NOTICE: This post references card features that have changed, expired, or are not currently available

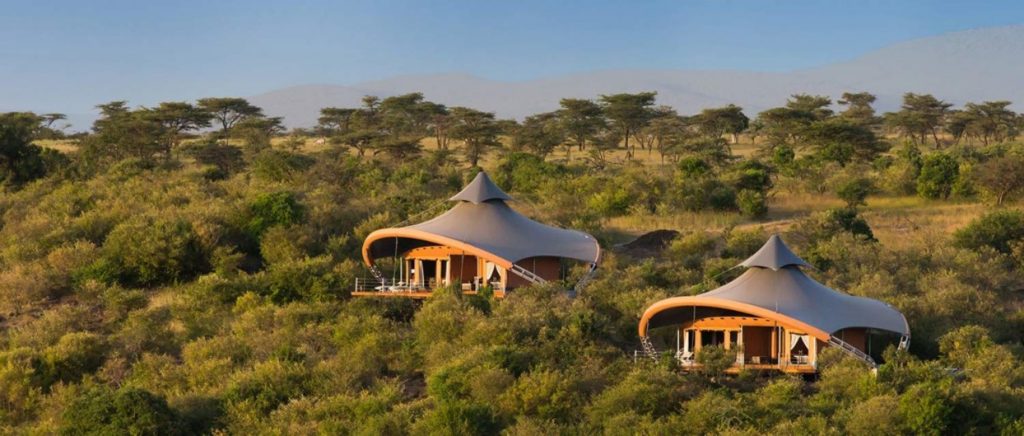

I went big with the latest (now expired) 30% transfer bonus from Amex Membership Rewards to Virgin Atlantic. Virgin Atlantic miles are extremely useful for direct Delta flight awards (and since I live near a Delta hub, that’s applicable to me), and they have a few specific partner awards that are really sweet (such as ANA first class US to Tokyo for only 120K miles round-trip). You can even use points to book Vigin Limited Edition properties, such as Mahali Mzuri and Necker Island. For more about why I wanted more Virgin Atlantic miles, see: Should I pounce on the Amex transfer bonus to Virgin Atlantic?

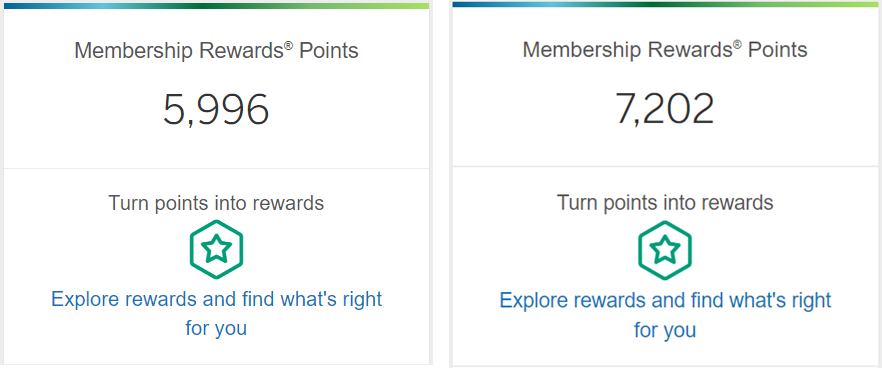

My wife transferred 182,000 Membership Rewards points into my Virgin Atlantic account, and I transferred 200,000. Thanks to the 30% transfer bonus, the combined 382,000 Membership Rewards points turned into just shy of 500,000 Virgin Atlantic miles.

We had left almost 300,000 Membership Rewards points in my wife’s account, just in case anything came up. Something did. We pulled the trigger on booking an award trip to Japan. As I discussed in a recent post, ANA sometimes reserves award seats for their own members. We found ANA first class available for three of us, and we used nearly all of my wife’s remaining Amex points to transfer to ANA for the three-person award.

That Sinking Feeling

I can’t remember the last time that I was Amex Membership Rewards poor. We currently have only about 13,000 points.

After nearly clearing out our points, I had a sudden sinking feeling. I was surprised to find that I was nervous about not having the points! What if we need Membership Rewards points? Something great might come up and we’ll be left on the sidelines.

And then it happened…

One day last week, Live and Lets Fly published: “HURRY! AEROPLAN ALLOWING SWISS FIRST CLASS BOOKINGS!” For a moment, I was excited (usually Swiss First Class is impossible to get with miles), but then I remembered that the only option for instant point transfers to Aeroplan is Amex Membership Rewards (you can also transfer from SPG, but that can take several days; and you can transfer from Diners Club, but you can’t get the card now if you don’t already have it.). I was sure that this deal wouldn’t last long enough for me to transfer points from SPG, so I sat it out.

In the end, it turned out just as well that I didn’t have the points since Aeroplan cancelled those Swiss awards. But it did show how important it is to keep a health stash of transferable points in your pocket. Next time something great comes along, I want to be prepared. See: The earn and burn fallacy. Shall we give hoarding and cherry picking a try instead?

Rebuilding

Now that I was convinced that I had to rebuild my Membership Rewards fortune, I turned to my own post for ideas: Amassing Membership Rewards. That post details six ways to quickly earn Membership Rewards points (please see the post for details):

- Credit card signup bonuses

- Extended payment option

- Upgrade offers

- Credit card referrals

- Category bonuses

- Amex Offers

Here were my thoughts about each option given my current situation:

- Credit card signup bonuses: My wife and I have previously opened many Amex cards in the past, so my first reaction was to look elsewhere (more on this below).

- Extended payment option: This is great, but my wife and I have already earned this bonus with our currently open charge cards.

- Upgrade offers: We checked our accounts, but didn’t find any good upgrade offers.

- Credit card referrals: We checked our accounts and found that we could earn 20,000 Membership Rewards points by referring friends to the Business Platinum card. I think this would be a great option for most people, but in my case the Business Platinum card is available through an affiliate link on my site (found here) and it would be better for this business for people to sign up through that link rather than my referral link.

- Category bonuses: Category bonuses are, in general, a great way to earn more points. The problem is that, unless you manufacture spend within a bonus category, it can take a very long time to rack up significant numbers of points. And now that Amex is cracking down on “gaming,” I wouldn’t want to risk it.

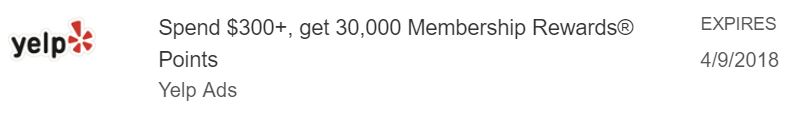

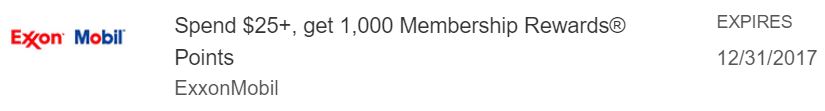

- Amex Offers: Amex Offers can be a terrific way to earn points quickly. I’ll certainly jump on the easy offers as they come, such as the Exxon / Mobile offer to Spend $25, Get 1,000 Membership Rewards Points. And I might even work with a local business to take advantage of the Yelp offer: Spend $300 on Yelp Ads, Get 30,000 Membership Rewards points.

As you can see above, Amex Offers appear to be the best option for me to rebuild my Membership Rewards fortune quickly. One problem is that I only have one personal Membership Rewards card, Amex EveryDay (but I have several business Membership Rewards cards). As I’ve noted in the past, it’s good to have multiple types of Amex cards in order to get targeted for all of the great offers. My EveryDay credit card is great, but it would be good to have personal charge cards as well. For more, see: Awesome Amex Offers and how to get them.

I cross referenced Membership Rewards cards on my Best Credit Card Offers page with my credit card tracking spreadsheet. Were there any good personal Membership Rewards charge card offers that my wife and I were still eligible for? Keep in mind that Amex doesn’t let you get a bonus if you’ve ever had that card before. It turns out there were some good options after all…

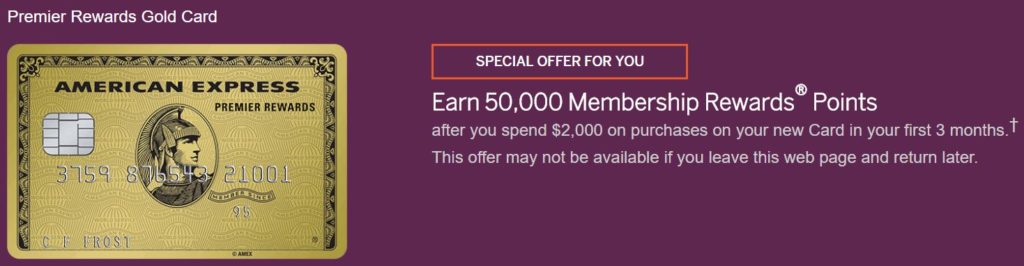

Premier Rewards Gold

After reviewing our credit card tracking spreadsheet, I was stunned to find that my wife had never had the Premier Rewards Gold card before. The public offer for the card at the time was just 25,000 points after $2K spend with the first year fee waived. But when she clicked through our card link (found here) from a Chrome browser instance that she had never used before, the offer showed up as 50,000 points after $2K spend. Via Firefox, only the regular 25K offer was shown.

Ameriprise Gold

Ameriprise offers an Amex card called the The American Express® Gold Card for Ameriprise Financial. The current signup offer for the card is 25,000 points after $1K spend. The annual fee is waived first year, then $160 per year thereafter. While 25K isn’t super exciting, it’s not bad for only $1K spend. Plus, I’ve never seen a better offer for this card, so I didn’t see any reason not to go for it now.

Green Card

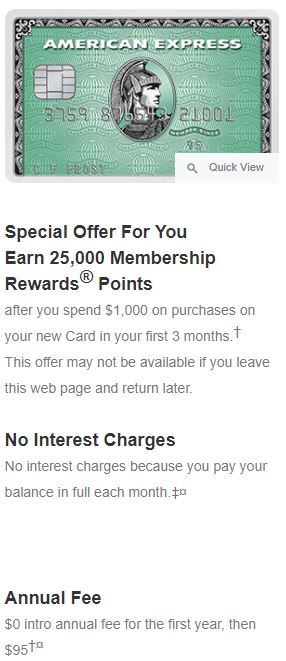

The American Express® Green Card currently doesn’t have any public signup offer, but in the same browser where my wife found the 50K Premier Rewards Gold offer, she also found a 25K Green Card offer. This one also had the first year annual fee waived. She already had this card in the past, but I did not.

Platinum Card Options

There are quite a few varieties of Platinum cards and we’ve each only held the generic Platinum, the Business Platinum, and the Mercedes-Benz Platinum in the past. That left us with three options: the Ameriprise Platinum, the Morgan Stanley Platinum, and the Schwab Platinum. The Ameriprise Platinum offers the first year free rather than Membership Rewards points as a signup bonus. That’s a great offer, but I’ll leave that for a future day when I’m not eagerly trying to accumulate points. The Morgan Stanley card has the standard 60K points after $5K spend, plus it gives you a free authorized Platinum card user. That’s a terrific deal, but I’ve found in the past that Morgan Stanley really enforces the rule saying that you have to be a customer to get their cards. That left the Schwab Platinum card which also currently offers 60,000 points after $5K spend. That’s a very good card too. For reference, please see: Which is the best Amex Platinum card?

Credit Card Applications

After looking through our credit card signup options, we decided to try for the following offers. Note that each of these are charge cards. My wife and I each already have the max of 5 Amex credit cards open, but there is no known limit to charge cards that you can have.

My Wife’s Applications:

- Premier Rewards Gold: 50K after $2K 3 months, first year free then $195

- Ameriprise Gold: 25K after $1K spend, first year free then $160

My Applications:

- Platinum Schwab Card: 60K after $5K spend in 3 months; $550 annual fee not waived

- Green card: 25K after $1K spend, first year free then $95

- Ameriprise Gold: 25K after $1K spend, first year free then $160

In total, we attempted to get approved for 185,000 points in signup bonuses across five cards.

Results: 185K richer

All five applications were instantly approved! Once we meet the spend requirements for these cards, we should be 185,000 Membership Rewards points richer (plus points earned for the spend itself). Plus, we’ll have more cards eligible for valuable Amex Offers, so our ability to generate points in the future will be increased as well!

Aside from the Platinum cards you mentioned and the Amerprise Gold Card, are there any other cobranded MR cards worth checking out?

There’s the Morgan Stanley card (they have both a Platinum card and a regular Amex card) which has some nice features, but you need to be a Morgan Stanley customer: https://frequentmiler.com/2017/04/05/morgan-stanley-amex/

[…] called the number on the back of my Schwab Platinum card (which I discussed signing up for here) and asked about booking my flight through this program. The agent who helped me found that he […]

[…] a 100K offer through the CardMatch Tool. Others may have been inspired by my recent post about Rebuilding my Membership Rewards fortune or even my silly Platinum unboxing […]

Sorry one more

If I cancell the Amex buss platt after the annual fee bills ( for the second time ) in like the 13 th month am I in danger of them clawing back the MR points ??

No, I don’t think that would lead to any risk of clawbacks.

Greg,

How is it possible to get so many cards at the same time ?

I thought there was a limit to how many you could hold .

Had you already cancelled all your other ones ?

Also

Can calling Amex to ask which cards you have had in the past trigger a problem ? ( like they say hey you keep opening and then closing cards )

I follow you and appreciate all your tips and advice , but just can’t understand how you amass sooooo many points , I get the cards but no where near the points you get ,

Is it the reselling ??

Thanks again Greg .

There is a limit of 5 credit cards that Amex will let you hold, but there is no known limit to charge cards. All of the cards I signed up for as posted here were charge cards. You can tell the difference by the official card name as listed on our Best Offers page. Amex credit cards all have the words “credit card” in the name.

No, I don’t think that calling Amex to ask which cards you’ve had before can trigger any problems.

No, I rarely do reselling (that’s Nick’s department). Credit card signup bonuses, friend referrals, and various options for increasing credit card spend and getting most of it back make up most of my point earnings. https://frequentmiler.com/go/ms

[…] and I signed up for five new Amex cards in order to earn 185,000 Membership Rewards points (see: Rebuilding my Membership Rewards fortune). With some of the cards we were given the choice to get working card numbers right away for […]

[…] Rebuilding my Membership Rewards fortune […]

How do you organize all the AMEX cards? Do you keep them in one login? Or you keep them separately based on the card type? For example, Premier Rewards Gold+AU with one login, and Ameriprise Gold+AU with another login.

I keep all of the cards that are in my name within one login.

thinking about opening the Swabb Amex Plat. Do I have to establish the brokarage account with swabb before applying or i can do it later? Thanks

I haven’t tested what happens with Schwab if you apply without first having an account. With Morgan Stanley the app is rejected. With Ameriprise it is approved. Fortunately, unlike Morgan Stanley, a free Schwab account is easy to get.

[…] to rebuild your Membership Rewards fortune? There is a new targeted offer out to earn 10,000 Membership Rewards points after making 10 or […]

Of the 5 applications for you and your wife, were they all on the same day? Was there a specific strategy to the order you used?

Yes, all the same day. I started with the bigger bonuses since those were more important to me.

Are you planning to hold these cards after the first year? AmEx’s language has me a bit uncertain about what to do with them. I think most people’s ‘reformed’ strategy is to hold a new AmEx card for a year, let the second year AF hit, then cancel and have the AF reimbursed. I think AmEx may be within their T&C to pull points back though if one does that with frequency.

It definitely changes the math if the sign-up bonus begins to cost two years of annual fees, leaving me hesitant to jump into AmEx cards.

In no world can Amex expect people to pay 1-2 annual fees or else claw back the points. That’s lunacy. Nobody wants to pay an AF for any CC.

Unless the AF is waived the first year, they definitely expect you to pay at least one AF. And if you were to establish a pattern of opening multiple cards same day, and then closing them after the second-year AF hits, it seems their terms leave them open to cancelling you out in their ‘sole discretion’. The 12-month window they provide is just a ‘for example’, so they could extend it.

“If we in our sole discretion determine that you have engaged in abuse, misuse, or gaming in connection with the welcome bonus offer in any way or that you intend to do so (for example, if you applied for one or more cards to obtain a welcome bonus offer (s) that we did not intend for you; if you cancel or downgrade your account within 12 months after acquiring it; or if you cancel or return purchases you made to meet the Threshold Amount), we may not credit Membership Rewards® to, we may freeze Membership Rewards® credited to, or we may take away Membership Rewards® from, your account. We may also cancel this Card account and other Card accounts you may have with us.”

Obtaining a credit card merely for the bonus with no plans to use it is unethical.

But banks are? Thanks for the laugh though.

srsly…

After a year I’ll evaluate each card to see if I think it is worth the annual fee for another year. Since Amex doesn’t have any fee free charge cards that I can downgrade to, I’ll cancel any cards that I don’t think are worth the fee. If they offer me a good enough retention offer, though, I’ll keep in another year.

I’m not worried about the new Amex language. As long as you keep the card for a year, it should be fine.

Good point on the retention offer! I’d forgotten how often AmEx makes it worthwhile to re-up the card, despite having just done so on my spg card. Thanks for the reminder!

Just to double check, Ameriprise Gold vs Gold, Ameriprise Plat vs Plat, they are all considered as different products correct? I have Gold card, had PRG before, and was about to sign up a new Ameriprise Gold card. Thanks!

Correct. All of the co-branded products are separate from each other and separate from the non-co-branded cards. You’re good to go on the Ameriprise Gold if you’ve never had the Ameriprise Gold before.

I got the biggest charge out of you being dismayed with only a couple thousand AmEx points left. I feel exactly the same way about Chase Ultimate Rewards and Hilton Honors if my balances get below 300K points.

Does this mean that we’re too weird … or are we just clever?

Too alike?

What’s the latest word on whether they are enforcing an account with Ameriprise for their co-branded gold/plat?

Ameriprise does not enforce it.

Confirming. Got Ameriprise gold bonus (25k) with no Ameriprise account or relationship a few months ago.