NOTICE: This post references card features that have changed, expired, or are not currently available

Update: This post includes offers that were valid at the time of publication, but have since expired. Please click here to see the best offers currently available.

My Business Platinum card has been open for a year now. I applied for the card last year when a 150,000 point offer was floating around. Not only have I enjoyed the card’s perks since then, but I also jumped on a 10,000 point offer for enrolling in their Extended Payment Option. And, of course, I took advantage of $200 in airline fee reimbursements in 2015 and again in 2016. Overall, the card has been well worth the first $450 annual fee!

| Quick Tip regarding the Amex Extended Payment Option Amex charge cards require cardholders to pay the entire balance each month (a practice everyone should to anyway). But Amex likes to encourage people to sign up for their Extended Payment Option so that people can pay over time (and pay Amex interest on the money they owe). Within a month or two of signing up for a charge card you’re likely to get “offers” to sign up for the Extended Payment Option. Don’t do it. Wait for an offer of 5,000 or 10,000 bonus points before signing up. In my experience, these offers usually appear about 9 months into card membership. Look for an email with a heading like this: “Dear [Your Name Here], You’ve Been Selected! You Now Have Payment Options and Can Get 10,000 Membership Rewards® Points” |

I know that a year has passed because a new $450 annual fee charge appeared on my Amex statement. My plan is to cancel this Platinum card and apply for a different Platinum card (there are many varieties) so that I can get the perks and the welcome bonus again. I was hoping to see the return of the Ameriprise Platinum 25K offer (this is the one version of the Platinum card that has no first year annual fee), but that offer hasn’t yet reappeared.

I still have time to wait. Under current rules, I will get my full money back if I cancel within 60 days of the appearance of the annual fee on my account. Even after that I will be refunded on a prorated basis.

I was under a different time crunch though. The Delta 50K and 60K welcome offers (found here) are scheduled to end on July 6th. I’ve written many times about how I use Delta credit cards to manufacture miles and to manufacture Delta elite status (examples can be found here, here, and here). I used to be under the impression that each person can only have one Delta personal card and one Delta business card, but quite a few people have told me that they had multiple Delta business cards. An extra card would help speed up the elite pursuit. Plus, I much prefer to run up spend on business cards since that spend is not reported to the personal credit bureaus and therefore has no negative effect on my credit utilization (which is a key part of FICO credit scores).

Even though I’ve had the Delta Platinum Business card before, I not only wanted another one, but I also wanted to see if the Amex “once per lifetime rule” applied per person or per business. That is, if I apply under a different business will I qualify for the welcome bonus?

As described above, I had made up my mind to apply for the Platinum Delta SkyMiles Business Credit Card. And, since it is known that Amex will make only one credit inquiry for multiple applications made in one day, my App-No-Rama process suggests that I should apply for at least one more Amex card at the same time. My best bet would be to apply for another business card since that second card will have absolutely no negative impact on my credit score as long as the inquires combined (see: Business card advantages). Ideally I would find a business charge card since I was already pressing up against Amex’s 4 or 5 credit card limit (more on that later).

I logged into my Amex account and clicked to view business charge cards. There I was surprised to find 75K offers for the Business Gold and Business Platinum charge cards.

I’ve never owned the Business Gold card before, so that looked like a great option. I decided to go for it.

Business Gold 75K Attempt #1 (AKA I shouldn’t have called)

I called Amex for the long shot chance of getting a retention offer for my Business Platinum card. No dice. Instead, they tried to sell me a downgrade to the Business Gold card. That would have been a mistake since there would be no bonus for downgrading whereas I could apply separately for the Business Gold card 75K offer and cancel my Business Platinum card later. I discussed this with the retention specialist in the hopes that she would offer me a big downgrade bonus. Unsurprisingly that went nowhere. My mistake was to let her transfer me to the New Accounts department to open my Business Gold card over the phone. I suppose that I was hoping for an even better offer than the one I saw online…

The New Accounts lady wouldn’t confirm the existence of a 75K offer until I told her the spend requirement that I saw online. I probably should have said “$5K” since many readers (and my cousin Michael) had received a $5K offer, but I truthfully told her that my offer required $10K spend. She found the offer and proceeded to torture me with a required reading of all of the card’s benefits, application terms, etc.

There was one interesting part to this endless onslaught of minutia. She read that I was not eligible for the offer if I have or have had this product within the last 12 months. Wait a minute… Those were the old business card rules! Online, the application states: “Welcome bonus offer not available to applicants who have or have had this product.” Had I stumbled upon an exception to the once per lifetime rule? Is the trick simply to call in your application for a business card? That would be awesome! Little did I know that it actually portended something bad…

When the New Accounts lady finally finished her cheerful reading of the application terms and conditions and I had said “yes” to the question of whether they had permission to check my credit for the application, she put me on a brief hold to get the decision. She came back to the line a changed woman. The moments ago cheerful agent had become cold and abrupt. My application was denied. She didn’t know why. I can check the reason online myself. Goodbye.

That was weird.

I checked online and found the reason for the denial. The offer I had applied for had expired. That @#$@#! New Accounts lady hadn’t checked the eligibility date of the offer she selected on my behalf. The funny thing is that my cousin Michael (who I mentioned above as someone who had received the 75K offer after $5K spend) had also called to apply recently and had also been turned down because the offer had expired.

I called Amex again to ask if they could simply resubmit the application with the correct offer code. After a very long hold to get a person on the line, I was told that they did not have access to the offer over the phone. I should apply online. Great. Thanks Amex. My cousin, though, called a second time and gave the phone rep his offer code (his offer had come in the mail). That worked for him.

Business Gold 75K Attempt #2

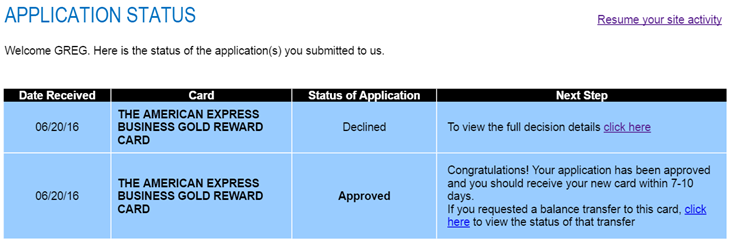

As instructed, I again found the 75K offer and applied online. This time the application went through and was initially pending. I called (and waited on hold again for a very long time) to find that they simply wanted to confirm some information. My app was then was approved.

Delta Platinum 60K Attempt #1

I already had 4 open Amex credit cards. That has been the Amex limit (they allow more charge cards, but only a limited number of credit cards). There have been hints recently that Amex has expanded the limit from 4 to 5, but I didn’t want to take a chance. My annual fee had come due for my Hilton Surpass card, so I cancelled it. I now had only 3 open Amex credit cards, so I was good to go. Or, so I thought…

I applied online for the Delta Platinum 60K offer. That was much easier than the painful process of applying online. The result: the website told me to check my application status online. Well, I tried to do that, but I found this:

The website only showed my two Business Gold applications. There was no mention of the Delta Platinum application. I had to call again. Ugh.

Delta Platinum 60K Attempt #2

After another long wait, I finally got a person on the line. She told me that my application was denied for having too many credit cards. She explained that there was a hard limit of 4 credit cards per person. I told her that I had cancelled one of the cards so that I now had only 3. She looked at my account to confirm this and then said that she would push the application through for reconsideration. She said that reconsideration would take 3 to 5 days. I asked if there was any way to expedite the process to get a same-day decision. She said no.

I asked how I would know if I was approved after reconsideration. She said to check my application status online. I told her that it only showed my two Business Gold applications, but she promised that once she pushed this through for reconsideration my Delta application would show up.

Later that day I checked online and still didn’t see the Delta Platinum application. I checked again the next day. Still nothing. I called again. And, after another long wait, a rep told me that the application was still pending and that it really would take 3 to 5 business days. No way to expedite? No.

On Thursday morning (I had applied on Monday), I received an email from Experian saying that they identified a change in my credit report.

I had signed up for the free Experian phone app on Monday after applying for the above cards (see: “Free Experian credit monitoring for iPhone and Android users”). I figured that the app’s credit monitoring feature had belatedly discovered the hard inquiry from Monday. I was wrong. I checked the app and found a new inquiry. Amex had made a second inquiry for the reconsideration. The entire reason I had chosen to apply for two cards in one day had been ruined. I ended up with two inquires after all.

At least I knew that Amex was finally looking at my Delta Platinum application. And, later that day I got an email from Amex:

Congratulations! You’ve been approved

Congratulations, and thank you for expanding your relationship with American Express OPEN. Your application for the Platinum Delta SkyMiles® Business Credit Card has been approved.

And the online application status checker? It still only shows my two Business Gold applications. It appears to be limited to two entries.

Wrap Up

After my most painful credit card application process ever, I was finally approved for two new cards. The Business Gold card will net 75,000 Membership Rewards points after $10,000 spend; and the Delta Platinum Business card may net 60,000 Delta SkyMiles + 10,000 MQMs (elite qualifying miles) after $2,000 spend. The latter depends on the answer to whether the once per lifetime rule applies per person or per business. I also may have a shot at the $100 statement credit after a Delta purchase made within 3 months. I wonder if the statement credit is also subject to the once per lifetime rule? We’ll see.

And my Business Platinum card? I set a reminder on my calendar for not-quite-60 days in the future to cancel my Business Platinum card so that I’ll get back the $450 annual fee. Normally, I would have to apply for a new Membership Rewards card at the same time in order to keep my points alive. This time, though, I’ll have my Business Gold card around to serve that purpose.

UPDATE: I’ve already received 10K MQMs and $100 statement credit after signing up for the Delta Platinum business card. I’m now confident that I’ll also get the 60K bonus miles after $2K spend. This is great news since I have had the Platinum Delta business card before but with a different business (Just last month I upgraded it to the Reserve card).

The enhanced signup bonus ends tomorrow so I wanted to get this out immediately to anyone who is following this thread.

I fulfilled the requirement for Delta spend by booking an award with a $5.60 TSA fee. I paid the TSA fee with the new Delta card and that was enough to trigger the $100 statement credit.

More details and links to the enhanced Delta credit card offer can be found here: https://frequentmiler.com/best-credit-card-sign-up-offers/#AmexAirlines

This is awesome and a game changer! Thanks for the post and the update Greg!

My business platinum fee just became do as well. I called in for a retention offer and was told there was none. After complaining about the Hamilton tickets fiasco (which I wasn’t part of but read about it) they gave me $100 statement credit. I canceled two days later so extra $100 back. Worth a try.

Nice tip. Thanks.

Why not pay the minimal fee to freeze your credit after applying for cards?

I’m assuming that they wouldn’t have approved the Delta card upon review if they couldn’t pull the credit report. No?

For AMEX, if you apply for more than 2 cards on the same day, the system automatically waits for 3-5 days to do another pull–usually, but not always from a different Credit Bureau. The only way to avoid this is to have a supervisor who handles reconsideration “cancel” whichever third application you do not want (which in this case, would have been the expired application).

Thanks. I knew that they did that with credit cards, but I didn’t think that charge cards were counted for same day apps

In my experience the automatic hold for about a week is only when 2 credit card apps are submitted on the same day. Last week we did 3 apps same day (1 credit + 2 charge) for hubby and all had instant approvals.

Thanks. That confirms my understanding

How did you get instant approvals for 3 cards in one day, but only get a 1-week hold when 2 credit card apps are submitted? Do you submit both apps at the same time, or do one after the other?

The online application status checker has been glitchy lately but it definitely can list more than 2 applications. Mine is currently listing 5 including an attempt to move credit between 2 cards. For several days the name of one of the cards I had applied for was missing for one of the entries. It was just a blank box, and at one point it listed some totally different card name there.

Thanks for the info. A few other people told me that too.

FM, What other CCs you currently have with Amex?

I just applied for my 5th credit card with Amex yesterday and was approved after calling. I read somewhere that it depends which CC you currently have and as I saw some more data points, I think if one of your CC is everyday card, you can be approved for 5th card. There might be some other cards in this list like blue series but I am not sure. Maybe you cannot have 5 co-brand card.

As to credit cards (not business cards), before this app I had:

* Delta Platinum (personal)

* Delta Reserve (business)

* Blue Cash

* Hilton Surpass (which I cancelled before applying)

FM- In the article you mention that it is possible to hold multiple Delta Business cards and earn points and MQM’s.

1. Were you referring to holding a Delta Reserve Business card and Delta Platinum Business card? OR

2. Multiple Delta Platinum Business Cards?

The question is more for spending and earning MQM’s rather than the 1 time bonus.

Thanks

1. Thanks to the new card, I now hold 1 Platinum biz card and 1 Reserve biz card

Time will tell whether I’ll earn:

1. The signup bonus

2. The MQMs from big spend (I’m pretty sure the answer to this one is yes)

This sounds like every time I apply for a card. In fact, the same exact card limit thing happened to me. Applied, got pending, called into, got denied for too many cards even though I didn’t have too many, had to go through reconsideration, finally got approved.

You got a second hard pull because your Delta application was put in pending status and was reviewed at a later date. And as typical with Amex, they did a hard pull to approve the app. Why were you under the impression that Amex will be OK using the first hard pull from days before not even associated with that card application?

If applied for (i.e. click “submit” or say “yes” to an online or in-branch card application) on the same day, Chase, for example, would maintain the same credit report for up to 30 days without the need for a new hard pull for reconsideration.

Not always. Twice I have applied for 2 Chase cards on the same day this year and both times I got two inquiries on my credit report. They never merge them.

If I would apply online for a business card and a personal card (both online) on the same day would would i get one or two hard pulls?

Seems you got two due to the expired offer. I’m looking to get a new Amex Business card to replace my Gold Open. And am wondering if I should apply for a personal as well.

Thanks for the info!!

I got two pulls because the recon people apparently pulled my credit again for that Delta card (that’s unusual: most banks won’t do another hard inquiry for a recon). It wasn’t due to to the expired offer. As long as both of your apps are approved on the same day, Amex will only make one hard pull.

I have 4 CC w/ amex. Business: Gold and SPG. Personal: EveryDay Prefered and Gold Delta. When I called up the rep to cancel my Bus. Gold OPEN, he suggested that I open the BLUE card before closing my gold. Not sure if the 5 card rule would apply here but just some info.

Your Business Gold card is not a credit card, it is a charge card. You only have 3 credit cards with AMEX. If you did convert to Blue, you would have 4 CC