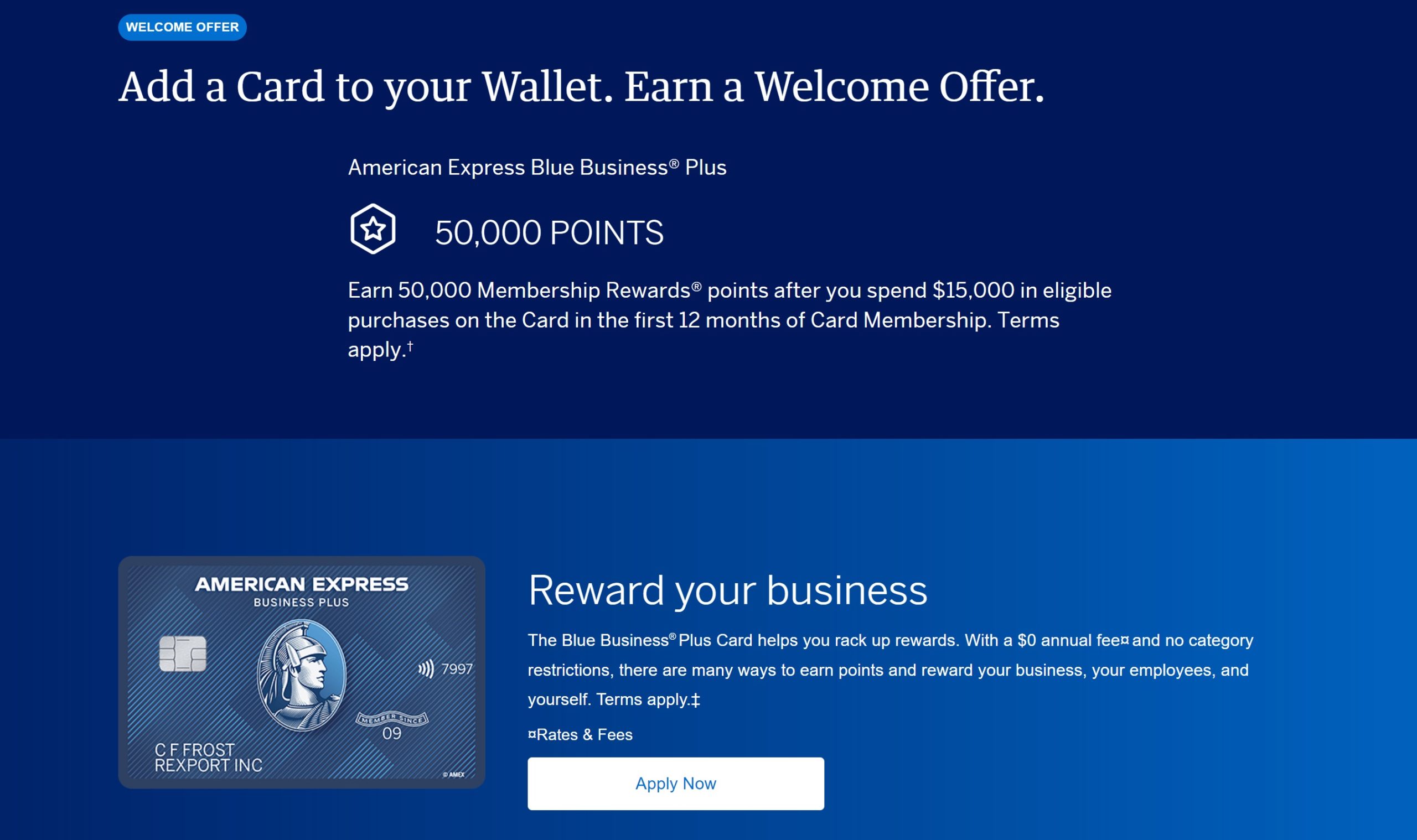

On the heels of targeted offers for the Business Platinum card and Business Gold card, Amex has now once again targeted some current cardholders for an offer on the Blue Business Plus card. With this welcome offer, those targeted can earn 50,000 Membership Rewards points after $15,000 in purchases in the first 12 months. This is as good as it gets on this card to my knowledge and it could certainly be worthwhile for anyone who is in need of a card with no annual fee to keep Membership Rewards points alive. It is also worth noting that the application terms do not include typical lifetime language, so if targeted you may be eligible even if you’ve had the card before.

The Deal

- Some people are being targeted for a new cardholder offer to earn 50,000 Membership Rewards points after $15,000 in purchases in the first 12 months on the Blue Business Plus card.

- Link to log in and see if you are targeted

Key Card Details

| Card Name w Details No Review (no offer) |

|---|

No Annual Fee Earning rate: 2X Membership Rewards points on all purchases, up to $50K spend per calendar year (then 1X thereafter). Terms apply. (Rates & Fees) Base: 2X (3.1%) Card Info: Amex Credit Card issued by Amex. This card imposes foreign transaction fees. |

Quick Thoughts

This offer doesn’t yield the most Membership Rewards points per dollar spent considering other welcome bonuses that offer far more points on less spend, but it is as many bonus points as I’ve seen on this card. The Blue Business Plus doesn’t ordinarily have a welcome bonus except when opening through a referral link, and then it’s typically only been 10,000 bonus points after $5,000 in purchases in the first 3 months.

This offer may be appealing since the card ordinarily earns 2x on all spend on up to $50K in purchases per calendar year (then 1x). That makes it a solid “everywhere else” card for most people who value Membership Rewards points. You would end up with a total of 80,000 points in the first year between 2x on the first $15K in purchases required to earn the 50K bonus points.

The Blue Business Plus is a keeper card since it has no annual fee and it keeps your Membership Rewards points alive and transferable to partners, allowing you to close other cards when you want without worrying about using or losing your points.

There are lots of other great offers right now and we have seen this targeted offer in the past, so I wouldn’t necessarily feel a need to pounce on this, but if it fits your strategy and you are targeted, it certainly isn’t bad.

Keep in mind that you will need to log in to apply. If you get to a message that says something like “Sorry, the offer is no longer available”, that means you were not targeted.

[…] HT: Doctor of Credit […]

Does BBP require an open Amex slot? I currently have 5 credit cards with Amex – do I have to close one to apply and how long should I wait before closing and application in this case?

Yes it’s a credit card. I’m not sure how long you would have to wait after cancelling one.

Canceled Hilton card, gave it a couple of days, applied and approved for BBP.

[…] HT: Frequent Miler […]

I wonder what is actually going on at Amex on these business card offers with no lifetime language and selling new cards to people who already have multiples. Not that it matters. It’s all good for us, but I’m genuinely curious.

Customers that already have multiple cards are probably the least likely to be induced to put additional spend on new cards since they already have significant Amex spending capacity on the same cards. And now they are pushing no fee cards? I guess this is potentially to get people limited by the $50k 2x cap to put money on a second card but even that makes little sense on a no fee card.

There must be some metric by which it is to Amex’s advantage to increase the size of its business card portfolio. They are going after low hanging fruit — existing customers, who are easier to attract than new customers. Maybe it relates to the way they account for revenue, or there are accounting principles that make this advantageous to how they have to report to shareholders and investors. Or maybe they have somehow securitized or sold interests in the portfolio that depend on number of cards. Or maybe number of accounts somehow is relevant under contracts with partners. But it’s very clear they are in the middle of an all out blitz to increase the total number of accounts in the business portfolio, using their own currency — rewards points — to pay for acquisition. Probably means nothing for us. Maybe necessitate a devaluation at some point. I suspect that redemption costs for Amex is better than other banks — they have fewer cash equivalent cash out options except for customers willing to pay a high AF for a Schwab card or those saavy enough to redeem using a business plat on their chosen airline for the 35 percent back (again, requiring a very high AF card).

It will be interesting to see if this also translates into increased retention offers on business cards. I just read on a different blog of someone being offered a $250 straight credit to keep the Hilton Business card — no spend required. That’s insane. It’s paying $155 to keep an account without even trying to get the customer to put the card at the top of his wallet.

[…] HT: Frequent Miler […]

Recently cancelled my card for a business I am shutting down. How long do I need to wait before applying for a different business I have.

With AmEx, just apply as a sole proprietorship. They don’t really care about what your business is for business cards.

Yes, but I do already have a second business with AMEX cards. I want to know how long I should wait after cancelling a card for Business 1 before trying to apply for that same card for Business 2 (assuming I get targeted).

That’s not how small business cards work. Small business cards are tied to an individual, not to the business. You cannot get multiple welcome offers on the same card. Small business cards have the same welcome offer restrictions that personal cards do. With AmEx specifically, that means once per lifetime for any one card.

Except that, per the article, this offer does not contain the lifetime language.

Right, this one doesn’t have lifetime language. @Frank, I don’t know the answer, but I suspect you don’t have to wait due to the abscence of lifetime language. For example, people have been able to open a second and third Business Platinum card under a single business (when targeted for that). So I think if you’re targeted, you should be good any time.

This seems to be an exception for a specific few business cards. In general, what I said holds true, especially regarding trying to use multiple businesses to get multiple SUBs on the same product. I’ve just seen a lot of people think that new business automatically means eligibility for a new SUB. Not how it works.

Well, I certainly did get multiple welcome offers on my Business Platinum card with in initial 90 days even before I had completed the spend for the first bonus, so I’d say things have changed at AmEx.

If the offers have no lifetime language, then yes, you can get multiple SUBs on a single product type. However, this seems to be an exception for a specific few business cards. n general, what I said holds true.

might want to consider that you can often get 15K via referral, so for those in 2 player mode with 30k referrals can get quite close.

(though its worth considering the potential tax implications, and likelihood of maxing out referrals)

Does anyone know if there’s any way to cheat this offer and to get it to trigger without logging in?

Phone them?