Earning miles, points, and cash back from home is an attractive option whether you’re avoiding contracting and spreading a virus or you simply prefer to avoid malls and Walmart stores. Regular readers of this blog know that earning rewards through credit card signups is an easy home based option. Most welcome offers, though, require meeting minimum spend requirements. For example, you may have to spend $5,000 in three months in order to qualify for a big new-card bonus. Getting this done from home can be a challenge.

Obviously, you can shop from home and buy more than usual in order to increase credit card spend, but this post is about finding ways to increase credit card spend without emptying your bank account. For example, bills that you usually pay by check may be payable with a credit card. And sometimes there are methods to spend money via credit card and get the money back in cash or as payment towards your credit card bill.

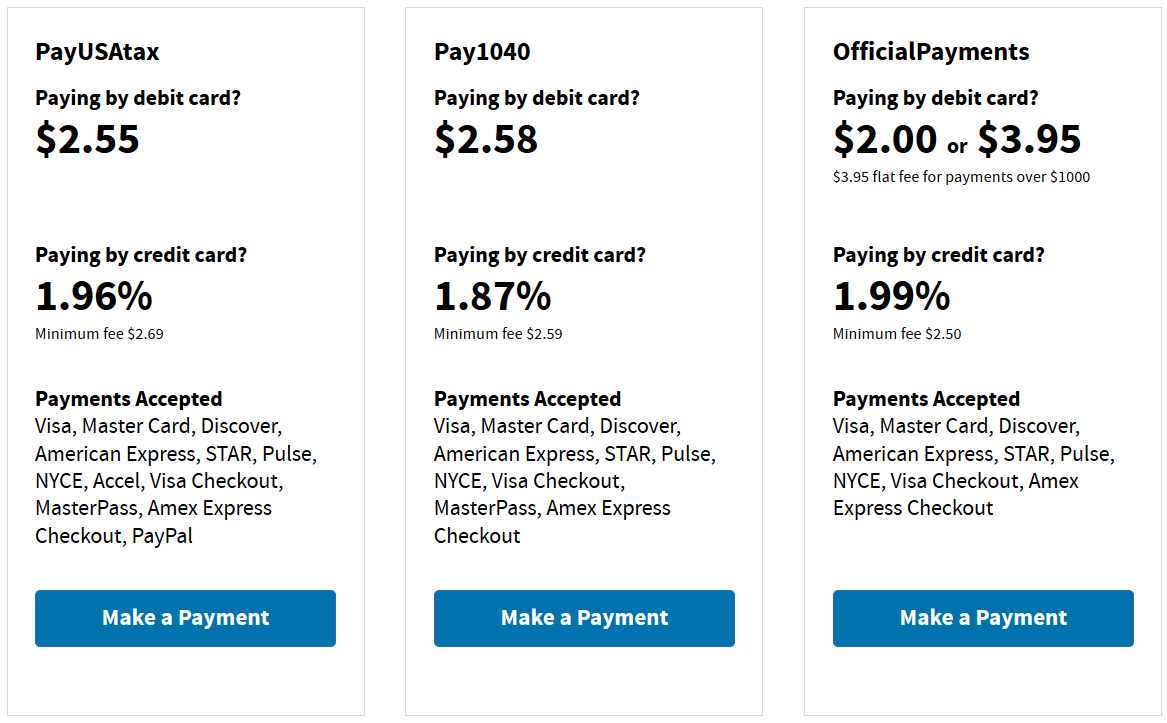

Pay federal taxes

If you don’t mind giving the US government a loan, you can use a credit card to pay your year-end and/or quarterly estimated taxes. Fees start at 1.96%. For full details, please see: Complete guide to paying taxes via credit card, debit card, or gift card.

Pay bills with Plastiq

Most bills that can’t usually be paid by credit card can be paid by credit card with the Plastiq bill pay service. Plastiq charges a 2.85% fee to pay by credit card. There are some limits as to what bills can be paid though. For example, you can’t use Plastiq to pay credit card bills. And in some cases there are limits to what bills can be paid with what cards. For example if you want to pay your mortgage, you can use Mastercard or Discover cards, but you can’t use Visa or Amex.

For full details, see: Complete Guide to Plastiq bill payments. Also see: Best credit cards for Plastiq bill payments.

Fund a new bank account

Many banks allow you to fund new bank accounts with a credit card. Options are very limited with nationwide banks, but some small banks and credit unions still allow funding new accounts with up to a few thousand dollars by credit card. Read this Doctor of Credit post for details showing which banks allow this and how to avoid cash advance fees.

Contribute to Kiva loans

Use a credit card to make micro-loans. Most loans pay back in 6 to 12 months, but with no interest. There is no charge to use a credit card to fund loans. Kiva provides filters which can be used to filter out risky loans. As a result, in my experience it is easy to limit loan defaults to far less than 2%. For more details, see: Manufacture Spend (and do good) with Kiva and Kivalens. Yes, I’ve written that defaults are higher than I’d like (see this post), but I still firmly believe that Kiva does a lot of good in the world (see this post).

Invest in small businesses with Kickfurther

Kickfurther is a platform that helps businesses find funding to support big purchase orders. For example, a business may have a purchase order to from a national retailer, but they don’t have enough money in-hand to pay for the production and delivery of the product to that retailer. Via Kickfurther, a company like this can list “consignment opportunities”. The basic idea is that individuals can “buy” items on consignment to be sold via the aforementioned purchase order. Each consignment opportunity includes expected duration (how long until you get paid back) and expected profit. You can invest by credit card with no fee, but keep in mind that Kickfurther charges a 1.5% fee to withdraw earned cash to a bank account.

If Kickfurther sounds too good to be true, keep in mind that you can easily lose some or all of each investment. I’ve personally lost quite a bit on Kickfurther based on how they operated when they first launched. Since then, they’ve made huge improvements that make investments safer for buyers. But, of course, there’s still no guarantee that you won’t lose money. If you’re curious enough to try Kickfurther anyway, consider using my referral link in order to get $10 free to invest (I don’t profit from this other than earning keys which give me early access to consignments).

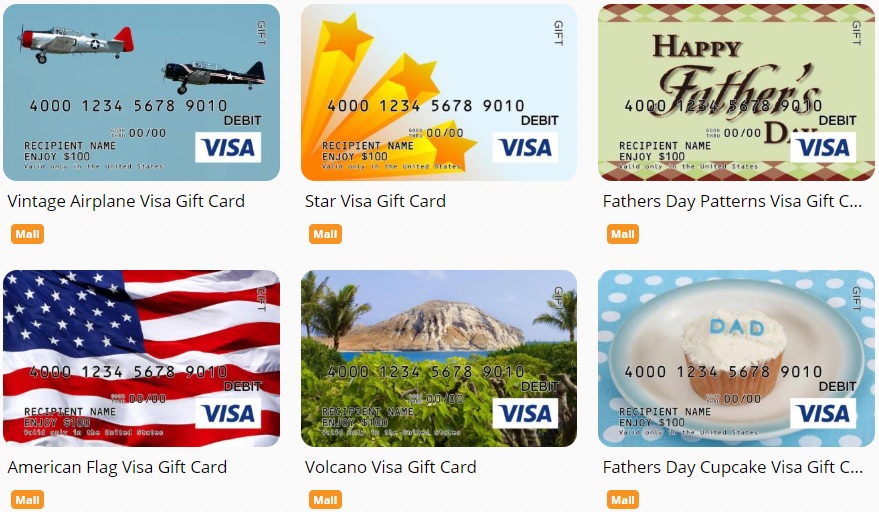

Buy Visa gift cards online

There aren’t many ways to cheaply liquidate Visa gift cards online, but if you have an option to do so then buying and liquidating gift cards can be a very easy way to increase spend from home. For others it may simply be a good way to “time shift” spend. For example, if you need to meet minimum spend requirements for a new credit card, you could complete the spend all at once by buying Visa gift cards and then spend down those gift cards at your leisure.

See: Best options for buying Visa and MasterCard gift cards.

Buy / sell merchandise

One option for increasing credit card spend is to buy items at a steep discount and resell them. By stacking gift card deals with portal rewards, coupons, sales, and retailer rewards it’s sometimes possible to not only increase credit card spend but also earn a nice profit.

There’s a steep learning curve for doing this right, and many things can go wrong, but there’s also an almost unlimited potential for increasing credit card spend and earning profits. See: Increasing spend through reselling.

If you go this route, please, please, please do not try to take advantage of emergency situations. Profiteering like that guy with the hand sanitizers is just wrong. Don’t do it.

[…] 翻攝自frequentmiler。 綜合媒體報導,台北市刑大上個月,在一場狼人殺聚會現場逮捕一名寸姓男子,原因是他經常參加各種網路揪團的桌遊活動,並趁著被害認不注意的時候,偷走信用卡盜刷,再變賣贓物換現金,目前以此方式得手50萬元。 […]

[…] How to increase credit card spend from home. […]

[…] Increase Credit Card Spend From Home: While I sit at home daydreaming about my next vacation, I’m also looking for ways to increase my points balance. I’m still staying at home but that doesn’t mean my point earning has to stop. Here are ways to boost your balance. […]

PLEASE STAY AWAY KICKFURTHER !!!

I lost $2,000 to them and they have had no way to protect investors from scam business. Kickfurther even locked my account, not let me warn other investors.

[…] Credit card welcome bonuses usually require high minimum spend. For example, you may need to spend $4,000 in 3 months to earn the bonus. Fortunately there are easy ways to accomplish this from home even if you don’t have $4,000 in credit card payable expenses. Details can be found here: 7 ways to increase credit card spend from home. […]

Yesterday and today, I am unable to pay 2020 ES taxes for April 15 quarter through official payments using a gift card.

It did not go through. I called black hawk network. Seems Official payments is running this as recurring transaction instead of one time payment

Thanks. I updated the “pay taxes” post with info stating that official payments is not currently working for debit gift card payments. https://frequentmiler.com/pay-taxes-via-credit-card/

[…] in a time when most of the United States is under stay-at-home orders? Greg recently wrote about 7 ways to increase spend from home. The truth is that apart from paying taxes, your options are limited today. Don’t buy these […]

[…] Others cards to consider now: If you need cash in the short term, the Chase Ink cards are good choices, but you can find many more options here: Best cash back credit card offers. Also see this post for ideas for how to meet minimum spend requirements: 7 ways to increase credit card spend from home. […]

[…] Meeting spend requirements can be a challenge at any time, but these days when many are stuck at home it can be much harder. Fortunately, there are a number of relatively easy tricks to help get it done. Please see this post for details: 7 ways to increase credit card spend from home. […]

1. Prepay monthly bills to get the sign up bonuses. You get it back from no payments for many months. 2. If you live somewhere Walmart or others will sell money orders from gift cards, get the sign up bonuses by buying $500 gift cards, then buying money orders, and depositing the MOs into your bank account to pay off the purchases. 3. Your $5,000 was a bad example. Most require $500 purchases in first 3 months to get $150 bonus.

Jerry, you’re on the wrong page if you’re just looking at $150 sign-up bonuses. Greg did specify “a big new-card bonus”. The value there is usually $500 – $1000 or more.

Yeah Jerry, those were the offers 5 years ago…today the banks have many offers that want 3-5k spend and some tiered offers for big points that want 10K++….I might be jaded but I wouldn’t lick a stamp for $150 bonus anymore…you can get $600 just for opening a checking and savings account (if you aren’t too lazy to set up your direct deposit.)

How about this for a new number 3: Cruise line gift cards…until they started cancelling them left and right my play was to go to Krogers, earn 4X fuel points, buy a few $500 gift cards for an upcoming cruise, go to casino on ship where they will let you load $1000 at a time, 3-5k a day depending on cruise at no charge (other than playing a few hands or pulls to not be obvious. At the end of the evening go to cage and cash your bank or chips, stick money in safe, the casino charge goes on your ships bill, which you can pay down with gift cards before you get off the ship, without gift cards works well too if the new card your qualifying has a 3X bonus in “travel” category…customs used to make you file forms for 10K+ cash but the last few times they said it wasn’t needed. The ports really had customs streamlined.

Thanks for sharing this fun option for those who like to cruise. Hopefully it will become relevant again in the next few months.

Loved doing this during our cruises, easy points!

Please do your research on Kickfurther before giving them money. There is no mechanism for recourse if those that you fund don’t pay back. Kickfurther hints that it is possible to get your money back through inventory repossession, etc. , but they themselves don’t do anything if things go south. They don’t even seem to even respond when recipients flake. Expect fraud, which is an odd business model. I have lost more than a bit of money to this.

Same here. I also lost some significant amount and would never advise anyone to invest in kickfurther.

I’m new to this points stuff, but I’m very interested in traveling for free. I feel confident I can rack up a good amount of points with welcome bonuses and regular spend, but millions of points?! How do people really do this? Are they travelling a ton or manufacturing that many points? I would just love some more real world examples of people earning and using these points.

I got enough for 4 years Maybe 5 years of air travel in economy with the Way it is Now . Hotels are tough now IF u can’t get 5 nites Free with one card just do the Air .

CHEERs

I’m not sure if Kiva loans are a good idea during the pandemic. I have a feeling that default rates are going to shoot through the roof.

As someone that invested in January, I am already seeing a huge delinquincy rate, well above average. And that, even from the highest rated partner on the platform.

It’s not a great time to be investing in Kiva.

Last month I only got paid back about half of what I was expecting. This month I only got paid back about 15% of what I was expecting.