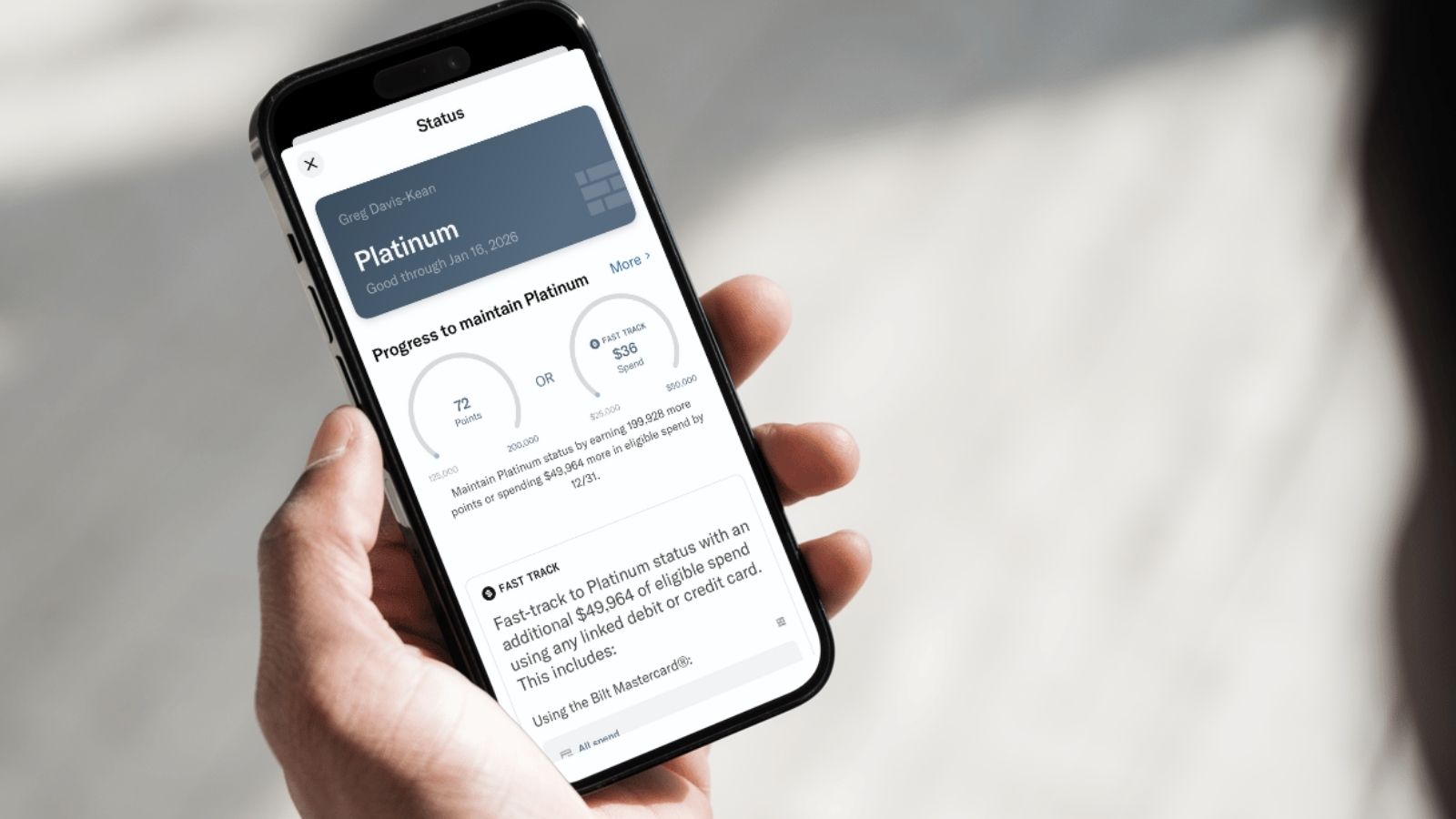

Bilt has an elite program that awards status based on the number of Bilt points you earn in a year. Or, you can fast-track status with spend. Top-tier Platinum status requires $50K spend. A couple of years ago, using the Bilt credit card to spend your way to Platinum status made a lot of sense if you were careful to concentrate that spend on the first of each month. Back then, Bilt doubled all card earnings on the first of each month, up to a maximum of 10,000 bonus points per month. This meant that it was possible to earn at least 2x on all spend and Platinum status by spending $5K on the Bilt card on the first of each month for 10 months. Since Platinum status frequently unlocks 100% transfer bonuses, this was like earning 4x airline miles for all spend. That deal came crashing to earth when Bilt capped Rent Day bonuses at 1,000 bonus points per month in October 2024. Luckily, we learned about this change months in advance, so I was able to increase my Rent Day spend to achieve Platinum status with my September 1st spend. Since then, I’ve ceased almost all spending on my Bilt card.

When I completed $50,000 spend on my Bilt card in 2024, that status was good for the rest of 2024, all of 2025, and (as I recently learned) through January 16th of 2026. I don’t know if I’ll ever get Bilt Platinum status again. Bilt is planning to unveil details of its new credit card lineup next week. Maybe one of those cards will offer an attractive path towards top-tier status? I don’t know. I am interested in earning Platinum status again in the future, especially since the Rakuten shopping portal now offers the option to pay out as Bilt points. I will need at least Silver status long-term to keep full value earnings from Rakuten. And, if Rent Day transfer bonuses keep to form, I’ll need Platinum status to get the best transfer bonuses. So, maybe I’ll be tempted to go for Platinum status, but I’m not at all confident about that. Right now, I assume that my Platinum status will end January 16th, potentially forever.

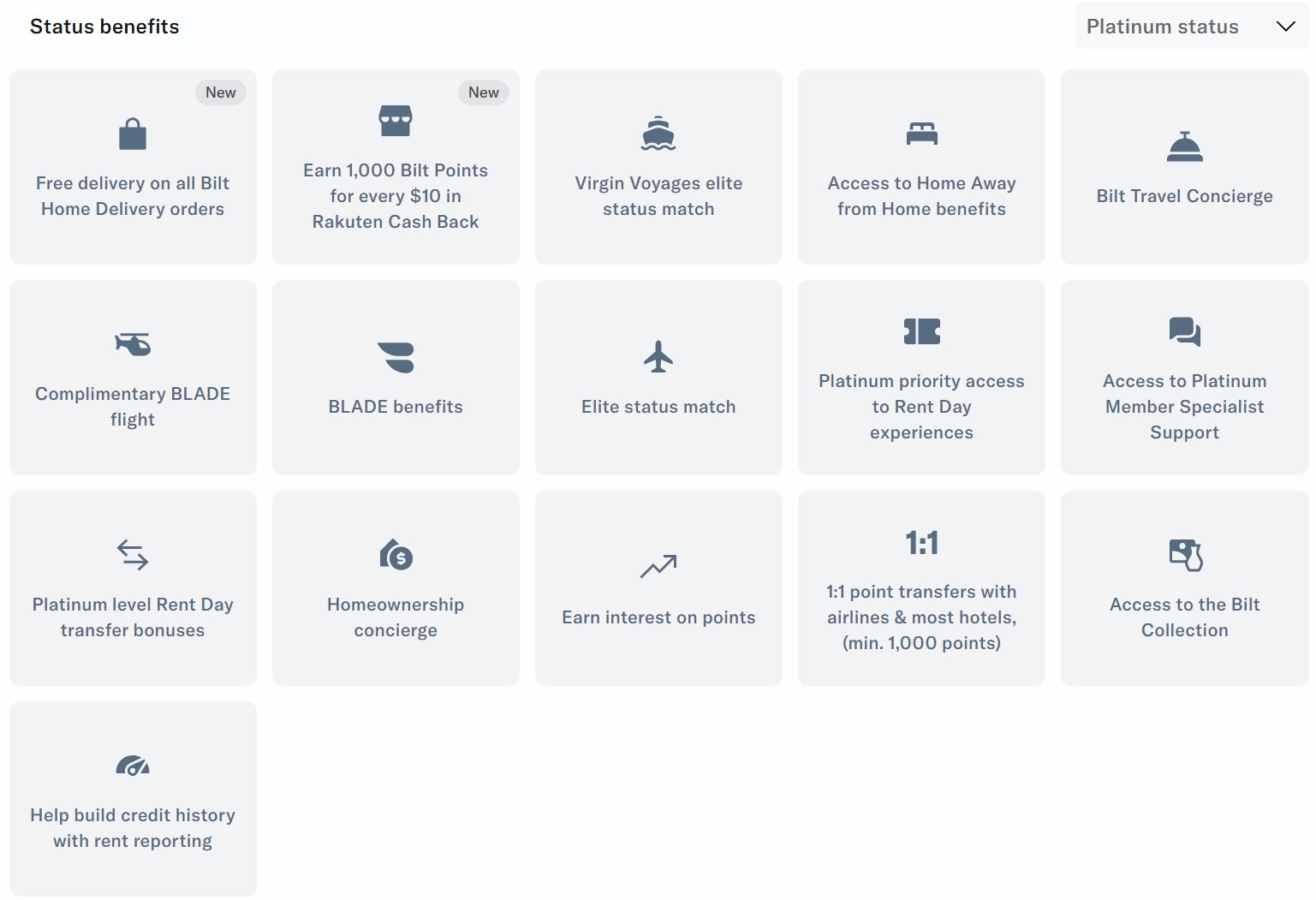

I logged into my account to see if there were any meaningful benefits I could use before it was too late. I tried to book a free BLADE helicopter ride, but it seems that Bilt hasn’t loaded that benefit into my account for 2026 (which seems reasonable). I had already used that benefit in 2024, but I think I had another free ride available in 2025 that went unused. Not a big loss — for the ride to be totally free, you have to limit your bags to 25 pounds or less. That’s not easy when packing for a multiple-day trip, especially when I’m carrying my podcast equipment.

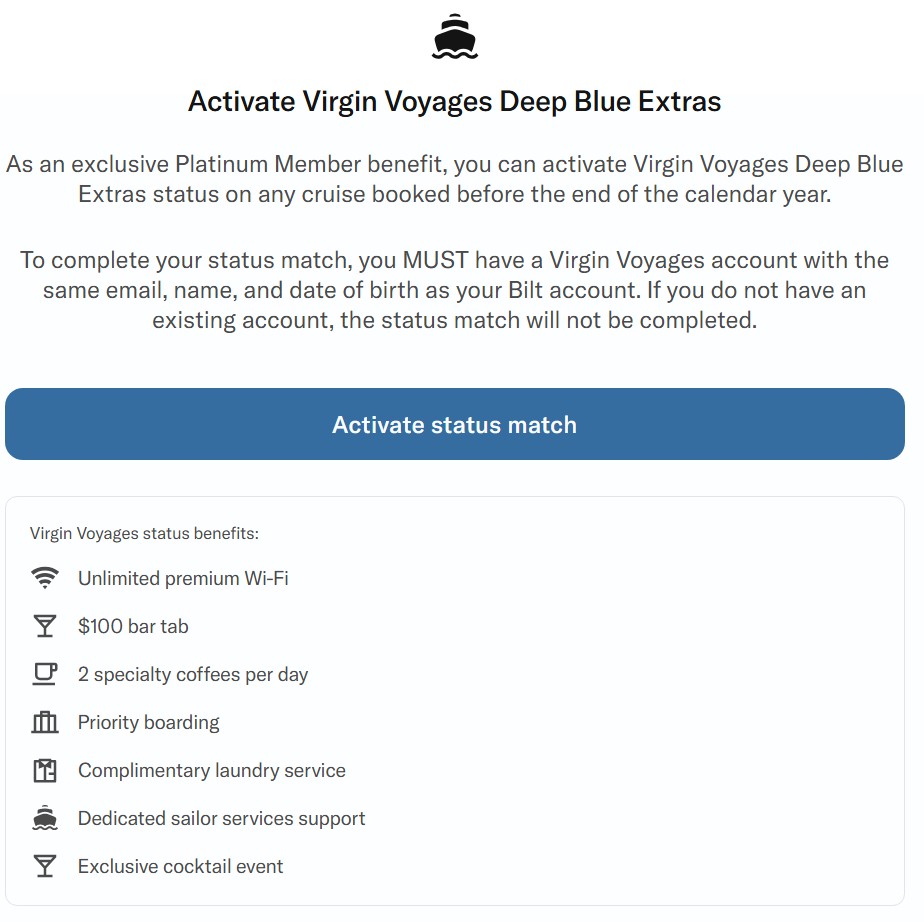

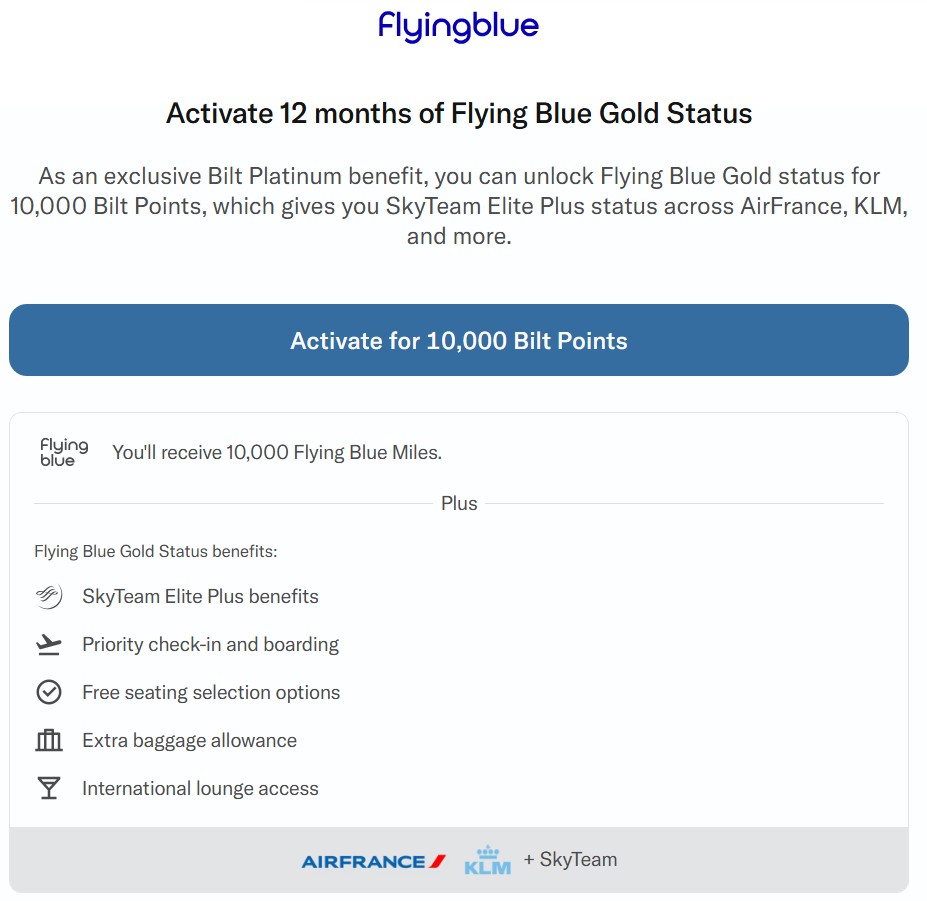

The only other benefits that seemed worth grabbing while they were still available were two status matches: one for Virgin Voyages and the other for Air France/KLM Flying Blue. I activated both. Now I’ll wait to see how long it takes for the status to appear and whether I ever make any use of either status…

I doubt I’ll make any use of Virgin Voyages elite status (I’m not into cruising), but I figured it couldn’t hurt to do the match. I created a Virgin Voyages account and then clicked to activate the status match.

I’m also unlikely to use Flying Blue Gold status: I currently have Delta Diamond status, which gives me some elite benefits when flying Air France or KLM. I don’t think that Flying Blue Gold status will be any better, but I honestly haven’t researched it yet. And, this status match wasn’t free. To activate it, I had to transfer 10,000 Bilt points to Flying Blue. That was indirectly costly: transfer bonuses to Flying Blue are pretty common, so the cost here was the loss of any transfer bonus. Not a big deal, but something.

To summarize, I’m now 10,000 Bilt points poorer and 10,000 Flying Blue points richer. At the end of next week, I’ll lose my Bilt elite status, but I should soon gain status with both Virgin Voyages and Flying Blue. And, I’m waiting to see what the new Bilt cards look like. I hope at least one of them offers a compelling path to spend one’s way to Platinum status. If not, at least I had a good run.

Holy moly… worse than even I thought, if true: https://www.doctorofcredit.com/rumor-full-details-of-upcoming-bilt-cards/

Expect to need to spend 75% of rent to breakeven on their 3% fee… so, for example, if you pay $5000 rent/mortgage, that’s a $150 fee… (no longer waived). You’d need to spend $3,750/mo in non-rent to earn ‘BILT Cash’ to offset. Wow, like using Plastiq but worse!

RIP BILT.

I’m in the camp that thinks the high end card may actually be a really good card if you don’t care about rent/mortgage if the rumors are true. 2% on everything plus 4% in Bilt cash that can be spent 1:1 on hotels plus Bilt gold status and PP (plus the annual hotel credit and Bilt cash plus the SUB). That’s better than Venture X.

The downside is Bilt cash expires at the end of the year so you aren’t gonna want to use it much in November, but the rest of the year that’s a decent catch all card.

It’s a terrible thing for the banana guys, but not sure it’s that bad for those of us who play the game (but I don’t have rent and I always assumed the mortgage points would be costly).

So, the main benefit of BILT (earning 1 point per dollar of rent) would basically be gone (unless you spend excessively on non-rent to breakeven)…

You claim to ‘play the game’ and are celebrating yet another $500 AF travel card… Ok, fine, maybe for the SUB, to churn and burn, close in 12 months. But, as for a keeper card. Oof. No. I don’t need an 8th Priority Pass membership. And all that doesn’t bode well for BILT’s underlying business (like, folks are gonna ‘use’ them, then ditch.)

What’s this about bananas?

Celebrating is definitely the wrong word, but considering it strongly, yes. Mostly to keep the Rakuten 1:1 transfer (at 100,000+ Rakuten points per year that’s much more valuable at Hyatt than Amex). Do I think it’s a slam dunk, not sure. It really depends on how Bilt cash will work and how easy it is to use.

For me, whether this card makes sense over Venture X entirely turns on how Bilt cash works and how easy it is to use for hotel bookings. If it’s as easy as Citi or CapOne’s credits, I am in and will probably abandon the CapOne ecosystem.

But free points for rent is probably gone. And given the economics for WF, it probably had to be. That’s not me being an apologist for Bilt. The economics of free points for rent never made any sense to me. I’m sorry for those this will hurt, but not surprised.

Bilt will still make money on the landlord side of the ACH transactions. I don’t think they care about losing the renter side cause the renter side was actually costing them money.

How long do you think that Rakutan arrangement will last? Seems temporary. I agree, it’s a nice sugar high, for now.

BILT does have better transfers than Amex. Facts. Hope those last, too. Losing AA wasn’t ‘great’ but at least Citi has them back.

I wish C1 would approve me for VX, but, LOL/24 is not in their algorithm…

Thank you for finally recognizing that the original business model was unsustainable without a backer (like WF) willing to foot the bill. I wish WF was dumb enough to continue.

My guess is that the Rakuten arrangement may last depending on the economics. Rakuten is almost certainly paying Bilt something (my guess is 75% of a cent per point, which is why those without Bilt status will only get half a Bilt point per Rakuten point after May). Rakuten still makes money (actually cheaper for them than paying out 1 cent per point) and Bilt gets cash flow and an incentive for people to get a Bilt card and spend on it or to otherwise spend money within the Bilt ecosystem. If people don’t get Bilt status, Bilt probably breaks even at .75 cents per half a point, and if people do get Bilt status, Bilt will make money through the activities that earn the status.

But only time will tell. If I am wrong and the transfers from Rakuten end, then I will have to reevaluate. Also, if using Bilt cash is terribly difficult, I will have to reevaluate.

I have never denied that something would have to change with the credit card. If you see my comments below, you will see that I acknowledged that the rent points for free on the credit card was a money loser (just not a money loser for Bilt – a money loser for WF who agreed to the dumb deal), and that I expected a change to that with Bilt 2.0. Ironically, I even thought we would get the details today (forgetting that the actual release date is supposed to be next week).

If that’s true, then I really have no incentive to use the Bilt card versus any other card, except for the transfer partners. Which is still an argument for Bilt, thanks to partners like Hyatt and Alaska, but the incentive has gone down dramatically, especially if I can get a huge SUB.

Speaking of Alaska, I’d like to know specifically whether the Atmos Summit card is gonna have the 3% fee waived in 2.0, because if it still does, then it’s the real winner here.

One bad sign…BILT went with Cardless. They must have been forced to do this due to an absence of similar terms from major issuers. Cardless has the weakest IT platform and, until 2025, could not handle more than one card per holder <>!

For real. Those in-the-know haven’t forgotten Cardless’s no-notice shutdown of the Celtic’s card.

The web site omitted a word I put in angle brackets. It was “lifetime” . Significant. Having had a “Penguins” card I could not get a Qatar, TAP, or Avianca card. They ignored requests for the reason. I wrote to the CEOs of these companies explaining how Cardless’s policies completely undermined their card programs. That got answers. Cardless told me that IT weaknesses accounted for the policy but it would be rectified “as a priority”. Six months later it became possible to get a Cardless card, but only one at a time. Hopefully they can handle more now, but this episode indicates to me that the company is not ready for primetime.

Oof. Not a good sign. At all.

“Since then, I’ve ceased almost all spending on my Bilt card.” Link Strata Elite to BILT and use it Fri. or Sat. evenings at any restaurant to stack. Get 9x points (6x Citi TYP, 3x BILT). On Rent Day this goes to 12x (6x on each) at BILT restaurants.

L3, but, do recall Rent Day bonus points now only up to 1,000 total, so, much more limited than it used to be… and they got rid of Trivia! What!?!

Yes. And likely to get worse with the issuer changeover.

100%. Ankur’s goons (see below) will try to have us believing otherwise, but, we all should know better. 2.0 is gonna be a major nerf at best; possibly catastrophic.

This isn’t right. Only Bilt card spend gets doubled, not the +3 Bilt Neighborhood Dining spend. So you would only get 9x total points if the restaurant is on Bilt Dining (not “any restaurant”) and even on Rent Day it would still just be 9x.

“Only Bilt card spend gets doubled,” Correct. But you get 9x at a BILT neighborhood restaurant (6x TYP + 3 BILT) paying with the Citi Strata Elite card.

Really shocked you haven’t considered FB gold since it provides an easy path to FB platinum, which has all sort of fantastic benefits like being able to book La premiere with points, and now expanded biz availability too

Actually, that was one of the reasons I chose to go for Gold: in case I decide to stretch for Platinum, it will be helpful. That said, when I’ve looked into what it requires to get Platinum status in the past, I’ve always come to the conclusion that it’s not worth it for me.

basically: sign up for AF card = 100xp, for remaining 200xp, can do mix of cheap intra-europe biz class with connection, so LHR-CDG-FRA RT in J equals 60xp. Then you can buy buy the remaining xp for 10 euros per xp with sustainable fuel donation. essentially credit card plus like $3000 for Platinum. it’s pricey but I think its safe to say you guys have gone to much greater lengths in the past for a good flight review/experience. plus the status would last 12 months and then right before it expires you can still book for the next 11/12 months so almost 2 years really to enjoy it

You can fly Det to Toronto in first class on Delta crediting your FB account. It’s an easy 50XP roundtrip. I’m using my Biz Plat to book with points with the 35% rebate for a trip to Toronto in June.

https://xpcalculator.app/?route=DET-YTZ-DET

I just grabbed FlyingBlue Gold myself from Bilt too. I’m going to add the BofA Flying Blue Card for an additional 100XP after spending $15k with the SUB offer. I’ve read on Flier Talk that you can hold multiple FB cards to add additional XP earnings.

greg,

i did my status match a few days after you. Tempted to get the new airfrance card and put 25k on it- which seems like it will get me in spitting distance of platinum- not sure how the timing of the bonuses will work out though- may all be after the 12 months I have to get to 280. any thoughts?

Yeah, I think that will work. I’m looking to do the same now that the card will let us earn so many XPs

Are you hearing if many are interested in keeping the Autograph card even if they get the new Bilt card?

3x on cell phones and the $600 protection isn’t a bad benefit of that no-fee Autograph card. I wish WF had actual transfer partners. Honestly, I wish WF was keeping BILT, but I understand they were losing big on it. Now, with them leaving, we BILT card holders likely lose… *incoming: The Other Jack to defend BILT*

I don’t think there’s any downside to keeping the Autograph card. I’m happy to have an easy way to get into the Wells Fargo transferable points system in case they ever introduce more interesting partners.

Awesome. Thank you Greg

I earned BILT Gold (because… ‘the rent is too damn high!’) and it did practically nothing for me. Not sure 2.0 ‘status’ will mean anything, or last long, but, we’ll see. Keeping an open mind. Prepared to be disappointed. Hoping for better.

Did you not take advantage of transfer bonuses?

Rarely. Aeroplan and FlyingBlue were decent, but, they kinda fell off lately.

Accor was a great one. That’s what I did to cash out.

I’ve gotten burned by a few Fairmonts, but some Raffles made up for it.

I got silver status at the end of last year, but now I’m considering abandoning the Bilt card, unless the new offerings are exceptional. I’m trying to take a break from new hard pulls and accounts for a while, and Bilt isn’t helping. I’m also concerned that Bilt will collapse like Mesa did. Clearly Wells Fargo didn’t see any hope in the relationship.

Bilt Rewards (as a company) has been profitable/cash flow positive for a few years now. I don’t think your fears will be realized.

Clearly wasn’t ‘profitable’ for Wells Fargo… losing $10 million a month ‘holding the bag’ for these jokers.

Oh, were you trying to base profitability on a technicality? Like, no, no.. not ‘BILT’… the subsidiary ‘Bilt Rewards’ was profitable… oof.

The card issuer (Wells Fargo) and the provider of benefits (Bilt Rewards) are separate entities. The fact that Wells Fargo lost money AS A CARD ISSUER has no bearing on Bilt Rewards or a person’s Bilt Rewards account (points). It will be the same under Bilt 2.0.

I’m not playing at semantics. When a person simply states “Bilt,” it is uncertain whether the person means the card or the rewards program. By using “Bilt Rewards,” which is the actual name of the rewards program, it avoids potential confusion with the card itself. (As a note, Cardless is NOT a card issuer. It is a credit card servicing entity. The actual card issuer of Bilt 2.0 cards is a third-party bank.)

So, I will say again: the rewards program is profitable/cash flow positive.

Ah, so you were doing the ‘technicality’ angle. Got it. No, you are the one doing semantics in-defense of all-BILT-entities on here, no differentiation required.

Here’s the thing… if the parent company goes under, the subsidiary is screwed, too. You can wordsmith and ‘PR’ this all you want, that’s the real deal there.

No, it hasn’t happened yet, and hopefully it won’t, because, as I’ve said before, I pay too much rent, and enjoy earning those points on that alone; the rest of this is mostly fluff to me. I prefer transferring to Hyatt and Alaska, because those are often redeemed at 2-3 cpp. The transfer bonuses were sometimes nice but not the ‘main show,’ to me.

Its not a technicality. Bilt doesn’t lose money if Wells Fargo or Cardless lose money. They are entirely separate entities. Bilt makes its money very differently than Mesa, and has been historically very conservative with how they award points (no SUBs for example). Bilt also encourages people to spend their points in dumb ways (like using Bilt points to buy stuff on Amazon, buying gift cards with points, rent credits, student loan credits, transferring 1:1 to IHG or Marriott, etc.). All the people who redeem points for poor redemptions help balance out those of us who redeem for Hyatt or Alaska. Most people who earn Bilt points are just renters who see it as free money…they aren’t the deep in the weeds points people who hang out in this forum (unlike Mesa, where the only people who even knew about the card were those of us deep in the points and miles game). The more users there are out there who don’t actually understand the value of their points and are happy with a free night a Holiday Inn or a flight on Spirit, the more money Bilt makes.

Megan… BILT currently pays out 1 point per dollar on rent while waiving a convenience fee on using their credit card for rent (otherwise, Plastiq and other charge 3% on average). So, BILT (and its partners) are covering what is 3-5 cents/points in value, depending on what we redeem/transfer for (for instance, Hyatt/Alaska cost them about 2 cents per point transferred). It matters who’s covering that cost, because, in the past it was too-big-to-fail-bank WF; Cardless cannot sustain that, and if they fail, then BILT has to cover it somehow, and I don’t think Ankur’s covering it himself. Exit. Fail. Bye.

Don’t get me wrong, I personally don’t plan to build up a big stock of Bilt points. Its earn and burn for me. No way I will have more than 100,000 points sitting in Bilt at any time. When they hit that point, I will preemptively transfer to Hyatt, unlike Chase or Amex or CapOne where I am glad to build up a large reserve.

But, I think we are likely to see some big changes with Bilt 2.0 with changes in earning for the no annual fee card. We will know a lot more tomorrow when the details get revealed.

Bilt makes money through multiple channels – through its travel booking portal (we know hotels pay about a 20% commission) and its neighborhood situation (Walgreens and all those fitness places are definitely paying them something) plus whatever they make from their landlord payment portal on the landlord side.

Bilt is not the same situation as Mesa, but that doesn’t mean I think things will work out long term.

We’re in agreement on ‘not hoarding points’ on this (or honestly, any platform, except, maybe the too-big-to-fail banks, like Amex, C1, Chase, Citi, etc., but, even then, they can get ‘spicy’ and claw-back if there’s any funny business.) Earn and burn (and churn) is the name of the game.

Are they releasing details tomorrow, or January 14? February 7 (not January) is the official transition, but we should know before then (in case you mixed up months).

I hope BILT stays afloat; I really do; mostly out of self-interest; I just wouldn’t wanna be an actual investor or anything. If it were my literal ‘job,’ I’d be a little concerned.

Sorry, you are right. I think I mixed up the January and February dates. Details should be coming on 1/14 with the official transition happening on 2/7.

Megan, you are correct. 1990 has no understanding of Bilt Rewards’ business environment or knowledge of Bilt Rewards’ financials. Indicative of an ax to grind, he makes the uncalled for statement that Bilt Rewards’ CEO has goons.

1990 has something in his craw and operates on opinions. 1990 is compelled to comment on everything on every blog. He also uses other pen names that are sexually suggestive. Look for yourself. . .

To be clear, i am not an investor in Bilt Rewards. I do not intend to hold its credit card. 1990 suggests that I am a defender of Bilt Rewards but in reality I don’t have a dog in the fight. And, I’m willing to call out those with unfair, unreasonable, or ill-informed comments.

I am also not an investor in Bilt, but the more I learn about how they make money, the more confident I am that Bilt is quite different than Mesa. Its clear that they have a thoughtful approach to their business, and its also clear that they have more than one way to make money. From what I understand, a significant portion of Bilt’s earnings comes from income sources unrelated to the credit card.

Now, I’m less convinced that Cardless will be successful, and I fear that Cardless could find themselves in a similar situation to WF but with less funds to throw away. The fact that Cardless’s IT environment seems to be behind the times gives me pause on this partnership and Cardless’s ability to support the Bilt environment from a credit card standpoint. I would hate to burn a slot on a card that doesn’t stick around.

Know that Bilt Rewards chairman is the former CEO of Amex. Know that Bilt Rewards has nearly 5 million members . . . with over 4 million being NON-cardholders. Its strength is comes from its affiliate programs.

Cardless is just the card servicing entity. Yes, it has IT issues but IT IS NOT THE LENDER. Yet, so many comments characterize Cardless as the lender.

Now, given all the news that is out there, the ACTUAL bank that issues the 2.0 cards is entering the deal with eyes wide open. No one is hiding the ball.

For nearly five years, self-styled know-it-alls have been predicting Bilt’s demise. But, as Mark Twain famously said, such reports are greatly exaggerated.

Jack, you (or someone else), recently brought up Ken Chenault on here before. While the Amex claim to fame is a nice PR move for any board, that doesn’t change the fundamentals here. Now, if Amex were to actually step in and fill WF/Cardless shoes, then I’m bullish on Bilt, but that hasn’t and isn’t likely to happen. Pipe dream, friends. Finally, if we’re mis-quoting the greats, then I’ll go with Lincoln, who famously said: ‘BILT 2.0 is gonna be a major nerf, folks!’ LOL.

If Cardless fails, then Bilt doesn’t have a card, and the premise of earning 1 point per dollar of rent without any 3% convenience fee disappears… so… umm… problem.

We shall see, Jack. The final countdown is upon us… and, you give me too much credit. I’m not the sexually suggestive username guy. As a card member, I do have a dog in this fight. I want the program to last and not to get nerf’d. Yet, the fundamentals are wacky, so I’m expecting the worst, in due time.

Bilt will be the new Mesa

And, you’re basing this on . . . ?

The reality that Wells Fargo was losing $10 million a month on BILT, and that gravy train is ending in a month.

You’ve repeatedly expressed your negative opinion about Bilt but you really don’t understand the underlying business relationships. But, undoubtedly, you will continue to wallow in your opinions.

Feel free to call me ‘dumb,’ more directly, if you wish. I do enjoy those silly name-games on here and elsewhere. But, but.. I just don’t ‘understand.’ Naw, I do. Believe me, I wish WF was staying.

Those so-called ‘relationships’ are not the quantitative genius that BILT (all versions, parent and subsidiaries) needs. Sure, a few VCs might pump some money here and there out of pure ‘hope-ium’ and hype, but the ‘data’ on renters/borrowers isn’t good enough; otherwise, Wells would have held on.

I bet you do

Zing!

Should get you the extra award space now reserved for those with status

For Flying Blue? IIRC I think that space opens up with platinum, not gold

Correct. Bilt Platinum (not Bilt Gold) opens up the status match. And, the status match affords Flying Blue/Air France Gold (not FB/AF Platinum). But, it is FB/Platinum that opens up extra/lower-priced award space. Easily confused.

Yeah, maybe BILT should re-name its tiers so as to not ‘easily confuse’ folks…