NOTICE: This post references card features that have changed, expired, or are not currently available

With ghouls, goblins, skeletons, and zombies shuffling through neighborhoods on this Halloween day, I’ve turned my thoughts to the dead that I’d like to see rise. Here’s a collection of credit cards that I once held dear, but are now either long dead or still exist but as empty shells of their previous selves…

The O.G… The SPG card. Back in the day, this was it. We didn’t used to have category bonuses or transferable points cards that earned better than 1x for most spend. This one too offered only 1x for spend, but SPG had a great award chart which made 1x earnings valuable for hotel stays. Even better, the SPG program had a killer feature: you could transfer 20,000 points into 25,000 airline miles and they supported every airline program you ever heard of plus a few dozen more. Thanks to that feature, this 1x card offered 1.25x airline miles… of your choice. That was huge. RIP.

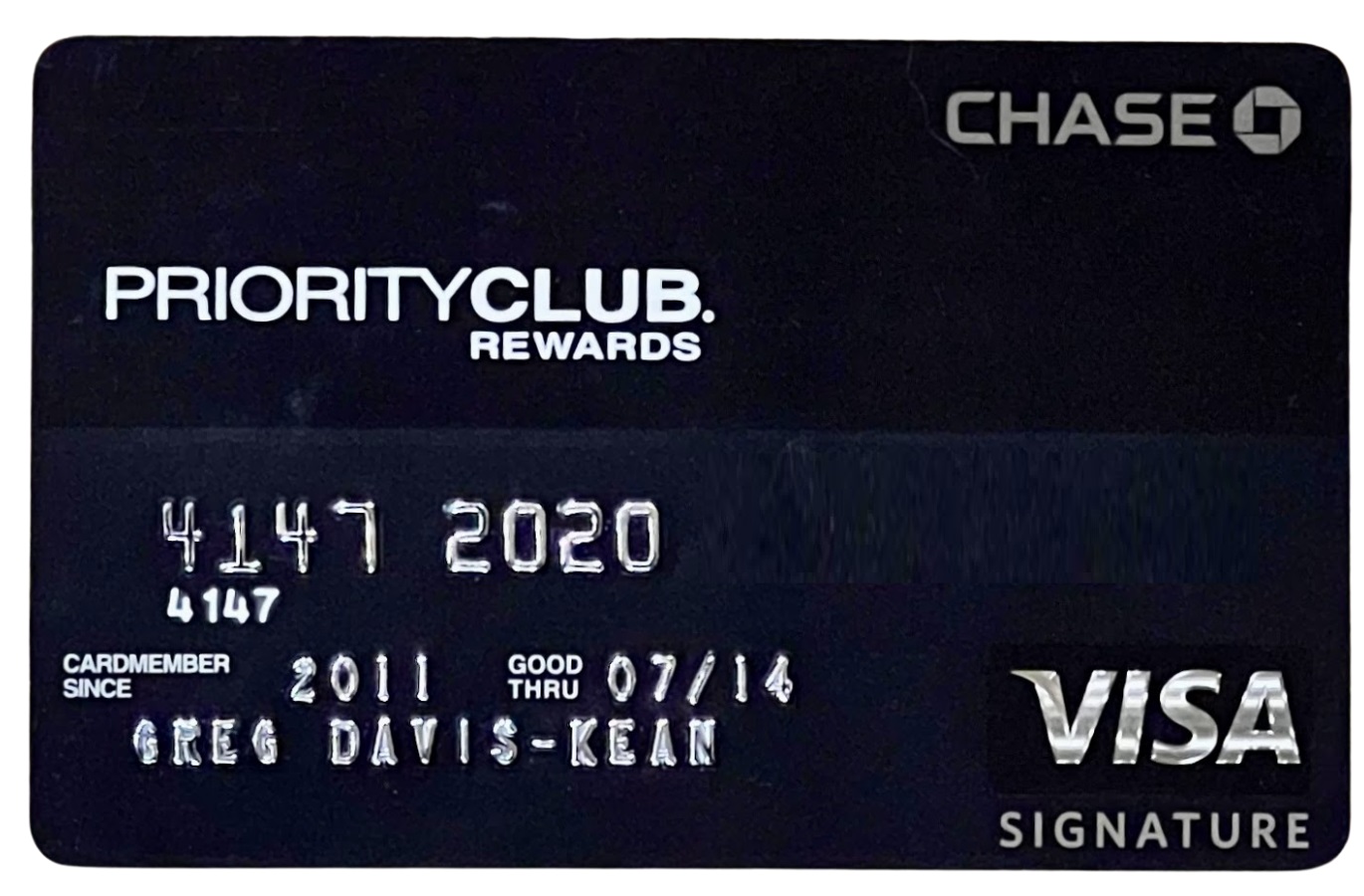

The $49 per year PriorityClub Rewards card offered an uncapped free night each year at any IHG property worldwide. You can’t get this card anymore, but many of us still have it. It is now the IHG Rewards Select Credit Card. It is still only $49 per year, but its free night is capped at 40,000 points per night and you cannot top off those free nights with points as you can do with the new and available $99 IHG Premier and IHG Premier Business cards. Still, if you have the old card (as I do), it’s worth keeping for that free night and 10% back on point award stays.

This was another great hotel card that bit the dust. This card used to offer a signup bonus of 2 free nights, uncapped. Even better, for only $95 per year, it gave you elite status which offered dining / spa credits, room upgrades, suite upgrades, and more. Plus, with only $12k annual spend, you’d get another free night each year. I signed up for this card just as it was ending its life and was able to use my bestowed elite benefits to upgrade my two free nights to a very nice suite.

The CNB Crystal Visa Infinite Card still exists but only as a shell of its former self. In days of old, you could pay one $400 fee to get four of these cards (one for yourself and 3 authorized users) and all 4 cards were eligible for great perks, including $250 in airline incidental fee credits. If you played your cards right (see what I did there?), you could get back $1,000 each year plus each cardholder could enjoy other benefits: Priority Pass with unlimited guests (this was actually limited to just 2 of your 4 cards), 12 Gogo In-Flight Wifi passes per year, Visa Infinite Discount Air Benefit ($100 off each 2 person round trip domestic flight), Global Entry application fee credit, etc.

The Club Carlson Premier Rewards Visa Signature entered the market with a killer feature: “Bonus Award Nights”. For any award stay of more than 1 night, the last night of the stay was free. It was easy to optimize this by booking multiple 2 night stays. For each 2 night stay you would pay with points for only 1 night. That feature was eventually killed off. Later, Club Carlson became Radisson Rewards. And now, the Radisson Rewards cards are dead too. Those I don’t mourn, but the I sure do miss the old Club Carlson Bonus Award Nights cards.

Which cards do you mourn for? Comment below.

Citi Forward- 5x TYP on Restaurants and Bookstores (counted Amazon.com), 0 AF

Priceline Rewards Barclaycard (2x points everywhere,5x on Priceline Express deals purchases) redeemable against anything at 1cpp, travel at 1cpp with 10% back, Priceline Express Deals, Flights, anything billed through Priceline.com at 1.5cpp with 10% back in points) That makes it over 3.5% back on anything. 0 AF, no foreign transaction fees.

Great list! Had them all except for Crystal Visa. Really miss the Club Carlson second (err last) night free, used it extensively.

I miss the free Hotel certificates that arrived after redeeming points for free plane tickets. I used a stack of them for a free week at the W hotel on Lex.

Continental Presidential Plus Card, the complimentary upgrades were insane.

On the same topic, which cards do you think available nowadays will be heading that way?

Sure we all play the game of trying to rationalize the value of the benefits received vs the annual fee..

But which card do you have now would you want to keep indefinitely just in case they are discontinued. For example the Chase Ritz card?

That’s a great question. Certainly the Ritz. I’m surprised its not only still alive but better than ever. The Hilton Aspire: I don’t think it will go away but I think it’s very likely to gain a higher annual fee.

I miss Citi prestige with the unlimited 4th night free, and back when it was actually the 4th night that was free.

Great card for a one year Run 4 years ago at a $4k profit.

Anyone remember the citi drivers edge card that gave rebates for car repairs auto purchases for miles driven matched 1:1 to rewards earned at 3% supermarket, gas, drugstore?

I had this and SPG, CNB, Chase IHG $49 card (Still have this). I also had the Drivers Edge, which became the Citi Forward card, which is now a double cash back card, which was converted to the 5x card.

Yes, I had the Drivers Edge card. I believe the Drivers Edge was created by Citi to force convert Ford cardholders when the Ford card was discontinued. Yes, there once was a Ford card similar to the “old GM card” before Goldman Sachs bought the GM card portfolio from Cap1 early this year and watered down the benefits. Citi called us “charter members” of the Drivers Edge card. Nice little card while it lasted. Ended around 2010 I think.

I had it for years but stupidly never redeemed the benefits. Hence I’m on a crusade to maximize benefits to make up for my past sin 😉

I sure miss the SPG card! No capacity caps! If they had a room available, you could use your points! Sigh….

And they had good redemption value and both high and low properties. One of my favorites was the Four Points in Houston SW Freeway. It was a great location, and it was 2000 points/night. Not fancy, but definitely worth more than $50/night + tax.

Great walk down memory lane. The Fairmont card in particular was very underrated and one of my favorites. It was better than the Hyatt card back in the day that also gave 2 free nights but without the confirmed suite upgrade and dining credits. We churned that baby and got some great memories from it.

I’ll always have fond memories of the Citi AAdvantage Executive card, specifically the feature to churn it every month for 100k SUB each and get the AF back when cancelled within 37 days plus keep the $200 credit.

A few other good ones: 1) Ameriprise Platinum AND Gold cards; got the Platinum in November and trpple-dipped the credits for no AF – more than once; since there’s no SUB, there’s also no restriction on how often you can reapply; 2) Mercedes Platinum; imagine another 100k+ Platinum offer.

Yes, I loved staying at the Savoy in London with the sign-up bonus, which I did twice.

Back before Chase’s credit card division was taken over by First USA, my mom had the Chase travel card. Everything CSP is now, except much better redemptions, 25000 bought you any ticket up to $500, and no annual fee.

After the Chase/Banc One merger, they devalued it to nothing then converted it to CSP.

Merrill still has this if you have the old Merrill+ card (which I do).

Great list Greg, I had many of those same cards over the years, they are dearly missed.

I would also like to nominate the Citi Forward, Citi AT&T Access More, and the OG Target Redbird…

Agree with Grant. Had all of these, still have AT&T Access More

Expedia Voyager with 2019 Black Friday elevated signup bonus of 70k points. At the time you could use them for 1.4 cents/point at VIP access hotels ($980 worth of hotel stays). With the SUB, traveling off peak I booked 1 night in London, 5 nights in Canary Islands, 1 in Bruges, and 2 in Sacramento. There was a $95 annual fee but you got $100 airline incidental credit per calendar (triple dip potential), which worked for Delta gift cards. I kept it for an extra year, then downgraded it to another Custom Cash to add to my Citi suite of cards. Then they killed the card a few months ago, but still gave me an extra $100 in Expedia credit because I had been a card holder this year (even though I downgraded 9 months prior). So for 2 annual fees ($190), I ended up with $1080 of hotel stays and $400 in Delta gift cards!

Great one. I triple dipped the credit for one $95 fee. Used the SUB for 5 nights around Big Sur.

Citi Prestige for the 4th night free benefit.

Whatever the price of that 4th night!

Not to mention how it turned Citi points into 1.6 cents per point on AA.

PLUS it was through a non online travel agency so it counted toward status AND they could use Corp codes.

Plus the Price Rewind.

Suntrust Delta Debit card. Gave an astonishing 1Skymile per dollar spend on all debit transactions, including pin debit!

Several of us racked up millions of Skymiles for peanuts in transaction fees before they sunset it > 5 years ago.

Millions of skymiles wow. At a MINIMUM that’ll get you 2 round trips from Detroit to Atlanta in Comfort +

I got in on that too. Skymiles were still useful at the time.

100%. Skymiles used to allow free stopovers on domestic award tickets.

Remember when AA allowed you to “stopover” in any hub on the way to another region? Like say going from Hawaii to Europe while stopping in NY, Chicago, or Dallas for 6-9 months?

Did you animate your cover image? I just heard the raven in the tree say, “Never more.” Creepy.