We are soon coming up on the ten-year anniversary of my first big trip booked with miles and points. My wife and I had been bitten by the travel bug years prior and had traveled together in more of a “backpacker” style whenever we could for six or seven years. Then, I stumbled on the world of award travel and spent a year reading blogs like Frequent Miler and a year collecting miles and points before we took off for a four-month round-the-world honeymoon to 18 different countries flying almost entirely in business and first class and staying in hotels we never would have imagined.

I’ve reminisced about all of that lately not only because this year makes a decade of award travel but also because of where it started: I still remember my excitement on the day around eleven years ago when I got approved for the Chase Sapphire Preferred card. In those days, there were no hundred-thousand-point introductory offers, but the card and its bonus were nonetheless my gateway to a world of travel that we thought only existed for travel channel TV hosts and jet setters. It all started with that shiny blue card in my hands and the way it inspired me to learn about transfer partners, award chart sweet spots, destinations, and a lot more. I’ll always be thankful for that shiny blue card in my hand and the long-term gifts it has given me in the form of the inspiration to continue to expand both my knowledge of award travel along with my world experience.

On the blog this week, read about how the best card for Costco isn’t a Costco card at all, where you can go with 100,000 points, a big Gondola enhancement, and a lot more.

This week on the Frequent Miler blog…

Awesome new 100K Chase Sapphire Preferred Card offer (last call)

Offers come and go all the time, but the 100K offer on this card is a very uncommon occurrence. Between the rarity of the offer, the value of the points, and the long-term usefulness of holding the card, it is an offer that is worth considering if you are eligible or can make yourself eligible (perhaps by downgrading a current Sapphire card). If you have it in mind to apply, know that it ends at 9am on May 15, 2025. Referral links end a few days before that.

(Offer Reduced) Rakuten offering up to 30,000 points / $300 Now 10,000 points / $100 on top of up to 100K welcome offer

Oddly, the best place to get a Sapphire Preferred this week became shopping portal Rakuten. That’s because it was (for a few days) possible to stack $300 back or 30,000 American Express Membership Rewards points) on top of the new card welcome bonus. Even at $100 or 10,000 points back it may still be appealing, though if a household member has a referral link, you may prefer the extra household Ultimate Rewards points. Keep in mind that Rakuten could change this offer again at any time, but we’ll have to keep an eye on whether they offer more cards in the future.

Rakuten’s shopping portal has a great new trick | Coffee Break Ep55 | 5-5-25 | Podcast

We were so intrigued by that new Rakuten offering (and determined to make sure that readers knew about it since we didn’t expect it to last) that we published this week’s coffee break a day earlier than usual to discuss the many strengths of shopping portal Rakuten — including that new nifty trick.

A trip to Europe for two people with just 100K points

Have you wondered just how far you could go with the 100,000 bonus points from the offer above? It is amazing to think that a single new credit card welcome bonus can be enough miles to plan a two-stop trip to Europe for two passengers, but that’s exactly what I laid out in this post. Keep in mind that while the post takes into account a couple of current transfer bonuses for small bumps, it doesn’t include the points earned with minimum spending requirement nor the fact that you could possibly cash out points and save some with a low cost carrier connecting your European cities if you prefer. With a little effort or a second card, it would easily be possible for a couple to extend this trip to a longer period of time, another destination, or use the additional bonus to cover your taxes.

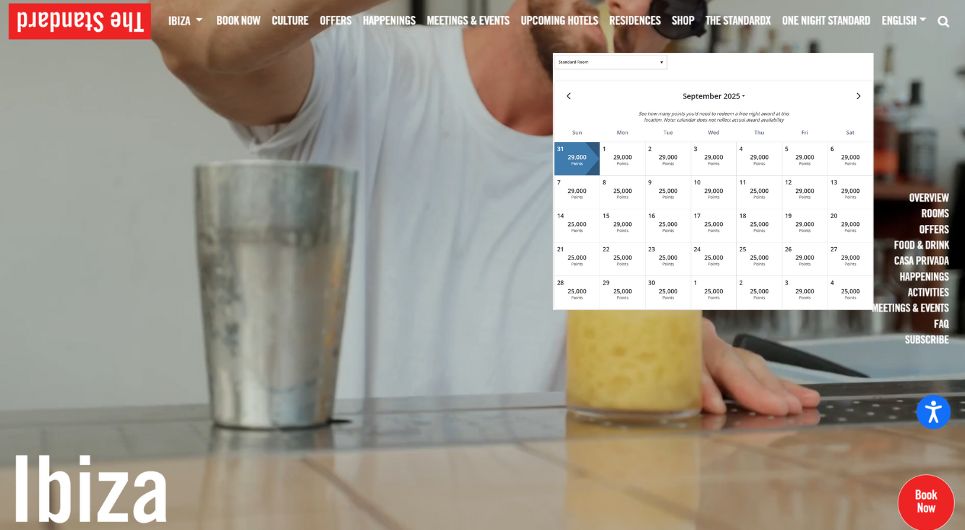

The Standard hotels integrating into Hyatt’s standard charts and benefits

I’m thrilled that Hyatt has given the, uh, standard treatment to The Standard hotels. I am less excited by the decision to continue to partner with the most vanilla-sounding chains on the planet. I know that I am not nearly young and hip enough to fully appreciate The Standard, but I just continue to have a hard time equating luxury with names like The Standard or Mr. & Mrs. Smith (no offense to any Smiths out there).

World of Hyatt adds new limit to award gifting

Hyatt has added new limits to award gifting — or rather, somewhat oddly, award receiving. By all accounts, this is a reasonable step for Hyatt to have taken to place some sort of speed limit on the purchase of these awards from others (though the person giving the gift seemingly maintains the ability to give away an unlimited number, so I’m not sure this stunts the market for sellers so much as for buyers, and even then the folks buying presumably weren’t earning status organically, so I’m not sure that many people buying needed more than 10?). I doubt we would use more than 10 awards per year, but I could nonetheless imagine a world in which it would be annoying. As a family of four, we’ve run into many situations in recent years where we need to book two rooms. In those situations, the second room goes in my wife’s name. Since I have Globalist benefits, I’d like her room to get breakfast also. We definitely did that more than 5 times last year (she ended up getting a couple of Guest of Honor certificates from friends), but probably fewer than 10. In fairness, our use case scenario is probably pretty rare, so I imagine that most people will be fine with the new limits.

How I booked my son’s graduation present flights to Japan

Greg is in the midst of planning a big gift trip for his son and a friend to visit Japan. What a cool graduation gift! Perhaps the most surprising here is the fact that that Greg found reasonably-priced Delta awards to Asia (though he didn’t book those flights to Seoul). That said, having spent time in Japan last August, I can guess as to why Delta is offering cheap awards to Asia in August: it is hot in both Korea and Japan in August. Fun fact: the 1964 “summer” Olympics in Tokyo were held in October to avoid the extreme heat and humidity of Tokyo in the summer months (and the more recent “Tokyo 2020” games, actually held in 2021, moved the marathon to Sapporo because of heat concerns. Hopefully his son’s trip is at a different time of year or he loves the heat as much as I do!

Award Booking Stories | Frequent Miler on the Air Ep305 | 5-9-25

If you enjoyed Greg’s story above about booking his son’s trip to Japan, you may enjoy this week’s Award Booking Stories episode of the Frequent Miler on the Air podcast, where Greg and I each share the details about how we booked a couple of upcoming trips from how we found availability to which miles we used to book. I even shared a “mistake” of sorts in booking my trip (intentional, but a poor choice in hindsight!).

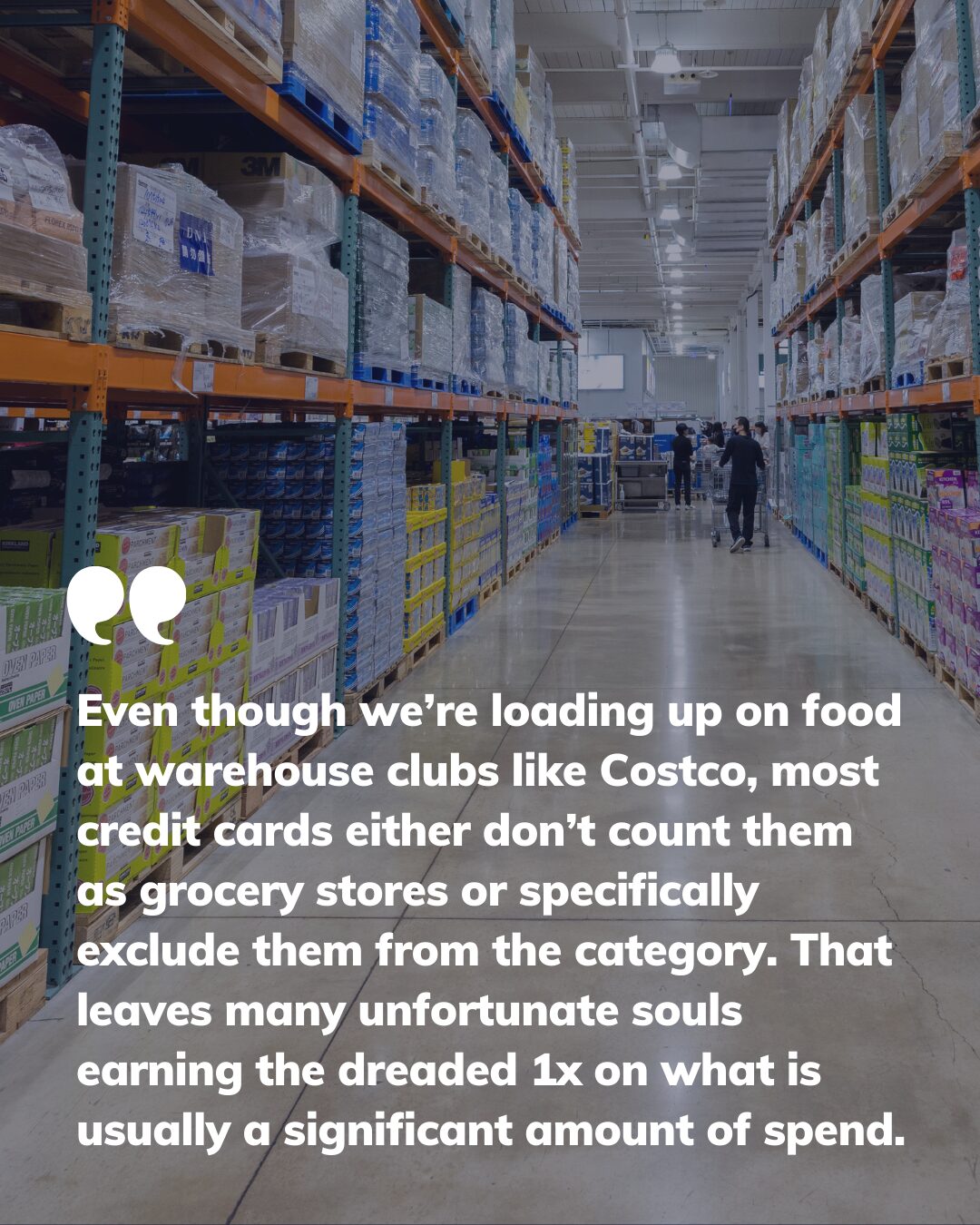

Best credit cards to use at Costco, Sam’s Club and BJ’s Wholesale

For years, my advice for the best credit card for warehouse clubs was simple: get the U.S. Bank Altitude Reserve and use it to tap to pay with your phone or smartwatch. Given that card earns 3x on mobile wallet, which can be redeemed at 1.5cpp for travel, that card effectively provides 4.5% back when paying with your phone. Unfortunately, that card is no longer available. Nowadays, if I wanted best-in-class ongoing rewards at Costco, I’d be looking at the Venmo card.

Why a US Bank approval rushed me to the Chase 100K offer

This week, Greg revealed part of the reason why he rushed to product change his Sapphire Preferred card and re-apply as soon as possible: A U.S. Bank approval would put him over 5/24. On the podcast, Greg noted that he wasn’t highly concerned since he didn’t expect the new US Bank credit card to show up on his credit report for 30 to 60 days. Funny enough, a day after we recorded the podcast, his new Smartly card showed up — less than a month after applying and within a week of his Sapphire Preferred approval. It was a good thing he moved quickly!

Gondola: My go-to hotel award search tool has fixed their email problem

Gondola has made a huge fix: you no longer need to provide full email inbox access in order to use the Gondola platform for free. That makes a huge difference and suddenly turns this tool from something that turned me away into something really intriguing for hotel searches. In my opinion, it is now well worth checking this tool out.

A checklist for cancelling credit cards

Ready to cancel your credit card? Before you do, consider how to keep your points alive, whether and how you can get back all or part of your annual fee, if a product change might make more sense, and more. This post has been updated with more information and tips prior to cancellation.

That’s it for this week at Frequent Miler. Keep an eye on this week’s last chance deals to be sure to keep them top of mind before they expire.

![Viral marketing proves infectious for two more airlines, a new card lands with a thud and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/06/viral-airline-marketing-218x150.jpg)

![Prices rise, benefits cut: The new normal coming for ultra-premium cards [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/06/Increasing-fees-218x150.jpg)

![Juicy rumors, but how far will cardholders be squeezed? [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/06/Juicy-rumors-218x150.jpg)