NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

Update 9/1/21 The transfer ratio was due to drop from 1.25c to 1.1c today, but it’s still showing as 1.25c. If you thought you’d missed your opportunity to cash out Membership Rewards to Schwab at that higher rate, it’s not too late.

It’s not known how much longer this will last, so I wouldn’t wait around if this is something you’re interested in. I’d also take screenshots of any transfers you do from today just in case an incorrect amount lands in your Schwab account.

Update 8/29/21: Just a quick reminder that the 1.25c rate when transferring American Express Membership Rewards to Schwab is reducing to 1.1c on September 1, 2021. That means there are only a few days left to convert your points to take advantage of the higher transfer ratio.

Update 7/5/21: Doctor of Credit reports that this has now been confirmed in an update to cardholders from American Express (a reddit member confirms the update came on their statement). I expect all current cardholders will see this update on their next statement. Bummer that Amex didn’t intend to give more notice and/or send an email rather than putting this on the statement where it might be missed.

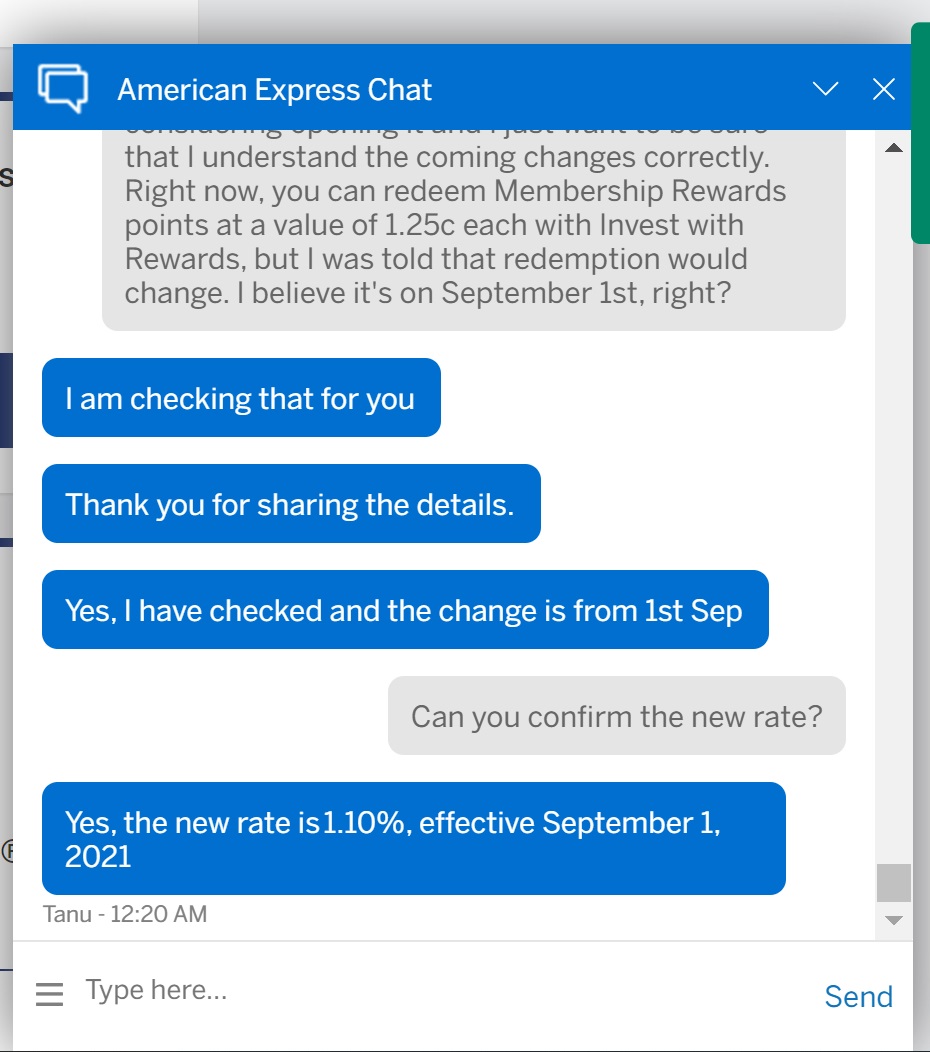

Dave Grossman at Miles Talk reports major news: Amex chat representatives are stating the the Schwab Platinum card’s Invest with Rewards redemption will decrease from 1.25c per point to 1.1c per Membership Rewards point effective September 1, 2021. I confirmed the same with a chat representative just now. While I typically regard information from front line customer service representatives as unreliable, the consistency of the message here indicates to me that it is likely true.

Doctor of Credit first reported the rumor that the 1.25 rate for converting Membership Rewards points to cash via a Schwab investment account might be changing. Greg theorized that it was possible that the cash out rate would increase to 1.5c per point (See: The Schwab Platinum Invest with Rewards Rumor: 1.5 cash out?). We also talked about it on Frequent Miler on the Air and my opinion was that there was no news in this rumor given that issuers change which features they market all the time and that the people taking advantage of this redemption must be such a small subset of a subset of cardholders as to not be incredibly significant. We both agreed that it seemed unlikely that the value would decrease, but it looks like we were wrong about that. Maybe the Foo Fighters cashed out at 1.25c per point after all?

Dave reports having seen a comment in a private group with a screen shot of a chat with an Amex rep stating that the redemption rate for Invest with Rewards would change from 1.25c per point to 1.10c per point effective on September 1, 2021 and he then had a rep confirm the same for him. I logged on and the first rep with whom I chatted told me that cardholders would be notified of any change via email and/or their statements but they wouldn’t confirm or deny anything, so I took another swing and tried a second rep. The second time, I led the agent a bit by saying that I was told the Invest with Rewards redemption was changing and I wanted to confirm that I had the details right. I then asked them to tell me the new rate and as you see above they gave me the same 1.10% answer that Dave reported.

I went on to ask whether that change would apply to me on September 1st if I opened the card today and the rep said it would, so it sounds like they intend to change this redemption even for existing cardholders with limited advance notice.

Of course, as I noted at the top, I typically put limited faith in the word of a customer service representative as they so frequently get details wrong. In this case, I led the rep a bit by saying that I knew the date, but I left it to them to confirm the rate change and they did confirm the same thing Dave was told, which was the same thing told to someone else who had previously reported it. The consistency of that message makes me more inclined to believe it is true.

However, without official word from Amex on a grander scale than the word of a customer service rep, I wouldn’t necessarily rush to cash out rewards tomorrow. On the contrary, since the worst case scenario has this redemption changing on September 1st, it seems that Schwab Platinum cardholders can breathe a sign of relief in having some advance notice and less concern that this will change in the night without notice. Of course, the timeline still could be changed since I haven’t yet seen it in official materials from Amex

If you’re sitting on a pile of Amex points from the recent fire sale (or working on the spend), keep in mind that you may want to position yourself to cash out when the time comes by considering the Schwab Platinum card sooner rather than later if you do not yet have it.

I was still able to transfer today (9/1/21) at x1.25 rate.

Still active at 1.25 rate on 9/2/21 6 pm (EDT)

I’m wondering now if the new rate (1.1 cents per point) is only in effect right now for new cardholders as of 9/1/21. Maybe existing cardholders keep the 1.25 rate until next card anniversary.

Yeah good point Greg. Isn’t there a law that CC companies cant change the rules on you in the middle of the cardmember year?

I don’t know if it’s a law, but I’m sure they could be sued if people signed up for the card under the old terms (especially when the offer page used to state how much points were worth when cashing out via Invest with Rewards)

Does anyone know if the Amex platinum card airline credit covers upgrading boarding status at gate on Southwest Airlines if that’s your selected airline?

A 60% reduction is huge!

?

(1.25 – 1.1) / 1.25 X100 = 12%

.15/.25 = 60%

Math is hard.

Unfortunately I keep getting the pop up. Argh!

I have the Amex Platinum and would like to refer my husband for the Schwab Platinum card. Created the link, but the Schwab Platinum isn’t coming up as an application option for him. Shouldn’t this referral be possible?

No. There is no way to refer to the Schwab or Morgan Stanley Platinum cards.

Thanks, I’ll plan to use the FM link!

Thanks, though as you’ll see there are no affiliate links for those cards at all. Still always appreciate it when readers think to use our links!

Thank you for this notice & advice, I just got approved instead of waiting until my regular PLT ran out later this year.

Saw this during the app: Welcome offer not available to applicants who have or have had this Card or previous versions of the Platinum Card. We may also consider the number of American Express Cards you have opened and closed as well as other factors in making a decision on your welcome offer eligibility.

Pretty vague, never had the Schwab or other version then the plain vanilla one . Any idea how I might confirm / deny the bonus BEFORE rushing to spend $6K ideally before the 9/1 change? Chat would give a truthful/realistic answer?

Thanks

We have a post about this. In short, you’ll get the bonus (others already have). The language is a poorly written way to say that if you’ve had previous versions of the Schwab card you can’t get it again.

If you’re particularly paranoid, all you need to do is make a single restaurant purchase. When you get the 10x, you’ll know you are going to get the 100K since both are part of the same welcome bonus.

Trying to decide if Schwab Plat is worth a 5/24 slot, after having just gotten under. Bonus is now 100k, and some DPs suggest disclosures still showing $550 AF. Still, I never felt the desire to cash out MR, preferring intl F/J, so not sure if the fact that an option is going away is by itself a reason to do it.

Tough call. I’d recommend doing it if you have more MR than you’re likely to use in the next several years. Better to turn those extra points into cash at 1.25 and have that cash grow.

Best use of Amex MR by far. Sad to see even this becoming devalued.

You can still do it though. Invest and 100k points becoming $1250 investment cash will grow several-fold with the right investments over time.

Or I guess can still cash it in for part of a comfy ride for your ass for 12 hours.

If I’d like to take the last chance of converting MR to Schwab account, what the order should be? Apply Schwab Platinum first then Schwab brokerage account OR brokerage account first before applying to Schwab Platinum ?

Open the brokerage account first then open the Schwab Platinum

Makes perfect sense to me. They likely were loosing money on the program at 1.25c / point (Amex loosing money, not Schwab). Presumably the interest income + interchange fees collected from the average Schwab customer did not outweigh the MR point magnification from making it 1.25c but would via there calculations at 1.1c / point. A much greater portion of Amex income (something like 35% of total) is from interchange income vs most bank cards or discover network possibly due to the higher credit scores and better spending habits of amex users. This is likely even more so for a Schwab customer. Consider Schwab was formerly one of the kings of discount brokerage services before everyone went no fee. The people who have a Schwab account are much more likely to be concerned about not making interest payments on any credit cards and are financially savvy. Eventually AMex probably said hey this is not working for us anymore to Schwab and a compromise

[…] Update: Nick from FM also chatted with Amex and received the above info as well. […]

If you open a joint Schwab account, can each account holder get their own Schwab platinum? That would allow you to transfer points in from P1 and P2 Amex accounts.

I just did that.

We have joint account and I already had Schwab plt and was moving points.

A week back , I created separate web login for P2 in Schwab site and our joint account showed up. From there I went to Schwab Platinum page and opened account for P2. In the application page itself P2 name was showing up on the card and name details were auto filled.

After getting the card in hand , then was able to move the points to the joint account.

Don’t use your temp plat card after the application approval to move the points. It got locked.then we called and unlocked that feature.

I opened the schwab platinum thru your non affiliate link.(thru the schwab web site)

However how do you xfer points to schwab . Is it from amex website or schwab website

Raghu

Amex website. Details here: https://frequentmiler.com/how-to-convert-amex-membership-rewards-to-cash-with-the-schwab-platinum-card/

Thanks

It’s a trap, of course. They’re trying to get people to cash out at 1.25 before they really raise it to 1.5.

Just kidding, Amex would never do something like that.

I’m a Amex Plat holder and as it stands don’t can’t find any other value with my MSR of 100k MR. If I open a Charles Schwab investment + checking account can I move my points from my regular Platinum to Schwab invest? If not, what do I need to do to invest my points?

You have to open a Schwab Platinum card to get that ability. Then you can convert all of your points even if they were earned on another card