Update 8/3/23: This is the last week for these enhanced Marriott offers, as their scheduled to end on 8/9/23. If you’re interested in grabbing one, now’s the time.

Most of the Marriott Bonvoy consumer credit cards are currently featuring increased offers that could be of great interest to those who will have at least 6 paid nights at Marriott properties by the end of January 2024.

The Offers & Key Card Details

For more details about each of these cards, click the card names below to go to our dedicated Frequent Miiler card pages.

| Card Offer and Details |

|---|

ⓘ $285 1st Yr Value Estimate$300 dining credit ($25 per month) valued at $270 Click to learn about first year value estimates 100K Points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Earn 100K points after $6k in eligible purchases within your first 6 months of card membership. Terms apply. Rates & Fees $650 Annual Fee Recent better offer: 185K points after $6k spend in the first 6 months (expired 9/25/25) FM Mini Review: Decent ultra-premium option for Marriott fans, especially those aiming for lifetime status tiers Earning rate: 3X airfare -on flights booked directly with airlines; 3X restaurants worldwide, 6X Marriott; 2X on all other eligible purchases Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Annual Choice Award with $60K calendar year eligible spend, choose one of: 50k points, 5 Nightly Upgrade Awards, 85k free night certificate, or $1K off a Marriott Bonvoy brand bed Noteworthy perks: ✦ 85K Free Night Award each year upon renewal ✦ $300 dining credit per calendar year ($25/mo) ✦ Platinum Elite status ✦ 25 elite nights credit ✦ Priority Pass™ membership (Lounges only) with 2 guests ✦ Global Entry fee credit ✦ Free premium internet at Marriott properties ✦ Note: Enrollment required for some benefits. See also: Marriott Bonvoy Complete Guide |

| Card Offer and Details |

|---|

ⓘ $317 1st Yr Value EstimateClick to learn about first year value estimates 85K Points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Earn 85K points after $5k in eligible purchases within your first 6 months of card membership. Terms apply. Rates & Fees $250 Annual Fee Recent better offer: 155K points after $5k spend in the first 6 months (expired 9/25/25) Earning rate: 6X Marriott.✦ 4X restaurants & U.S. Supermarkets on up to $15K in eligible purchases per year ✦ 2X on all other eligible purchases Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: One 50K Free Night Award after $15K calendar year spend on eligible purchases. Noteworthy perks: 15 night credit towards elite status every year upon account anniversary ✦ 1,000 bonus points with each qualifying stay ✦ Gold elite status See also: Marriott Bonvoy Complete Guide |

| Card Offer and Details |

|---|

ⓘ $1378 1st Yr Value Estimate5 Marriott 50K Free Nights valued at $1520 Click to learn about first year value estimates Five 50K Free Night Certificates ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Five 50K free night certificates after spending $3k on eligible purchases within the first 3 months + get up to $100 in statement credits after spending $500 on eligible airline purchases. That's up to $50 in statement credits semi-annually.$95 Annual Fee This card is subject to Chase's 5/24 rule (click here for details). Earning rate: ✦ 6X Marriott Bonvoy ✦ 3X gas stations, grocery stores, and dining on up to $6K in combined purchases each year ✦ 2X everywhere else Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: Earn Gold status when you spend $35K each year ✦ 1 Elite Night Credit towards elite status for every $5K spent Noteworthy perks: ✦ Annual free night certificate for 1 night at a hotel redemption level up to 35K ✦ Automatic Silver status ✦ 15 nights of elite credit each year ✦ 1 Elite Night Credit for every $5K spent ✦ Complimentary Instacart+ for 3 months (must activate by 12/31/27) ✦ $10 monthly Instacart credit See also: Marriott Bonvoy Complete Guide |

| Card Offer and Details |

|---|

ⓘ $585 1st Yr Value Estimate2 Marriott 50K Free Night valued at $608 Click to learn about first year value estimates 2x 50K Free Night Certificates ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 2x 50K free night certificates after spending $1k on eligible purchases within the first 3 monthsNo Annual Fee This card is subject to Chase's 5/24 rule. Click here for details. Recent better offer: 60K points + Free Night Certificate after $2K spend (Expired 7/17/25) FM Mini Review: The best use for this card is probably to downgrade from the Ritz or Boundless card to avoid the annual fee. That way, you can always upgrade again when you need the annual free night or other perks Earning rate: ✦ 3X Marriott Bonvoy ✦ 2X grocery stores, rideshare, select food delivery, select streaming, and internet, cable and phone services ✦ 1X everywhere else Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Noteworthy perks: Automatic Silver status ✦ 5 nights of elite credit each year ✦ Complimentary Instacart+ for 3 months (must activate by 12/31/27) ✦ $10 monthly Instacart credit See also: Marriott Bonvoy Complete Guide |

Quick Thoughts

These new offers are excellent if you are a Marriott fan as they all provide a solid number of points, but where the bonuses really get bolstered is if you will also have six paid nights by the end of January, 2024. I imagine that will be a pretty low bar for many Marriott fans to cross, which makes these bonuses significantly better.

You could effectively think of the additional bonuses as an extra 8,333.33 points per night for your first six paid nights, though you will of course only receive the bonus if you complete a total of six paid nights.

I should note that there are actually two different offers available for the Chase Marriott Boundless card at the time of writing. Shown above is an offer that includes free night certificates, though those who will have at least six paid nights by 1/31/24 will likely prefer the alternative offer, which you’ll also find on our card page when you click the card name above to go to the dedicated Frequent Miler page with more card information.

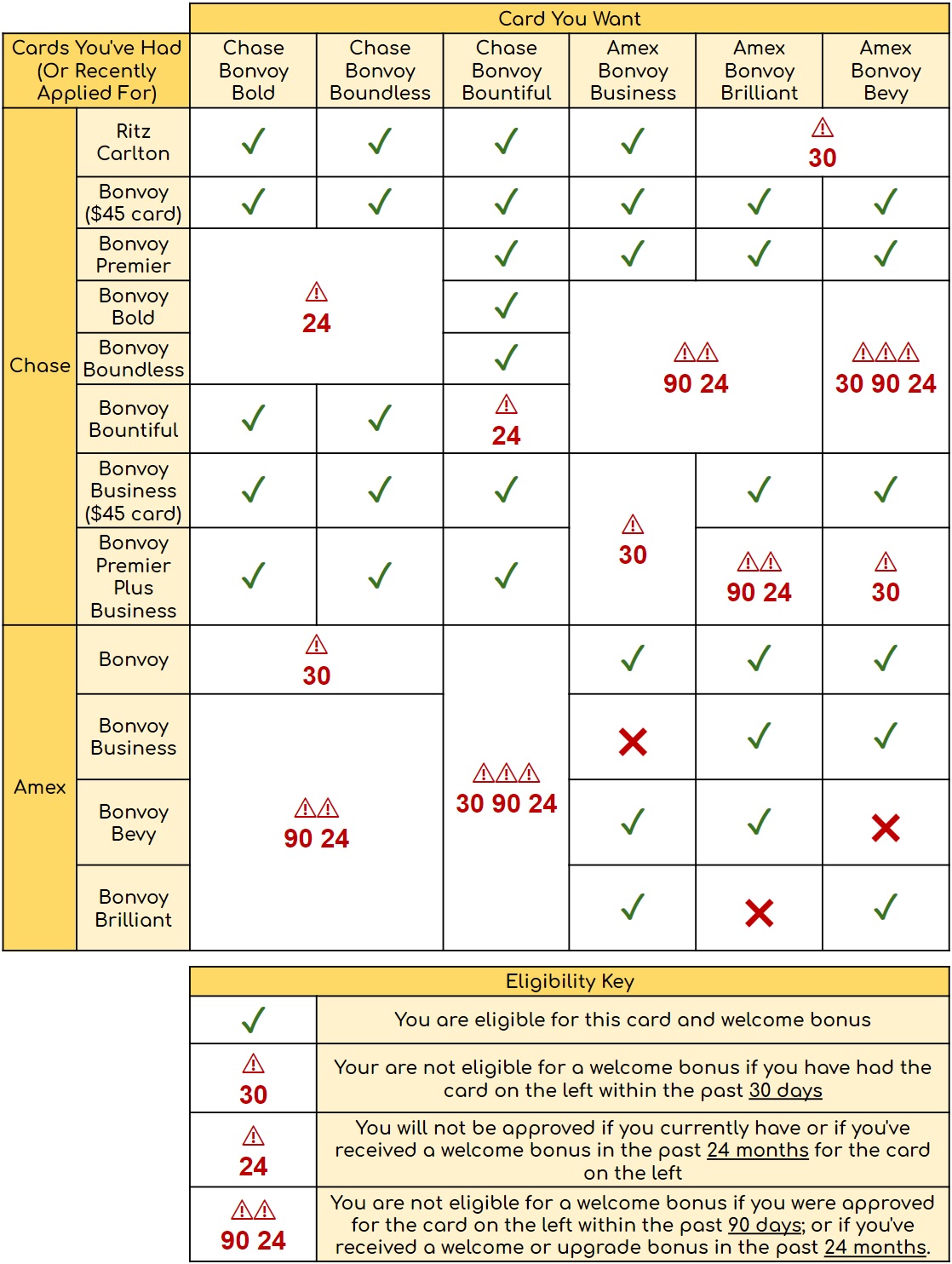

Before plotting out your strategy, you’ll need to consult the Marriott credit card eligibility matrix to know whether or not you are eligible for a new cardmember bonus.

See also our Marriott Bonvoy Complete Guide for more details on the credit cards and eligibility (our click on any of the card names above to go to our dedicated card page for each card.

While we have arguably seen a better offer on a couple of these cards (for example, the Boundless card recently featured an offer that included 5 free night certificates each valid for a night up to 50K points), the nice thing here is that points don’t expire with activity and are far more flexible. Personally, I highly prefer earning points over free night certificates — and there is no doubt that there are plenty of points on the table with these new offers.

One odd thing here is that the Chase Marriott Bonvoy Bountiful card seems to have not been invited to this party. I’m not sure why that card got left out of the increased offers, but if that’s the one you had your eye on you may want to reconsider and go after one of these new increased offers.

I want to get the Amex Brilliant but currently have the Ritz. Can I downgrade/product change the Ritz, wait 30 days, then apply for the Brilliant? Then upgrade/product change back to the Ritz later on?

Whoever designed this application matrix should be jailed…. Makes me want to close all Marriott cards. Wait 90 days and/or after the 24 month mark of last bonus. Then restart the application process.

It’s easier solving differential equations than figuring out if you are eligible to open one of the Marriott cards

P2 has an “old” (older than 24-month) bonvoy premier plus business and an amex bonvoy business (also older than 24 months)…hurts my head trying to figure out if they are eligible for another card bonus or not

I have an old Bonvoy Premier Plus Business card too and it seems like it eliminates all the Amex cards except the mega $$ AF Brilliant. Wait a minute I have the Ritz too so there goes that one too! Chase and 5/24 only.

Thanks for the useful chart of requirements!

Is it possible to get approved for both Chase and Amex Bonvoy card if you apply for them simultaneously?

Probably not. There seems to be a separate checker on the Marriott side for credit cards which prevents you from gaming the system.

So you will not get approved for the Bevy if you currently hold the Boundless or Premier Plus cards?

You can approved for the card, you just won’t be eligible for the welcome offer. You cannot get the welcome offer for the Bevy if you currently hold ANY Chase co-branded Bonvoy card, or have within the last 30 days.

Alright, will just have to get the Brilliant card. $400 more annual fee for 25k more points.

I already have 15+15 EQN from credit cards this year. With the Brilliant, I should get 10 more EQN. That will motivate me to go for Titanium.

I received my Brilliant card a few weeks ago with a significantly lower enrollment offer. I called Amex and was told that Amex does not generally upgrade offers, but the agent offered to submit a ticket to the “back office” with my request for a matched offer. I have been successful getting Chase to upgrade offers, so I was surprised by the rep saying Amex generally doesn’t do this.

Don’t all the cards come with an annual free night certificate??

These are additional “SUB” FNCs. Separate from the annual one.

The Bevy and the Bountiful cards do not come with an automatic certificate. They require $15K of spend every year. The fee-free Chase Bold card also does not come with a free night certificate

Why doesn’t the RC card also appear across the top?

The Ritz card is not open to new applicants. There is no way to sign up for it. You can only get it through an upgrade.

Technically referred to inside Chase as a “product transfer.”

How long do I have to wait if I product change from the boundless before I can try for these offers?

Unless you are trying to get the Boundless again, you don’t need to product change. It will have to have been at least 24 months since you received the welcome offer on your Boundless card to be eligible for a new welcome offer (not just since you opened the card. I’d suggest looking closely at the eligibility matrix in the article. It should answer any eligibility questions.

I already have a Boundless currently. What I was wondering is how long I have to wait between closing or product changing to something different before I can re-apply and get the bonus. That information doesn’t seem to be in the table.

So you want to get the Boundless card again, specifically? If that is the case, you will have to close the card completely (the downgrade path does not allow you to reopen the boundless card). For Chase cards in general, the length of time can vary greatly. For some people, they can apply again as soon as 3 days. For others, they have to wait weeks. Best practice is to wait 30 days or until the end of your last billing cycle. The card has to clear out of Chase’s system before you are eligible again.

Why do I feel like 5x50k FNC boundless is still better? With a willingness to call and get them extended, you have basically 2 years to use, and only 2k more spend?

It can be better in certain circumstances, but some people prefer the flexibility of points and the that you can keep them alive forever pretty easily. You are taking a small gamble with certs that you’ll be able to use them for optimal value before they expire, even with an extension.