Like many other carriers, T-Mobile offers a per-line discount for setting up and paying your bill via autopay with a debit card or checking account. The discount is $5 for each line, with a maximum of $40 per month/account, and paying your bill with a credit card officially invalidates that discount. However, there has long been a workaround: set up an autopay with a debit card, then manually pay your bill with a credit card before the due date.

This enabled those of us who wanted to earn credit card rewards, get cell phone insurance, and/or use the $10 monthly credit on our American Express Business Platinum® cards to have our cake and eat it too. We could get the $5 per line discount AND still utilize credit card-based perks.

That’s all come to an end, though. As reported by TMO News, any payment made to a T-Mobile account using a credit card will now invalidate the autopay discount for the next billing cycle.

Quick Thoughts

Well, this is a bummer.

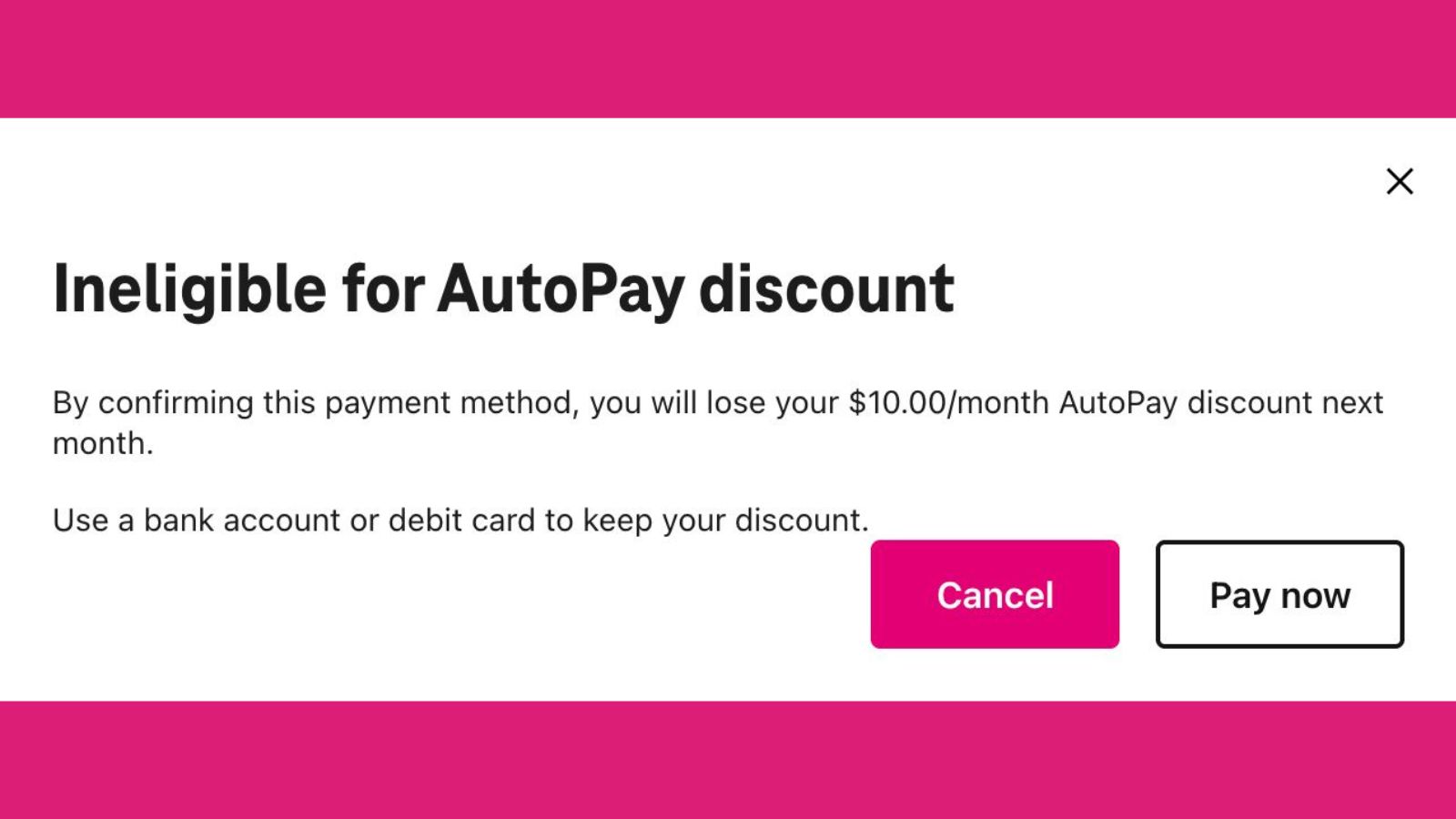

The pop-up shown above is what I received when trying to make a $10 payment on my current bill. We thought that there might be an opportunity to still get the autopay discount by overpaying the previous month’s bill (by paying in-between closing dates), so Nick gave it a shot.

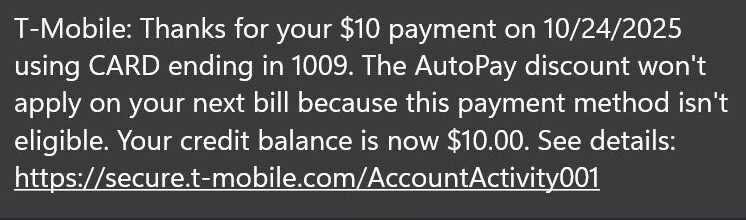

Initially, it seemed like it might have worked, as he didn’t get the pop-up. However, a few minutes after making the payment, he got the following text:

So, it appears that the autopay discount is officially dead if you want to use a credit card to pay.

I have two lines through T-Mobile, and another $5 per month discount for my home internet. I also currently have nine Business Platinum cards, so I’ve been able to get $90 off of my bill each month by making manual $10 payments (in order to use the Business Platinum’s $10 monthly wireless credit). Now that I won’t be able to stack the autopay discount, those $90 in monthly credits will actually be worth only $75 for me.

Nick is an even more applicable example, as he has nine lines on his plan and maxes out the $40 monthly autopay discount. He has four Business Platinum cards, so with the change, the $40 in credits and the loss of the $40 autopay discount completely offset. It’s still slightly worth it for him to pay with a credit card, since he’s able to earn rewards and get cellphone insurance on the remainder of the bill, but it ends up being a huge degradation in the value of that benefit for him.

I suspect that most folks will be more or less in Nick’s boat. They may have one Business Platinum (or none) and the removal of the autopay discount will effectively offset the value of the $10 credit or the combination of credit card rewards and/or insurance.

Now that we’re seeing a modest proliferation in rewards-earning debit cards, I’d love to see one of them step into the gap by offering cellphone insurance, so that it would stack with carriers’ autopay requirements. Until then, T-Mobile customers are now faced with a choice: credits, insurance, and rewards or an autopay discount.

If the rule is that any credit-card payment invalidates the discount for the next billing period, then it should still be possible to “lose” only $5 every two months from the Business Platinum credits. If your billing period is the 16th to the 15th, then pay $10 in late October and $10 in early November to get $20 off but lose the discount for the billing period starting on November 16. Then pay by bank account for the period starting December 16 and get the full discount. Then pay $10 each in late December and early January, etc.

Seth

I have great experiences with T-Mobile. But I always took the debit from checking at face value. For most the $5/line discount is worth more than any CCs $10 credit. I also would not rely on CC insurances. They have become more and more difficult to deal with.

NINE business platinums?

wat da f?

Booooooooooooooo

It does suck to lose the chase ink insurance, but what about payment with a visa debit card? Like the $200 sold at Staples. Still earn 5x UR, but lose the insurance. Will that work to not lose the discount?

I have just used this, like loading Amazon.

can you explain? Did you use a visa/mastercard debit from staples to make a partial payment with debit card to avoid losing the fee?

Frank, can you let me know how you did this? Did you buy a visa debit card from staples, load it as your payment type and make a payment? Did it say eligible when you loaded it?

Sucks. I have Tmo and the Plat Biz and was doing the same. Any ways to use the $10 monthly credit independent of Tmo?

Switch carriers or go prepaid still works .

I also have Google Fi device that works far better overseas than T-Mobile. Supposedly Amex and Google Fi have solved their issues. Google Fi can be very inexpensive. They use T-Mobile domestically and overseas they use a local carrier. You pay for what you use and won’t get throttled like T-Mobile does overseas. I never have an issue with Google Fi overseas.

Do any debit cards offer phone insurance?

This is the first time I have considered leaving T-Mobile. They can suck it, respectfully, if my money I pay all the time in advance, is not good enough for them, I own my unlocked phone, so it’s finally time to go.

Time to try Mint Mobile – Hello Ryan Reynolds! (Or at the very least, I am now compelled to do the research and overthink my choice)

There goes the coupon book

Considering pre-paying the bill before the bill actually hits (i.e. I have a $0 balance right now so pay $x before the bill is sent to make my balance -$x), keep my bank account linked, then see if the auto-pay discount applies. I just have a large auto-pay discount right now because it applies to every line, including watches, sync up trackers, etc. so really don’t want to have to pay if it doesn’t work. Ugh this sucks.

PenFed Debit Card (Checking account) includes a $500 Cellphone insurance protection . For those who do not want to loose the $5 per line discount.

https://www.penfed.org/content/dam/penfed/en/general/pdf/form-25-visa-debit-benefits-guide-final.pdf

$895 card & constant headache

Bummer – 15,000 Chase points a year and the discount was nice.

We’re on to you Pauley

I was hoping to pre-pay $2,500 for the BoA double cashback day on Nov 6, I presume if I did, it would only take away the autopay discount for the November billing period? If so, still worth losing the 1-month autopay for 2x extra Atmos points

Yes, I believe that would be the case. Both the text and the pop-up say that making the payment will invalidate the discount on the next billing period, not indefinitely.

We will close those too Stinkee

Lmao

So do you think a sizeable pre-pay with an Ink card will “keep the dream alive”? after that initial loss of the discount? That would be as close to a work around as possible.