NOTICE: This post references card features that have changed, expired, or are not currently available

The Bilt Mastercard launches this morning and it looks like an interesting idea for those who pay substantial rent and don’t currently earn points on that expense. Bilt is offering the chance to earn transferrable rewards points on rent without any fee, though there are some constraints that might not make this quite as appealing as it sounds on the surface. That said, given transfer partners like World of Hyatt, American Airlines, Aeroplan, Turkish Miles & Smiles, and Virgin Atlantic Flying Club, this could work out to be a pretty good deal for some renters.

Bilt Rewards: Offering rent payments & rewards without a fee

Bilt Rewards is a brand new loyalty program centered around rewarding people for paying rent with the premise being that rent is the largest monthly expense for millions of Americans and yet most people are not earning rewards on that expense because most landlords charge a fee to pay rent with a credit card. The most interesting thing about Bilt Rewards is that they are offering surprising 1:1 transfer partners:

- American Airlines AAdvantage

- Air Canada’s Aeroplan

- Emirates Skywards

- FlyingBlue

- Turkish Miles & Smiles

- Virgin Atlantic Flying Club

- HawaiianMiles

- World of Hyatt

The fact that Bilt Rewards, a brand new loyalty program, somehow picked up World of Hyatt and American Airlines AAdvantage is a major coup. This list of partners is surprising, though less so when you consider that one of the people behind the new program is Richard Kerr, formerly of The Points Guy and a prominent voice in miles and points for years. The Bilt Rewards team clearly knows which transfer partners people want and they didn’t waste time and space with partners that don’t add value. I can appreciate that.

According to Bilt’s press release, they are partnering directly with large real estate companies that will presumably accept rent payments directly through the Bilt app.

Through a partnership with the nation’s largest real estate owners including The Blackstone

Group, The Related Companies, and Equity Residential, Bilt Rewards will enable renters in

more than two million units across the country to earn points just by paying rent.

Whether or not your landlord is part of the Bilt Rewards Alliance, and whether or not you apply for the Bilt Rewards Mastercard, you’ll be able to pay rent directly through the Bilt app.

Landlords who join the Bilt Rewards Alliance will be paid electronically through the app and you’ll still earn a minimum of 250 Bilt Rewards points per month for paying your rent whether or not you get the Mastercard; individual landlords may offer opportunities for additional points in the form of periodic incentives like points for consecutive on-time payments, referrals for new tenants, etc.

If your landlord doesn’t accept credit card payments, you’ll pay through the app and Bilt will send them a check. The fact that you’ll be able to earn rewards on rent payments with no fee is great, but in order to earn many points paying your rent you will also need to use the Bilt Mastercard for unbonused purchases at 1x.

How the Bilt Mastercard earns points on rent

Update: Bilt has completely revamped how rewards are earned on rent. The good news is that you now only need to make 5 transactions per month on your Bilt card in order to earn points on rent. See this post for more detail: Re-Bilt: rent rewards card makes big improvements

The Bilt Mastercard is billed as a way to earn “up to 2x points” on rent payments. While that’s true, it requires a lot of spend and has some limitations.

At a base level, the Bilt Rewards Mastercard earns 1x everywhere. As a welcome offer, you’ll earn 3x points on your first month’s rent up to 10,000 points and 2x points on all non-rent spend for the first 30 days. Tenants living at select Bilt Rewards Alliance properties should receive emails today asking them to join the Bilt Rewards program and they will be eligible to apply for the Bilt Rewards Mastercard. For everyone else, there is a waitlist to join at Biltrewards.com which will notify you when you’re eligible to join the rewards program and apply for the Bilt Mastercard.

Beyond that first 30 days, you’ll need to spend a significant amount on non-rent purchases in order to earn many points on rent. The Bilt Mastercard has a built-in elite status program that offers more points per dollar spent on your rent based on your non-rent purchases. Status levels are as follows:

Blue Status: Once you spend $250 in qualifying non-rent purchases in a calendar month, you’ll earn 1 point per $2 on your next rent payment.

Silver Status: Once you spend $1000 in qualifying non-rent purchases in a calendar month you’ll earn 1 point per $1 on your next rent payment.

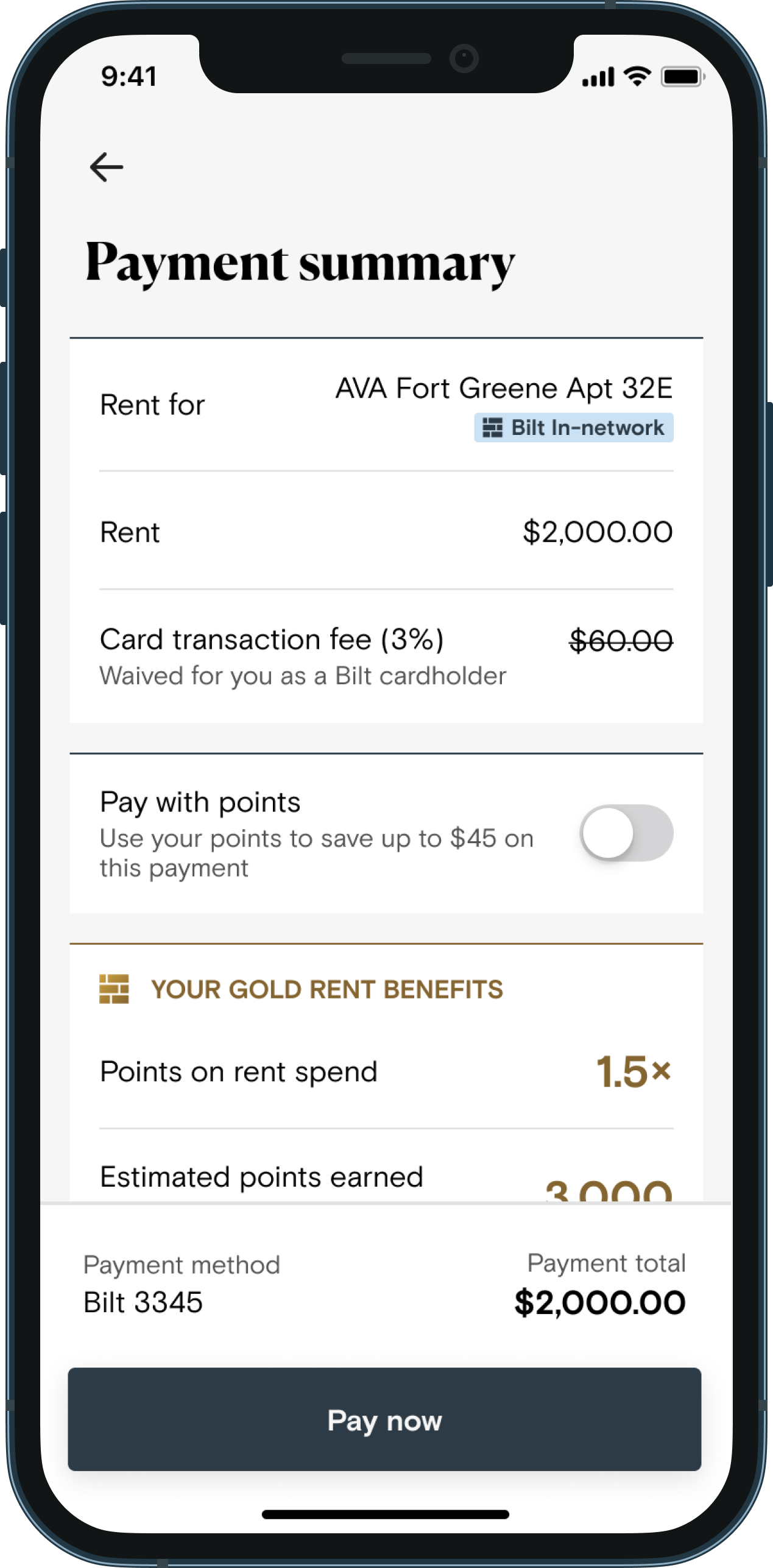

Gold Status: Once you spend $2000 in qualifying non-rent purchases in a calendar month you’ll earn 1.5 points per $1 on your next rent payment.

Platinum Status: Once you spend $3500 in qualifying non-rent purchases in a calendar month you’ll earn 2 points per $1 on your next rent payment.

In other words, in order to earn 2 points per dollar on your next rent payment, you’ll need to spend $3500 in qualifying non-rent purchases in a calendar month. At 1x. That’s unideal.

There is furthermore a limit of 4,000 points earned on monthly rent, so those living in the most expensive markets may not be able to earn 2x on their full rent payment. Earning anything at all on rent is obviously an improvement over the current situation for most people, but the opportunity cost of spending $1,000-$3,500 per month on the card in order to earn 1-2x on rent seems steep for those who could otherwise earn 2%+ on those purchases. If we generously value Bilt points at 1.5c each, you’re earning a maximum of $60 per month in rewards, but if you would otherwise make the required non-rent purchases with a card that earns 2% back, you’ll need to figure the opportunity cost of spending on the Bilt card at half a percent less.

For example, if we say that Bilt points are worth 1.5c each, then $3500 per month in non-rent purchases earns about $52.50 back in points. If you instead made those purchases on a card that earns 2% cash back, you’d have $70 cash. The “cost” of spending enough to earn 2x on rent is $17.50. That certainly isn’t bad if your monthly rent is $2,000 and you’ll earn 4,000 Bilt points (an effective $60 in points based on these theocraticals).

If your landlord currently accepts credit card payments without a fee (which is highly unlikely, but maybe it happens somewhere?), you’d still be better off with a card that earns 2% back everywhere as you’ll earn more total rewards on spend. However, if your landlord doesn’t ordinarily accept credit card payments without a fee, it might be worth dedicating unbonused spend to the Bilt card in order to earn points on rent. It isn’t a slam dunk, but it might work out.

On the flip side, if you are someone who would otherwise open a few new credit card per year, you can come out ahead with a few new welcome bonuses each year triggered by your rent payments even if you’re paying a fee to pay by credit card.

For instance, let’s say that your rent ordinarily costs $1,000 per month. With the Bilt card, if you put $3,500 in non-rent purchases on your card each month so that you can earn 2x on rent, you’ll earn a total of 5,500 Bilt Rewards points per month for a total of 66,000 points per year (on annual spend of $54,000). If we value those points at 1.5c per point, that’s $990 worth of rewards.

Alternatively, if you ignore Bilt Rewards altogether and instead use Plastiq or your landlord’s credit card portal to pay your rent at a 3% fee, you’ll pay $360 in fees over the course of 1 year to make $12,000 in rent payments ($1K per month). If you can use that $1,000 monthly spend to trigger more than $1350 in credit card welcome bonuses over the course of the year, you’ll ultimately earn more rewards with a lot less spend (freeing you up to do other spend on cards that earn bonus categories and/or to trigger more welcome offers on other cards). It really wouldn’t be all that difficult to eclipse the potential earnings of Bilt. But, and this is a big qualifier, this strategy relies on continuously opening new cards year after year. If you aren’t someone who will do that, Bilt might work out for you.

Interesting Bilt Mastercard features

In addition to being a World Elite Mastercard with no annual fee that offers cell phone insurance and purpose protection against accidental damage for 90 days, the Bilt Mastercard offers a few interesting features that make it unique.

Bilt Protect is billed as a way to protect you from using your credit line for rent payments. Essentially, this is a feature you can enable that will automatically withdraw the funds to pay your rent from your linked bank account, essentially turning your Bilt Mastercard into a debit card for that transaction. The idea here is that your rent payment won’t use up any of your credit line with this feature enabled. For those with high rent, this frees up limit to go toward the purchases required to earn maximum rewards.

Fee Protect is described as a way to prevent you from inadvertently paying fees for paying your rent with your Bilt Mastercard. Rent payments made through the Bilt app incur no fee. However, if you attempt to use your Bilt card to pay your rent through your landlord’s website or payment portal, Bilt will automatically decline the transaction “to save you the fees” that your landlord might charge for using a credit card. In reality, this is a clever way to make sure that Bilt controls the rent transaction and has the opportunity to sell the landlord on a Bilt Reward Alliance partnership, but since payments through the app are fee-free, this won’t be a problem for most people.

In addition to transfer partners, Bilt will offer other types of redemptions for products, fitness classes, and the ability to use points toward rent or future mortgage payments. Since the people who designed the program clearly have a strong understanding of desirable rewards (did I mention that they somehow got Hyatt and American Airlines?), hopefully they’ll offer some interesting additional redemptions.

Bottom line

The Bilt Rewards Mastercard launches today and represents an opportunity to earn rewards on rent payments, which is a significant chunk of spend for many Americans. With a slate of solid transfer partners and a team of people who understand loyalty rewards well at the helm, I think the Bilt card has some promise for the right customers. At the very least, this card and program will open an opportunity for those who have been ignoring credit card rewards to earn significant and valuable points on their most significant monthly expenditure. The Bilt card may therefore be a first eye-opener for some as to how valuable credit card rewards can be, particularly if the Bilt card helps them learn the ins and outs of transfer partners (and with an excellent set of launch partners, it won’t be hard for most people to get decent value out of the points). I’ll consider it a definite win for the segment who would have otherwise missed out on rewards altogether, but it isn’t a game-changer for those who have already found ways to earn rewards on rent — whether by using a third-party service to make payment while triggering new card welcome bonuses or by manufactured spending techniques that enable them to indirectly earn rewards on rent.

TL;DR As much as I want this to succeed its only real value will be realized for small pockets of population who have rent that’s 2-8x the median rent cost in the USA and/or for those who heavily value the unique transfer partners like AA and Hyatt. Unless the minds behind Bilt can increase the value proposition for spend (rent and non-rent alike) and/or do targeted spending offers and/or add more exclusive travel partners, it’s prime for a flop like Ryan Reynolds in Green Lantern.

Now for the unabridged version. I read your article earlier today and put it on simmer in the mental backburner until my thoughts were fully cooked. Great work as always Nick! Thanks for putting in the time to think through the details.

To begin, anytime I see that Richard Kerr is behind something points/miles related, I sit up and pay attention. Those unfamiliar with RK (as I colloquially refer to him) should know that he’s consistently found a way to maximize earning and redeeming of nearly every points/miles program out there, and the scope reaches far beyond the travel realm (see beer and fuel rewards programs). He’s one of the real “thought leaders” in shaking down any proverbial money tree to consistently harvest much more than the average bear — a true outlier and MVP in “the game”.

So, as I comb over the details of something backed by RK, I see that he’s put the brakes on any runaway trains and put all the community Jokers and Riddlers in cuffs before fun and games even begin. Capping the points earned from rent spend at 4,000? Killjoy. Pairing the rent spend earn rate with non-rent spend per month? It’s creative and clever, I’ll give you that. I know you have to make a buck from interchange fees, but aren’t the non-rent spend “status” tiers a bit high?

Also, I know welcome offers for cards with no annual fee are consistently lower than those with annual fees, but this one is underwhelming. You’d have to make your first rent payment $3,333+ to max out the 10,000 points from rent spend, plus the 2x on non-rent spend in the first 30 days makes everyone think “Yeah, I can just drop this in the sock drawer right away.”

I’ve narrowed this down to the two groups who would benefit most from this kind of card, and they’re both outliers in terms of the US population and even still within the points/miles world.

Going further into detail on group #1, the only real way this becomes competitive is if you have much higher rent spend that saturates the 4,000 point max earned from rent each month with lower non-rent spend in lower status tiers. To illustrate:

Blue Status: $8,000 rent spend + $250 non-rent spend =

(8000/2)+250 = 4,250 Bilt points with only 250 “sacrificed” spend/month (17x)

Silver Status: $4,000 rent spend + $1000 non-rent spend =

(4000*1)+1000 = 5,000 Bilt points with only 1000 “sacrificed” spend/month (5x)

Gold Status: $2,667 rent spend + $2000 non-rent spend =

(2667*1.5)+2000 = 6,000 Bilt points with 2000 “sacrificed” spend/month (3x)

Platinum Status: $2,000 rent spend + $3500 non-rent spend =

(2000*2)+3500 = 7500 Bilt points with 3500 “sacrificed” spend/month (2.14x)

If your rent is less than $2,000 then the sacrificed spend becomes that much more of an opportunity cost since you’re not maxing out the bonus earned from rent spend, no matter how much you spend in non-rent. Given that median rent across the US is about $1,200, this really limits the number of people who can clearly benefit from this kind of card. In cities like New York, San Francisco, Boston, and Los Angeles it may be common for high rent, but nearly every other city, including Gotham, Metropolis, Chicago, Miami, Seattle and Denver, the number of people paying $2,000+ for rent is the minority.

Now, if some of these details aren’t set in stone, there’s a chance the value could increase beyond the fringe groups described above. It could start with lowering the spend thresholds in the status tiers. Additionally, raising the rent and non-rent point earning multipliers could easily garner some additional attention. Even if there were periodic promo periods or targeted spend offers this could easily drum up some excitement for using an otherwise “set and forget” card in the sock drawer. The most intriguing option would be to increase the value of the Bilt points by having temporary bonuses on point transfers and/or adding more high-value transfer partners at a 1:1 transfer ratio. I’m thinking the diamonds in the rough on the Marriott Bonvoy transfer list like KE, OZ, JL, and AS (as long as the oneworld alliance doesn’t mess with the other partner redemption rates) or something fun like LH, SK, or LA.

I’m hopeful this card does well. It has some of the right ingredients, but I’m afraid there’s enough missing that RK’s star power may not be enough to make it a blockbuster success. Kinda like Ryan Reynolds as Green Lantern…

Who am I kidding though, I’m clearly not the target market for a card that incentivizes rent spend. I don’t pay rent to live in Gotham, everyone pays me!

One silver lining I’ll pick out in my analysis above is the Blue Status Tier. If you spend exactly $250/mo and spend only a modest amount on rent, let’s say $750, then after a year you’d earn 7,500 Bilt points ((750/2)+250)*12 That would be enough for a one way flight on United from anywhere in the US to Hawaii using Turkish Airlines miles.

For a card with no annual fee that you can set to pay your rent fee free and automate some monthly expense of $250 it’s a pretty good deal. Spending $750/mo on rent allows you to earn Bilt points at a rate of ((750/2)+250)/250 = 2.5x. If you pay more on rent then the earning ratio increases up to a maximum of 17x with $8,000 rent. So, if you historically have not put rent on a credit card and your rental cost is anywhere from $750-$8,000 month, then this could be an easy way to earn valuable points on autopilot.

Thanks for the thoughts Mr. Wayne. We’ve made some modeling assumptions that we’ll obviously be validating over the coming months and we have no problems making changes based on what we see and hear.

Nice recap Nick! does this count also for Condo fees? I understand it does not work for mortgages but many of us own and pay condo fees as well..

Anyone know if this will result in a hard pull and count for 5/24? I know there was some stuff with the new man united and cleveland cavs cardless cards where some articles were saying they didn’t add to 5/24 status.

I haven’t heard that about the Cardless cards, but Bilt isn’t issued by the same backing bank. I’d certainly expect it to both result in a hard pull and count toward 5/24 since it is a consumer credit card. I’d be shocked if it didn’t.

Can the payments go towards commercial rent payments?

Interesting possibility for months where I’m not working towards a CC SUB. However, it’s a very limited win, at the risk of trusting a new company with delivering my rent payment on time (as was the case with some Plastiq competitors).

Given you are trading unbonused spend for rewards on rent, instead of just paying rent directly for free, you can look at it in terms of bonus points on the non rent spend. Let’s say $2500 rent. At blue level you have to spend $250, and will get 1250 points on rent, so you’re getting 5x on $250 spend. At silver you’d get 2500 points for $1000 spend, or 2.5x. The return on spend gets worse at each higher level.

To take a risk trusting a new rent payment processor just to get 5x on $250, and forgo using rent towards a cc sub, is a hard pass for me.

that’s insightful, and speaks to maybe the best way to use the card — going at the blue level, you get something (instead of nothing) for a rent payment while being most realistic — minimizing how much other spend is diverted from better earning opportunities (including those months when one needs the rent payment for a SUB). Can’t speak to the trustworthiness of using these services though (have only used plastiq before)

@WR2, I like this way of thinking about it, but aren’t you forgetting about the 1x earned on non-rent spend?

Ah yes, indeed. Add 1x to my numbers. Makes it a little more appealing, and I might get on the wait list, but I think I’ll wait to see other’s experience before I jump in. My next few months rent are already allocated to MSRs anyway.

Is there a link to see companies in the Bilt Alliance? Do you think condo maintenance payments would be considered as “rent”?

Head to Biltrewards.com and the company logos are towards the bottom of the page. You can also create a Bilt Rewards account and enter your address which will automatically tell you if your address is in the Bilt Rewards Alliance.

Are you going to be adding any companies that manage rentals of single family homes?

We don’t have a minimum size of the landlord to join the alliance right now, just a backlog of people wanting to join to work through. Any landlord interested in joining can email alliance@biltrewards.com.

thanks. dont see mine.

I’ve read four articles about this now and this was by far the most clear, best one (as usual). 🙂

Good analysis as always. I guess non-renters can potentially find value in the card for the fee-free option to transfer Bilt Rewards to some really good partners…with rewards accrued on (largely) unbonused spend.

How the heck did Bilt get Hyatt and AAadvantage as a transfer partner? Amazing.

I’m generally not a big fan of cards/programs where you have to hit different spending targets every month, but for those of us living in high-rent locations, this is pretty much a no-brainer.

My rent is basically $4000/month. I easily have $250 of unbonused spend each month that I could put on this card to get 2,250 points/mo, essentially earning 9x points on my spend. And then it’s probably worth my time to make sure I hit $1000 each month to end up at 5,000 points/mo.

keep in mind that you’re capped at earning only 4K points a month on rent spend. It might not be worth the opportunity cost to shoot for those higher multiplier levels if you’re just going to get capped out anyways.

Does paying rent to a landlord code differently than trying to use this card to pay my mortgage? Curious if this would

Work for homeowners. Would be a great alternate to plastiq, which is much more costly.

You can only pay rent via the Bilt app, so that won’t work if you’re looking to get the 2x bonus for rent. Very doubtful that you’ll be able to set it up to pay your mortgage as a landlord.

Very interesting proposition, especially if you value Hyatt or any of the other transfer partner points enough to justify the 1X on $1000-3500 / month in non-rent spending. How Bilt managed to get AA when Citi and Barclays couldn’t for their core cards is quite notable too.

Sounds like a good way to market higher than it should be rent…TPG FTW again. Meh

That certainly came to mind as well – the cost is made up somewhere – but the good news is that you can indeed pay your rent even if your landlord doesn’t join up. Not sure how long they’ll continue to eat the processing fees like that, but for a while I guess.

my thought is that this would work like a store card, where the specific co-branded merchant gets a break on the processing fee (in this case, the rental management company), and then they make up the fee on all the other non-merchant swipes you make on the card, plus whatever interest that people accumulate if people get behind on their rent payments (which seems kind of nefarious now that I think about it).

Coup != coup d’etat. Just saying.