Each year around the dawn of the new year, Greg makes predictions for the coming year’s news in points, miles, and loyalty. His track record is pretty darn good over the years: many of his predictions have come true. At least, many of them have. I’ll let him address his 2019 predictions whenever he makes his 2020 predictions, but I wanted to beat him to the punch with a few predictions of my own as we look to the new year in just a few days. Here are the changes/adjustments/additions we will see in points and miles in 2020. I think. Maybe. Call it my 2020 vision…..which might be overly ambitious, but time will tell.

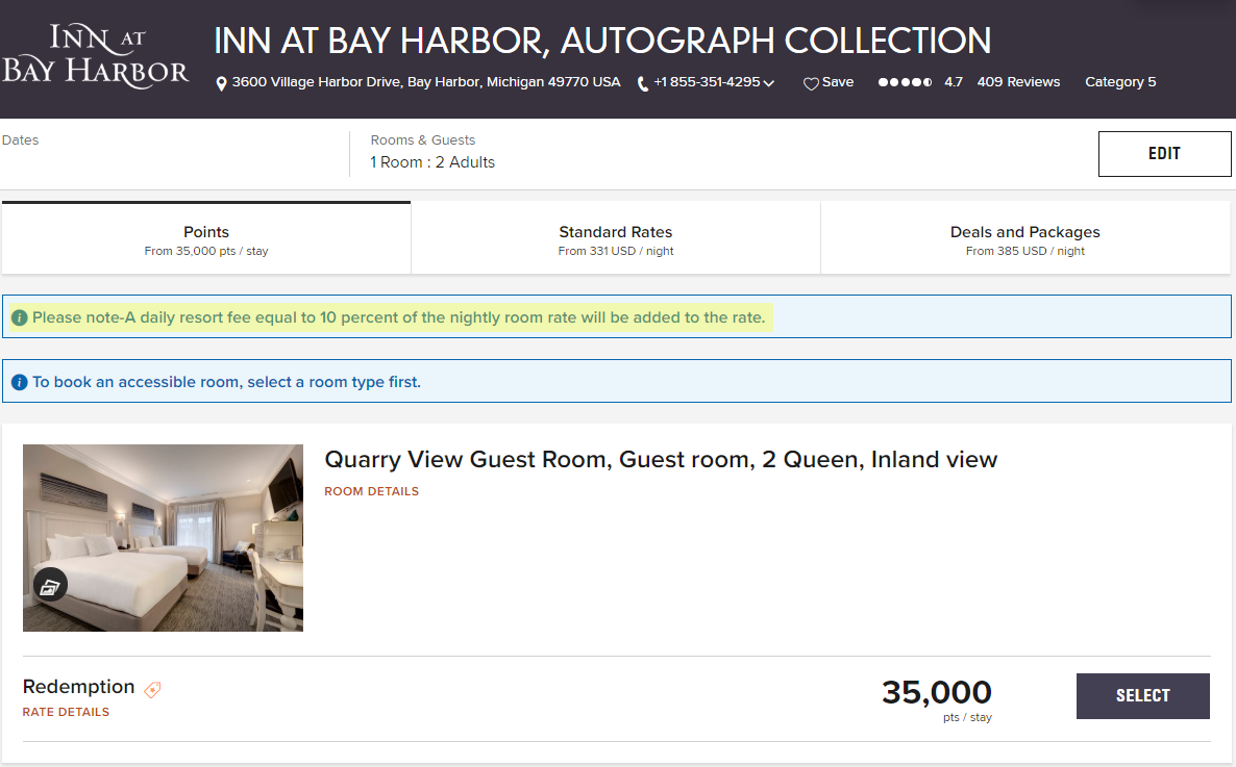

At least one chain eliminates resort fees

Now that Expedia is punishing those properties that charge resort fees in search results, I see this game taking one of two directions: either those properties begin paying OTAs like Expedia more to bump themselves up in search results or they just start including the cost of doing business in their room rates again and they secure their spot high in results by being competitive. I don’t expect it to be Marriott, but some chain is going to realize that playing the resort fee game costs them happy customers and finally change the way they play. Maybe this is just wishful thinking, but I predict it’ll happen in 2020. It’s not going to come from Marriott, but there must be a smaller chain out there thinking about this already.

American Airlines becomes a transfer partner

I feel less strongly about this prediction than others, but I think it’s high time that American Airlines becomes a transfer partner. Citi has slaughtered the benefits of its premium credit cards while working to enhance the value of the ThankYou program by making the Double Cash rewards transferable to ThankYou points. I initially assumed that they were going to come back with a new suite of benefits that would be announced shortly after dropping all travel protections from the premium cards. Since they haven’t done that, I have to believe it was like a sports team clearing cap space by cutting ties with an aging superstar: they must have made this move in order to have the money for something big, right? It had to have been more than 5x dining and airfare. Was it just the Double Cash? I think they had something bigger in mind and I’d like to see it be adding AA as a transfer partner.

Loyalty programs will become more aggressive in targeting “gamers”

The recent wave of American Airlines shutdowns has been notable from a number of standpoints: first, it is notable for the fact that it is a loyalty program closing accounts based on bank activity; second, shut downs were swift and severe – closing accounts and canceling tickets for trips in progress during the December holiday season. That second part seems to me particularly poignant: AA was sending a message that they’re not playing. We’ve recently seen IHG place limits on the points you can buy with their cash & points trick and I recently read that National is showing language in some cases that they will contact the travel administrator for your company to verify eligibility for certain coupon codes. Marriott has cut out the meeting trick for 10 elite night credits. There seems to be some tightening of the belt on the loyalty end and I have to imagine that some other folks in the industry took note of AA’s approach to getting rid of its perceived “bad apples”. I think we’ll see a similarly aggressive move from someone else in terms of a loyalty program shut down. I’m not sure what it will be, but I imagine something is coming on this front.

We’ll see another credit card offer an “entertainment” bonus category

Millennials enjoy collecting experiences; that point is evident when you look at the push from many loyalty programs to sell members on redeeming points (to poorer value) by redeeming for experiences. I’m frankly surprised that we haven’t seen much activity from issuers in terms of finding a way to entice folks to put entertainment-related spend on a specific card. My first thought is that the category feels awfully broad, but if Citi was able to pull it off with the Prestige card and Capital One can do it with the Capital One® Savor® Cash Rewards Credit Card, it can obviously be done. Further, since I was often surprised by what counted as “entertainment” (for example, it was discovered that spend at some wineries was bonused as “entertainment”), I found myself using the Prestige card during my travels more than I otherwise would have in the hopes that perhaps a borderline purchase would code as entertainment (and I certainly didn’t always check after the fact). I feel like there is a marketing opportunity here that brings a card to the top of the wallet for many consumers.

Amex will offer an awesome new benefit on the Platinum cards

Is this prediction too general? I’m not trying for an easy layup with this one, but I think we’re going to see Amex introduce some awesome new benefit on the Platinum cards in 2020. With annual fees that are reaching sky-high numbers, these cards just have to maintain some perceived value. After cutting the WeWork benefit and taking away GoGo passes, I have to imagine that Amex intends to replace those things with something exciting (I hope it is as exciting to me as it will be to their marketing team). I think the likelihood of a semi-annual Away Travel credit seems decent: the plastering of ads in a number of New York City subway stations for Away Travel tells me that they aren’t afraid to spend some money on marketing and their brand seems as though it would align with Platinum card clientele. Further, something like a $50 semi-annual credit isn’t going to cost them a ton since that won’t amount to a big enough discount on a bag to kill their bottom line and there will be a fair amount of breakage since most people aren’t going to buy from them twice a year. I’m definitely not convinced that Away Travel credit will be the new benefit, but I think it is a contender. At any rate, something good will come as a replacement for benefits lost and I imagine that Amex is going to make it something eye-catching.

Capital One will shake things up with its rumored Ultra-premium card

It’s time: Capital One has firmly taken a seat at the transferable currency table this year and made their miles cards relevant again (at least for those who can get them). It’s been rumored for a while that they would launch an ultra-premium credit card and Greg analyzed the rumored structure earlier this year. I think that the end of his post was probably right in that details on the card likely leaked with plenty of time for Capital One to make changes, so I don’t think it will exactly match what’s been rumored. I could see them going halfway and launching a card with a $300 fee that gives the expected 10x hotels and 5x airfare when booking travel through their portal and perhaps 4x on dining and entertainment. But my prediction here is that I think they will include a side benefit that we aren’t expecting that will make this card competitive with the others on the market. Capital One surprised us all when they made their points transferable and then surprised us again with transfer bonuses; I imagine they have something up their sleeve with this ultra-premium card that will generate buzz. Maybe it will be a dining or entertainment credit instead of a travel credit? I’m not sure how they’ll surprise us, but I think they’ll make a splash.

Chase or Citi will have a $150-250 card

Frankly, I’m surprised this hasn’t yet happened: as their ultra-premium card annual fees creep toward and over $500, there seems to be a massive spread between a more traditional $95 “premium” credit card and the ultra-premium monsters. Amex finally took a slice of that market with a card that features a $250 annual fee. Chase now has the Southwest Priority card at $150. I think there is room for both Chase and Citi to install a mid-range premium card and it is a slice of the market that is being under-served. Amex proves that there are certainly customers among us willing to pay $250 per year for the right suite of benefits. I think that Ultimate Rewards is rapidly losing ground to Membership Rewards and Citi is gaining ground to close the gap with both programs: I think 2020 will see some new mid-range card from at least one of these two issuers.

[…] / credit cards / loyalty programs. I published my 2020 predictions almost exactly a year ago (See: Nick predicts: 2020 vision). December 2019 seems like eons ago, so it may not be a shock to hear that I didn’t have […]

My prediction: Amex is gonna swing a huge banhammer in 2020.

Plot twist: Resort fees will be replaced by ‘convenience fees’ as seen in event ticket industry. 😉

Hahaha. Touché.

If you think a $50 Away Travel credit would be an “Awesome New Benefit” then a) you’re mistaken that its awesome, and b) its not much of a prediction.

I expect better than $50 if they are going to do it. I agree that $50 wouldn’t be awesome. I also doubt that’ll be the only thing they add to replace a WeWork membership and the loss of GoGo. They came out of left field with the $100 or $150 Away Travel credit as part of the welcome bonus on the Green card and the annual Lounge Buddy credit — so they are obviously building new partnerships. If that’s what they did for the Green card, I’m pretty excited about what could be coming for the Platinum card — especially so since I’ve used neither the WeWork nor GoGo benefits.

Amex has 7 personal cards that offer a bonus on grocery spend… Perhaps time for the others to catch up?

Yes agreed, although the superstore exclusion kills value for many of the Kroger chain stores and other Superstore/Grocery offerings in various parts of the country.

Nick, seems a fairly desultory set of predictions. Haven’t there been bills introduced in Congress to force companies to include them in their advertised prices?

I’d like to see Amex introduce an uncapped 2x everywhere personal card – toss in a $95 annual fee or something. BBplus cards are nice but capping at $50K is annoying.

You’re probably right on most of these fronts. I have it on good authority that the capital one premium card is dead so wouldn’t expect that.

The rumored Capital One ultra card will be left at the starting gate and no one really talking about it if it doesn’t offer an initial bonus on spend or mile/points match. Venture got off to a great start when they did a miles matching bonus in which they would match up to a $1000 value if you showed them your existing miles with such things as AA. They could do something like that in which it included airline, hotel or dining program matches since that is their rumored target customers for this speculated card. With a annual fee reportedly that large I would only be interested in investing time and 3 credit pulls into applying for this card if the initial bonus is valued at $1000. I keep Cap 1 when I do go through all of that instead of churn. And, I use it regularly (I still have that Venture I received $1000 bonus value from the match).

Chase Performance Business AF is $199 and had a decent offset for ROI or Brake-even if you fly them enough. The 80K RR was a nice SUB the 3X on SW flights or SW GC.

The Plat has lost a ton of value -with Centurion caps and more congestion by granting access to Delta Reserve holders in 2020 – PP loss of restaurants – Uber/Eats has had huge devalue with higher cost more fees and/or fewer promos. ( 50% off promo on Uber trip was still more expensive than Lyft w 25% off promo on same airport run this month), so since the partnership with AMEX and IPO – Killing the GC loop-hole last June for those that monetized rather than banked cards for later trips. So yeah the Plat card, got cancelled when the AF posted this year. Gonna take a lot to compete with USB AR/or CSR card for AF vs ROI.

The Cap One Ultra prem card cold be nice.

Would love to see a INK Reserve Biz card.

I personally wonder the longer term ramifications for the LOL/24 people – especially after an economic slowdown or recession – with UW tightening up – I think that people with that have been in the game for 10 years with 50-100+ cards opened/closed – could find car loans/mortgage or even credit card approvals difficult even with high FICOs – its not hard for them to use an Algo on HP to weed out churners. 20 years ago I was far less conservative and would have been part of the LOL/24 group –

I think I saw feed notice that WeWork was sticking around for a while longer and not dead yet for Biz Plat???

They are dropping WeWork as of January 1st, but if you sign up for a WeWork account before 1/1, your membership will be good until 12/31/20.

YoniPDX

U got it right Ai will weed us out but them too . Why keep my Prestige card with my 6 current lounge passes with others . I’ll spend the $250 on a SW GC then book (2) 4 nites stays online then cancel and get the rebate on my $450 AF.

I got a new $100 credit on the Global Pass can u Reup early or do u have to wait ??

CHEERs

Yes I’m downgrading Biz Platinum to Blue Plus as soon as I hit the one year from my upgrade bonus. I rarely get to use the lounges as they are always in the wrong terminal and not worth the trip.

Luckily I have a lounge where I live, and it’s directly across from AA early morning gates. If I didn’t , the travel credit would be a deal breaker. Already, the first card I ever had,the Biz Plat, 24 years ago, is going to get cancelled.

This is a great plan… except for the fact that you can’t downgrade a Biz Plat to a Blue Plus.

bummer – I guess I’ll just apply for the 0 bonus and cancel the other one. : )

There’s usually a 10k-20k BBP bonus if you know what you’re doing. Do a little research.

The Plantinum card does need more to keep me as a customer. I find it very hard to get value out of the $200 incidentals credit, since the things it is good for are charges I don’t incur anyway because of another credit card, or things I am not interested in. The lounges are worth something for sure, but not $550 a year.

I think you mixed up Citi Prestige with the Citi Premier in the Entertainment predication paragraph.

No, I meant the Prestige — which is why I referred to it in the past tense (they cut that bonus category in September on the Prestige). You’re right that it remains a bonus category on the Premier.