NOTICE: This post references card features that have changed, expired, or are not currently available

Update: This post references an American Express Business Platinum feature that has changed. As of June 1, 2017, the pay-with-points rebate has changed to 35% for your chosen airline or any airline in business or first class. Additionally, there is a cap of 500,000 rebated points annually.

I had a small epiphany the other day. I realized that when paying for flights, I should use the most restrictive points currency that matches my needs rather than the one that lets me book with the fewest points.

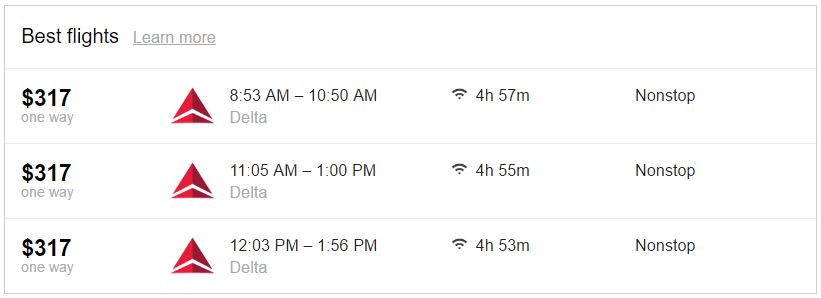

Consider this $317 flight:

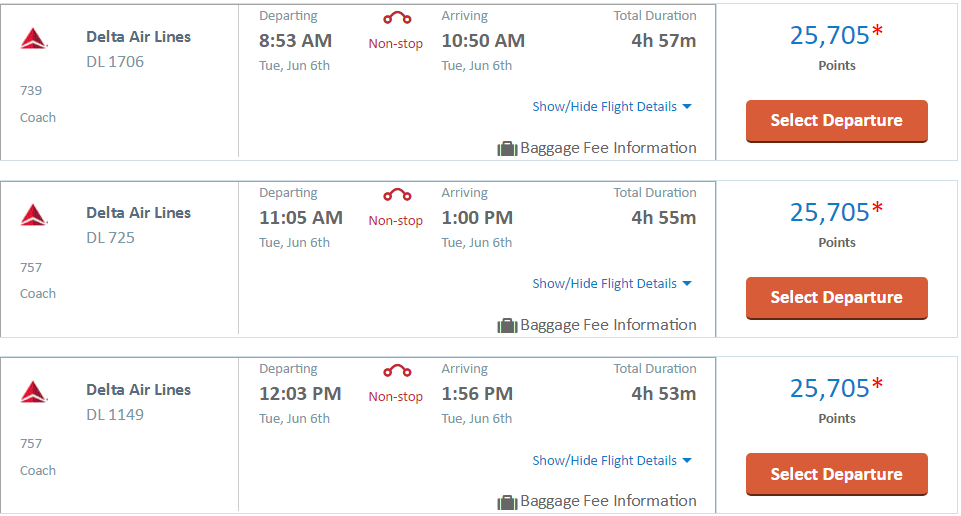

Thanks to the Amex Business Platinum card’s 50% point rebate, I could pay 15,850 Membership Rewards points (I’d first pay 31,700 points and then I’d get half back). Or, I could use my CNB Crystal Visa Infinite Rewards and pay 25,705 points:

On the surface, the Business Platinum option seems like a no-brainer. With that option, I’d save almost 10,000 points. Right? Not so fast…

As I thought more about this, I realized that each points currency has a different maximum potential per-point value. CNB points and Amex points are completely different and they shouldn’t be compared 1 to 1. If we assume that CNB won’t radically change their rewards program for the better (a pretty safe assumption, I think), then I know from past experiments that using points to purchase flights is the best I can do with that currency.

Membership Rewards points, on the other hand, have the potential to be worth far more than 2 cents each when transferred to an airline program for a high value award flight. It’s not unusual, for example, to get 3 to 8 cents per point value for international business or first class awards.

As I thought about this, I realized that when using points to pay for flights I should always use the most restrictive currency that delivers the closest to the maximum potential value for each redemption. This is true even when the total point cost is higher.

General Strategy

Once I’ve decided to pay for a flight with points rather than with airline miles, my go-forward strategy will be to check whether the flight will maximize value from one of my point currencies. If not, I’ll simply use the most restrictive currency I have. Here are some examples…

- Is the flight’s paid price less than but very close to $400 (or another FlexPerks threshold)? If so, pay with FlexPerks points.

- For other flights, pay with CNB Rewards points since paying for flights is the best use for CNB points.

- If I want to book a car rental or hotel (and I don’t care about losing out on point earnings and elite privileges), then use US Bank Altitude Reserve points (once I get them!)

- If I want to book a cruise, AirBnB, or really any travel other than air, hotels, and car rentals, then use a point system that reimburses travel after it is paid for. Examples include Barclaycard Arrival Plus, Capital One Venture Rewards, BankAmericard Travel Rewards, etc.

- If none of the above apply because I do not have enough points, then use Citi ThankYou points, Amex Membership Rewards, or Chase Ultimate Rewards. Each of these will be held as a last resort because these points can be transferred to airline and hotel programs and have the potential for much more value than through their fixed value pay with points options.

What do you think? Do you see any holes in this strategy? Please comment below!

Well.. now that Amex is cutting the 50% pay with points benefit on June 1, I’m back to paying first with MR points before anything else. Have to make the most of this benefit while it’s still around!

https://frequentmiler.com/2017/04/28/business-platinum-rebate-decreasing-june-1st/

Makes a great deal of sense:

-I’m worried that AA is falling into a “restrictive” currency for me (and other) as I’ve found myself considering a standard level redemption on more than one occasion in the last year (haven’t pulled the trigger only on principle and now absurdly waiting AA out to generally open up inventory.)

-I also find “ease of use” and “easy to replenish” a good strategy, in alignment with “earn and burn”

-I’m fully in the camp of value of points = what you would pay cash for the ticket. I simply can’t get behind the 8 cent valuations as I’d never pay (and I doubt no one here would either) $10,000 cash to fly Int. first. $1,500 sure, so my values are never going to be above about .03/point.

[…] Why pay more? Here’s why paying 25K points is sometimes better than 15K by Frequent Miler. Most people will already know/do this, but worth keeping in mind. Biggest take away is: “always use the most restrictive currency that delivers the closest to the maximum potential value for each redemption”. […]

I agree with this and just yesterday used this same concept to pay more in MR points than UR, which to me are much more flexible.

However, I agree with WR above that if you have a valuation assigned to currencies, then part of the valuation should reflect its flexibility. If you’re willing to pay more in points, that means those points aren’t worth as much as another for whatever reason.

Also if you’re not planning on keeping a card for much longer then using up those points would also be best.

I have points & miles in a lot of programs so I do some mental math like you do, in addition to just straight “how many points.” Like James, I consider ease-of-earning when deciding which points to use. Also which points might be expiring (I’m looking at you, TYP from Citi Prestige which I’m gonna cancel in July). Also, I have a ton of AA miles, fewer BA miles, and even fewer Alaska miles, so I have to weigh that when deciding which program to use for AA or Alaska flights. AA is always the most expensive, but I have so many miles that I just need to start burning them.

I tend to spend more just to use up AA miles too because I can hardly ever find availability for them!

I typically redeem points in the order of ease-of-earning. I earn way more MR’s than TY or UR, so if I can get 2 cents / point from MR’s I typically do that since I know I will be able to replenish that stash pretty quickly.

This is my approach as well. Ease of earning is a major factor for me. I don’t mind blowing through MR points because I can replenish them quickly. SPG points on the other hand, I have never used and will only redeem when I can get max value. Earning these are like watching grass grow.

Shouldn’t the factors you speak of like restrictiveness already be factored into your point valuations? If your point valuations are rational, you go with whatever option is the lowest cost. If you don’t then you need to rethink your valuations.

My point is that it doesn’t matter which option is the lowest cost. Suppose you have points worth $500 towards flights with program A, and points worth $1000 towards flights with program B. For a given flight, it doesn’t matter whether A charges fewer points than B or if B charges fewer points than A. Either way, you’ll eventually get $1500 worth of flights.

That’s only true if you are set on specific redemptions with both programs, and of course no devaluations occur. There’s no guarantee that you get $500 of value out of points you value at $500. Your valuations should factor in the comparative advantage between the two programs, but I get your point that restrictiveness is a major factor.

You would only need to rethink the valuations if you want to add value to them in the context of a portfolio of points currencies. Most people value their points on a stand alone basis. That is, they value them as if their only two choices are that particular kind of points or cash. What Greg is pointing out here is the additional value of points within a portfolio or what economists call the law of comparative advantage. Effectively if you have limited resources, then you will get the most benefit if you use each resource to its best use, even if that resource is worse at everything than another resource.