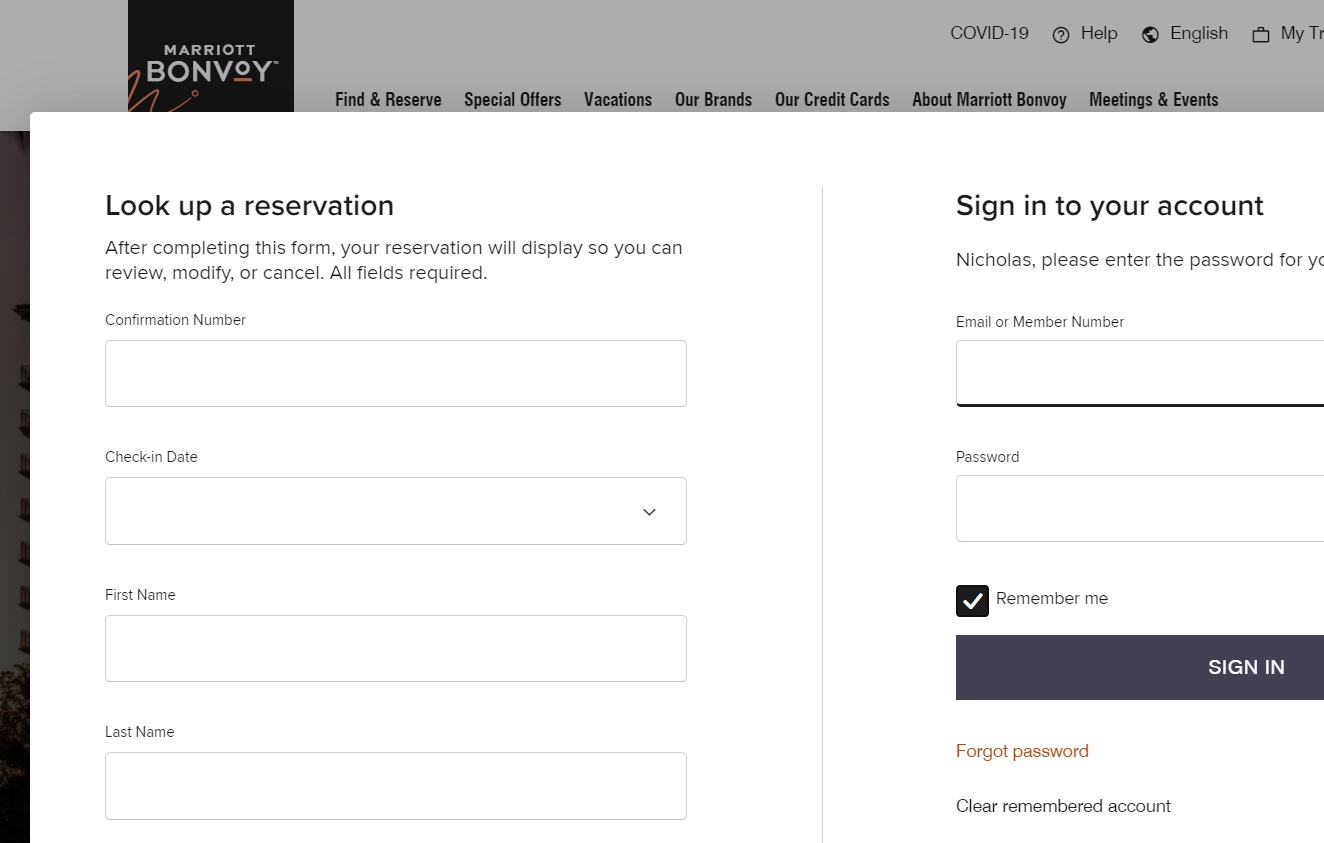

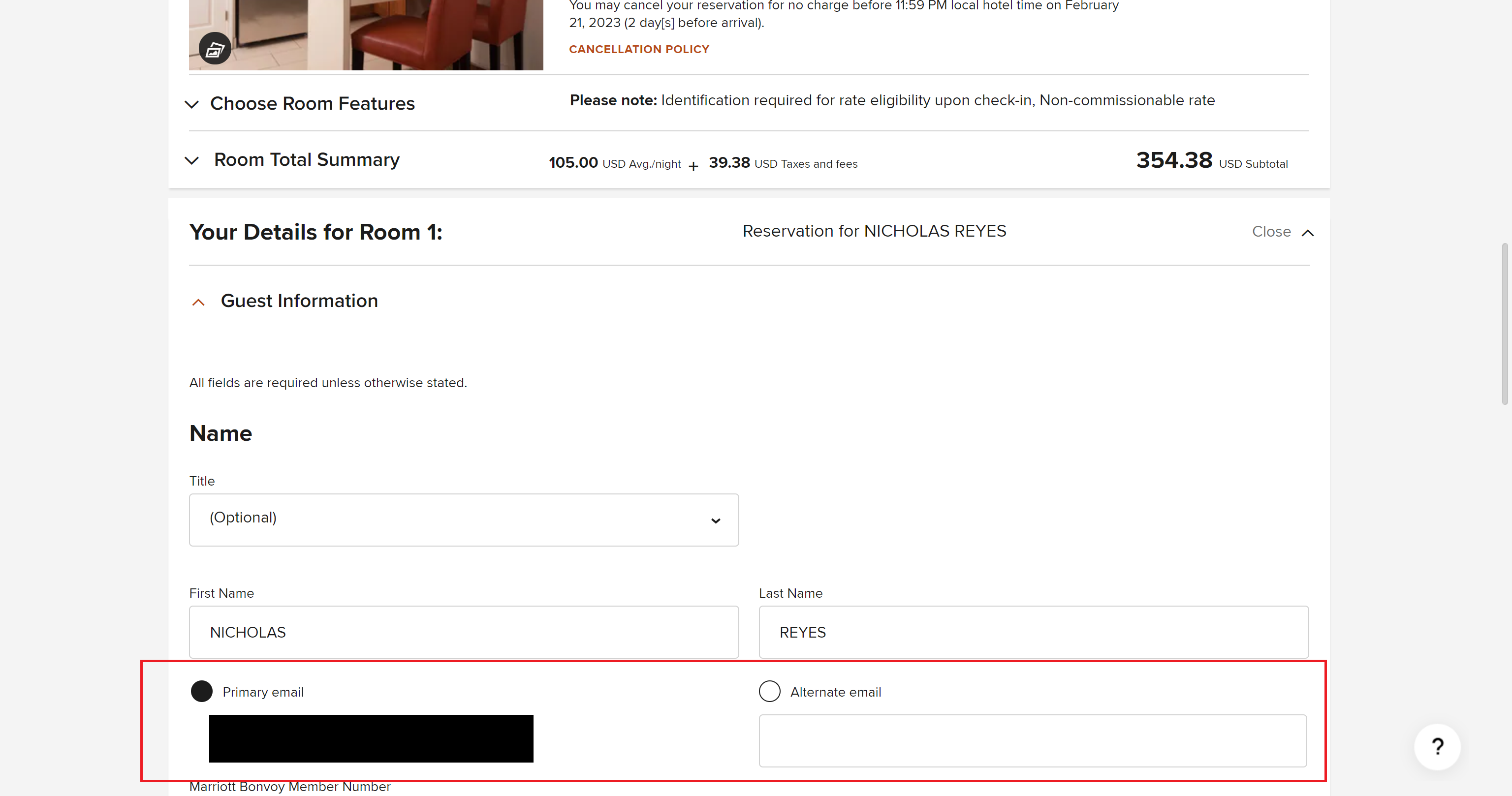

From there, I went to Marriott.com and pulled up the reservation by going to “My Trips” and then “Look up a reservation” using the confirmation number, name, and check-in date.

The reservation came up and had my name on it, but a billing address and payment method associated with Bluegreen. I tried entering my Marriott Bonvoy number, but I got an error message every time I tried to save it.

Here’s what worked to fix that: the email address field was associated with an “alternate email” line that was blank. I was able to select “primary email” with my primary email address and save that on the reservation — and then I was able to add my Bonvoy number and save it successfully.

Once I got my Marriott number on the reservation, I saw it immediately under “My Trips” in the Marriott app.

From there, the short version of the story is that I received elite benefits on check in, I earned 6 elite nights (my three nights got doubled as part of the current Marriott promotion), and I earned both points on the nightly rate that Bluegreen paid and the 1K bonus points per night (for a total of more than 6,000 Marriott Bonvoy points).

In the end, for $279 + $40 in tax, I got 3 nights that I needed in a hotel anyway, 80K Choice Privileges points, a $25 Amex gift card, 6 Marriott elite nights, and more than 6,000 Marriott points. I’d call that a win that was certainly worth the time spent hearing them out (even if they went far too long). My kids might disagree, but they don’t have much room to complain.

Bottom line

I think a Bluegreen Vacations package isn’t worth the money if you play the points and miles game, but as long as they are offering such a good incentive package, it might be worth taking them up on the chance to hear them out. I’d recommend being a bit firmer on the promised time commitment if you’ll get impatient with the drawn-out sales routine, but they were true to their word on not being pushy or rude or applying a lot of pressure. The timeshare / vacation ownership lifestyle isn’t for me since I am happy to pour time and energy into credit cards and hotel points and award travel, but I could imagine vacation ownership working out for some people. Of course, if that were the case for me, I also know that these things can often be purchased on the secondary market for pennies on the dollar since many people get into them without realizing the cost of payments (if they finance) and the ongoing maintenance fees. I didn’t specifically look for those types of opportunities with Bluegreen because, again, I travel more often and more comfortably using miles and points and I wouldn’t want to pay a large sum to lock myself into a single program that may or may not fit my needs 5 or 10 or 25 years from now. I didn’t think that they would convince me otherwise, and they didn’t, but I was certainly willing to listen given the great incentives they are currently offering.

I found that if I wait for the 60% bonus points, I can buy 100,000 choice points and get 160,000 for the 100k price, with my hotels averaging 12-14,000 pts per night I get around 12-14 nights with no added taxes or fees & it’s cheaper than bg timeshare or paying for a choice room at time of booking. I have gone to bluegreen presentations twice for the freebies but otherwise stay away

Terrible company! I booked the deal and was told I could change in 14 days, however they did not disclose that not showing up would result in a $200 penalty. I am done staying in choice hotels for their relationship with this company. I was hospitalized and unable to go.

Heres the question. After the agreed amount of time say 2 hours can I just walk out and not be charged the additional fee. Seems like they are not efficient with their time. We stayed 3 hours after getting to the point of saying constantly we are done over and over like a record. We said you are out of time repeatedly and we would like our gift now but feel like they were holding it over our head and almost a prisoner with it.

I called on this. It’s an “expired promotion” but I got the “last spot” available. The offers started out bad, but eventually was offered 60K for a nonresort option (there were 20 possibilities). Cost was $199 and $25 gift card if set dates within 30 days.

Wow, what a great detailed report on the Bluegreen experience! I found this post after I ended up getting a Getaway Vacation from Bluegreen on a redirected call from Choice Hotels. It’s a 3-night package for $250 with a $275 Amex gift card or 60k points. I now have a full appreciation of the sales pitch waiting for us. We went through a long sales pitch for a time-share in Key West 30 years ago. I want to spare my wife from this pitch and tell the salespeople she is too sick to attend if it is asked. Will this risk the benefit? Nick got the points sent before the sales pitch even began so it does not appear to be a benefit risk.

This was a great write-up, Nick. Thanks!

I signed up for the Wyndham offer in Vegas where one of the hotels they use is the Hyatt Place. I was hoping to be able to replicate your success at getting the stay to count under my own reward account in connection with Hyatt’s current promotion, but I asked two different reps for a confirmation number and both told me there is no separate number. In addition, the confirmation email I received from them has a room description that mentions Wyndham, so I’m guessing it’s booked under their corporate code/special rate. I’ll try adding my Hyatt number by phone or at the desk, but I’m not holding out much hope. In any event, I was able to get a rate of only $149, rather than their advertised $199, plus 30k Wyndham points, so I can’t complain too much.

One of these just landed in my inbox. The deal seems pretty solid, but I need to read the fine print to see if it’s limited to Spring which is in the headline.

3 NIGHTS FOR $279*

+ 30,000 Points** + $150 American Express® Gift Card

After years of this nonsense, I’m kind of amazed that vacation timeshares even exist. Doesn’t everyone know by now that buying one from these sales presentations is a horrific deal? How could there be enough suckers left?

I still haven’t gotten around to one of these but I think this 80k offer might finally get me to do it. Choice points are super useful for me but hard to come by.

I can’t wait to talk to these people and explain how I either pay almost nothing using points/miles, or I legit sleep on the ground (with my ultralight backpacking gear) and hitch-hike when thru-hiking

Hey Nick, great opportunity here!

We’re in the same boat as you, where we need a place to stay anyway (Smoky Mountains area) as we have travel booked before and after and can cancel something to jump on this lucrative opportunity (and possibly double dip with the Marriott promo!). However, before we commit we would like to confirm our very narrow window of location and dates will work.

Would you happen to have the phone number they gave you to call the ‘reservation department’ and book the hotel portion? To be clear, we’re not trying to circumvent the sales department, we just want to make sure they do indeed have availability and that an overzealous sales person isn’t just telling us what we want to hear. 🙂

Thank you for your help!

I do. It was 1-855-612-5203. That said, the person with whom I spoke first (when I bought the $279 package) was able to confirm availability for my desired check-in date and nail that down before I purchased (then my hotel got automatically assigned shortly after the call). Of course, like you said, I don’t know that she actually checked anything and wasn’t just telling me what I wanted to hear though.

Thank you so much, we really appreciate it!

The property in Surfside FL (next to the collapse) is really fun

I am doing this same offer. IMO it’s worth it for the Choice points and you get a slightly discounted stay for 2+ ish hours of your time. Should be interesting. I do own a Disney Timeshare which for me has actually been a very good use of money.

So if they give you the IHG points before the presentation what’s stopping you from leaving at the 2 hour mark? Not like they can hold you against your will as you’re fulfilled their requirement.

Oh, the irony of this post and its timing. 45minutes before this article email I received an email from the title company that handles Bluegreen ownership because I’m desperately trying to get my wife’s mom out of this scam trap.

4 years ago my wife’s mom bought a Bluegreen timeshare for $25k and financed the entire amount for a total payment of $37k over the 10-12 year term due to the horribly high interest fees. Also, she has to pay like $1,200 a year for maintenance fees, an amount that goes up 5%+ every year like clockwork. And if the property ever needs maintenance or repair, and it always does, there are special assessments of varying amounts that you’re required to pay. If she wants to exchange her timeshare for another location she needs to pay a per-occasion fee plus a yearly membership fee for the privilege.

Once you’ve passed the 3-15 rescission (cool off that depends per state) period you’re locked in for at least the loan term, but likely for life. Bluegreen will never release you form your loan, because that’s money you are legally obligated to pay them till the loan is paid off. It’s like a mini-mortgage, but you own nothing and have absolutely no equity in anything. It is not an investment or an asset. It is a money pit. It’s why ebay/Facebook/Craigslist is full of people trying to sell their fully paid off timeshare for $1 or free just to get out of the ever increasing monthly/yearly fees. If you stop paying the fees or the loan payments it will go to collection and your credit will be destroyed like any other loan default. The loan, yearly fees, monthly fees, etc will all go to collections and will make your life miserable.

If you can do basic math you can see how paying $6k/year (at the $25k price. I can only imagine how crushing the payments would be for a $35k timeshare) for 7 days is an absolute ripoff and total scam. You could take that money and go anywhere worldwide, split it up, whatever. Use the money for other expenses in your life, etc. That’s $857/night and will go up every year. INSANE that anyone in their right mind would ever commit to something so foolish.

These companies usually prey on older folks who can’t even afford a timeshare in the first place, as the vast, vast majority of older Americans have $0 retirement saved at all and will have much less income in retirement. Being saddled with this debt is such a burden. Don’t fall for this trap and definitely don’t buy a time share, points, whatever scam they’re pedaling past the initial vacation if you can sit through a presentation. The only way to get out is to pay off the entire loan and do a dee back and hope Bluegreen takes it back, but they are allowed to refuse and then you’re on the hook forever. You can sell it or give it away, but then whoever assumes ownership is now trapped. The best thing to do is not to buy in the first place. I never write this much. That’s how much I want people to not get trapped by these sleazeballs.

After doing a ton of research there’s basically nothing we can do until the loan is paid off. So after lighting another $15k on fire we can then try to get out of it. At least if we pay the rest in a lump sum we’d avoid another $4k in interest fees. Not sure if Bluegreen will even allow this. More money for them is they don’t of course.

Bluegreen offers a deed back program. You can begin the process at responsibleexit.com. This is the cheapest and least hassle method to get out if you already own and are current on all your payments/fees owed. Good luck.