Near the beginning or end of each year, the Frequent Miler team makes predictions for the year to come in terms of points / miles / credit cards / loyalty programs. I published my 2020 predictions almost exactly a year ago (See: Nick predicts: 2020 vision). December 2019 seems like eons ago, so it may not be a shock to hear that I didn’t have “global pandemic that nearly grinds travel to a total halt” on my 2020 bingo card, but looking back I was still disappointed to see that I got almost nothing right for 2020. I did manage to get a chuckle out of just how bad a couple of predictions feel post-2020. Read on to join my in my eye-roll back at my 2020 predictions.

My predictions: quick recap

You can read my full post here for entertainment value: Nick predicts: 2020 vision. In summary, here were my seven predictions for 2020:

- At least one chain eliminates resort fees

- American Airlines becomes a transfer partner

- Loyalty programs will become more aggressive in targeting “gamers”

- We’ll see another credit card offer an “entertainment” bonus category

- Amex will offer an awesome new benefit on the Platinum cards

- Capital One will shake things up with its rumored Ultra-premium card

- Chase or Citi will have a $150-250 card

Well, 2020 mostly ate those predictions up and spit them out. Here’s my look backward at what went wrong and whether I think there’s any chance of these predictions turning around in 2021.

My 2020 predictions in review

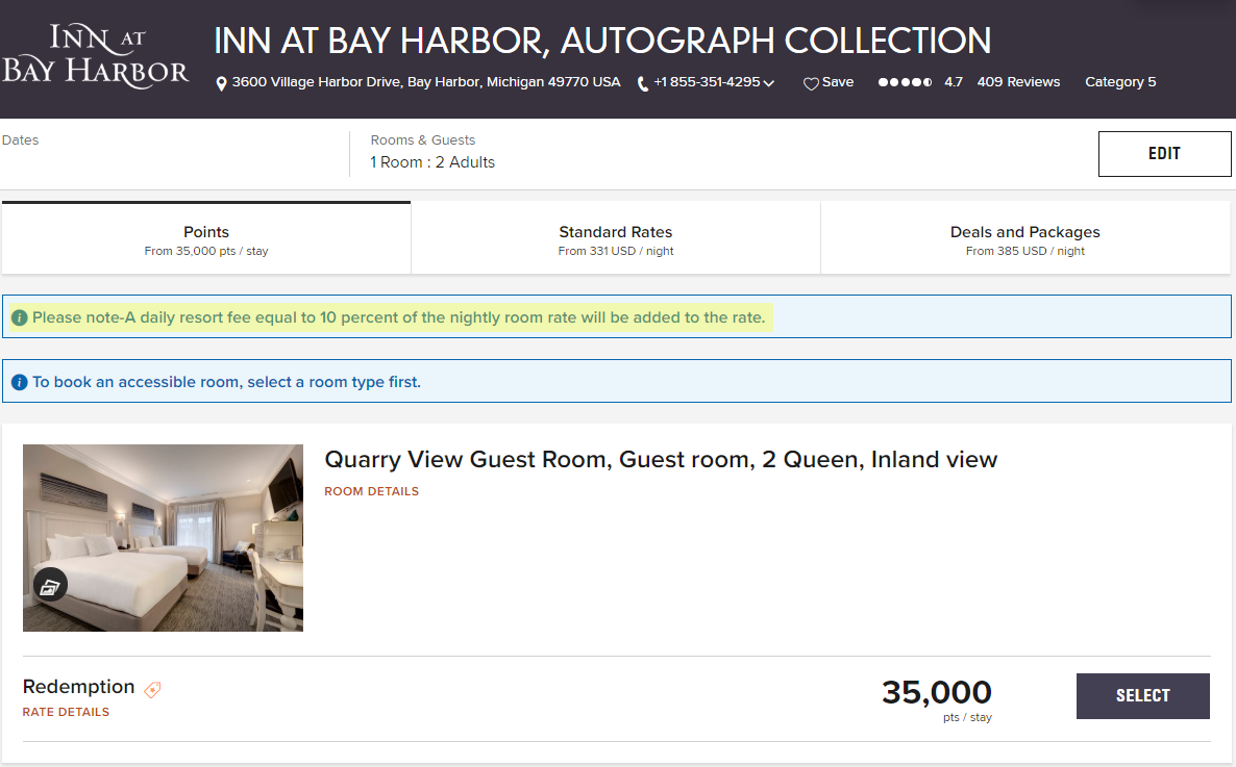

At least one chain eliminates resort fees

Not only has no chain eliminated resort fees, but some chains have continued charging resort and destination fees even with many standard amenities unavailable due to COVID. I have certainly heard of some instances where hotels have waived those fees, but at this point we feel far from the elimination of these fees becoming a chain-wide practice for anyone. If resort fees survive the COVID-19 era, the daydream of their elimination seems like a lost cause. Given the near total elimination of change and cancellation fees from the major US airlines, I remain surprised and disappointed that hotels haven’t felt pressure to get rid of these ridiculous hidden surcharges.

American Airlines becomes a transfer partner

I guess it was just wishful thinking that Citi had something up its sleeve when it eliminated most of the travel benefits on its premium travel credit cards. While 2020 didn’t shape up to be a great year to launch new travel-related benefits, I still feel like we would have heard anything there was to hear on this front by now. I guess American Airlines just isn’t in the running to become a transfer partner after all.

Loyalty programs will become more aggressive in targeting “gamers”

My prediction here was that it would be loyalty programs themselves (rather than just Amex) targeting customers who they perceived to be “gaming the system” to get outsized benefit. Now that I know what I do about 2020, it seems preposterous to imagine that any travel company would put effort into losing any customers for the foreseeable future. Instead of targeting “gamers”, loyalty programs have more or less encouraged gaming of the system with Marriott making Platinum status extra easy to reach and Hyatt all but demanding “gamers” book Globalist mattress runs. Given what could certainly be a slow recovery period for the travel sector, I just don’t see anyone else following AA’s lead on this for a long time.

We’ll see another credit card offer an “entertainment” bonus category

LOL. Thanks, 2020. I don’t expect we’ll be seeing this prediction come true any time soon.

Amex will offer an awesome new benefit on the Platinum cards

I’m giving myself partial credit here. Sure, some of you will say that taking credit here is a stretch as the temporary cell phone / streaming / shipping / Dell credits on the various Platinum cards have been temporary enhancements and not new long-term benefits. Still, it was the Platinum cards on which we saw the vast majority of enhancements on the Amex side (whereas Chase has added both temporary and long-term bonus categories on a slew of cards). Furthermore, given that we’ve now seen the incredible 100K + 10x Platinum card offer, I feel like the spirit of my prediction (that Amex would do something to keep the Platinum cards exciting) has been met even if it looks a bit different than I’d expected. Half a point here, no more.

Capital One will shake things up with its rumored Ultra-premium card

I strongly think that Capital One has long-term plans to try to compete for a slice of the ultra-premium pie, but I’d expect that most development here has been put on the backburner for a while given COVID’s impact. The timing just obviously isn’t right and likely won’t be for a while.

Chase or Citi will have a $150-250 card

Again, 2020 did this prediction no favors. But even beyond 2020, I think this is looking fairly unlikely at this point. Chase essentially squeezed themselves out of the market here by adding the types of benefits I might expect on this type of mid-market card on its fee-free cards when they . Add to this the fact that Citi just doesn’t seem all that interested in competing / keeping up the Joneses, I don’t think this prediction is any more likely in 2021 than it was in 2020.

Bottom line

The year 2020 obviously hasn’t worked out as any of us have expected, but my predictions for the miles-and-points space couldn’t have been much farther off for 2020. Predicting 2021 may be a fool’s game, but the added challenge of trying to predict the loyalty space reaction to an ongoing pandemic almost makes it more appealing to see what the Frequent Miler team can get right in 2021. Of course, not everyone fared as poorly as I did this year (you can look back at all of our predictions here), so perhaps I can’t lean on 2020 as my excuse after all. I can say this much with confidence: I am unlikely to do worse with whatever I predict for 2021. That’s my first prediction for 2021; stay tuned for the rest.

I don’t know if this counts, but the Venmo card kind of fits this(3% for the category which has the most spent in it each month, and 2% for the second most.one of the categories being entertainment):

Okay wait you did better than you’re giving yourself credit for:

Resort fees: Marriott did introduce a button to show pricing after taxes and fees. I click that button all the time now and as a result resort fees are not something that irk me as much. They probably did this to avoid a lawsuit but hey!

Targeting gamers: AMEX’s tantrum surrounding Hilton grocery store spend this summer certainly felt like a personal attack. I still have a case open.

[…] anyone and they will likely tell you that 2020 was a dumpster fire. I can hardly be blamed for how far I missed the mark on my 2020 predictions given the circumstances. But 2021 is my year. I have peered into the future and what to my […]

Not surprised here

[…] summarized his results here: Nick predicts….almost nothing correctly in 2020. Nick got .5 out of 7 correct. He avoided 0 out of 7 with one partially correct […]

I could have lost my job. LOL. I would take this missed predictions 1000 times as long as you and the rest of the team continue providing us with great content. Frequentmiller is the blog that I trust and read religiously.

If you had predicted 2020 correctly you’d probably have been burned at the stake by this point, so probably better to have such a significant miss.

“I am unlikely to do worse with whatever I predict for 2021.”

DEAR GOD, DON’T TEMPT THE FATES THIS WAY!!!!

Don’t be too hard on yourself Nick. I’m sure you will do better on your 2021 travel predictions 🙂