| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

The Amex points parade continues with an even bigger bonus opportunity than normal.

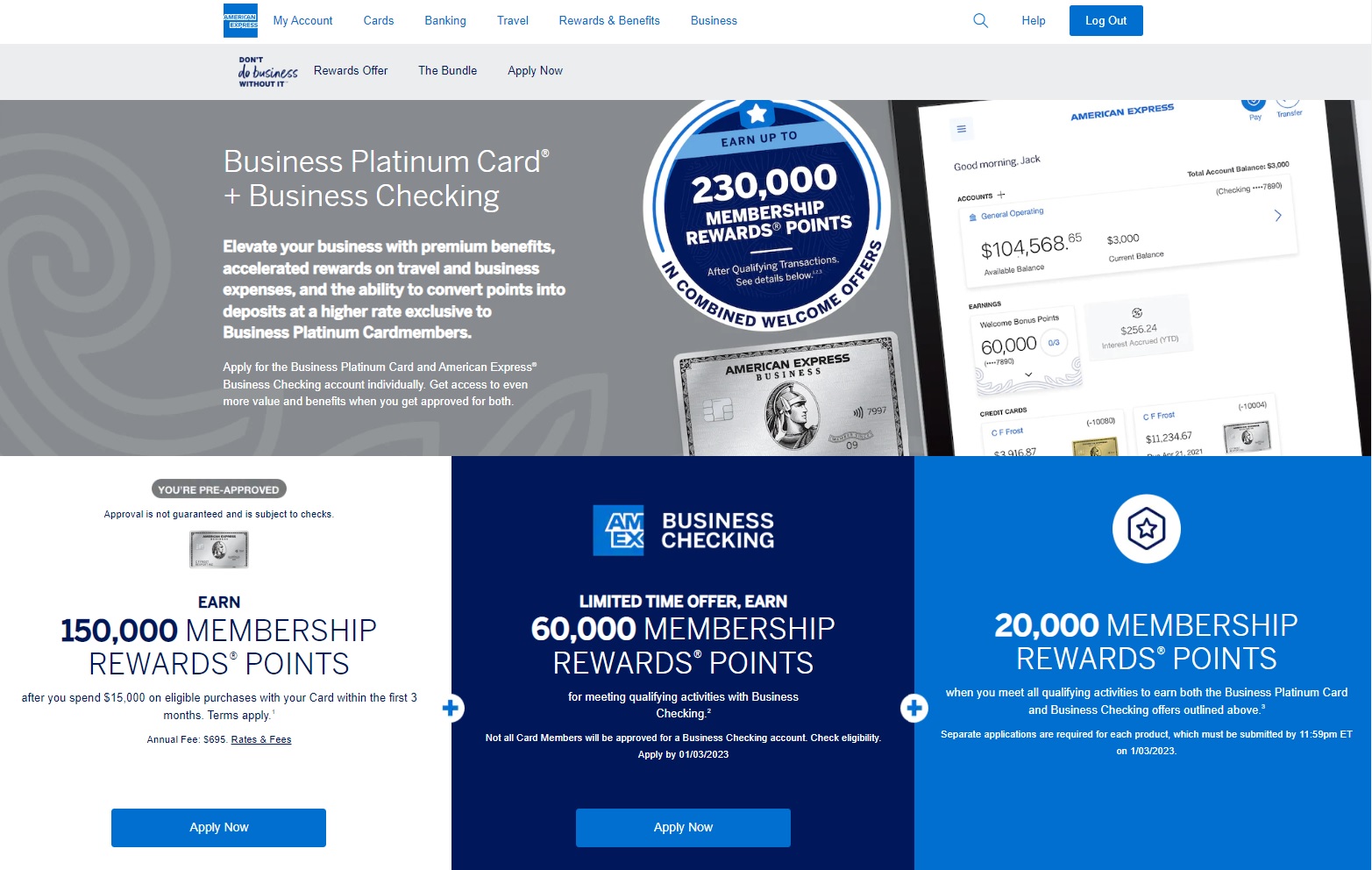

For the last year or two, they’ve been generously handing out No Lifetime Language offers on the Business Platinum card for 150,000 Membership Rewards when spending $15,000 in 3 months. They’re now targeting some cardholders with that same offer, but with the added incentive of 60,000 bonus points for a Business Checking account and 20,000 bonus points when applying for both.

The Deal

- American Express is targeting some cardholders with the following offer:

- Earn 150,000 Membership Rewards after you spend $15,000 on eligible purchases with a new Business Platinum Card within the first 3 months.

- Earn 60,000 Membership Rewards for meeting qualifying activities with Business

Checking.- Open your first American Express Business Checking account, which is subject to approval;

- Deposit a total of $5,000 or more in “new money” into your account within twenty (20) days of account opening (the new money must also post to your account and appear in your Available Balance within twenty (20) days of account opening). “New money” is defined as deposits that are not deposited from any other American Express Business Checking account and are not deposited using our Redeem Membership Rewards points for Deposits feature;

- Maintain an average balance in your account of at least $5,000 for sixty (60) days, starting on the date that your deposits of new money are equal to $5,000 or greater; and

- Complete 10 qualifying transactions within sixty (60) days of account opening. “Qualifying transactions” are defined as mobile deposits, and electronic/online transactions, including ACH, Wire, and Bill Payments made to or from your account. Business Debit Card transactions and deposits using our Redeem Membership Rewards points for Deposits feature are not qualifying transactions. Transfers between American Express Business Checking accounts held by the same business are not qualifying transactions. Stop payments and transactions that do not post to your account and do not appear in your Available Balance within sixty (60) days of account opening are not qualifying transactions. You are not eligible to earn a Welcome Offer for any accounts opened for a business that currently has or has had an American Express Business Checking account.

- Earn 20,000 Membership Rewards when you meet all qualifying activities to earn both the Business Platinum Card and Business Checking offers.

- Direct link to see if you’re targeted.

Key Terms

- Separate applications are required for each product, which must be

submitted by 11:59pm ET on 12/31/2022.

Quick Thoughts

This is a great offer if you’re targeted for it, especially because it appears to be a No Lifetime Language offer on the Business Platinum card.

In addition to the 60,000 Membership Rewards you’ll earn on the Business Checking account, that account provides the ability to cash out your Membership Rewards on a 1cpp basis. While that’s not as good as the 1.1cpp redemption option on the personal Schwab Platinum or the much higher value you can get by transferring the points to travel partners, having the ability to cash out the points at that higher-than-normal value is a nice option to have.

I was hoping to get this (showed as eligible via link), got the card/opened checking account and completed both the 15k minimum spend and the checking account requirements. 150k MR posted long ago and the 60k for checking posted about a week ago, but nothing on the additional 20k.

Has anyone gotten the additional 20k? If so, how long did it take to post?

I’m still waiting for my additional 20K

Has either of you reached out to amex regarding this yet?

Not yet, no

Hi there, have you received that additional 20K bonus yet?

As far as I can tell, NOBODY has gotten the 20k additional “bundle bonus” from Amex. Total bait and switch by Amex.

I got a 200k bundle mail offer that says apply by 01/31/2023 but when i go to the link it says offer expired…..

Bummer, that can happen. Sometimes, those targeted links will come back, so it might be worth trying again in a week or two (or from incognito mode)

Can you use a referral for the Business Platinum Card and still be eligible for the 20K MR bonus?

I don’t know. My guess is no but I’m not sure

Thanks Greg! I think The Bundle is a better deal anyways.

Has anyone seen the 30k points post on business checking account?

@stephen I can see the targeted offer in incognito, but as soon as I log in, amex says “This offer is no longer available.” I have never had an amex Business card, should I use my amex personal account or should I create a new one (using the same SSN as my business is sole prop).

If you don’t see the offer when logged in, it’ll mean that you’re not targeted for it.

As for if you should create a new one, that’s a personal preference – it won’t affect whether you’re targeted or not. I have my personal and business accounts on the same login just because I find it easier that way.

Thanks @Stephen. I was just wondering if I could trick Amex with a new account and get this targeted offer, but seems not.

@Stephen I am targeted for a similar offer except it’s for the biz gold NLL and offers 90k + 30K + 10k (130k MR in total).

Question: does anybody know if I will receive a tax statement from AMEX regarding the 20k and 30k of points? I know on the 150k of points nothing will be issued. I’ve set up bank accounts with CITI before and received tax statements at year end. Definitely a bummer.

So I got targeted for both this offer and the gold offer, but I already have the biz checking account. Landing page says you have to apply through that page for the offer. When I click the biz checking apply link it just forwards to my open biz checking account. Should I:

Also any DP’s about applying for both? I was going to do biz plat in next couple weeks to try triple dip on credits and space out gold. Wondering if I wait too long in between if one of the offers will disappear. Maybe even you need to app together?

I have Plat that I’ve used for yrs, got a second one about 14 mos ago, closed it at end of first yr, then they offered me another one in Sept and I got that –and the big signup bonus. Can I really get a 4th card now (or 90 days after the most recent one?)

Yep, 90 days after you most recent one and you should be good.

Hmm. I opened the Biz Plat for 150K in October. Think I could just add on a checking account now and have it count?

When visiting the landing page for this offer while logged in to your Amex account, does it give you a message saying the offer is no longer available, or does it still display the 200k total offer? If the latter, it might work to apply for the Business Checking account, but there’s no guarantee that you would indeed get the additional 20k points.

Received this offer by email, I’ve gotten both offers separately by snail mail but the combo with 20k bonus may get me to pull the trigger.

I have many of these 30k offers to open the business checking account. What’s the trick on doing one? it asks me to upload documents… such as business license or registration etc. I don’t have any of that. Never needed to open amex business cards. Do I really need a licensed/registered business to open one?

btw, 6 month ago, I had my mom open a 150k business platinum and manage to make a biggest blunder/mistake of all time in 7 years of playing this game. I knew it was 3 month to meet $15k at the time of opening but later I forgot and thinking 6 month like the platinum personal my wife opened at the similar time.Arrrrgh $#@%!

so don’t forget, it’s 3 month to meet the spending requirement!

What are the “qualifying transactions” on the business checking account?

Good question – I’ve just added those terms to the post.

i am not certain, but i believe that transferring from a non-amex account into your new amex checking account qualifies as a “qualifying transaction”. i see bloggers stating that the best way to get in your 10 qualifying transactions is to do ten transfers of $500 so you kill two birds with one stone.

The language is a bit unclear. Is a regular point-of-sale transaction with the business checking debit card considered a “qualifying transaction”?