Update 12/21/23: After re-launching, Amex cards had once again stopped working on Plastiq. It appears that it was just a brief technical issue and they’re up-and-running again.

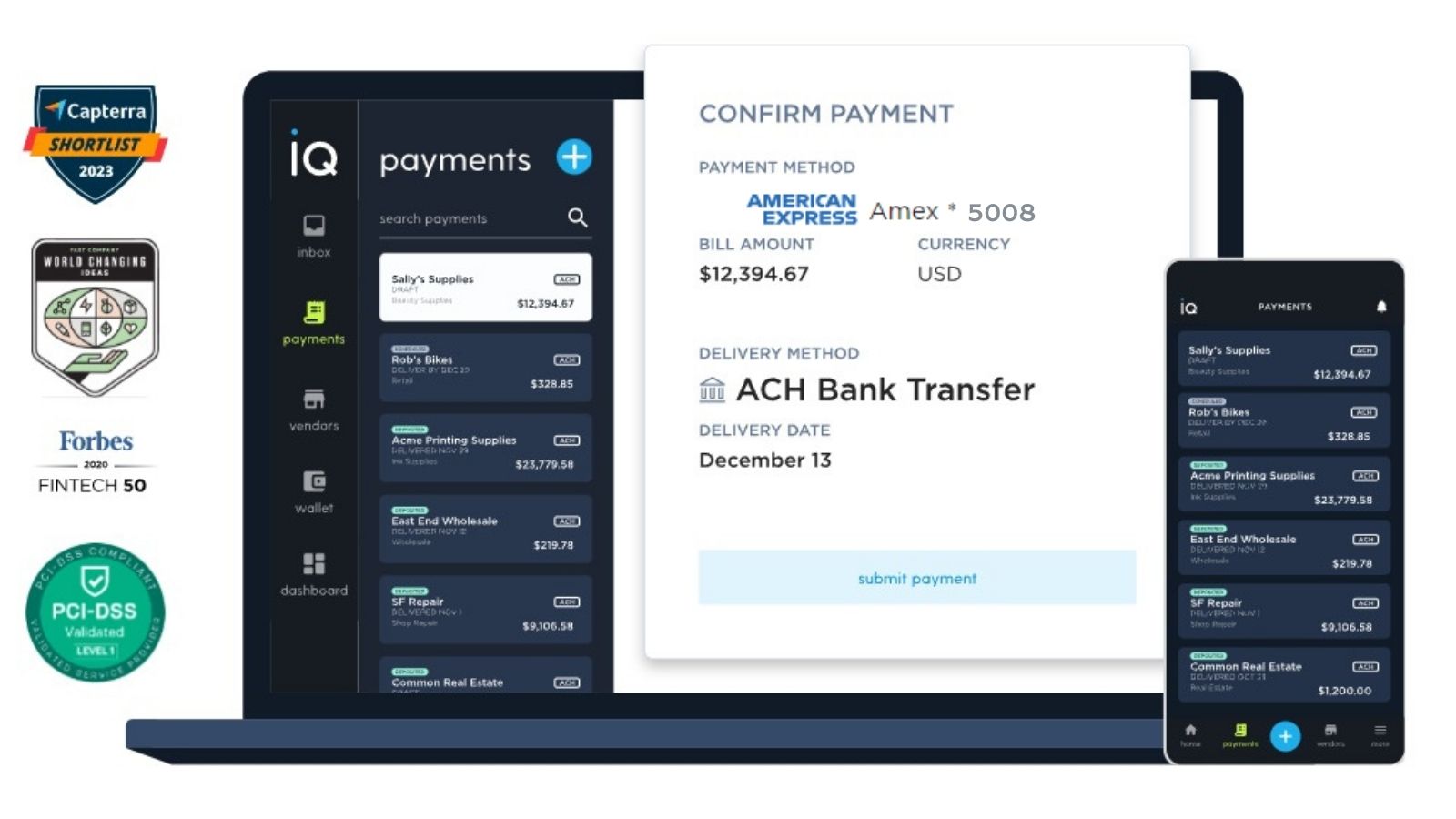

Plastiq has once again begun accepting American Express cards for payments. I was able to successfully send a tuition payment to my son’s “3K” program last night using an American Express card as both “tuition” and “daycare” are among the many categories that can now be paid with an American Express card.

Plastiq has released an announcement indicating that as of 10/30/23, they have once again begun accepting American Express cards for many types of payments. I was able to test this out by making a payment to my son’s educational program and the payment was processed successfully and I now see it pending on my Amex account. That’s great news.

As was the case in the past, Amex cards can be used for a wide variety of payment types, including taxes and government fees, residential rent and HOA fees, tuition, daycare, membership clubs, construction services, many types of business services and inventory purchases, purchases of ATVs and golf carts, and many more things. You can not use an Amex to pay an auto loan, mortgage, student loans, or most other types of debt products. For a full list of which types of payments can and can not be made with each major card type, see this article. See also our Plastiq Guide: Pay Bills via Credit Card.

Do note that Plastiq relatively recently added a fee for delivering payments by check. Even though I had more than enough fee-free dollars to avoid paying the credit card processing fee for the payment I sent last night, I still got hit with a $1.49 fee for sending the payment via check. That’s understandable since Plastiq incurs the cost of postage, envelopes, and the time to print and mail the check, but it’s worth being aware of that new fee which did not exist until recently.

Overall, the reintroduction of Amex to the Plastiq service is great news. It still won’t make sense for most people most of the time, but Plastiq can still be a great way to meet minimum spending requirements by paying bills that you may not ordinarily be able to pay by credit card. The tuition bill I pay for my son is a good example as I wouldn’t otherwise be able to use a credit card to pay it, but thanks to this change from Plastiq I was able to use that expense to help meet the minimum spending requirements for a new Amex card that I recently opened. In my case, I wasn’t paying the 2.9% credit card fee, but if that would make the difference in meeting the spending requirement I certainly might consider it.

Nick, why did you not have to pay the 2.9% Plastic fee for paying tuition?

“ but thanks to this change from Plastiq I was able to use that expense to help meet the minimum spending requirements for a new Amex card that I recently opened. In my case, I wasn’t paying the 2.9% credit card fee, but if that would make the difference in meeting the spending requirement I certainly might consider it.”

Nick explains in the post that he has fee-free dollars, presumably from Plastiq referrals back when Plastiq was giving fee-free dollars.

Nick, Thanks for your post. I’ve been trying to get my kids’ private school tuition to pay by check (Amex) for weeks now and always the same message – “Recipient cannot be paid by Amex due to card network rules.” How did you get yours to go through? Any details would be appreciated. Thanks!

None of the blogs have been talking about the fact that Plastiq stopped accepting AMEX AGAIN very shortly after they supposedly started re-accepting it. They said it’s “temporary” but they’ve said that for more than a month now and I’m getting quite worried as I applied for an AMEX card with big min spend and needed Plastiq to hit the spend

Didn’t they file for bankruptcy? What is the confidence level to do business with them?

Yes, they did file for bankruptcy protections. Another company acquired them at the beginning of August though. Frankly, I’m not concerned at all. Credit cards have consumer protections and bankruptcy protections are often just a way for a company to reorganize. If you’re not comfortable doing business with them, don’t let me convince you otherwise. Personally, I’m not concerned. Sears filed for bankruptcy more than 5 years ago and they’re still alive and kickin’. Obviously a much bigger company with a much different financial picture, but my point is that bankruptcy doesn’t definitively mean imminent doom.

With a 2.9% fee and with most of us valuing Amex MR points at >1.45 cents each, wouldn’t paying for as much as possible with Plastiq using an Amex BBP card inherently make sense?

e.g., if we value MR points at 2 cents each, then we’d be paying 2.9% but earning 4%, right?

At 2.9% the math actually works out to 1.4 cpp because you are earning points on the fee.

Ah, even better. So is my understanding right, that this is basically a no-brainer all the time for people using a BBP? (I’d expect *most* of us valued points at >1.4 cents each, right?)

Interesting news about Plastiq. Is Bilt accepting American Express again?

You can only use the Bilt card to pay your rent with Bilt.

The image on the plastiq page showing where you can use each card is ridiculously small. And no way to expand it except by opening it in a new tab where it’s still small. How is anyone supposed to read it?

I agree that it’s annoying, but I just zoomed my browser to 200% on desktop (and pinched with my fingers to zoom on my phone) and it was fine. I’m not saying it’s an icon of usability — it clearly isn’t — but I didn’t have too much trouble nonetheless.

This is great news – takes some presuure off all the SUBs were working on as it adds flexiblity to our options.

You mentioned residential rent, do you mean that I could pay the actual monthly rent?

Yes. For a fee. On the other hand, you can pay rent with the Bilt card without any fee.

Yes, that’s what it says. As Lee says, you could alternatively pay your rent with the Bilt card without any fee and they would send a check to your landlord. The primary reason to use Plastiq for this would be that you want to earn multiple welcome bonuses over the course of the year and it’s worth paying the 2.9% fee to Plastiq to meet those requirements. Otherwise, you would be better off getting the Bilt card than paying a 2.9% fee if you just want to earn points paying rent.

I typically pay my mortgage with my Citi double cash. I look at it as buying Citi points at about 1.34 cpp. It isn’t a great deal, but when they have a transfer bonus to a program it seems worth it.

Mastercard is the only network that allows debt payments.

Discover also accepts debt payments. And, if you have a Discover It Miles card, you may come out even since Discover doubles your cash back during your 1st year (i.e. their normal 1.5% becomes 3% cash back at the end of the 1st year). I think Chase Freedom Unlimited is currently offering a similar deal on new applications.

Freedom Unlimited is Visa. Freedom Flex is MC.