NOTICE: This post references card features that have changed, expired, or are not currently available

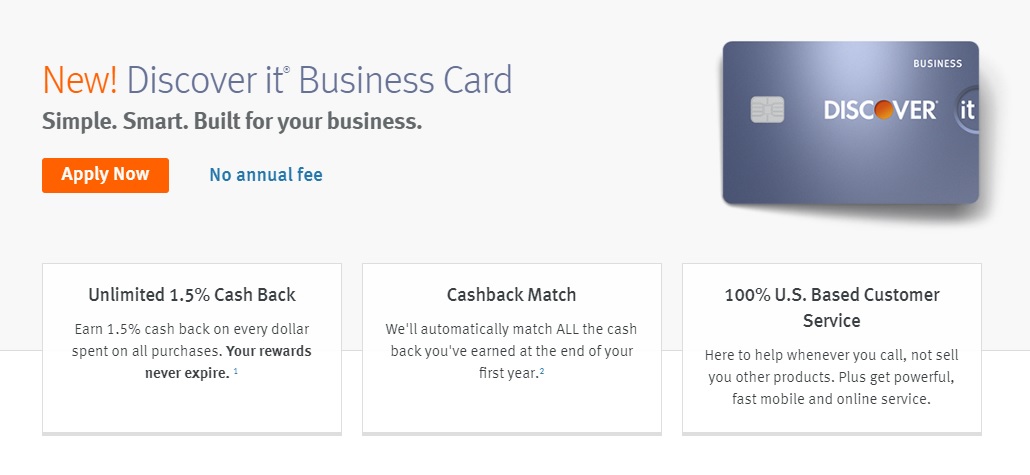

Discover is out with a new business credit card that features their popular first year double up offer. The new Discover it Business Card earns unlimited 1.5% cash back everywhere — and Discover will match all the cash back you’ve earned at the end of your first year, making this a 3% cash back card for the first year with no annual fee and no foreign transaction fees. That makes it excellent for the first year, albeit less compelling in future years (and not necessarily the best option in year 1 depending on your situation – read on).

The Deal

- Discover has launched a new small business credit card: the Discover it Business Card, featuring 1.5% cash back everywhere, doubled at the end of your first year

- Find more information and an application link on our dedicated Discover it Business Card page

Key Card Details

- No annual fee

- No foreign transaction fees

- Earn unlimited 1.5% cash back everywhere

- Redeem cash back in any amount

- Double cash back the first year. Discover will double all cash back earned the first year. This means that for the first year, you get 3% cash back on all spend.

Quick Thoughts

This will surely be a popular offer for those looking for a cash back alternative to points as you can effectively earn 3% back for the first year (though note that you’ll have to wait until the end of the first year to get your double up). Depending on your business expenses and spending patterns, that could be a really compelling return. Of course, this card essentially duplicates the offer on the Discover it Miles card, which earns 1.5 “miles” per dollar (worth 1.5 cents) and doubles at the end of the first year. The Miles card adds a small signup bonus and $30 annual in-flight Wi-Fi credit. That card is a personal card and this one is a business card. Unfortunately, that doesn’t mean much here as the Discover it Business card looks like it will count against 5/24 based on prior reports (it’s been a few years since Discover last offered a business card).

It’s worth noting that Discover isn’t completely alone in offering a card with 3% back for the first year: The Alliant Cashback Visa offers 3% back in the first year, though that one is a personal card and not everyone will qualify (on the flip side, it earns 3% without the need to wait for a year to get the second half). The Alliant card earns 2.5% in subsequent years, though it carries an ongoing annual fee of $59. One major drawback on that card has been that Alliant has frowned on overly heavy spending and zeroed out cash back on some types of purchases (See: Alliant paying 0% cash back at Giftcards.com).

The Discover it Business card offers no annual fee ongoing, though 1.5% back in subsequent years would not be terribly compelling with the Ink Business Unlimited credit card also offering 1.5% back everywhere and carrying the added bonus of being able to combine those points with premium Ultimate Rewards cards to transfer to partners for outsized value. If you are under 5/24, that card probably makes more sense even for those viewing it as a purely cash back card as its $500 new cardmember bonus might make up for the lack of a first year double up unless you intend to spend in excess of $33,333. Here’s the math on that:

- Discover it Business: Spend $33,333, get 1.5% back now ($499.995) and 1.5% back at the end of the first year ($499.995) for a total of $999.99 cash back

- Ink Business Unlimited: Spend $33,333, get 1.5% back ($499.95) plus $500 when you trigger the new cardmember bonus with $3K spend in the first 3 months for a total of $999.995

If you continue to spend beyond that threshold in the first year, you’ll earn more cash back with the Discover it Business card. Which option makes more sense depends on your spending patterns and 5/24 status (though it’s worth noting that you don’t necessarily have to choose between the two if you’re under 5/24 and can qualify for both, putting most of your spend on the Discover it Business card the first year). In my mind, the Discover it Business card makes the most sense for someone who wants to keep it simple and earn a solid return for a year without juggling multiple cards.

Overall, this is certainly an interesting offer and it’s good to see a new option hit the market.

H/T: TPG

Does anyone know if this card will have access to discover deals portal? Discover Deals double cash back is really the most compelling part of the discover sign up bonuses.

Folks be very aware when applying for Discover’s new business card they are dinging your personal credit to do the judgement. They are testing the waters and obtaining feedback and hopefully plan not have to check your personal credit when applying. My personal got dinged and not happy about it cause I was unapproved and I knew I was applying for a business card which usually doesn’t touch your personal credit score.