NOTICE: This post references card features that have changed, expired, or are not currently available

If you’ve used one or more of thousands of different apps in the last nine years, there’s a good chance that you’re eligible to submit a claim under a Class Action Settlement involving Plaid.

The Details

A Settlement has been proposed in class action litigation against Plaid Inc. (“Plaid”). Approximately 5,000 mobile and web-based applications (“apps”) use Plaid to enable users to connect the app to the users’ bank account(s). This class action alleges Plaid took certain improper actions in connection with this process. The allegations include that Plaid: (1) obtained more financial data than was needed by a user’s app, and (2) obtained log-in credentials (username and password) through its user interface, known as “Plaid Link,” which had the look and feel of the user’s own bank account login screen, when users were actually providing their login credentials directly to Plaid. Plaid denies these allegations and any wrongdoing and maintains that it adequately disclosed and maintained transparency about its practices to consumers.

Eligibility

You may be a Class Member if you are a United States resident and you connected a financial account to an app between January 1, 2013 and November 19, 2021. More specifically, you are a Class Member if you own or owned one or more “Financial Accounts” (defined in Question 7) that Plaid accessed using your login credentials and connected to a mobile or web-based app that enables payments or other money transfers; or for which you provided Financial Account login credentials to Plaid through Plaid Link; between January 1, 2013 and November 19, 2021.

Settlement

In addition, the Settlement establishes a $58 million Settlement Fund, to be used for cash payments to Class Members who submit valid claims for compensation, after deducting the costs of the settlement administration, court-approved attorneys’ fees and expenses, and Service Awards for eleven Class Representatives. The amount of monetary payments issued to Class Members will depend on the number of valid claims received. In exchange for the benefits the Settlement provides, Class Members will release any and all claims they may have (whether known or unknown) regarding the allegations in the Complaint.

How To Make A Claim

Direct link to submit a claim.

Claim forms must be submitted online by April 28, 2022 or postmarked by this date if mailed.

Quick Thoughts

There’s a good chance that most Frequent Miler readers will be eligible to make a claim under this Class Action Settlement. Plaid is the service used to link thousands of different apps to your financial accounts. That’s sometimes used for card-linked offers, other times to easily link accounts for payments and more.

Among the many thousands of apps/services you might have used Plaid for there’s Bitmo, Dosh, Bumped, Drop, Webull, Robinhood, SoFi, Ibotta, Fetch Rewards, Varo, Voyager, Chime and many more.

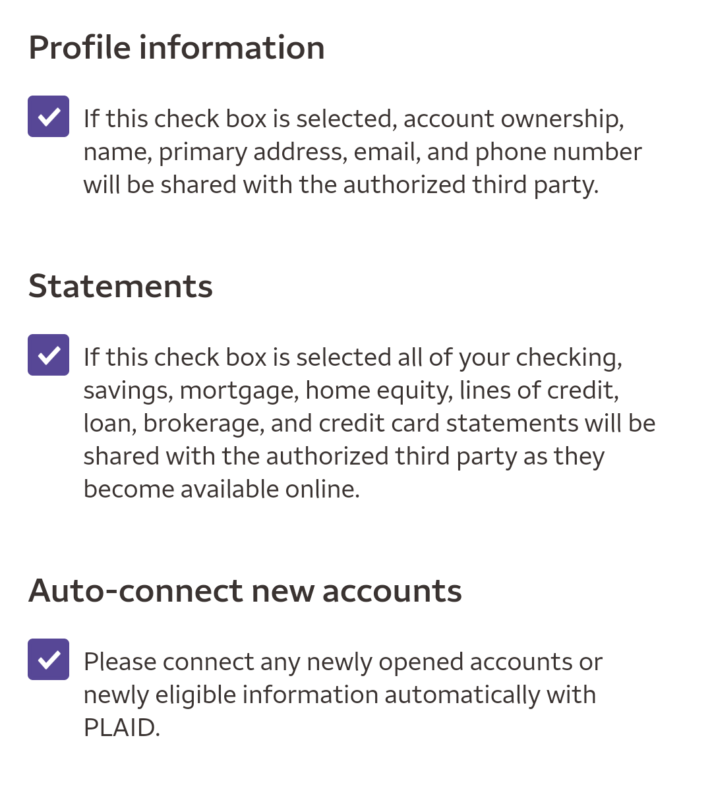

Quite possibly as a result of this Class Action, I’ve noticed in recent weeks that Plaid has been providing a lot more information about the information it’ll collect and giving you an option to opt out. For example, with the recent Bakkt/Wyndham promotion, if you want to actually cash out points then you have to link a financial account. That requires linking via Plaid and here’s all the information that it wanted to collect:

I noticed similar permission requirements/requests from other services recently, so these options seem to be a standard Plaid request rather than it solely being Bakkt wanting these details.

I can understand details like my name, email address, phone number, etc. being passed along. However, the fact that a random third party would be passed all my financial information from whichever bank I was linking – including mortgage information, credit card statements, etc. – is downright concerning. It’s not only historical details they’d be getting either – all future financial information would be passed along including new accounts if neither of those boxes were subsequently unchecked.

There have been rumors that X1 has been preemptively shutting accounts after one or even zero purchases by cardholders off the back of information they’ve been passed by Plaid. While I’ve loved how easy Plaid has made it to link accounts and the potential benefits of card-linked apps and services, I’m far more wary now about the information they collect and I’m glad they’ve started to provide some semblance of control over what data is shared.

Although a $58 million Class Action Settlement might sound like a lot, I imagine that the amount that gets paid out per person won’t end up being too significant. Still, both my wife and I are going to be making claims anyway on the off-chance that it becomes worthwhile.

I recieved $35 and some change direct to venmo from this class action yesterday, so theyre starting to pay out. Thanks for posting!

I just Haus my Venmo account attacked be fraudulent transactions from my bank on 3/1/22, Can I submit a claim?

Is there a comprehensive list of apps/sites that use plaid? I know I’ve used a couple apps that were powered by plaid, but without a comprehensive list I can’t know all of them. There must be a list somewhere?

You can search for apps and websites here: https://www.plaidsettlement.com/search.php You can input a letter into the search box and it’ll display all apps/websites with that letter in it, so you could do that alphabetically.

A class action settlement only benefits the lawyers. While we, us the people receive a small fraction ($5) of the settlement while the lawyers gets millions. No, I want no part of it and may seek to sue them on my own.

Or do you have access to the info plaid wrongfully took, and now people are just telling you when, so you can pin-pointedly access their info – etc etc…..

I’m leary because fraud has become a profession- and for someone who is claiming this, that just “travels” is a concern to me. So please explain to me what court this class action is called into – and the status of said cause – PLEASE!!!

Thank you so much! I’ve used many of the apps you’ve mentioned so I’m concerned!

What apps

I’m afraid to give the settlement company my address and information..do you guys think this is legit? Are you filing a claim?

It is legit. I have settlement from other class action

I filed a claim and they asked for my bank account info and I did. Now I’m worried because I emailed them and asked why was banking info needed and haven’t got a response.

Do you actually track when you link accounts to Plaid? This kills it for me lol.

There’s something called Plaid Portal that allows you to see which banks / apps are connected via Plaid. This was helpful in completing the Class Action form

https://my.plaid.com/

Does it show dates?

No. I put in the year.

No but claim form just asks for approximate date. The my.plaid thing tells me they know when it happened sonce i’m sure all of that stuff is time stamped on their end. I think its just asking to make sure you are in the claim window