NOTICE: This post references card features that have changed, expired, or are not currently available

Southwest Airlines is targeting some Chase Southwest credit cardholders with a 25% bonus on all purchases between 11/1/2022 and 2/28/2023. It appears that the promotion applies to both base points and category bonuses. Even better, the bonus points are good for 2023 companion pass qualification (although the points from the actual purchases will count towards 2022 qualification if the statement closes in 2022).

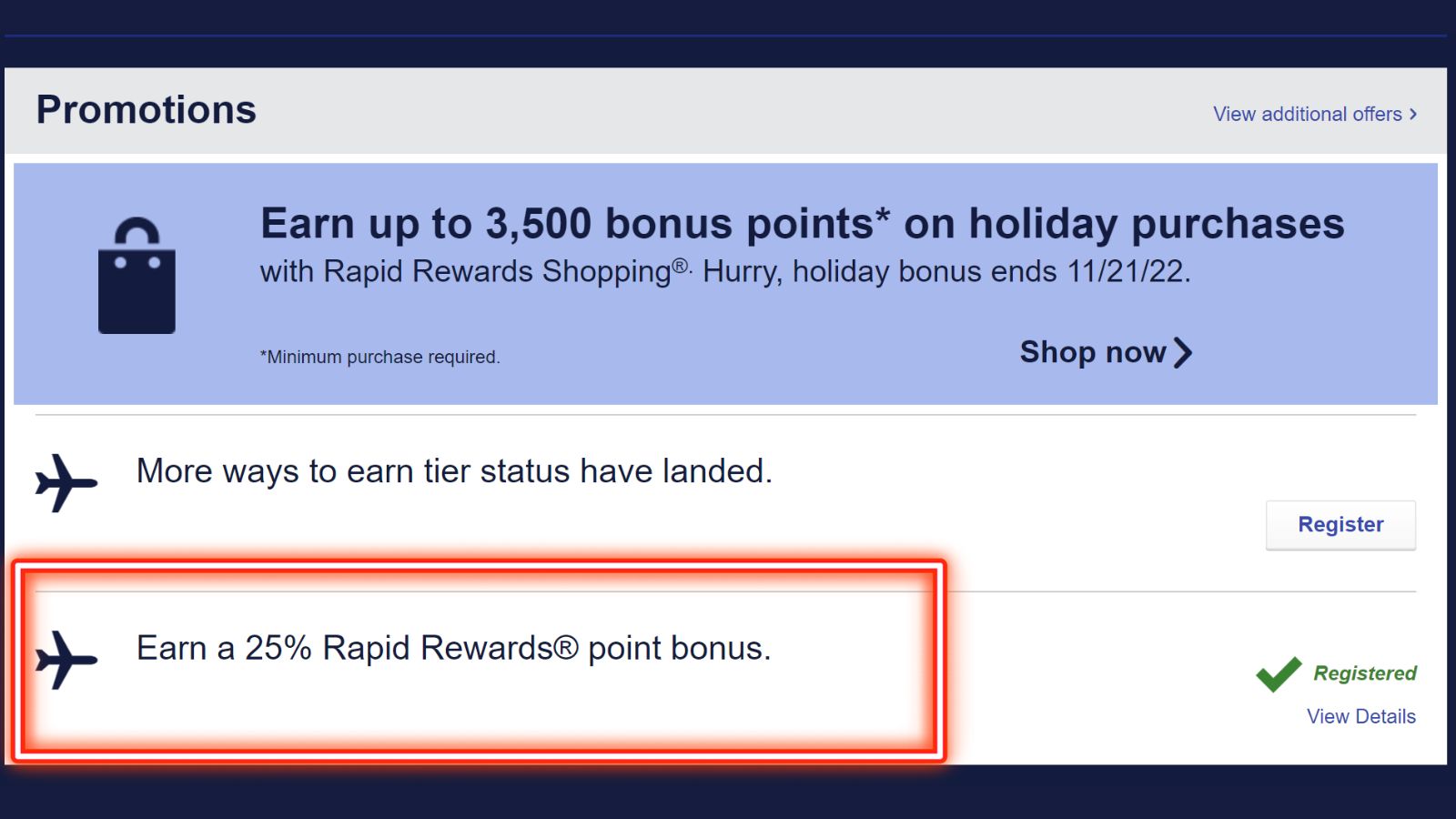

This offer was e-mailed to Nick and also appeared under “promotions” in his account tab. It requires you to first register for the promotion and then spend at least $1,500 on the card that you registered with. The maximum amount of total bonus points that you can earn through the promotion is 20,000. It looks like this is just targeted at consumer cards. Actually, it sounds like at least some folks with business cards are targeted as well.

● Complete Guide to the Southwest Companion Pass 2022

● How to earn 2 Southwest companion passes with 3 credit cards

The Deal

- Southwest Airlines is targeting some cardholders with a 25% bonus on all purchases

- Registration required

- Must spend at least $1,500 to activate offer

- 20,000 total points is the max bonus

- Bonus points ARE companion-pass qualifying. All bonus points will go post in 2023 (and thus help for companion pass qualification next year

Direct Link to “Promotions” in Southwest account (must log-in)

Terms and Conditions

- You must register between 11/1/2022 and 2/28/2023 11:59 p.m. ET.

- After you use your Southwest Rapid Rewards Credit Card to make at least $1,500 of purchases during the promotion period of 11/1/22-2/28/23, you will earn 25% in points as a bonus on purchases made on your Rapid Rewards Credit Card during the Promotion Period, up to 20,000 bonus points.

- The 25% bonus is in addition to the points you already earn with your card.

- The 25% bonus points will count towards Companion Pass® qualification, but will not count toward A-List or A-List Preferred qualification.

- Please allow up to 8 weeks after the end of the Promotion Period for the 25% bonus points to post to your Southwest Rapid Rewards account.

- Bonus points will post to your account in 2023. Maximum bonus point accumulation from credit card purchases during the Promotion Period is 20,000 bonus points per Rapid Rewards account.

- “Purchases” do not include balance transfers, cash advances, travelers checks, foreign currency, money orders, wire transfers or similar cash-like transactions, lottery tickets, casino gaming chips, race track wagers or similar betting transactions, any checks that access your account, interest, unauthorized or fraudulent charges, or fees of any kind, including an annual fee, if applicable.

- Points transferred from Chase Ultimate Rewards to Southwest Rapid Rewards are not eligible for the 25% bonus. Points and bonus points earned on a new Rapid Rewards Credit Card account opening are not eligible for the 25% bonus.

Quick Thoughts

Southwest has run this same promotion the last couple of years at approximately the same time. It’s a good one for those that reach Companion Pass qualification through a combination of sign-up bonuses and credit card spend. Especially handy is that it applies towards category bonuses as well as base points, although these aren’t terribly compelling on the Southwest cards:

| Card Offer and Details |

|---|

ⓘ $533 1st Yr Value EstimateClick to learn about first year value estimates 50K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 50K points after $1K spend in the first 3 months$99 Annual Fee After clicking through, be sure to manually select the exact Southwest card in which you are interested. This card is subject to Chase's 5/24 rule (click here for details). Recent better offer: 85K points after $3K spend in the first 3 months (Expired 12/16/25) FM Mini Review: This card can be great for its new cardmember bonus, but its ongoing perks are worth the annual fee only if fully used each year. Earning rate: 2X gas station and grocery (up to $5K in purchases combined per anniversary year) ✦ 2X Southwest Card Info: Visa Signature or Platinum issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: If you earn 135,000 points in one calendar year, you'll get a companion pass good for the rest of that calendar year and all of the next year. Noteworthy perks: 3000 bonus points each year upon card renewal ✦ 10,000 Companion Pass qualifying points each year ✦ First bag free for cardholder and up to 8 companions ✦ Receive a 10% promo code each year on cardmember anniversary (Excludes Basic fare) ✦ Complimentary Instacart+ for 3 months (must activate by 12/31/27) ✦ $10 monthly Instacart credit ✦ Available for flights from 1/27/26 onward: ✦ Group 5 boarding ✦ Standard seat selection up to 48 hours pre-departure (if available) |

| Card Offer and Details |

|---|

ⓘ $483 1st Yr Value EstimateClick to learn about first year value estimates 50K points ⓘFriend-ReferralThis is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer 50K points after $1K spend in the first 3 months$149 Annual Fee This card is known to be subject to Chase's 5/24 rule. Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 85K points after $3K spend in the first 3 months (Expired 12/16/25) Earning rate: 3X Southwest ✦ 2X restaurants and grocery (up to $8K in purchases combined per year) ✦ 1X on all other purchases. Card Info: Visa Signature or Platinum issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: If you earn 135,000 points in one calendar year, you'll get a companion pass good for the rest of that calendar year and all of the next year ✦ Earn 1,500 TQPs for each $5K in purchases Noteworthy perks: 6000 bonus points each year upon card renewal ✦ 10,000 Companion Pass qualifying points each year ✦ First bag free for cardholder and up to 8 companions ✦ Receive a 15% promo code each year on cardmember anniversary (Excludes Basic fare) ✦ Complimentary Instacart+ for 3 months (must activate by 12/31/27) ✦ $10 monthly Instacart credit ✦ Available for flights from 1/27/26 onward: ✦ Group 5 boarding ✦ Standard or Preferred seat selection up to 48 hours pre-departure (if available) |

| Card Offer and Details |

|---|

ⓘ $403 1st Yr Value EstimateClick to learn about first year value estimates 50K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 50K points after $1K spend in the first 3 months$229 Annual Fee This card is known to be subject to Chase's 5/24 rule. Recent better offer: 85K points after $3K spend in the first 3 months (Expired 12/16/25) FM Mini Review: Great for frequent Southwest flyers - this card could easily be a long-term keeper. Earning rate: 4X Southwest ✦ 2X gas & dining ✦ 1X on all other purchases. Card Info: Visa Signature or Platinum issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: If you earn 135,000 points in one calendar year, you'll get a companion pass good for the rest of that calendar year and all of the next year ✦ Earn 2,500 TQPs for each $5K in purchases Noteworthy perks: 7500 bonus points each year upon card renewal ✦ 10,000 Companion Pass qualifying points each year ✦ First bag free for cardholder and up to 8 companions ✦ Complimentary Instacart+ for 3 months (must activate by 12/31/27) ✦ $10 monthly Instacart credit) ✦ Available for flights from 1/27/26 onward: Group 5 boarding ✦ Preferred seat selection at booking (if available) ✦ Extra legroom upgrades up to 48 hours pre-departure (if available) |

There are a couple of possible gotchas. First off, you must register the targeted card before making purchases and then you must spend at least $1,500 on that card in order for the promotion to kick in. Secondly, while the promotion states that the bonus points all count towards companion pass qualification in 2023, that doesn’t necessarily hold true for the actual base points from spend.

Southwest points post to your account upon statement close. For example, if you would like to have points from spend hit a card in January, you should wait to make the purchases until after your December statement closes (since purchase activity after your December statement has closed will post to your Southwest account upon the close of your January statement). Thus, if you want both the base points from spend AND the bonus points from this promotion to count towards 2023 qualification, you should wait until after the December statement close to begin ramping up spend.

Got it. Thanks for the heads up.