Over the past few months, I’ve seen Capital One’s advertisements on buses and in newspapers and on billboards, and they have really nailed it: Elevated, not complicated. The value proposition of the Capital One Venture X Rewards credit card is so easy to explain: if you spend $395 a year on travel, you could redirect that to the card’s annual fee and only need to use one relatively simple coupon while getting solid return on everyday spend and the freedom to choose how deeply you want to delve into the game, by either learning how to maximize transfer partners or simply booking travel wherever you want and using your miles to erase the purchases. Add on top some elite statuses and lounge access and you have a neat package that anybody can understand and many can appreciate.

When Capital One launched that marketing campaign, it was surely aimed at American Express and Chase, each of which re-launched their flagship products this year, complexifying and couponizing them to the point of frustration for folks who were willing to pay for a premium experience but didn’t want to be bogged down by hours at the computer seeking out ways to use coupon credits. Personally, I’m getting more value than ever before on my Platinum cards, but the complexity fatigues many folks.

This week, Bilt launched what had the potential to displace the Venture X card from atop the premium card pedestal for those seeking simplicity. And for a segment of people, it certainly will push the Venture X out of wallet. But to say that the story hasn’t been simple so far would be putting it lightly. Read more about Bilt 2.0 — and now what some are dubbing Bilt 2.1 — in our week in review.

This week on the Frequent Miler blog…

Re-Bilt already: All the Bilt news

Rather than summarizing each of this week’s Bilt-related posts separately, I thought it made more sense to condense it to one paragraph with multiple links.

On Wednesday, Bilt officially announced its new lineup of credit cards. After seemingly denying last week’s rumors, they announced….exactly what was rumored, more or less. That’s not to say that it was simple; in fact, we had to publish a standalone “Frequently Asked Questions” post to address the many questions we had right away. Greg published his take and then we dedicated the Main Event of the podcast to discussing the complexities and breaking down who should be considering the new cards based on the complicated framework. Then, on Friday, barely 48 hours from the tail end of their launch event, Bilt already announced a re-do in response to feedback. While Bilt’s nimble nature and willingness to take quick action stand out from competitors, they probably would have benefited from sleeping on this one for a couple of days and more carefully packaging any changes. Unbelievably, they managed to make things even more complicated. We had to record an emergency Coffee Break to offer our hot take on Bilt 2.1. At this point, with people having applied under the framework of Bilt 2.0, I imagine that any changes they want to make from here forward will necessitate adding even more options to an already-complicated product. Unfortunately, despite promises of a seamless transition, it seems that a number of existing cardholders have seen the transition burst at the seams, which is to say that they were denied a new card after all.

The irony is that I still want the Obsidian and Palladium cards in my household, but I don’t think I could explain why at a dinner party without losing the interest of the table. I think Bilt will probably weather the storm, and I want to continue to see a competitor to the more established rewards programs offering splashy transfer bonuses and promotions to keep things interesting, but hopefully, they will more carefully consider the level of complexity that they think their customers want.

All of the posts linked above:

- Bilt 2.0 cards are official: Up to 2x everywhere + 4% back in Bilt Cash

- Bilt 2.0 Credit Cards: Frequently Asked Questions (FAQs)

- My take on Bilt 2.0

- Introducing the new and confusing Bilt 2.0 | Frequent Miler on the Air Ep341 | 1-16-26

- Bilt makes earning rewards on housing payments even more confusing

- Breaking News: Bilt’s sudden & crazy u-turn | Coffee Break Ep88 | 1-16-26

- Bilt 2.0 transition not “seamless” for all cardholders

- Bilt 2.0 “simplified” – which option is better?

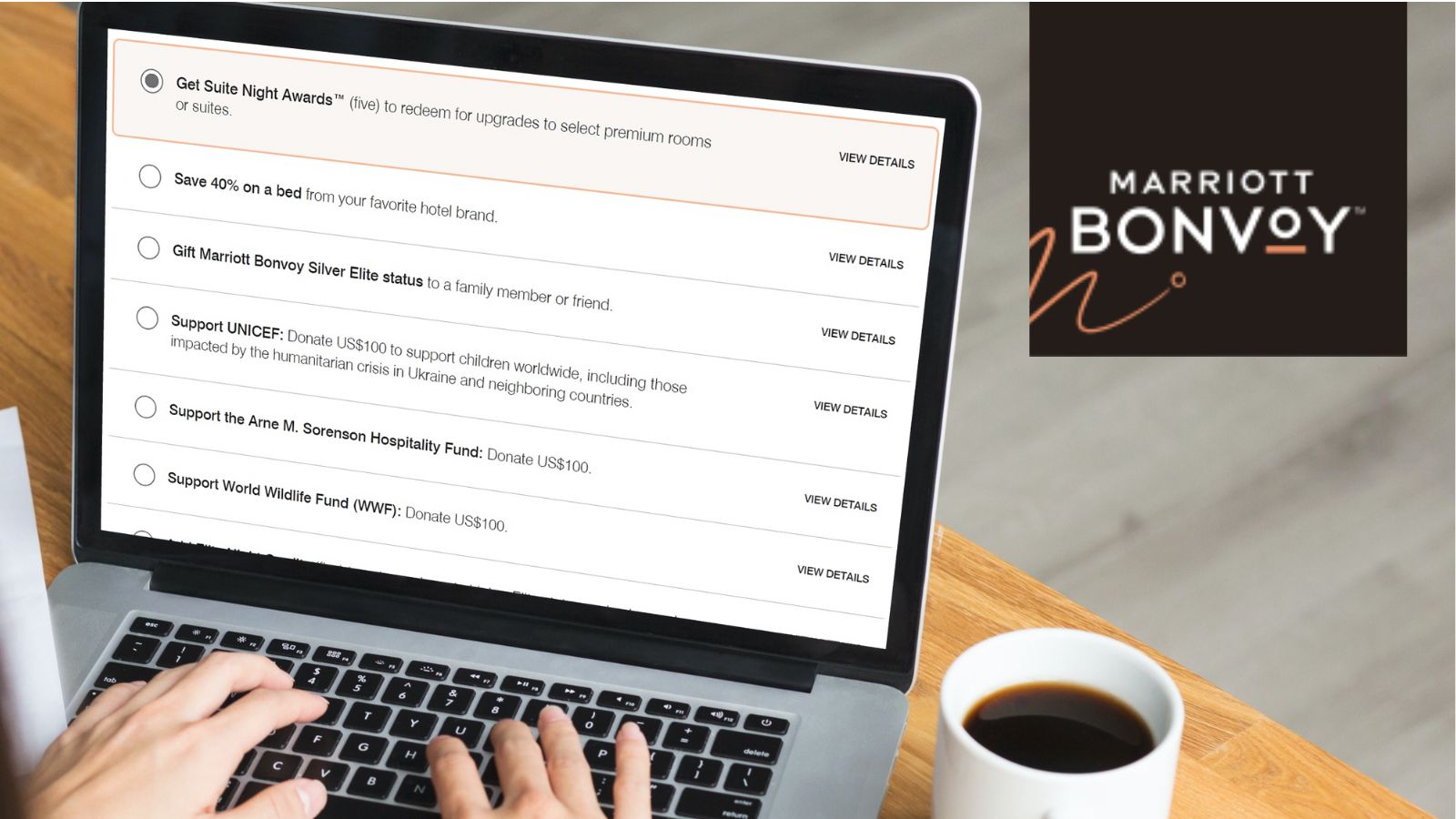

How to fix Marriott Bonvoy | Coffee Break Ep87 | 1-13-26

It is hard to talk about things that need fixing without mentioning Marriott. On this week’s Coffee Break, Greg and I discuss the ways in which Marriott falls short. At the end of the episode, we each try to pick the one thing we wish that Marriott would fix first, but it was awfully difficult to stop at just one. Personally, I was glad to hit Lifetime Platinum when this year’s credit card elite nights hit. I’ve already downgraded my Marriott Bonvoy Brilliant card to the $95 Bonvoy Amex card and gotten my prorated annual fee refund. I’ll stay at Marriott when I need to, and hopefully I’ll get free breakfast when I do it, but I won’t actively seek them out until they make some program changes.

Marriott Bonvoy Choice Benefits

Speaking of Marriott, don’t forget that you only have a couple of weeks left to select your 50-night and/or 75-night Choice Benefits. If you reached those milestones, see this post for your best options at both levels.

Best Hyatt Category 4 Hotels & Resorts

More exciting than the best options for those Marriott Choice benefits are your best options for using a Hyatt Category 1-4 free night certificate, and this post is full of reader recommendations and our own favorites. Just last week, my family decided to stay in Orlando for an extra night just so we could use a free night certificate at the Hyatt Regency Grand Cypress, which is among our favorite domestic Hyatt hotels. At breakfast on checkout day, my wife and I decided that we just didn’t want to leave and we extended for another day, changing around our flights and extending our rental car just to get one more day of the water slide, free bike rentals, climbing wall, pitch-n’-putt golf course, and fantastic service in exchange for one more free night certificate. Find that property and many other greats in this post.

Shortcuts to Hyatt elite status and Milestone Rewards

Hyatt gets a lot of love in the frequent traveler community for its elite program, and I think it is well-justified: During a couple of stays over just this past week, I’ve enjoyed things like a suite upgrade at check-in, excellent free breakfasts, free valet parking, and waived resort/destination fees (even on a paid stay). This post gives you the shortcuts to get to elite status or at least hit the level where you can give yourself the gift of Globalist benefits for a stay without having achieved 60 nights.

Tim’s 2026 Elite Status Plans: Titanium! Diamond! Platinum! Oh My!

Tim has finally joined the chat with his 2026 elite status plans. Unsurprisingly, he intends to keep his Alaska Titanium status, which has served him very well both in the previous iteration of Mileage Plan and in the new Atmos program. However, you might find some other surprises here, like how he might drop to Hilton Gold this year and just how much he’s going to spend on Hyatt Business and IHG credit cards to keep status. Read all about his plans in this post.

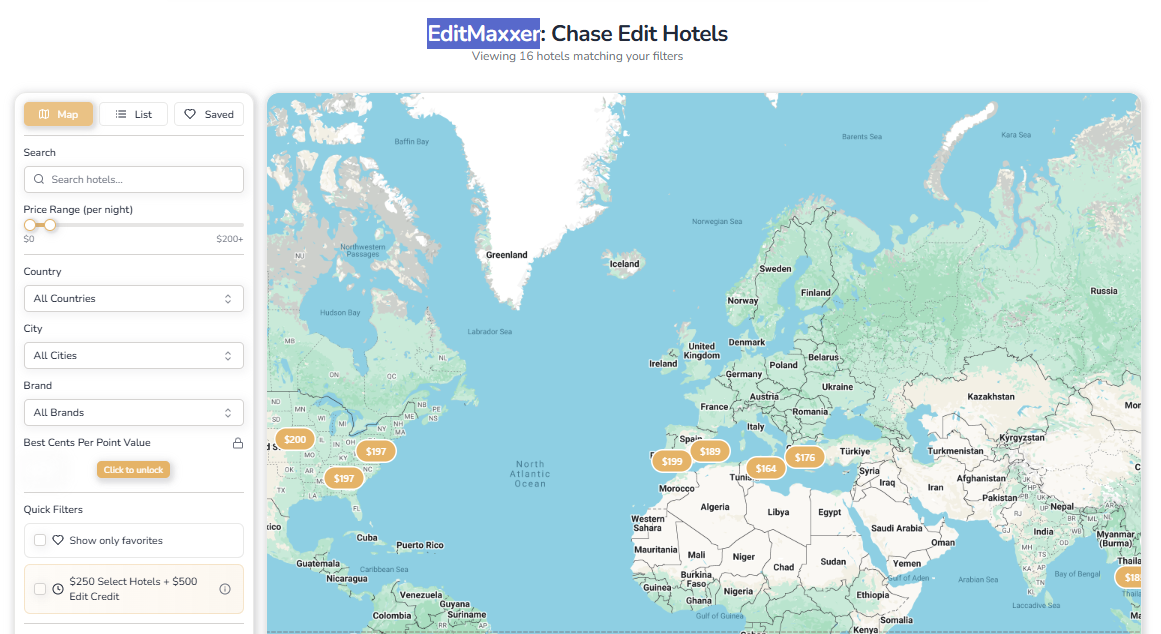

EditMaxxer: A tool to help maximize your Chase Travel℠ The Edit credits

One of the reasons that Tim isn’t interested in spending to earn hotel free night certificates this year is because of the number of hotel credits he has thanks to his credit card portfolio. I’m in a similar boat in terms of hotel credits! One of the credits I’ve found hardest to use has been the Edit credit on my wife’s qualifying credit card. In this post, Tim reviews a new tool that is cut from a similar thread as MaxFHR, albeit with fewer bells and whistles, that will make it far easier for me to find a use for the credit.

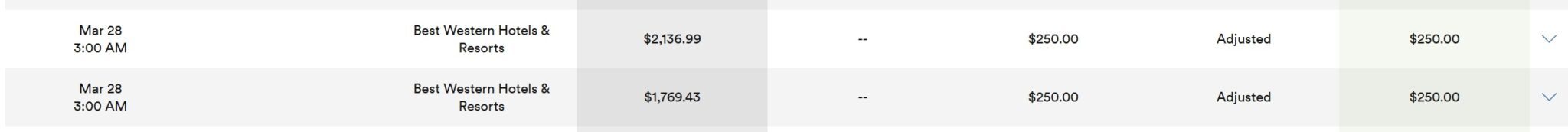

Success: Capital One Shopping cash back on a hotel booking, 10 months later

One of the reasons my enthusiasm for credit card hotel credits has been lukewarm is that I’ve been able to get sizable payouts through shopping portals when I’ve needed to make a cash booking, particularly through Capital One Shopping. The pain point here is that Capital One Shopping often displays travel bookings as “ineligible” until sometime after the stay is completed, which can really dampen one’s confidence that the rewards will be paid out. Despite that, I recently had a stay that I booked 8+ months in advance — and sure enough, almost 10 months after booking, I ended up with $500 back. This post explains what happened that might be useful for your own bookings.

A weekend in Birmingham, England: German Christmas market, Peaky Blinders experiences, canal cruise, & more

Birmingham has never really been on my radar, but Stephen’s post has convinced me that it belongs on our list. I’ve never watched Peaky Blinders in full, but I’ve seen enough clips on Youtube that I’ve been intrigued, and the museum that Stephen and family visited sounds fascinating even for those who aren’t into the show (or is it a movie? I don’t even know). And if you had asked me to guess as to the largest German Christmas Markets outside of Germany, I don’t think Birmingham would have been my first or second or 97th guess, which just adds to the intrigue.

Which elite status would you prefer, American or Alaska? | Ask Us Anything Ep82 | 1-7-26

While Tim loves his Alaska elite status, should you be considering status with American Airlines? We answered that question and many more on our most recent Ask Us Anything, live on Youtube.

Guide to Airline Companion Tickets for 2026

If you frequently travel with a companion, you might be curious about your best options for a companion ticket. In this updated guide, we cover the best opportunities for airline companion tickets in 2026.

That’s it for this week at Frequent Miler. Don’t forget to keep an eye on this week’s last chance deals.

![A coupon book with a credit card, a credit card program with an airline, and more [Week in Review] a person reading a magazine on a couch](https://frequentmiler.com/wp-content/uploads/2017/05/kick-back.jpg)

I too was in the obsidian for P2, palladium for me…however, then I realized I can just charge (most) groceries to my CSP, and dining to CFF/CFU – so I can get 3x on those. With 6k/mo in mortgages – and I can do at least that in spend if I dump almost everything on the card – im looking at 18-20k miles per month…200-240k/year…BEFORE Rakuten & transfer bonuses & Bilt funny cash. I might pick up the Rakuten Card to supplement this too. I dont like dumping EVERYTHING into the Bilt ecosystem…but it may prove to be too rich not to. I won’t make the same Mesa mistake though…im not keeping more than 50k or so points in the system for a while.

You can compare Tier vs Bilt cash here:

https://docs.google.com/spreadsheets/d/1AD8pZ0p2RlvoVj9jESZhr2FhXjZt9FgWE4YmVoF_Jr8/edit?usp=sharing

Both within this community (BILT, 10% cap proposal, etc.), and in the country/world (*gestures broadly*), 2026 is been freakin’ nuts so far. I feel like I’ve aged a decade in these first two weeks alone. And, not like a fine Scotch; more like smelly cheese.

I hear there’s a new 10% tariff on the UK and France beginning 2/1 so better stock up on that Scotch and smelly cheese now. Naturally, do make sure to use a card without a foreign transaction fee.

Unless and until Marriott’s revenue is adversely affected, I don’t see Marriott changing anything. Indeed, Marriott would have every incentive to continue to devalue benefits as they have been over the past several years.

Any idea if the new option is based on monthly spend or annual? If monthly and housing is $2k/month and you spend $3k month 1 and $1k month 2, does it average out so you get the 1.25x multiplier both months, or do you get 1.25x month 1 and 0.75x month 2?

I think you nailed it in your analysis. Impossible to explain at a dinner party let alone to P2. And I don’t know why this company is going to make it – major bank dumped them and this launch is a mess, and they found a way to make a confusing launch even more complicated. Hard to trust these guys to actually process my mortgage payment when they seem to be making it up as they go along.

I’m not sure that anybody knows for sure, but I would *expect* that it is going to be based on your spend from a single month. If your rent is paid on the 1st of the month, is that based on your spend from the previous calendar month, the previous billing cycle, or the rest of the month that follows your rent payment? I don’t know. But I would not expect that spending big one month and small the next will “average out”.

In terms of Bilt “making it”, my honest take is that there is this huge skew toward completely misunderstanding their business. I think if they had no credit card at all, it may not make a big difference. If they maintain the ability to process rent and mortgage payments (completely separate from CC) and they make even a small profit for the payment processing services that they offer the largest property management companies in the country (and now one of the largest mortgage servicers), that could add up. Add in all of the neighborhood merchants and whatever those businesses must pay for access to the system and incentives they offer to neighborhood customers, etc, and I think that Bilt has potential. But the launch of this card has included a series of unnecessary missteps, in my opinion. I like their inclination to try something new and crazy, but I think it is clear that they needed a far more measured approach.

Correct. There are 5 million members of Bilt Rewards, of which only 1 million are cardholders. Bilt is processing about $40 billion in rent every year (cardholders and non-cardholders). If its fee is 0.1 percent, that’s $40 million in income. Then, as you state, “neighborhood” vendors pay to access the membership base (cardholders and non-cardholders). Etc., etc. Indeed, people don’t fully understand Bilt’s business model. And, in spite of Bilt being profitable for a few years now, some claim that it continues to burn through VC cash and is ready to collapse.

I agree that they want to become a payment clearinghouse but 0.1% or whatever on ACH transactions doesn’t sustain a points infrastructure. Renters that have been using the credit card to float their rent for a month may flee now that it is ACH. And folks with mortgages need to trust them as a payment processor – and nothing they have done in the past few days screams “trustworthy”. So it’s great that they want to be a bigger payment clearinghouse, but unless the property managers and mortgage servicing companies are going to force people to use Bilt to pay, they still need to acquire customers.

The “Neighborhood” may be one way to do that but that’s a competitive landscape – on dining, Bilt is just a Rewards Network customer just like Rakuten, AA dining, etc. (Rewards Network is sponsored by TowerBrook – huge PE firm) and the money is made off of restaurant financing (we just see and benefit from the veneer of whatever loyalty program is placed on top of that). What else does Bilt really offer – a class at Barry’s Bootcamp? Sure they have nice packaging, but that’s not really a differentiator. Rakuten 1:1 is a differentiator though, as are the outsized transfer bonuses. Other than that… not much of a “there there”.

All of that said… back to the card earnings… as between the new option and the “old option from two days ago” isn’t the old option based on annual spend? You earn Bilt Cash over the year that can then be redeemed for points by year end and you can roll over $100? Unless you know that you will hit your housing spend each month, isn’t the old option potentially “safer” / more lucrative?

At the moment, Bilt just seems like a house of cards. We can criticize the new CSR and the rollout of Citi’s Strata Elite all we want, but those cards are built upon the foundation of very solid bank balance sheets. Bilt was just abandoned by a major bank. Sure it has some backing and folks that want it to succeed, but this is far from a sure thing.

Building managers *do* force tenants to pay via Bilt already – that’s what I’m saying. Several of the largest property management firms in the country use Bilt exclusively to process their payments. Everybody who lives in their buildings uses Bilt to pay rent, credit card or not (most of them don’t have or use the credit card and thus are probably only earning 250 points on rent). I expect the same will be true with UWM – it remains to be seen, but I expect that their customers will pay via the Bilt app, whether they want to earn rewards or not.

In terms of what they offer, they offer the building managers and neighborhood businesses the opportunity to reach and incentivize customers. There’s this whole ecosystem of stuff that has nothing to do with the credit cards. I completely agree that they have absolutely bungled this new launch and that they should take a step back and learn from that and move forward with a more measured approach, but they certainly have a framework that can extend well beyond the Rewards Network Dining program.

I imagine that they wanted more engagement on the credit card. Every program does. They all try various ways to achieve that. Some offer category bonuses to get you to take the card out of your wallet more often. Some offer coupons to get you to use it more often on a wide range of purchases. Some offer big spending bonuses to try to get you to use it as your main card. Clearly, Bilt is also trying to get people to use the card more. And both new systems do incentivize that. But they complicate it too much, in my opinion. The fact that rewards enthusiasts like you and I have to stop and pull out a calculator to try to figure out which option is better tells me they needed an easier option.

The fact is that YOU don’t know Bilt’s financials. Yet you draw conclusions. You rationalize your position with arguments based on what? Do you actually have information and knowledge about how much revenue the neighborhood program generates? Or, any of its other revenue channels? Hold my beer, I got this.

Perhaps, the better thing is to acknowledge an absence of information, which is a source of uncertainty/risk, and that you prefer a less uncertain path. That’s fair. And, while I don’t know your circumstances, I sense that’s probably what you might want to do.

Definitely not. You’re right that there is an absence of information. I don’t know what the future holds for them any more than you do, and this week suggests that their GPS was miscalibrated, too. My point here was just that there is a lot more complexity in their system, for better or worse.

Agreed.

PS – On Reddit, there’s a post in which the writer notes that the no-fee Bilt card is a 5% back card. It requires redemption of that 5% in specific ways but it is 5% nonetheless.

If someone bemoans the specific ways to redeem on the Bilt card, then they will be sure to complain about Capital One Shopping only redeeming rewards via gift cards.

For some, that’s fine. For others, it’s not. If it’s not for you, fine. But, don’t argue that others ought not to find it attractive.

I’ll hold judgment on that until we see how you can actually use Bilt Cash.

Agreed.

This is the way. Once we’ve made our selection (I went Palladium), just gotta wait for February 7, then re-evaluate rent/non-spend strategy entirely, depending on how many new ‘Option’s get announced by Ankur…

Yeah I think that’s right @1990 and I understand what you’re saying of course @Fred. I have no idea what their financials are and what backing they have. All I can go on is the fact that their prior model did not work, an actual bank dumped them, and this launch was a mess – exhibit A being offering a new “simple complicated” option offered two days later, exhibit B being not being able to explain a key element of the new program (Bilt Cash) at launch.

Little risk in picking up a 50k SUB and getting Gold / 1:1 Rakuten transfers for ~2 years for $495. Actually moving spend over though… have to wait for the dust to settle to even consider it (at least for me). And they need to actually articulate what Bilt Cash can be used for so that we can all value it in whatever way we choose to (gift cards may not be a preferred currency, but one can value them at some discount to 100 cents on the dollar and factor that in to Capital One Shopping rewards; likewise Bilt Cash that is used for cash will probably be valued by many at a discount, how much that discount is… who knows).

I certainly would like Bilt to succeed! Competition is a good thing! But if you’re going to take on the likes of Chase – the #1 bank by market cap by far – you need to be crisp and clear with what you are doing, and this is not quite that as of yet. (By the way, I think it’s why many are so hard on AA in how they are taking on DL – we want AA to succeed and do better and mount a real challenge!).