The US Bank Altitude Reserve is no longer taking applications as of this morning, December 1, 2020 (update: the card is once again available as of 12/18/20). This is an unfortunate and disappointing development if it represents a permanent change.

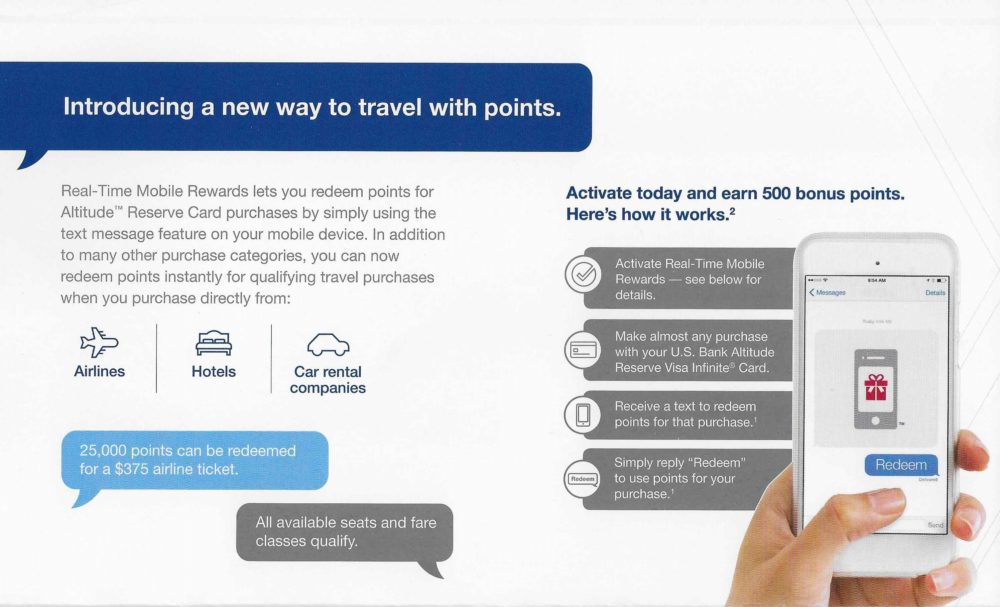

The key draw on the Altitude Reserve has been the fact that it earns 3x on mobile payments like Apple Pay, Google Pay, or Samsung Pay. Given that points can be used at a value of 1.5c each to book paid travel (in some cases quite easily and directly), this card has been the hands-down best card for in-person spend for years.

Those who do the bulk of their shopping in-store at a place like Costco have long loved the Altitude Reserve for fantastic return on everyday spend. I am very disappointed to see this go for new applicants.

That said, there is a possibility that this is temporary. Just a couple of days ago, Doctor of Credit reported the rumor that this was coming without any information as to whether or not it would be temporary. I could see this being pulled in order to re-design the benefits and earning structure, though I can’t see room for much improvement.

I’ll say that I feel like US Bank did a horrible job marketing this card. They have essentially had the most valuable everyday spending card on the market for a couple of years and just haven’t made much effort to make people aware of the fact that they could out-earn the return on their other rewards cards by using the Altitude Reserve in a mobile wallet every day. In a time when contactless payment is sharply on the rise, it feels like a missed opportunity for a big hit.

Of course, it never seemed like US Bank was looking for a big hit. They would only accept applications from those with an existing US Bank relationship, which is likely part of the reason why they didn’t make an effort to market the card more aggressively.

Again, there’s been no official word as to the reason or permanency of this take-down and there is furthermore no word on how this may affect existing cardholders. At this point, all we can do is hope for a strong return.

Is it true that DAY 1 starts the day the card is activated? For the 90 day spend requirement to receive the promotion offer. (In other words, DAY 1 does NOT start the day you APPLLIED, like Chase cards.) This is what the US Bank rep told me on the phone, I just found that odd.

I don’t know

I applied using the link and was rejected. I called the reconsideration number listed and heard a recorded message saying that as of Nov 30, they were no longer accepting applications for this card.

I was worried they were going to relaunch & change the rewards structure (esp. 3x mobile), so relived to see it back with no changes

[…] surprised when I lost the signal on another card on my radar. According to Doctor of Credit and Frequent Miler, the US Bank Altitude Reserve card is no longer open to new applications. There’s a rumor that […]

[…] So long: RIP, US Bank Altitude Reserve [no longer taking applications]. […]

I love these comments. I am fascinated how the single best in person spend card, particularly if you had a Samsung phone, flew so far under the radar. Sadly, the value has been hampered by Walmart shutting down Samsung Pay.

I canceled my card last year when the car rental insurance was quietly changed from primary to secondary. I receive most of the benefits from other cards and I’m no longer willing to commit the AF upfront to use the travel reimbursement later.

The rental coverage on this card is primary. Altitude Reserve is a Visa Infinite which part of the suite of benefits includes primary rental coverage. It’s most of the premium AMEX cards where the rental coverage is secondary.

That’s not what CSRs from US Bank and Visa told me when I called to confirm.

I’m getting my information directly from the Visa Infinite benefits guide that’s viewable when signed into my account which states “Your Auto Rental Collision Damage Waiver benefit acts as primary coverage…” Sounds like the reps you spoke to are not providing correct information.

Yeah I also confirmed with US Bank a year ago that this does in fact have primary on it. Maybe the people he spoke to were confused.

What’s the big deal?

Get an Alliant cc at 2.5 and avoid the 450$ af

AF is $400 simple travel credit $325 that easy to use like CSR net AF is $75.

4 PP restaurant visits per year

It’s 4.5cpp if you cash out with RTR.

You really need to look more closely at the benefits if you’re thinking the alternative is to “just” get the Alliant Visa

Just called US Bank. They said the card isn’t going away and benefits will stay. She said they are introducing new cards. She mentioned a gold card. So I wonder if they are revamping to have the same type of structure as Amex, Chase, etc.

My real question is weather or not they are going to kill the redemption value of already earned points over night like they did the flexperks card. It went from .015 to .01 with no warning.

So now I’m wondering if I should looking into refundable flights.

When did Flexperks drop to .01? Looking at Flexperks Gold page right now and it says, “Earn 30,000 bonus FlexPoints worth $450 on airfare, hotel stays, car rentals and more.” That’s .015 by my math.

FlexPerks real time mobile rewards dropped the value from 1.5 to 1. I think the points are still worth 1.5 towards travel booked through US Bank’s website

Got it. Imo this really isn’t a big deal. I believe Altitude is still 1.5? Also, using real time mobile disqualifies you from getting the $25 Flexperks airline credit (which I use on a gift card). My rule is any flight under $555 I will book thru Flexperks portal and anything over $555 I book with Altitude and use real time rewards ($25 Flexperks credit divided by the $0.045 you would get from booking with real time rewards).

Nick, disappointing development indeed. I’ve been a user and believer of this card from launch and obtained a Samsung watch to do so exactly as Greg did. That said, USB may “lose” money for each mobile wallet purchase and not enthusiastic for cardholders using it for most or all of their purchases. The Covid related increased use of mobile wallets may be much less appealing to US Bank then it is to the cardholders.

I don’t find myself using it as often especially since all the home depots around me killed samsung pay on their machines.

The card is definitely coming back. It’s redesign is featured in the Rewards Center. Whether or not it maintains 3x mobile wallet with $0.015 point value is another matter. I’d rather they dump Priority Pass and GoGo and keep the 3x at 1.5cpp — if I had a say.

I’m intrigued. I don’t see anything in the Rewards Center showing a redesign. What are you seeing?

In the comments of the DoC post, TommyT had a link to download the new card design. Instead of the big A, it has a more vertical layout, similar to the Go and Connect cards.

Given that there is a redesign to the card, I doubt they are killing it outright. It is all speculation, but I wonder if they are trying to make a more cohesive family of Altitude cards.

It looks like they took the image down—I saw the new image about a week ago. It looked like the Altitude GO card, vertical orientation, except ”GO” was replaced with “RESERVE”.

Interesting to see the new design, not sure if I’m a fan of the enormous lettering.

I’m skeptical the 3x mobile wallet stays. As more and more businesses upgrade and people are encouraged to use contactless pay it seems like it’ll turn into 3x for everyone every location, and that can’t be sustainable