NOTICE: This post references card features that have changed, expired, or are not currently available

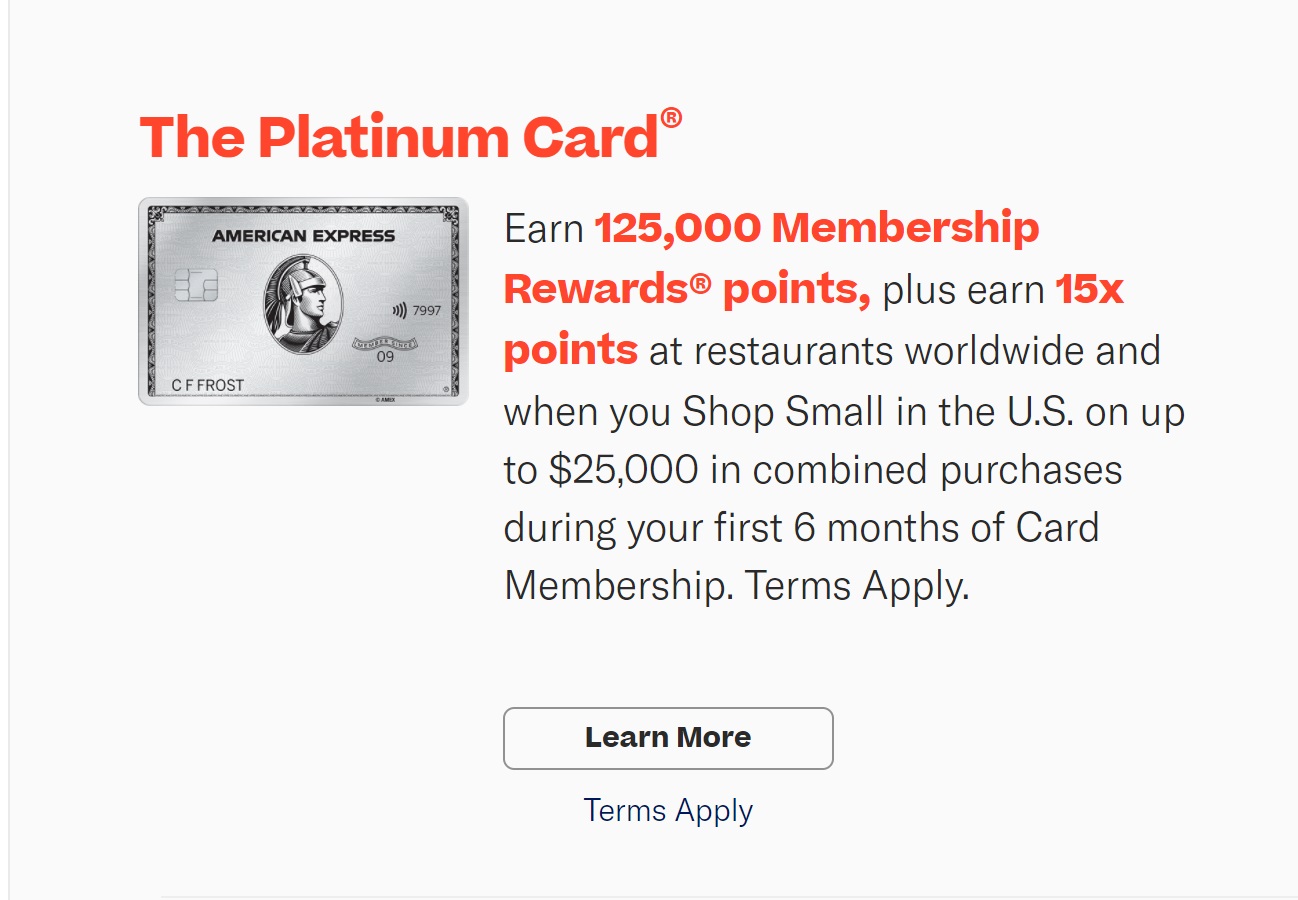

Ever since the amazing Resy Platinum offer appeared, I’ve been itching to jump on it. It’s an offer for the generic Amex Platinum card that’s only available through the Resy website. And the offer is fantastic: 125K points after $6K in purchases in the first 6 months plus 15x at restaurants worldwide and when you shop small in the US on up to $25K in combined purchases in the first 6 months. If you spend $25K on eligible restaurants and shop small purchases during the offer period, you’ll end up with a total of 500,000 Amex points! Even better, I’ve found that nearly all of my spend seems to count as either dining or as shop small purchases (I have a separate active offer for 5 points per dollar for dining and shop small purchases). Even some very large transactions have counted. So, I’d really love to earn 15X instead of 5X!

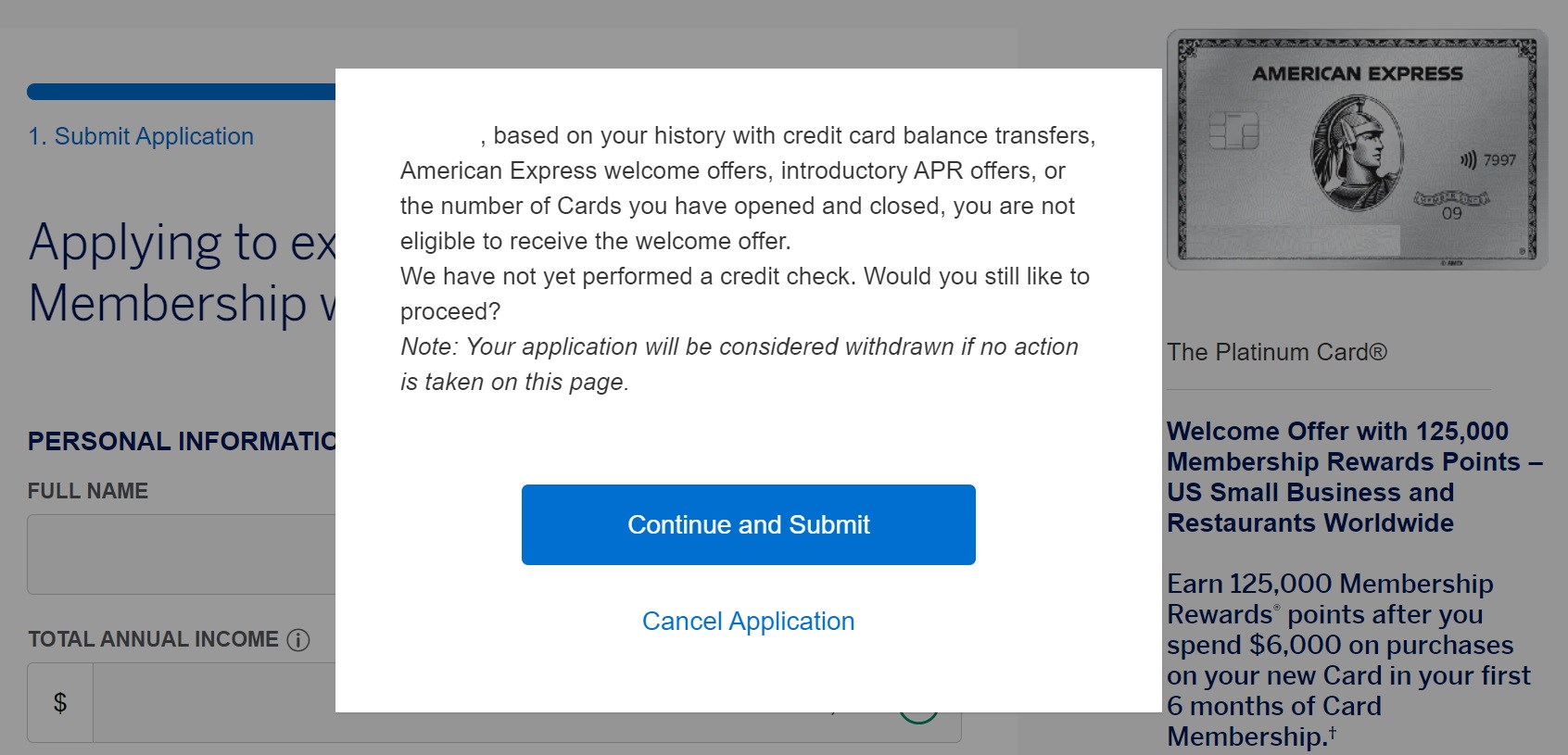

Unfortunately for me, I signed up for a Platinum card about a year ago and so I’m not eligible for another. And my wife signed up for one on June 30th of this year. That was the day before the Resy offer premiered. Great timing. And my son is in Amex pop-up prison: whenever he tries to sign up for a personal Amex card, a pop-up says that he’s not eligible for a welcome bonus (as an aside, this doesn’t happen when he applies for business cards).

With no hope of getting in on the Resy offer in my household, I turned my eye instead to the Schwab Platinum offer: 100K points after $6K in purchases in the first 6 months plus 10x at restaurants worldwide and when you shop small in the US on up to $25K in combined purchases in the first 6 months. If you spend $25K on eligible restaurants and shop small purchases during the offer period, you’ll end up with a total of 350,000 Amex points. That’s awesome, unless you compare it to the Resy offer! Note: there’s an identical offer for the Morgan Stanley Platinum card.

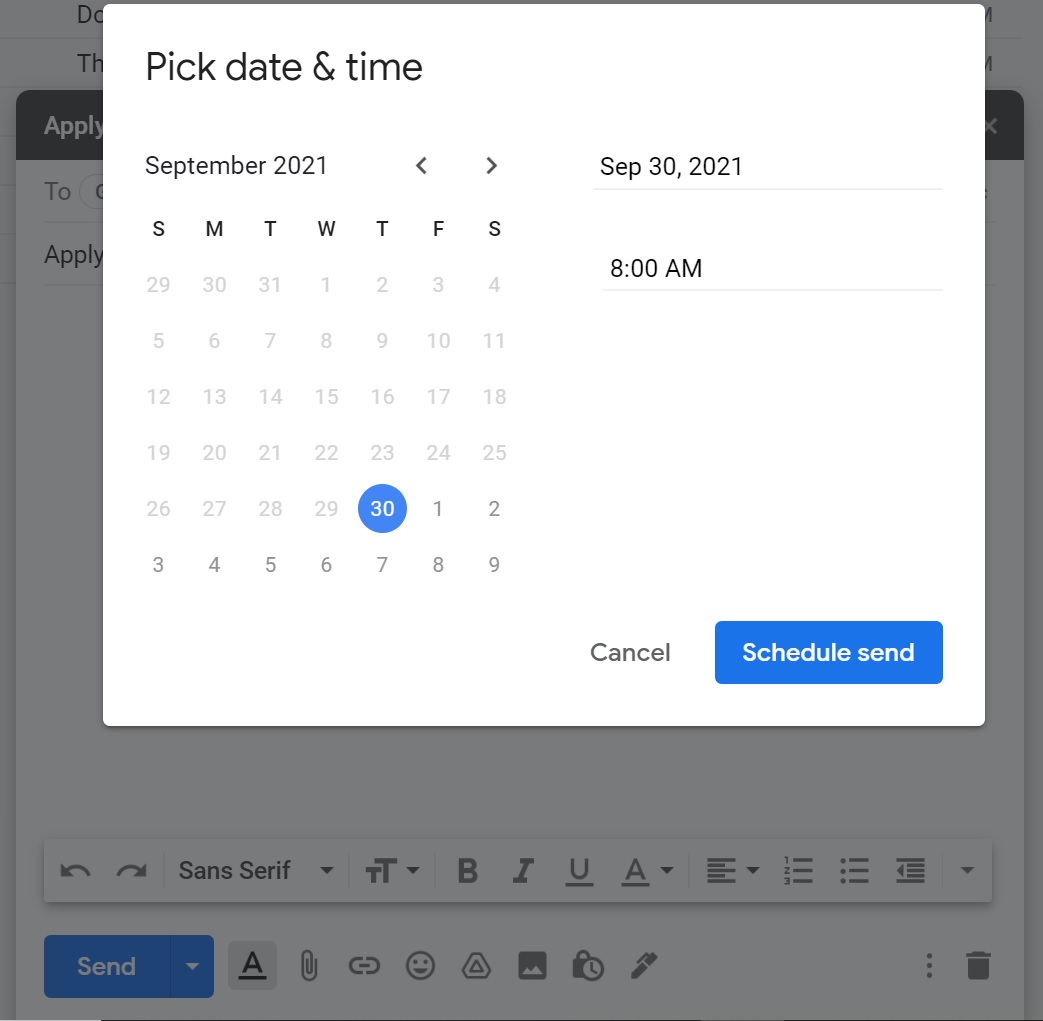

I already had the Schwab Platinum card so I wasn’t eligible. My wife, though, was eligible (including having a Schwab Investment account). She first tried applying for the Schwab Platinum card in July, but was denied. It turns out that Amex has a strange rule that applies only to the three variations of consumer Platinum cards (Platinum, Schwab Platinum, and Morgan Stanley Platinum): They won’t approve you if you’ve opened another card in that group of 3 cards within the past 90 days. And, as I wrote earlier, she had opened the Platinum card on June 30th. After learning about that rule, I sent myself a reminder for my wife to apply. I used Gmail’s Schedule Send feature (thanks to Nick for telling me about that!) so that the email reminder arrived on September 30th.

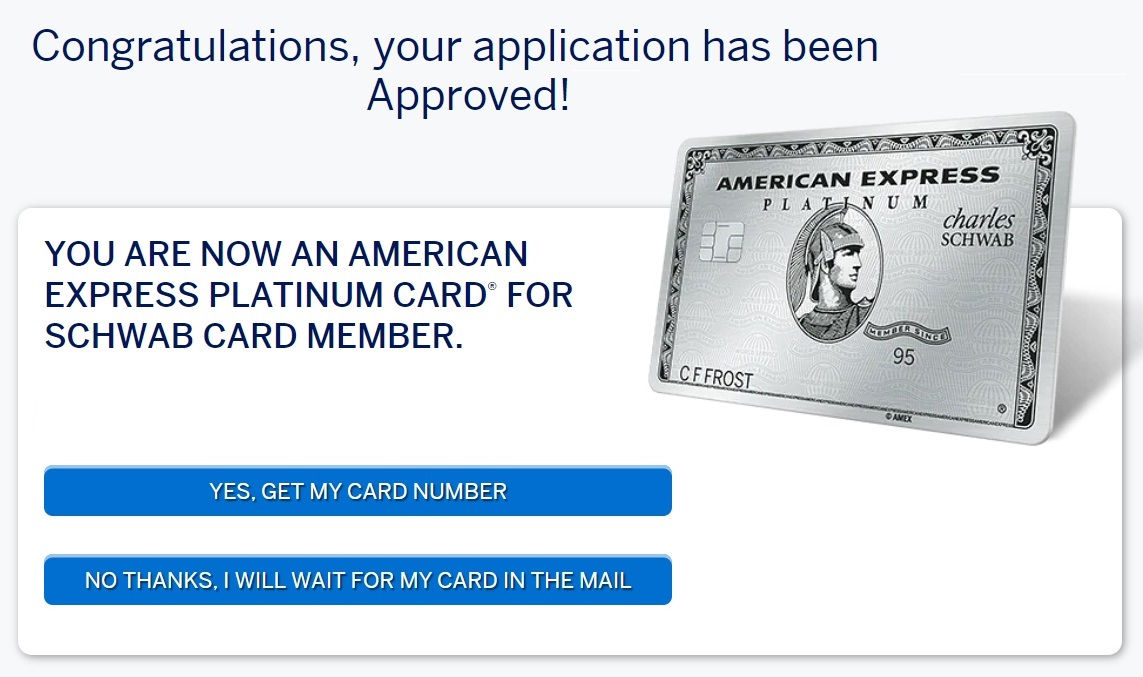

My wife then applied and was instantly approved. Yay!

Now, if we spend $25K on dining and small businesses within the next 6 months, we’ll earn 10 x 25K = 250K points from spend plus the 100K welcome bonus for a total of 350K points. That really is amazing for a single welcome bonus. Plus, since I’ve been an authorized user on some of my wife’s other Amex accounts for more than 90 days, we can transfer points to my loyalty accounts.

What will we do with all of those points? I’m not sure, but our post “How to use your Amex Point fortune” is a good place to go to start dreaming. Here are the recommended uses from that post:

- Fly First Class to Australia or South Africa

- Fly First Class to Japan

- Fly First Class to Europe

- Fly Business Class Around the World

- Fly Business Class to Australia, Africa, Japan, and more…

- Fly Business Class to Europe

- Stay in top tier Hilton properties

- Enjoy Top Shelf Drinks from the Delta SkyClub

- Do (sometimes) pay with points for flights

- Do (sometimes) invest with Rewards

I sent my wife the referral link but neither the Schwab nor the Resy cards appears. Are the eligible for referral bonus for me?

No they’re not

I also had a Business Platinum card application that wasn’t approved based upon the rule that you can’t have opened the same card (Biz Plat) within the past 90 days. I received an expand your membership offer, and my application went into the “cancelled” status. I called and they eventually found that was the reason. I waited the extra 5 days needed to reach 90 days, and it was then approved after calling.

[…] Can you believe the fantastic Resy AmEx Platinum offer is still available? By Frequent Miler. […]

Thanks Greg! Interesting to hear about small business coding. I never expected to be able to spend much in this category but sounds like that’s not correct.

If I have a joint Schwab brokerage account with my wife, is each of us eligible for the Schwab Platinum? I already have it but my wife never did.

Yes, I believe that she would be eligible

Oh-oh. I finally decided to pull the trigger on it today. When applying for the Schwab card, I have to login into the account and Amex application automatically pulls the account holder info into the application. It pulls the first holder from a joint account and it’s not changeable. I’ll try to chat with Schwab tomorrow and see what they can suggest or maybe they could switch the order of the accountholders.

Greg, you mention:

“since I’ve been an authorized user on some of my wife’s other Amex accounts for more than 90 days, we can transfer points to my loyalty accounts.

I had not thought about being able to move my husband’s points! I have Morgan Stanley AX Plat, my husband has vanilla AX Plat as of last November. I am thinking of closing his at AF time, but if I want to be able to move his points to my account, should I become an AU on his card first for 90 days and then close? But then I’m stuck with the hefty AF on his card coming up in November if I must wait 90 days. Can I product change his card to some other AX card, be an AU and then be able to transfer his points?

To be clear, you can’t transfer his Membership Rewards points to your Membership Rewards account. But you can transfer his points to your loyalty program accounts (ANA, Aeroplan, Delta, etc.). Best bet is to have him sign up for a fee free card like the Blue Business Plus or Everyday and then add you as an AU to either of those. Then he can cancel his Platinum card and he’ll keep all of his points. And then 90 days after you became an AU, you can transfer his points to your loyalty programs when you need them.

Thank you for that clarification and the fee-free path.

The Amex Everyday link to apply on your page throws an error message:

Sorry, it looks like something went wrong. This could be:

Any good ideas on how to MS the small biz or restaurant spend? I think I’ll be able to hit the 25k with a wedding coming up. But I want a backup just in case

Back in July 2021, I tried to get the Amex Resy offer, but got the not eligible for welcome bonus. I never had an Amex Platinum before of any kind. I currently got 5 Amex cards. Oldest is 1998.

When can I try applying again?

You can try any time. If you get the pop-up, just cancel the app and it won’t do any harm.

Is there a good way to see what codes as 14x bonuses? The site seems to show random cryptic amounts for bonuses that I can’t always tie back to a transaction. Thanks

It’s pretty hard to tell when they lump multiple purchases together, but this post might help: https://frequentmiler.com/yes-your-new-platinum-card-is-earning-10x-where-appropriate/

Do you know why it is so hard to find the application for the MS platinum? The link on FM is the only place I can access it. Google is useless when I search for it.

No, I don’t know why.

Any risk of shutdown by having multiple types of platinum?

I don’t think so

Wow, you really like to dine out and shop small. I will never be able to spend so much in this 2 categories in 6 month.

There are grocery stores that count as shop small businesses 😉

Which grocery stores count as shop small so cal/and az here

Many online transactions count as small business purchases too.

I notice you’ve mentioned this twice now Greg 🙂 could you pretty please drop a clearer hint? :D.

Thanks for the great blog!

Any idea how long this Schwab deal might be around? My husband and I both have the generic Plat, but are planning to have him get the Schwab. Unfortunately we are in the middle of a refinance and aren’t supposed to open any new accounts till after closing; plus we don’t have the required Schwab brokerage account yet either. Also, do you have any guess on what credit score is needed? We WERE both over 800 but we loaned a family member some use of credit/money that now they can’t pay back yet (so we had to shift about 15K to a few newly opened 0% intro interest cards). Now my husband is at 770ish and I’m at 715. We should be able to pay off all cards with the cash out at the closing of the refinance in mid November, and then wait for scores to go back to normal, hopefully quickly…

Sad to have missed the old annual fee and the 1.25 redemption, but, oh, well!

No, I don’t know how long it will be around. I can’t say about credit scores either. Amex is usually pretty easy on approvals, but I don’t know what history they’ll look at and/or care about.

Ha, that was me. Signed for plat 6/30 after being in popup jail. Then the resy offer comes out which was better. Tried for swab but got denied due to that rule. Now i guess stuck with the points.

Is that the normal bonus on the Schwab Plat or is that a limited time promotion?

I think it is the new normal, but I don’t know for sure.

Do you know if these items might qualify as ‘small business’ by Amex:

I can’t say for sure about any of them but they’re all possibilities. With Plastiq I assume it will depend upon who you pay but maybe it will work for all — who knows. I do have a Plastiq payment where I’m waiting for confirmation that it worked (the charge has been sitting as pending for over a week for some reason!)

Extra points never posted for my Plastiq spend. When I get a chance I’ll try to get the points credited through online chat.