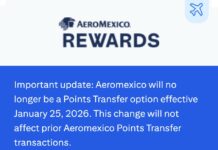

NOTICE: This post references card features that have changed, expired, or are not currently available

Citibank ThankYou Rewards points can be earned from several credit cards, and from some Citi bank accounts. By default, each credit card or bank account has its own ThankYou Rewards account, but Citi provides a mechanism to pool these “sponsor” accounts together.

Pooling ThankYou Accounts Advantages

There are a few advantages to pooling accounts:

- Simplicity: View all of your points at once. If you have any expiring points, the soonest to expire points will be used first when you redeem points.

- Quantity: If you don’t have enough points in one account for the award you need, but you do have enough via separate accounts, pooling accounts is one way to solve that problem.

- Value: Some accounts make your points more valuable. For example, Citi Prestige accounts can be used to buy American Airlines flights with a value of 1.6 cents per ThankYou point, or other airfare for 1.33 cents per point. And, the Premier card allows purchasing any available travel (flights, hotels, car rentals, etc.) with a value of 1.25 cents per point. Both cards also allow transferring points to a select list of airline and hotel programs. By pooling your points with a Prestige and/or Premier account, you automatically get access to these higher value rewards even if the system uses your points from an inferior account. One exception: points earned from a bank account cannot be transferred to airline or hotel programs even if those points are pooled with a Prestige or Premier account.

Pooling ThankYou Accounts Disadvantages

Pooling points won’t keep points alive. If you have an account with expiring points, or you close an account that has points associated with it, those points will expire regardless of whether or not they have been pooled with other accounts. For more, please see: How to know if or when your ThankYou points expire. As a result of this, pooling has a few serious disadvantages:

- Loss of info: Once you pool accounts, there is no easy way to see how many points you have in each account.

- Loss of control: Once you pool accounts, you can’t choose which account to use for redeeming points for an award. The system will automatically use points that expire the soonest (if you do not have any points with expiration dates, then I believe it will use the oldest acquired points). But, what if you’re planning to close one of your accounts and would like to use those points first to avoid losing them when you cancel? Once your accounts are pooled, you’re out of luck – you can’t control the order in which pooled points are used.

- No way out: Once you pool your accounts, it appears that you cannot undo that action. The ThankYou Rewards website states “Please review your accounts carefully before combining, as this process cannot be undone once you have confirmed it.”

How to get the advantages of pooling, without pooling

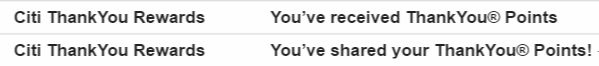

Some of the advantages of pooling shown above (quantity and value) can be obtained without pooling accounts. Instead of pooling, you can move points from one account to another at the time you need them. Citi calls this “Point Sharing” (Travel with Grant has a primer on Point Sharing here). Points Sharing is intended to be used to move points from one person’s account to another (an incredibly useful feature in itself), but it can also be used to move points between your own accounts.

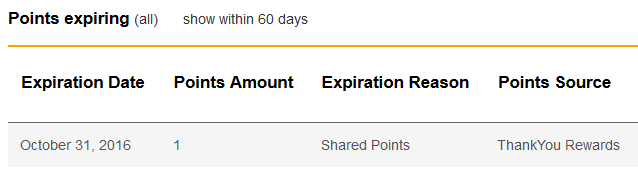

Once points are moved (shared) from one account to another, they’ll expire in 90 days. Unless you have other points expiring sooner, shared points will be used first when redeeming an award.

The basic idea is to keep your accounts separate. Then, when it is time to redeem points for an award, figure out which account you want to redeem from. If that account gives you the best available value for your award, then simply redeem from that account and you’re done. If another account offers better value, then move (share) the required points to the better value account and then redeem from that latter account.

Example: Suppose you have a two year old Prestige account and a 6 month old Premier account. And, suppose you want to keep your Prestige card long term, but want to cancel your Premier account when the annual fee comes due (note: you would probably be better off downgrading your Premier account to a Preferred account, but that’s another story). In this case, even though points from your Prestige account are older, you want to use up your Premier account points first. If you had pooled the accounts you’d be out of luck. By keeping them separate, you can simply redeem awards from your Premier account. And, if you want to get better value paid flight awards (e.g. 1.6 cents per point value to book AA flights), then you can move (share) points from your Premier account to your Prestige account right before redeeming those points.

One big exception to this approach is with bank account points. Points earned from bank accounts are taxable (unlike points earned from credit cards which are not). And, Citi does not allow moving (sharing) points from taxable accounts. In order to get better value from such an account, you would have to pool it with your Prestige or Premier account. You still would not be able to transfer the points to airline or hotel programs, but you would be able to get better than 1 cent per point value when redeeming for flights (Prestige) or travel in general (Premier).

One big limit with this approach is that point sharing is limited to 100,000 points per calendar year. The ThankYou Rewards site states: “The total number of points a member can share is 100,000 points in a given calendar year and the total number of points a member can receive from other members is 100,000 Points in a given calendar year.”

Conclusion

I recommend not pooling ThankYou accounts. Rather than pooling accounts, share points across accounts as needed. Exceptions:

- Points earned from bank accounts cannot be shared so there is an argument to be made for pooling those points with a premium account in certain situations.

- You are limited to sharing 100,000 points per calendar year. If you need to use more than this, you may have to pool accounts.

Hat Tip to Mike for inspiring this post

[…] account. Citi does provide a way to combine accounts, but should you? In the past, I said no (see this post for details), but now things have changed and the question is once again […]

I have (4) Citi TY accounts (Premier, Prestige, Preferred, Rewards+)

Can I pool only (2) of these accounts (e.g. Prestige & Rewards+)?

Or can you only Pool all accounts?

**Sharing points doesn’t work for me here; I have a big stash of points on my Prestige, and I want to leverage the 10% points-back on redemption offered by the Rewards+.

Thanks 🙂

You can pool all of them.

I don’t want to pool all of them, I only want to pool my Prestige & Rewards+.

Is this possible?

Oh, sorry I misunderstood. Yes, as long as the other cards aren’t already pooled with either of them, you can pool only the Prestige & Rewards+

Is this still the state of thankyou points?

Which part?

[…] previously argued against pooling points with Citibank (see: Should you avoid pooling ThankYou accounts?). If you have this combo, though, it may be worth accepting the downsides of pooling […]

[…] ways of combing points between your ThankYou accounts: Should you avoid pooling ThankYou accounts? by FrequentMiler. This blog is about few advantages and disadvantages of pooling different […]

[…] Should You Avoid Pooling ThankYou Accounts? Yes. Or more specifically per Frequent Miler: […]

A few months ago I shared 55k from my sisters premier into mine and 53k from my fathers premier into mine. So either the 100k restriction wasn’t in place or it wasn’t enforced.

100k definitely IS NOT enforced. I’ve shared 133k in the past 3 months.

How do you tell if you have points expiring?

https://frequentmiler.com/2016/07/05/how-to-know-if-or-when-your-thankyou-points-expire/

What I did is that I combined all the Thank you point accounts, which accumulates points through cards with no annual fees, into one and keep the rest separate. In this case, you would to be able to balance the need to manage your accounts in a easy way and being flexible at the same time.

Because I have pooled my points and do not intend to use/transfer any of them, I had to keep my unused card as it is, eg Thankyou Preferred. I could have converted this card to a Dividend card to earn $300 cash back each calendar year minus a little bit of fees. However Thankyou series card seems to get more retention offers or targeted spending offers, so that offsets some opportunity loss of keep this card. Two take-aways here: (1) Always downgrade unused Thankyou card, unless the associated points are depleted. (2) The Thankyou points system should really be revised to compete with Amex’s Membership Rewards and Chase’s Ultimate Rewards. Neither of these two point systems has issue with moving/combining points.

I actually accidentally combined my TYP from Prestige with Premier. It wasn’t a lot (total 25K), but I was annoyed when it happened. I thought I was actually transferring over some points from one account to the other, I didn’t know that combining accounts was something different altogether.

One thought about uncombining Citi TYPs. In order to have all your Citi TYP accounts combined, they must have the same address and phone number on file. If you change that info, your accounts may be uncombined or you may call to have your accounts uncombined. Ive never tried it, but based on the logic Citi uses for combining accounts, it might work in the opposite direction.

Interesting idea!

I was recently forced into combining my accounts because Citi instituted a 100k annual transfer limit per account.

Ooh, thanks for that. I’ll update this post to mention that restriction. Via the ThankYou website: “The total number of points a member can share is 100,000 points in a given calendar year and the total number of points a member can receive from other members is 100,000 Points in a given calendar year.”

100K annual limit? I have never heard of this. When did it get implemented?

Is it certain that all points pooled into a Prestige account can get the 1.6 on AA flights or only the points earned with the Prestige?

All points that are pooled get the 1.6c rate. I earned most of my points before I got the Prestige and was able to redeem those points for AA flights at 1.6c / point. It’s a nice benefit!