NOTICE: This post references card features that have changed, expired, or are not currently available

Correction: In the original version of this post I wrote that the reader had applied online for the business banking account, but he had actually applied in-branch and received the credit card offers described below via email.

A reader going by SamBam reached out with a very interesting find. After opening a Business Complete Banking account in-branch online in order to earn $750, he was emailed an interesting deal on his choice of two Ink Business cards:

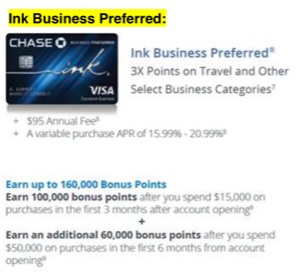

Ink Business Preferred 160K Offer

- 100,000 points after $15,000 spend in first three months

- 60,000 points after $50k total spend in first six months

- Total: 160,000 bonus points after $50K spend

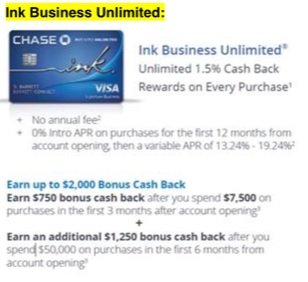

Ink Business Unlimited 200K Offer

- $750 back (75,000 points) after $7500 spend in first three months

- $1250 back (125,000 points) after $50k spend in total spend first six months.

- Total: $2,000 (200,000 points) after $50K spend

In both cases, the first part of the promotion exactly matches the current public offers for these cards. The new part is the extra bonus you get with a total of $50,000 spend in six months. Of the two offers, the Ink Business Unlimited offer is clearly better (assuming you complete the $50K spend). Plus, since the Ink Business Unlimited earns 1.5x everywhere, the $50K spend will generate another 75K points for a total haul of 275,000 points. That’s an average of 5.5 points per dollar with $50K spend.

If you want to try your luck to see if you’ll be offered something similar, you can apply for the business banking account online:

-

- Public offer link: account.chase.com/consumer/business/XT49992

- To earn $750, you must:

- Open a new Chase Business Complete Checking account with your offer code (use the link above to get the offer emailed to you)

- Deposit a total of $10,000 or more in new money within 30 days of coupon enrollment and maintain a $10,000 balance for 60 days.

- Complete 25 qualifying transactions within 90 days of coupon enrollment. Qualifying transactions include debit card purchases, Chase QuickAccept deposits, Chase QuickDeposit, ACH (Credits), wires (Credits and Debits).

- Doctor of Credit has more info about the deal here

My Take

I don’t know about you, but personally I’m not going to pursue this because I’m too busy trying to meet minimum spend on multiple cards: 100K Capital One Venture offer, 100K Chase Sapphire Preferred offer, 150K Amex Business Platinum add-on, etc… That said, if you’re a big spender and you like your Ultimate Rewards points (who doesn’t?), this combination of bank bonus and new credit card bonus could be hard to pass up!

Thanks for the post. DoC posted about this as well a few months ago:

https://www.doctorofcredit.com/targeted-chase-ink-unlimited-up-to-2000-sign-up-bonus/

Also, this offer is publicly available through a BRM, you don’t need to be targeted.

Anybody have any luck seeing if the card offers are available prior to commuting to opening the checking account?

*committing

As there is no mention, This offer does not bypass 5/24 correct?

Correct, 5/24 is still enforced.

YMMV on this one, obviously. I did the same business account in-branch last week and have received no such card offers (yet).

I asked if there were any credit card opportunities to go with the new business banking account. Then I was offered the deal. W

Did you ask in person when opening the account or later? Any additional details would be really helpful. That’s a hell of an offer but screwing it up would make me terribly unhappy.

After all the paperwork was done for the bank account i offhandedly asked if there was a cc that I could get with the bank account. The csr told me another bank officer would contact me and she did. The bank account was opened in branch. But the cc was opened over the phone with an officer from that branch. Nothing was done “online”. Ymmv.

do you have a post on what is needed to churn for business checking accounts with Chase? I have only opened business credit cards with Chase, Amex, Citi saying that I resell on ebay with 2-3k annual revenue and use my personal SSN. Would I need actual small business doc, name, tax payer ID etc for a business checking account?

No, we haven’t posted that info in detail. If I recall, Chase does require a dba (“doing business as”) when opening a business bank account. I”m not sure if they require that when the business name is your own name though. I believe that you’ll also need a business EIN (tax payer ID)

How does the banking offer turn into ultimate rewards? How can I make the $750 into 75k UR? It doesn’t show that on the link.