NOTICE: This post references card features that have changed, expired, or are not currently available

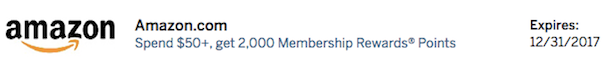

In my post “Awesome Amex Offers and how to get them,” I argued that the way to get the best Amex Offers is to get every type of Amex card (Membership Rewards vs. Other; Personal vs. Business; etc.) and to get lots of those cards by adding lots of authorized users. I intended to follow my own advice, but I dragged my heels for a while. Then came the amazing Amazon offer: Spend $50 or more at Amazon, and get 2,000 Membership Rewards points. Wow. I had to get in on that one. But I couldn’t. None of my cards had this targeted offer.

I dug into reader reports and found that the Amazon offer was only available on cards that earn Membership Rewards (that part was obvious) and only on personal cards. As far as I know, no one has seen the offer on a business card. So, I checked through the many Amex cards that my wife and I have to count up our personal Membership Rewards cards… The grand total came to… zero. We had just recently closed my wife’s personal Platinum and Green cards and we were left with no personal Membership Rewards cards. Obviously this has to change.

I dug into reader reports and found that the Amazon offer was only available on cards that earn Membership Rewards (that part was obvious) and only on personal cards. As far as I know, no one has seen the offer on a business card. So, I checked through the many Amex cards that my wife and I have to count up our personal Membership Rewards cards… The grand total came to… zero. We had just recently closed my wife’s personal Platinum and Green cards and we were left with no personal Membership Rewards cards. Obviously this has to change.

Pondering the ideal set of cards for my Amex Offers portfolio

With most of their cards, Amex will let you get up to 99 authorized user cards for free. I don’t want that many, but I do want a handful of each type of card. And since each card requires setup time, I want to make sure that the account is one that I’ll never cancel. In other words, I’d ideally like a fee free card of each type so that I can add authorized users, setup Twitter handles for each one, and never have to consider closing those accounts.

Here are my primary targets:

- Consumer Membership Rewards card: Amex EveryDay or Morgan Stanley Credit Card. The advantage of the latter is that it offers uncapped 2X rewards for select department stores. Since Amex Offers are often specific to certain department stores, there should be opportunities to double dip.

- Consumer Non-Membership-Rewards card: I already have the old Blue Cash card which has no annual fee, so I’ll probably stick with that. Otherwise I would probably look at the Hilton Honors card.

- Business Membership Rewards card: No question here. I’ll go with the new Blue Business Plus card. 2X everywhere and no annual fee? Yes please!

- Business Non-Membership-Rewards cards: I’ve had a Business Delta Platinum card for many, many years (sometimes I upgrade it to a Delta Reserve card and later drop it back down to Platinum). I don’t see myself getting rid of that one, so I may just add some more authorized users to that account. Additionally, my wife has the SPG Business card, which I believe is worth keeping. However, given that Marriott and SPG plan to eventually merge programs, we can’t count on that account lasting forever. If I didn’t have the Delta business card available, I’d probably go for the no fee SimplyCash Plus card. That one is worth considering anyway for its 5% and 3% cash back categories.

Dealing with the 4 or 5 credit card limit

Amex limits each person to having either 4 or 5 Amex credit cards. Charge cards and authorized user cards are not limited and are not included in the count. Unfortunately, all of the candidate cards I identified above are credit cards.

I currently have three Amex credit card accounts: Delta personal, Delta business, and old Blue Cash. I don’t want to get rid of any of those, but that’s OK — I still have room for 1 or 2 more. I can probably get away with adding on both the Blue Business Plus card and the Morgan Stanley card. Unfortunately, I would then be stuck if Amex introduces a new credit card or credit card offer that I would want to take advantage of.

My wife currently has four Amex credit cards: Delta personal, Delta business, SPG personal, and SPG business. Again, I don’t want to drop any of those cards. The Delta cards are valuable for manufacturing elite status. And the SPG cards are valuable for earning SPG points through spend and referrals. If we don’t drop any of these cards, then she can, at best, add one new credit card to her lineup.

One other consideration: I really want both of us to get the Blue Business Plus card. That card’s 2X earnings work for just the first $50K of spend per year. If we each get the card, though, we would have $100K to spend towards 2X rewards each year.

Amex used to strictly enforce a 4 credit card limit, but in the past year that has changed. Some people get automatically approved for a fifth card. Others get approved only after calling in for reconsideration.

My overall approach will be to sign up for new credit cards and hope that I can get to 5 credit card accounts for each of us.

The Amex Offers portfolio plan

My tentative plan is as follows:

- Me: Sign up for both the Blue Business Plus card and the Morgan Stanley Credit Card. If approved, I will then have 5 Amex credit cards. If a new and attractive credit card offer surfaces I’ll then consider dropping one of those 5.

- Wife: Sign up for the Blue Business Plus card. If approved, she will then have 5 Amex credit cards. If a new and attractive credit card offer surfaces we’ll consider dropping her SPG personal card.

Note that I can’t sign up for both of my target credit cards at once. As you can see in our Amex App Tips, Amex will only approve 1 credit card per 5 days and 2 in 90 days. So, I’ll wait a week between applications. I’ll apply for the Morgan Stanley card first since that’s the one I most urgently need in order to be eligible for Amex Offers that are available only for personal Membership Rewards cards.

Authorized User Cards

UPDATE: Since writing this post I’ve learned that quickly adding a bunch of authorized user cards may be a trigger for an American Express financial review (which could, in turn, lead to account shutdowns). As a result, I will change my plans from those written below. I recommend only adding “real” authorized users and to add them slowly over time rather than all at once.

Assuming the above plan goes well, the next step will be to add a handful of authorized user cards to each account. One consideration when doing so is that authorized user cards from personal Amex cards can negatively impact the ability to get approved for new Chase credit cards. Chase has their dreaded 5/24 Rule in which, for most of their cards, they won’t approve you for a new card if you’ve opened 5 or more cards, from any bank, in the past 24 months. They count these accounts by looking at your credit report. Since Amex business cards do not show up on these credit reports, those do not hurt your 5/24 status. Personal Amex cards and authorized user cards, though, are counted. You can always get those authorized user cards off of your credit report, or call Chase after a denial to argue that they shouldn’t have counted the authorized user cards, but who needs that hassle?

I don’t mind being added as an authorized user to personal cards since I’m already way, way over 5/24. However, I won’t add my wife as an authorized user to any of our personal cards since she has some chance of eventually falling below 5/24.

Dreading the work

To fully take advantage of Amex Offers, it is necessary to maintain a spreadsheet containing every individual card and authorized user card along with info about which offers are active for each card. Plus, it’s a good idea to setup a separate Twitter account for every single card in order to easily (and potentially automatically) enroll in Amex Offers. Full details can be found here: Complete Guide to Amex Offers.

Then there’s the work of actually taking advantage of the best offers. With the Amazon offer, it would be easy. I’d simply log into Amazon and reload my credit balance $50 at a time with each enrolled Amex card. Many of the best offers, though, require visiting stores. I’ve been known to go to Lowes to buy $500 Amazon gift cards and pay $50 at a time. Not only do you have to carefully keep track of which cards are enrolled and which have already been used, but you also have to put up with the angry stares from those in line behind you. While Amex Offers are an amazing way to save significant amounts of money or to earn huge rewards, they can also be a lot of work.

I currently have 22 Amex cards (including AU cards) that I manage. I don’t really want too many more. I’ll probably add 6 to the Morgan Stanly card, but fewer to the others. I’ll try to stick to a total of around 30. Or, maybe 40… We’ll see.

[…] the cards in your wallet — so much so that Greg explored the ways in which he is planning our his Amex portfolio with an eye toward maximizing Amex Offers. On that note, if any of your offers have vanished, […]

@Greg: How do I determine which of my Amex cards are charge and which are credit? It’s hard enough to look through and see which are mine and which are cards I’m an AU on. Thanks!

Check the official name of each card. If the name includes the word “credit” then it’s a credit card. Otherwise its a charge card.

You can google for the card to find its official Amex page to see its name. Or look at the name on our Best Offers page: https://frequentmiler.com/best-credit-card-sign-up-offers/

Awesome, much easier than I would though. Thanks!

[…] Planning my Amex Offers portfolio […]

I just applied for the Morgan Stanley credit card. App went pending.

[…] my recent post “Planning my Amex Offers portfolio,” I described my plans of ensuring that I had at least one of each type of Amex card […]

Thanks to those who commented warnings here, I did a bit of research about whether adding many AUs can lead to a financial review. While I couldn’t find much evidence, I found enough to make me rethink the plans originally written here. I will publish a post about my findings tomorrow morning. I’ve updated the AU section of this post with a caution, as follows:

UPDATE: Since writing this post I’ve learned that quickly adding a bunch of authorized user cards may be a trigger for an American Express financial review (which could, in turn, lead to account shutdowns). As a result, I will change my plans from those written below. I recommend only adding “real” authorized users and to add them slowly over time rather than all at once.

That is exactly what happened to me. Added 2 AUs to 3 diff cards. Got my FR within a week after a fairly unpleasant call from AMEX. Tread carefully, I say.

I’ve heard that adding an AU to a personal Amex card is counted by Chase against their 5/24 rule. In other words, if I add Joe as an AU to my personal Amex card, Chase thinks that Joe has obtained another of his quota of 5 cards in 24 months.

Is this correct?

Yes. That’s why he didn’t want to add any AU’s in his wife’s name since they will show up in her credit report and she might be below 5/24 sometime soon. All of this is spelled out in the article.

Slightly off-topic (but related) question – I’ve noticed that the last 2 offers I used I had added to multiple cards (Boxed.com on 5 cards and Amazon on 2). I only used the offer on 1 card and then it disappeared on the others. I used to be able to spread out my use of them. I read these blogs pretty regularly and haven’t seen anything about this. Does AMEX now delete them from other cards when you use it on 1? Is it immediate? Or end of day? Maybe when the credit posts for the offer you used? Thanks for any info anyone can provide.

Yikes. I just tested this and found the same. I hope this is just a bug with the new interface!

Actually, just confirmed that it is a bug in the new interface. US Credit Card Guide has a link that lets you open the old interface. I did so and found the offer still there on my other cards.

Here’s their post: https://www.uscreditcardguide.com/dont-like-the-new-amex-account-design-heres-the-link-to-a-very-old-design/

In the name of blogging you are just acting so adamant and stupid by blogging about unnecessary things that should not be posted in a widely read site like yours. Off late you have become so irresponsible like some of your fellow bloggers and this is definitely not sensible blogging. If you feel you are responsible enough, please bring down this post soon.

I would not risk adding too many Authorized Users or adding yourself as AU on Amex cards. I have done this in the past and had a FR done with several questions being asked as to why I have added AUs in my own name when I was the card owner. I missed a bullet when they only closed my AUs and not the cards, not worth the hassle for a few dollars or pennies you will make following this guys advise.

Can you share a copy of your spread sheet so that I can use it as reference

I would, but its not in a shareable form at the moment. I basically keep a Google Doc spreadsheet with a row for each Amex card and a column for each offer that I want to track. In that cell I put “Y” for signed up. “U” for “I used the offer and I’m waiting for the Amex reimbursement. “G” for “got the Amex reimbursement”. For offers where I don’t meet the spend all at once, I put the dollar amount I’ve spent so far.

A good addition would be a second column for each offer to list the end date and offer details (e.g. spend $200 online only by 8/31)

A number of people here have commented with the assertion that adding a bunch of authorized user cards will lead to getting shut down. I’ve never heard this before and yet I know many people who have far more AU cards than I’ll ever get. Is the shutdown warning just conjecture? Can anyone point to credible evidence of this? I certainly wouldn’t want to do this myself let alone suggest it to others if it was a real risk.

I got a couple of AU cards and the following week I got hit with an FR. It was unusual because I didn’t have the usual triggers like large spending on new cards. I don’t know if you’ve been paying attention but Amex has recently been revamping their AU system. The ability to add AU’s to the SPG Biz cards was down for a few days a few weeks back, and the AU site has been down intermittently. The writing on the wall is that Amex is cracking down on illegitimate use of AU’s for AO’s. I respect a lot of the research and material you put out, but I’d suggest researching this a bit more yourself before recommending this to others.

Can you elaborate on how you set up the Morgan Stanley brokerage account that is required for the credit card? Is that the same as their StockPlan Connect account?

Actually, I haven’t found out yet whether one really needs to have a Morgan Stanley account to sign up for these or if it’s more of a suggestion. Or, if it is really required, whether there’s a low cost or no cost way to create an eligible account. Researching that will be my next step.

Actually, I got declined for the card back in April because I didn’t have a Morgan Stanley brokerage account. I was assuming that they won’t check, but after about 3 weeks, the dreaded decline letter came. I still haven’t figure out how to setup the right brokerage account without much effort, and hopefully without any maintenance fees, but I feel it is not worth it to spend the time investigating it so I gave up. Please keep us updated if you find out more. Thanks!

For what it is worth, @Greg, I had the offer on TWO AU cards, but both under the same main card, AMEX Everyday. (Though each card has its own log in and Online account and twitter.)

However, only one card has been deemed to have redeemed the offer. Nothing on the other one, and it has been days. So I think their tech is getting better or something. Then again, who knows, but just offering that data point.

Are they showing the new *bigger* interface? The new interface seems to have some bugs, but it also seems to be limiting the number of Amex Offers you can sign up on both the main card and its AUs or something.

Yep, “bigger” seeming, anyhow. I’ve read that on multiple offers, load them all but redeem one, then wait for points, then redeem the next. No idea if that is true, but next time around, should I get multiples, I will try that as that worked for me a year and a half ago on the AIRBNB 50 off 100 deals.

I would highly recommend not adding yourself as AU’s, this is asking for an Amex shutdown and at the very least, a financial review and questioning. If you have legitimate people/SSN’s you can add to have more AU’s with their permission, that’s one thing, but simply adding yourself, I would stay clear from this.